Using PDF files online is always surprisingly easy using our PDF editor. You can fill out form 1128 pdf here without trouble. To make our editor better and less complicated to use, we continuously come up with new features, with our users' suggestions in mind. To begin your journey, go through these simple steps:

Step 1: Click the "Get Form" button above on this webpage to open our PDF tool.

Step 2: The editor lets you modify PDF files in a variety of ways. Enhance it by writing any text, adjust existing content, and include a signature - all manageable in minutes!

It is actually easy to complete the form following this detailed tutorial! Here's what you need to do:

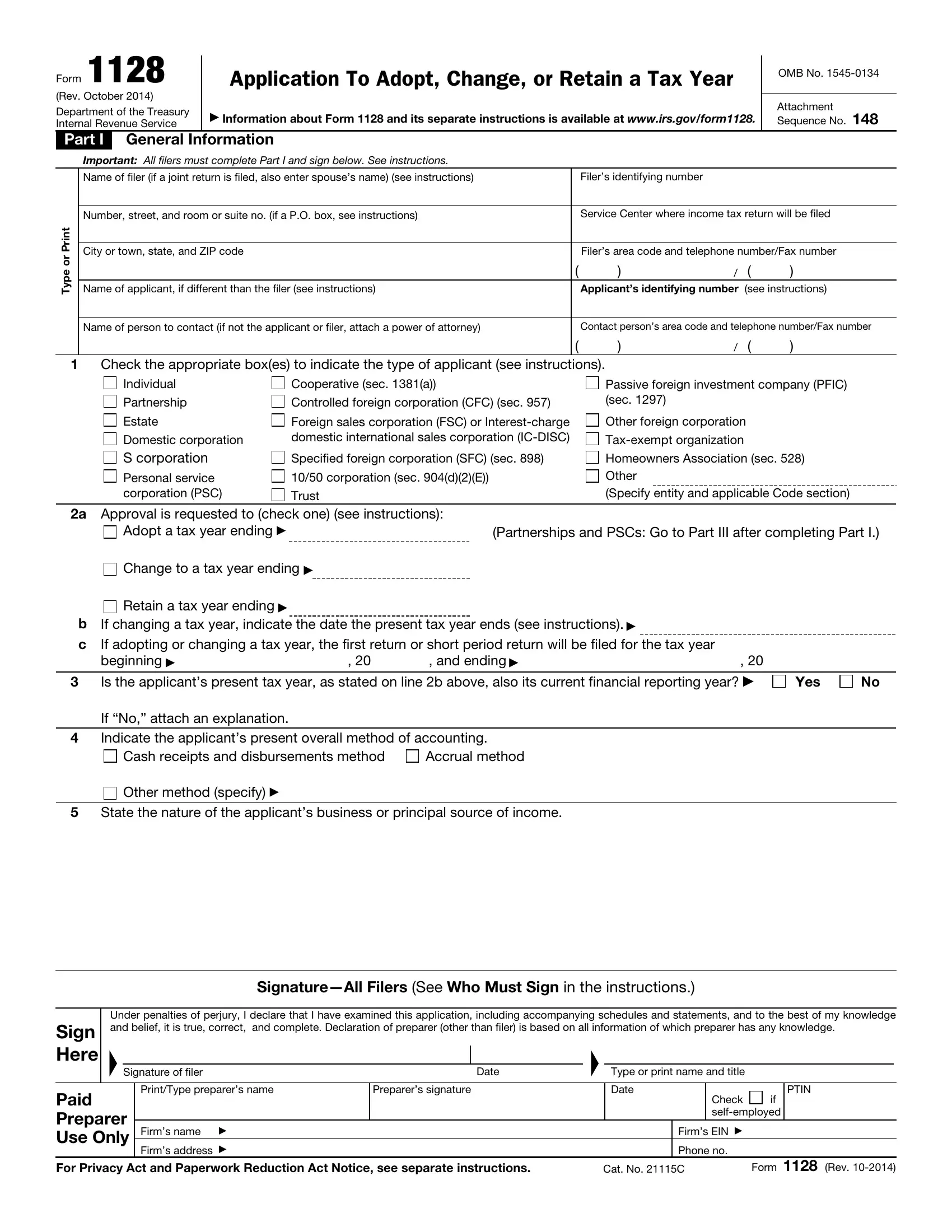

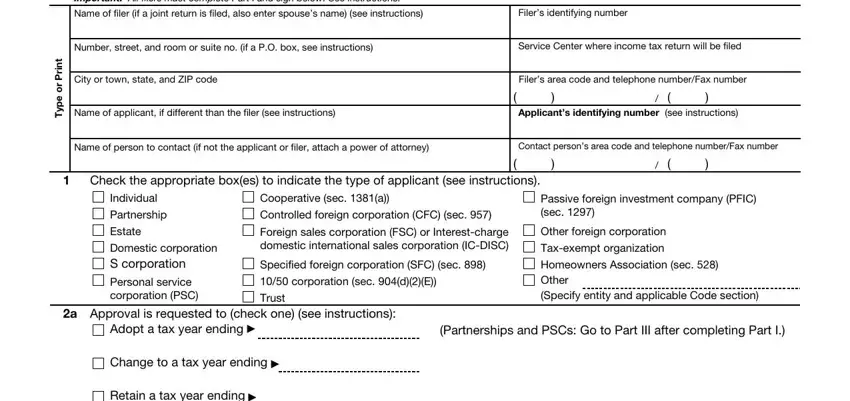

1. Whenever filling in the form 1128 pdf, make sure to complete all necessary fields in its corresponding section. This will help hasten the work, allowing for your information to be handled fast and properly.

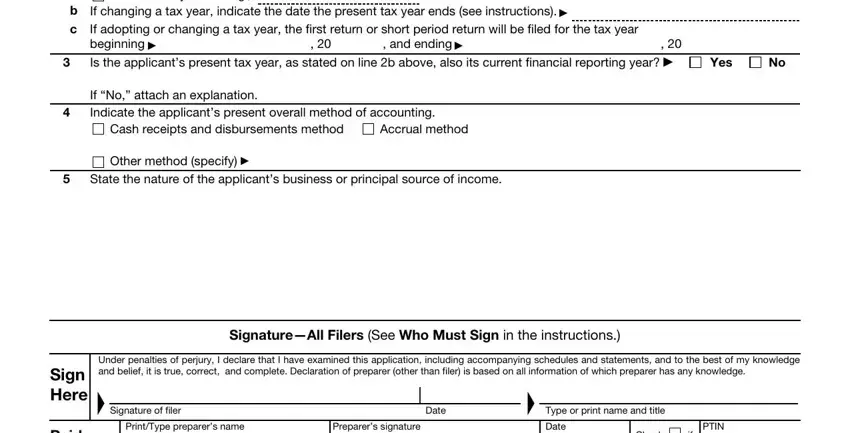

2. When this selection of fields is filled out, go on to type in the applicable information in these: Retain a tax year ending, If changing a tax year indicate, and ending, Yes, If No attach an explanation, Cash receipts and disbursements, Accrual method, Other method specify, State the nature of the applicants, SignatureAll Filers See Who Must, Under penalties of perjury I, Signature of filer, Date, Type or print name and title, and Sign Here.

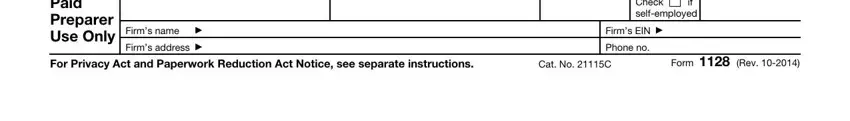

3. This part is generally simple - complete all of the blanks in Paid Preparer Use Only, Firms name, Firms address, Check if selfemployed, Firms EIN, Phone no, For Privacy Act and Paperwork, Cat No C, and Form Rev to complete this process.

Regarding For Privacy Act and Paperwork and Firms name, make sure you get them right in this current part. Both these are considered the key ones in the file.

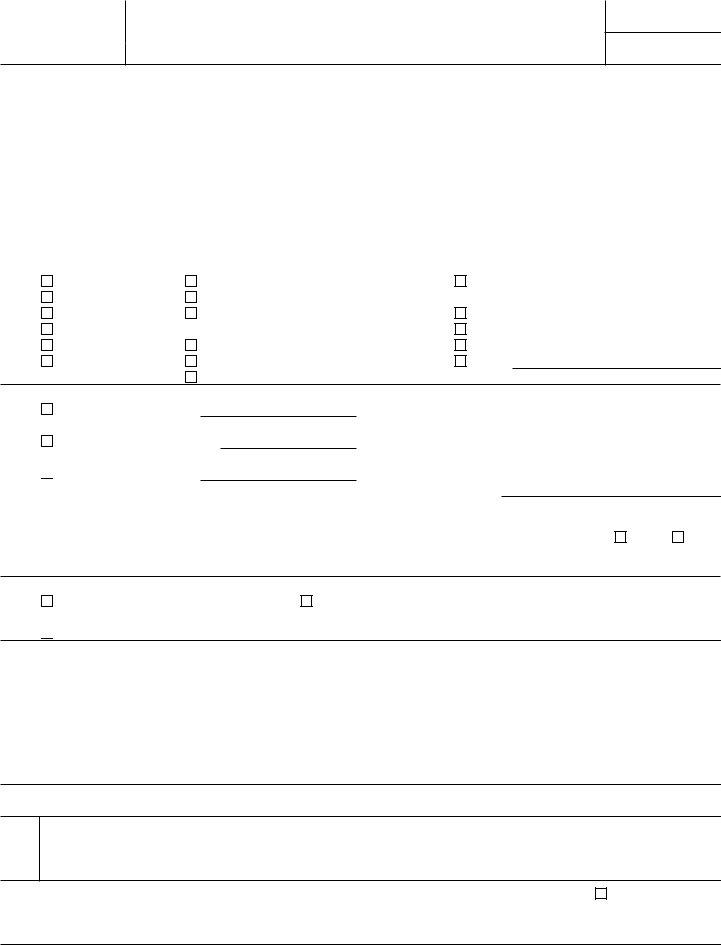

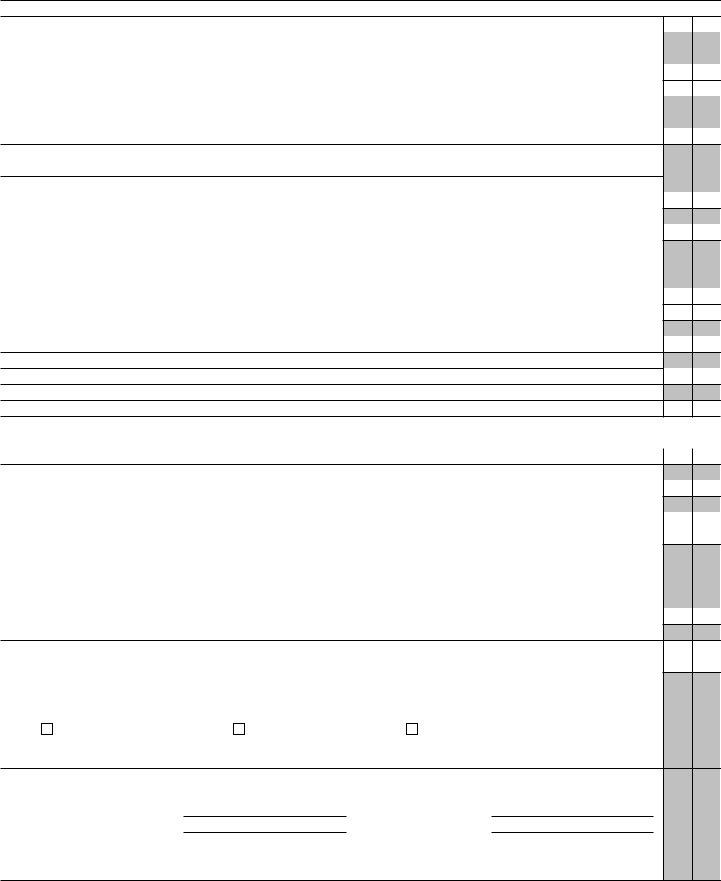

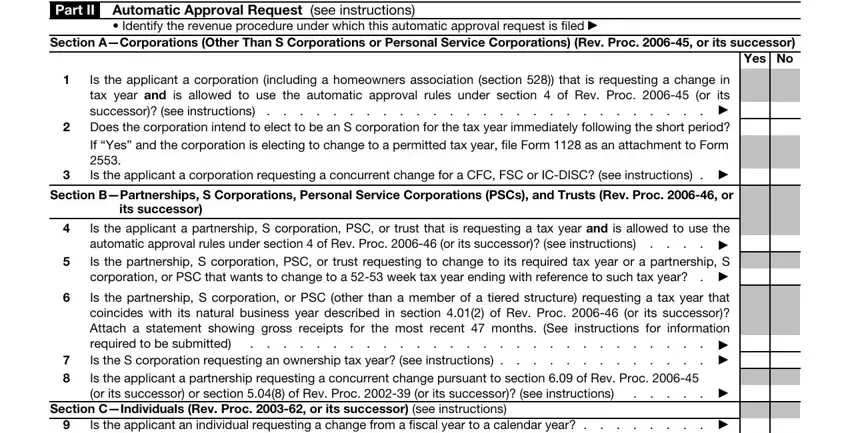

4. The next part will require your involvement in the subsequent areas: Form Rev Part II Automatic, Identify the revenue procedure, Section ACorporations Other Than S, Is the applicant a corporation, Section BPartnerships S, its successor, Is the applicant a partnership S, Is the partnership S corporation, Section CIndividuals Rev Proc or, and Is the applicant an individual. Just remember to give all required information to go further.

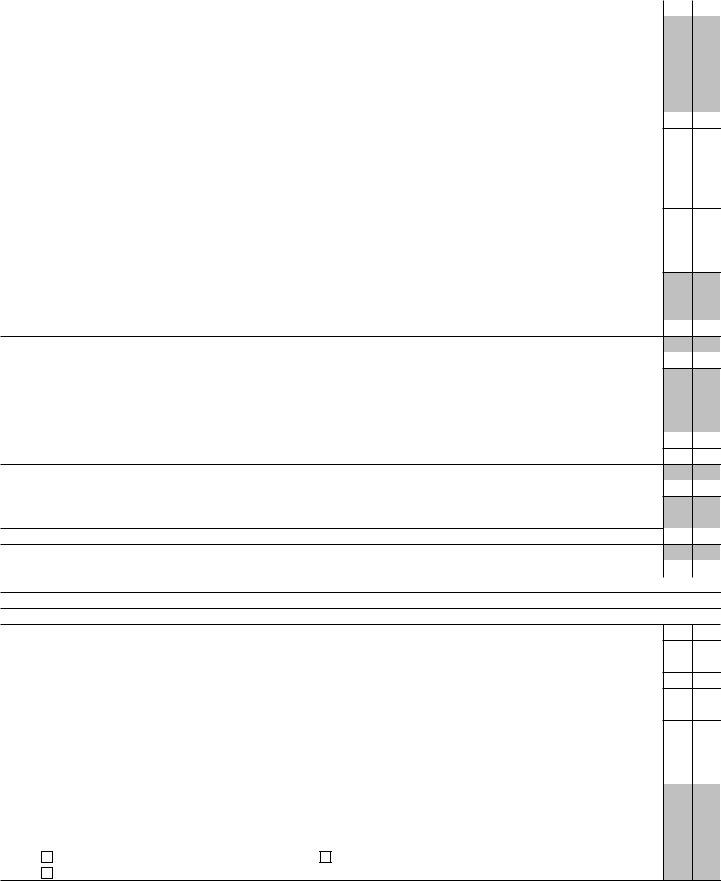

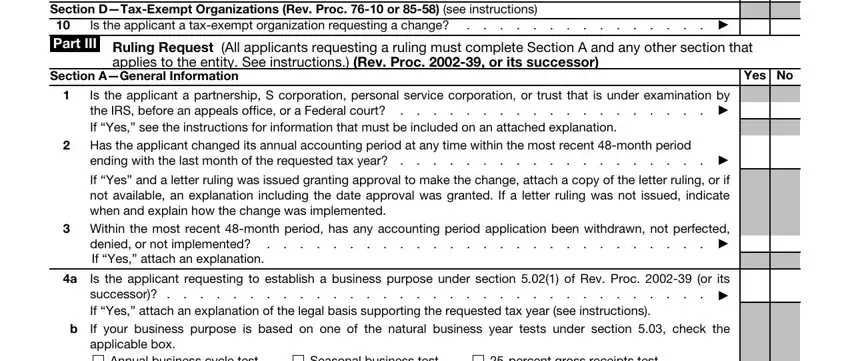

5. This pdf needs to be concluded by filling in this section. Further you'll see a comprehensive listing of fields that need correct information for your form submission to be complete: Section DTaxExempt Organizations, Is the applicant a taxexempt, applies to the entity See, Section AGeneral Information, Yes No, Is the applicant a partnership S, Has the applicant changed its, ending with the last month of the, If Yes and a letter ruling was, Within the most recent month, denied or not implemented If Yes, a Is the applicant requesting to, successor If Yes attach an, Annual business cycle test, and Seasonal business test.

Step 3: Check all the details you have inserted in the blanks and then press the "Done" button. Sign up with FormsPal now and easily gain access to form 1128 pdf, all set for download. All changes you make are preserved , which means you can edit the form at a later time when necessary. With FormsPal, it is simple to fill out documents without having to worry about data incidents or records getting distributed. Our protected platform ensures that your personal details are kept safely.