17238O can be filled in online without difficulty. Simply make use of FormsPal PDF tool to complete the task without delay. To retain our editor on the forefront of practicality, we strive to put into operation user-driven features and enhancements on a regular basis. We're always looking for feedback - play a pivotal role in reshaping PDF editing. To start your journey, consider these easy steps:

Step 1: Simply click the "Get Form Button" in the top section of this page to open our form editor. Here you will find everything that is needed to fill out your document.

Step 2: With this online PDF file editor, you could accomplish more than merely fill out blanks. Try all of the functions and make your docs seem professional with customized textual content added, or modify the file's original input to excellence - all supported by the capability to insert your own graphics and sign the document off.

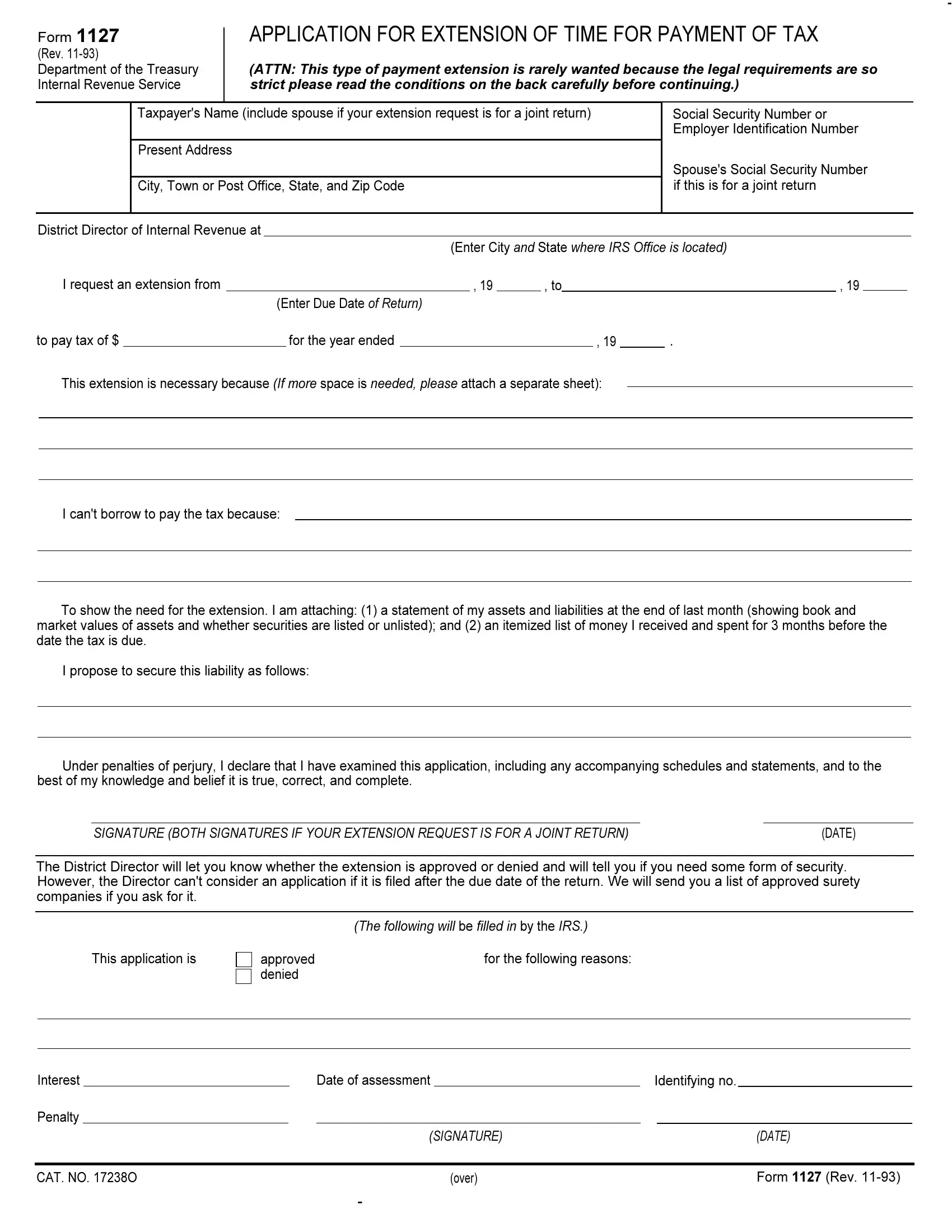

With regards to the blanks of this specific PDF, here is what you should know:

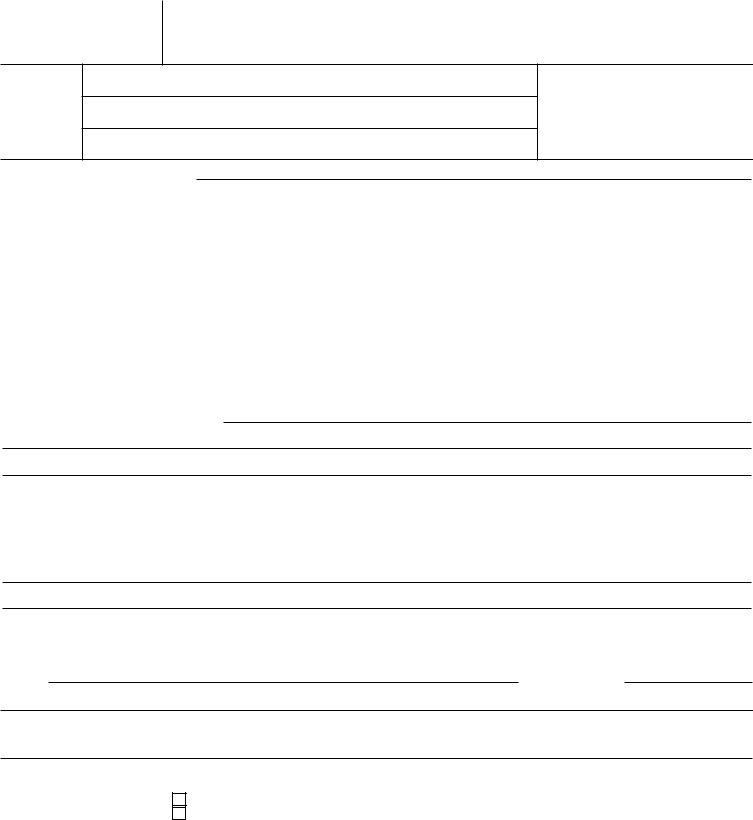

1. The 17238O requires particular information to be inserted. Ensure the following fields are finalized:

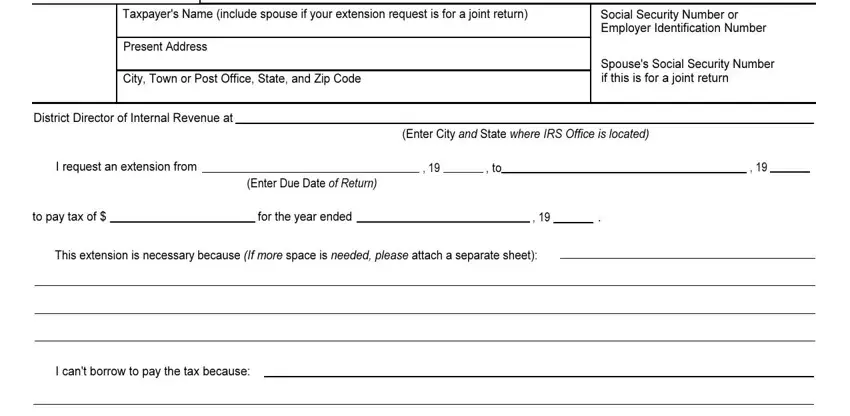

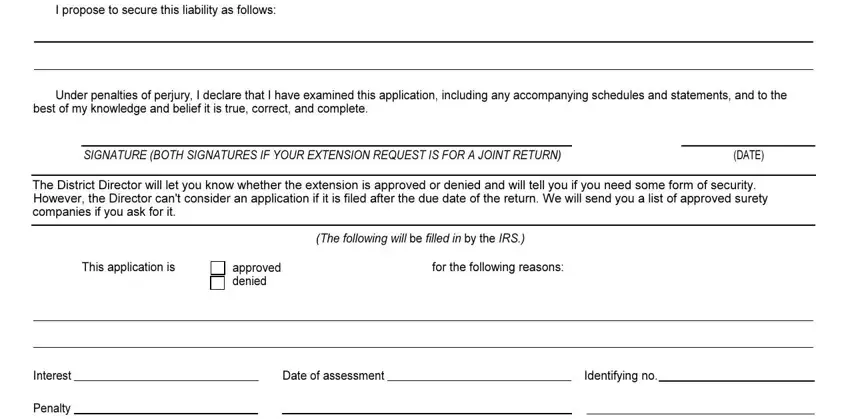

2. Once your current task is complete, take the next step – fill out all of these fields - I propose to secure this liability, Under penalties of perjury I, best of my knowledge and belief it, SIGNATURE BOTH SIGNATURES IF YOUR, DATE, The District Director will let you, This application is, approved denied, for the following reasons, The following will be filled in by, Interest, Penalty, Date of assessment, and Identifying no with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Be extremely careful when completing This application is and Interest, as this is the part in which many people make mistakes.

Step 3: Once you've reviewed the details provided, simply click "Done" to finalize your form at FormsPal. Join us today and easily gain access to 17238O, available for download. Each and every edit made is handily preserved , allowing you to change the file later on if needed. Here at FormsPal.com, we strive to be sure that all your information is maintained protected.