Navigating through the complex landscape of corporate tax obligations, the Colorado Department of Revenue introduced the Form 112CR, a comprehensive document aimed at simplifying the process for corporations to claim various tax credits. With a meticulous structure designed to ensure accuracy and compliance, this form serves as a bridge between corporations and their eligible tax benefits for the fiscal year 2013. It mandates the inclusion of detailed information regarding the tax credits a corporation intends to claim, complemented by the necessary supporting documentation. The form facilitates a streamlined submission process, offering options for electronic filing through Revenue Online or attachment to a paper return, thus accommodating different preferences. Crucially, Form 112CR emphasizes precision in financial reporting, instructing corporations to round dollar amounts to the nearest whole and calculate percentages up to the second decimal place. It covers an array of credits ranging from new and old investment tax credits to more specialized ones like the contaminated land redevelopment credit and child care contribution credit. Each section meticulously outlines the requirements for reporting the total credit generated, its application against the tax for the year, and any carryforward amount. This detailed approach underscores the importance of accuracy and completeness in reporting, aiming to ensure that corporations fully leverage their eligible tax credits while adhering to regulatory guidelines.

| Question | Answer |

|---|---|

| Form Name | Form 112Cr |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | inkind, 2011, 2009 colorado form 112 fillable return, colorado 112 fill in form |

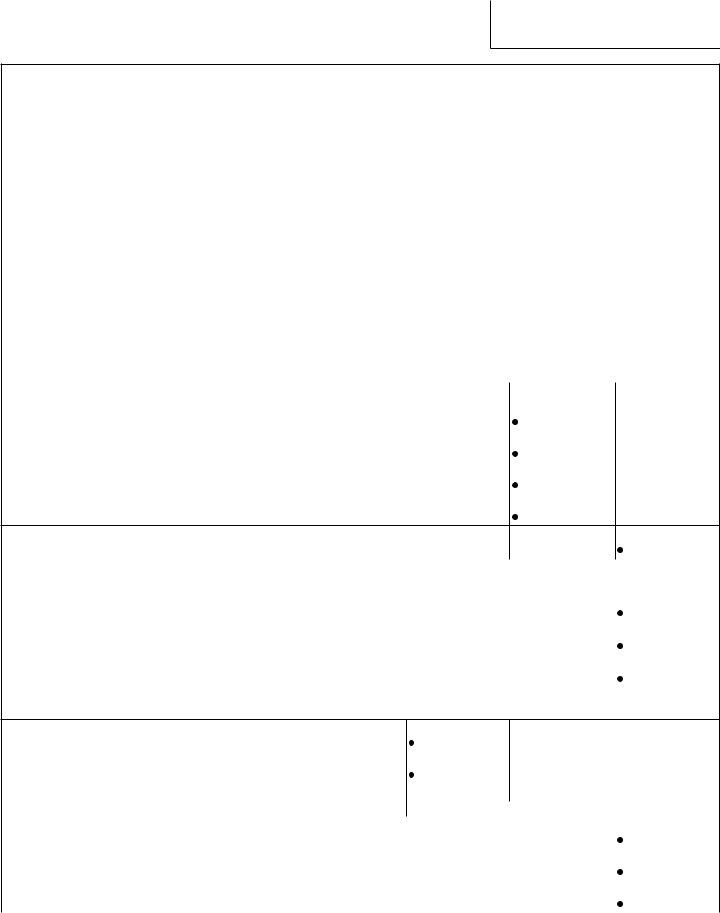

Form 112CR (10/03/13) |

|

|

COLORADO DEPARTMENT OF REVENUE |

Form 112CR |

|

Denver, CO |

|

|

|

|

|

2013 |

2013 Credit Schedule for Corporations |

|

*130112CR19999*

Submit the following information with your tax return

•Use this schedule to determine which tax credits you are eligible to claim.

•Be sure to submit the required supporting documentation for each credit.

•Most software products and tax preparers have the ability to submit this schedule and attachments electronically. Revenue Online can also be used to ile your return and attachments electronically. Otherwise, attach all required documents to your paper return.

•Dollar amounts shall be rounded to the nearest whole dollar. Calculate percentages to the second decimal place.

Name of Corporation |

|

Colorado Account Number |

|

|

|

Ownership % |

Entity Account Number |

|

|

|

|

Enter in Column (A) the total credit generated in 2013 and any carryforward credit that is available from a prior year. Enter in Column (B) the portion of the credit in Column (A) that is being used to offset tax in 2013. If Column (A) is larger than Column (B) and the credit can be carried forward to future years, enter the carryforward amount on line 26.

1. Tax liability from line 17, Form 112 |

|

1 |

|

|

A. The New Investment Tax Credit |

|

|

|

|

|

|

|

|

|

|

|

Column (A) |

|

Column (B) |

2. |

$1,000 minus amount on line 7 |

2 |

|

|

3. |

Current year qualiied investment |

3 |

|

|

4. |

1% of the amount on line 3 |

4 |

|

|

5. |

New investment tax credit carried over from prior year |

5 |

|

|

6.Enter in Column (A) the total of lines 4 and 5. Enter in Column (B) the

|

lesser of the amount in Column (A) or the amount on line 2 |

6 |

|

|

B. Other Credits |

|

|

|

|

|

|

|

|

|

7. |

Old investment tax credit |

7 |

|

|

8. |

Crop and livestock contribution credit |

8 |

|

|

9. |

Historic property preservation credit (see FYI Income 1 for limitations) |

9 |

|

|

Child care contribution credit (see FYI Income 35 for limitations)

10.Enter the sum of all DR 1317 line 4 amount(s) donated

|

in 2013 |

10 |

|

|

|

|

11. Enter previous year deferred & carryforward amount(s) |

11 |

|

|

|

|

12. Add lines 10 and 11 |

|

|

|

|

|

12 |

|

Column (A) |

Column (B) |

|

|

13. Enter in column (A) 50% of line 12. Enter in column (B) the portion |

|

|

|

|

|

of (A) being used to offset 2013 tax |

|

13 |

|

|

14. |

Child care center/family care home investment credit |

|

14 |

|

|

15. |

Employer child care facility investment credit |

|

15 |

|

|

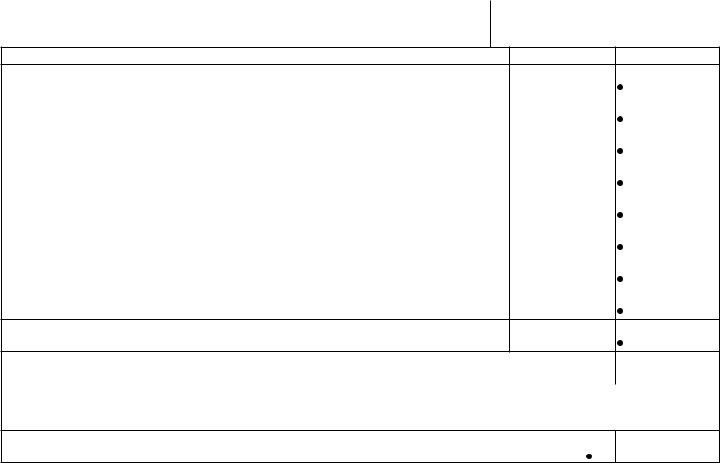

*130112CR29999*

Column (A) |

Column (B) |

16. |

16 |

|

17. |

Colorado works program credit |

17 |

18. |

Contaminated land redevelopment credit carried forward from a prior year |

18 |

19. Aircraft manufacturer new employee credit |

19 |

|

20. |

Job growth incentive credit |

20 |

21. |

Gross conservation easement credit |

21 |

22. Alternative fuel refueling facility credit |

22 |

|

23. |

Certiied auction group license fee credit |

23 |

24.

year |

24 |

25.Total nonrefundable credits, add amounts in Column (B) lines 6 through 24

Enter here and on line 18 of Form 112 |

25 |

Limitation: The total credits entered on line 25 on this Form 112CR may not exceed the tax on line 1. Most unused |

|

portion(s) of the credits on this form [the difference between the amounts in Column (A) and Column (B)] for each line may be carried forward to the next income tax year. Please list any credits to be carried forward to tax year 2014 below.

26. Credits to be carried forward to 2014 |

26 |