Filing taxes is a responsibility that comes with its own set of complexities and nuances, exemplified by the detail-oriented process of completing the 11E form. Designed specifically for individuals who are self-assessed, the Form 11E Pay and File Income Tax Return for the year 2010 serves as a comprehensive documentation tool for reporting income, charges, and capital gains. This form, provided by the Office of the Revenue Commissioners in Ireland, underscores the necessity for individuals to report their financial activities accurately and within the stipulated time frame to avoid any potential civil penalties or criminal prosecution for non-compliance with tax laws. Embedded within this process is the convenience offered by the Revenue On-Line Service (ROS), which not only facilitates electronic filing and payment but also provides users with an instant calculation of their tax liability. The 11E form caters to various aspects of an individual's financial landscape, encompassing the declaration of income from different sources, the acquisition and disposal of chargeable assets, and claims for tax credits, allowances, and reliefs. It is pertinent for individuals to thoroughly review their eligibility to use this form through the accompanying Helpsheet, ensuring that their circumstances align with the criteria set forth for the 11E form submission. This critical piece of documentation underscores the importance of accurate self-assessment in fulfilling one’s tax obligations and navigating the intricacies of tax law compliance.

| Question | Answer |

|---|---|

| Form Name | Form 11E |

| Form Length | 18 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 4 min 30 sec |

| Other names | form 11 2020 download ireland, form 11 2020 pdf ireland, form 11 2020 download, form 11e revenue |

44792819372010120E

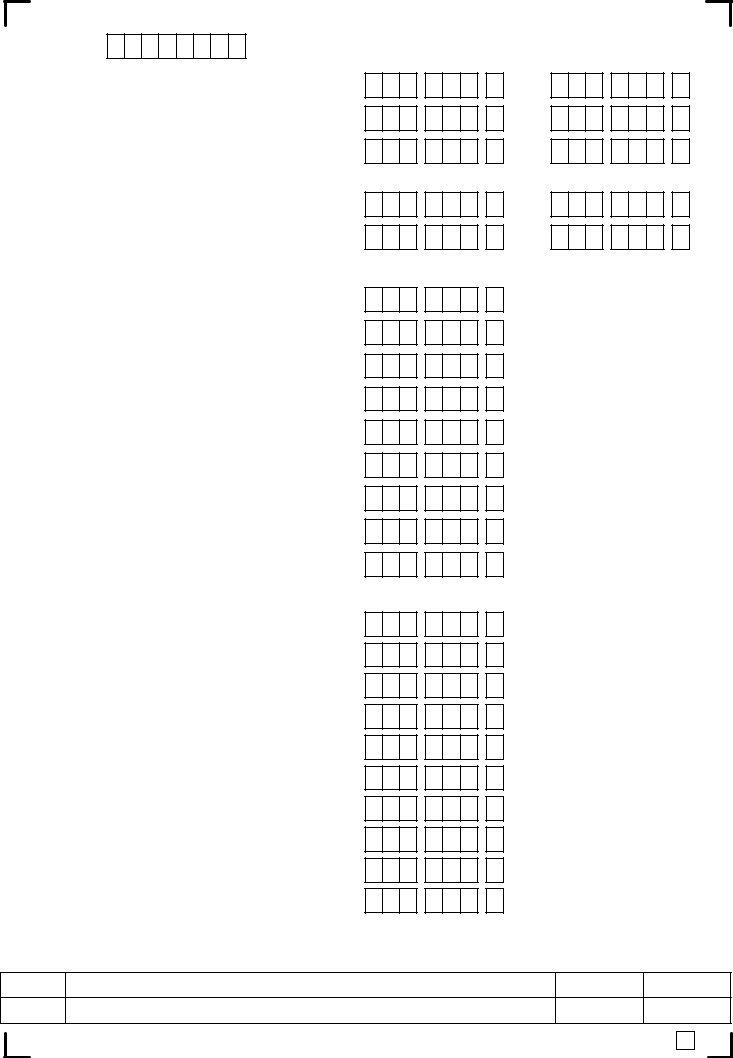

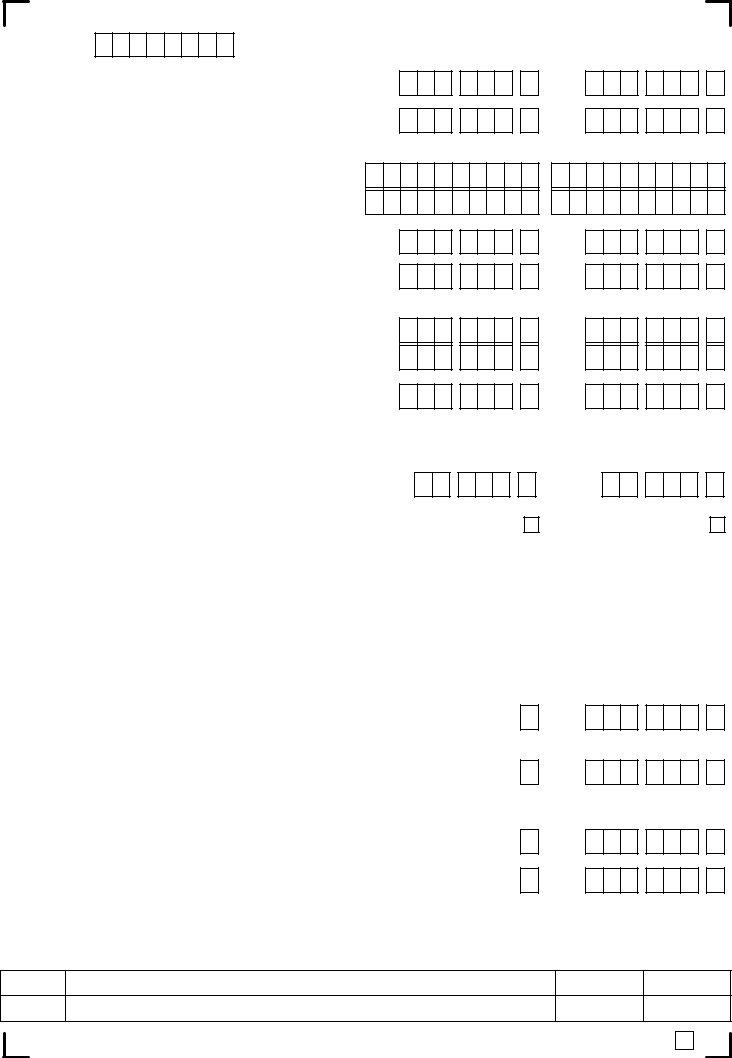

Form 11E

Pay and File Income Tax Return for the year 2010

(for individuals chargeable under

Your PPS Number Remember to quote your PPS number in all correspondence or when calling at your Revenue office

Return Address

Office of the Revenue Commissioners,

PO Box 354,

Limerick.

GCDTAIN

Revenue

If submitting this return use any envelope and write “Freepost” above the Return Address. You do not need to attach a stamp.

RETURN OF INCOME, CHARGES AND CAPITAL GAINS FOR THE YEAR ENDED 31 DECEMBER 2010 CLAIM FOR TAX CREDITS, ALLOWANCES AND RELIEFS FOR THE YEAR ENDED 31 DECEMBER 2010

This short tax return may be suitable for your circumstances. However, this form is not suitable for everybody and before you start filling it in, you should read Panel P and page 1 of the Form 11E Helpsheet to check if you can use this form. You must use the correct form for your personal circumstances. The Helpsheet will tell you how to obtain a different form if required.

If you have not received a copy of the Helpsheet you can get one on www.revenue.ie, (under 'Taxes & Duties > Income Tax > Forms > Tax Return Forms’), from Revenue’s Forms & Leaflets Service at LoCall 1890 306 706, or from your local Revenue office. LoCall rates - note that rates charged for the use of 1890 (LoCall) numbers may vary among different service providers.

Civil Penalties/Criminal Prosecution - Tax law provides for both civil penalties and criminal sanctions for the failure to make a return, the making of a false return, facilitating the making of a false return, or claiming tax credits, allowances or reliefs which are not due. In the event of a criminal prosecution, a person convicted on indictment of an offence may be liable to a fine not exceeding €126,970 and/or to a fine of up to double the difference between the declared tax due and the tax ultimately found to be due and/or to imprisonment.

If there are any changes under the following headings, not already notified to Revenue, enter the new details below:

Nature of Primary Trade, Business or Activity

Business Address

Telephone

Main Residence Address

Telephone

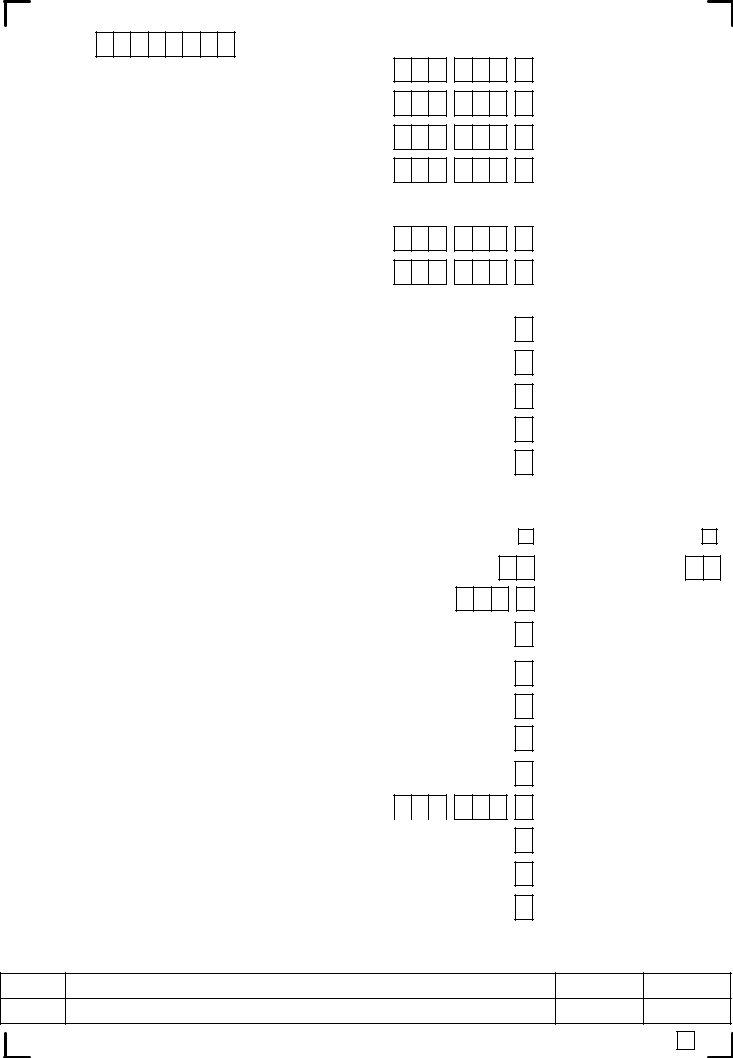

YOU MUST SIGN THIS DECLARATION

I DECLARE that, to the best of my knowledge and belief, this form contains a correct return in accordance with the provisions of the Taxes Consolidation Act 1997 of:

–All the sources of my income and the amount of income derived from each source in the year 2010, and

–All disposals and acquisitions of chargeable assets and the amount of chargeable gains that accrued to me in the year 2010.

I DECLARE that, to the best of my knowledge and belief, all the particulars given as regards gifts and inheritances received, tax credits, allowances and reliefs claimed and as regards outgoings and charges are correctly stated.

Signature |

|

Date |

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Capacity of Signatory

Contact Details (in case of query about this return)

Agent's TAIN |

|

|

|

|

|

|

Contact Name |

|

|

|

|

|

|

|

|

Client's Ref.

Telephone or

Page 1 |

FOR OFFICE USE ONLY |

8993281932 ANY PANEL(S) OR SECTION(S) THAT DO NOT REQUIRE AN ENTRY SHOULD BE LEFT BLANK. 2010120E

PPS No.

Legislative references relate to Sections of the Taxes Consolidation Act 1997, unless otherwise stated.

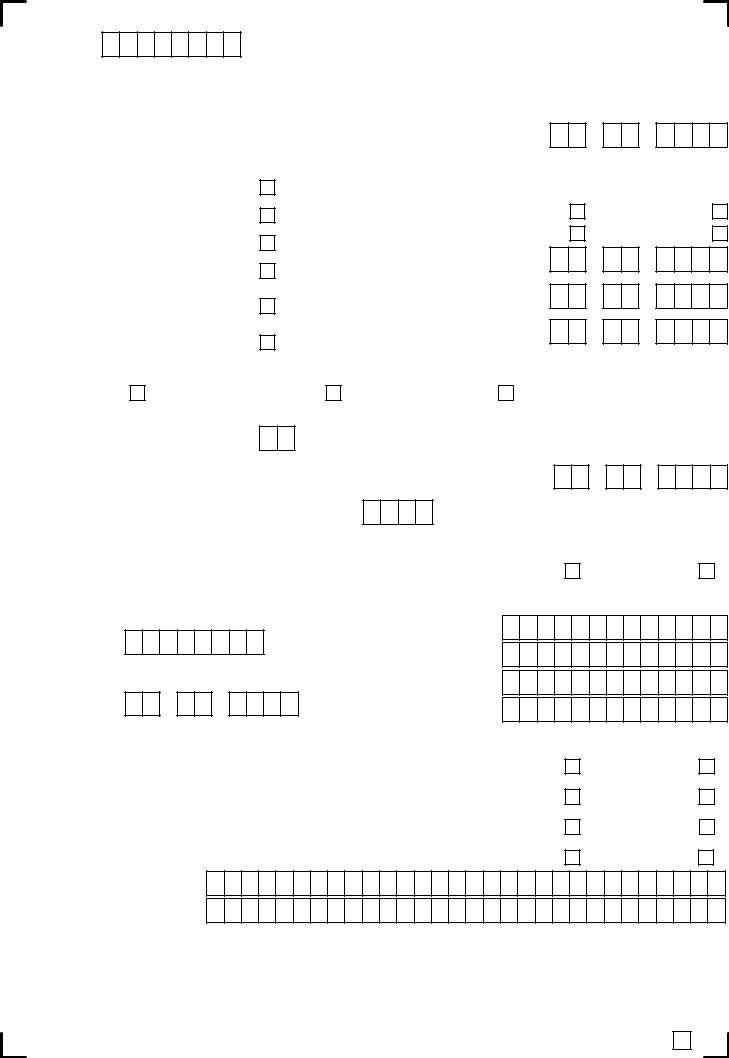

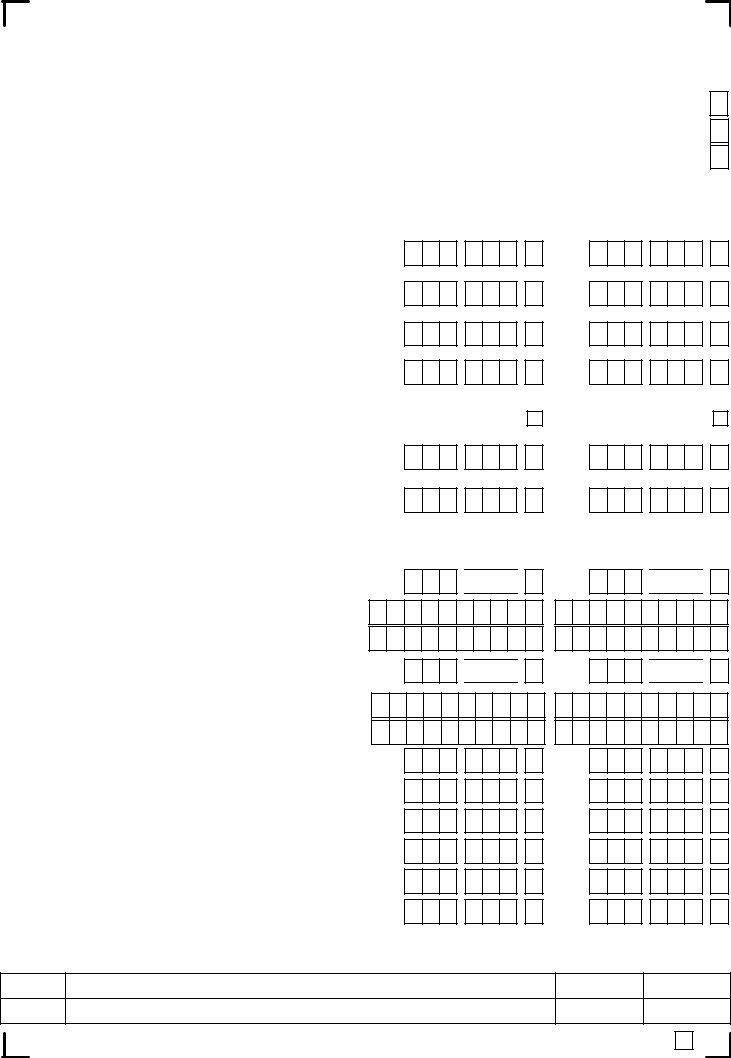

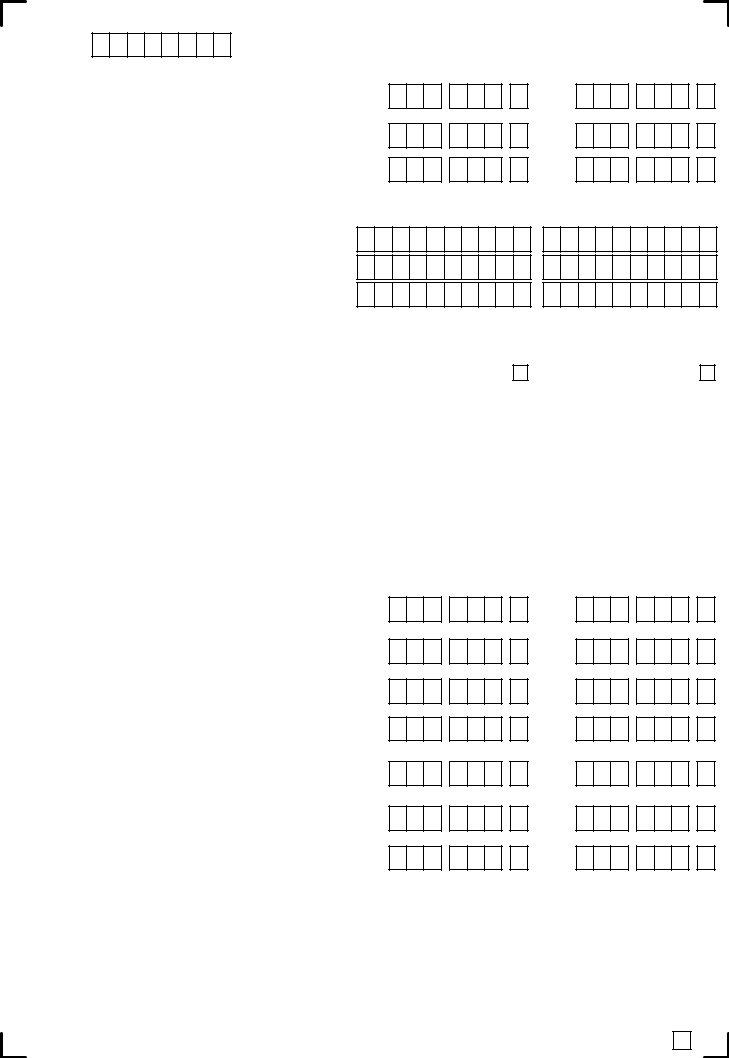

A - PERSONAL DETAILS

1.If you are completing this return on behalf of a deceased individual enter the date of death. (Note: in the case of a married person, only complete this section where the deceased was the assessable spouse in the period to which this return refers.) (DD/MM/YYYY)

/

/

2.Insert ⌧ in the box to indicate your marital status:

(a) Single

3.If your personal circumstances changed in 2010 insert ⌧ in the box to indicate your previous status and state date of change:

(b) Married

(c) Married but living apart

If wholly or mainly maintaining your spouse insert ⌧ in the box

(d) Widowed

(e) Divorced

Single |

|

Married |

Married but living apart

Date of Marriage (DD/MM/YYYY)

Date of Separation/Divorce (DD/MM/YYYY)

Spouse's date of death (DD/MM/YYYY)

/

/

/

Widowed

Divorced

/

/

/

4.If married, insert ⌧ in the box to indicate basis of assessment applicable for 2010:

Joint Assessment |

Separate Assessment |

Single Treatment |

5. State the number of Dependent Children

6.If you wish to claim Widowed Parent Tax Credit state date of death of your spouse (DD/MM/YYYY)

7. Your Date of Birth (DD/MM/YYYY) |

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/

/

8. If you and/or your spouse are/is subject to the Limitation on the use of Reliefs by |

Self |

Spouse |

|

|

|

||

Insert ⌧ in the box(es) if the Limitation on the use of Reliefs by |

|

|

|

does not apply to either you or your spouse. |

|

|

9.Spouse’s Details:

(a) PPS No.

(b)Date of Birth (DD/MM/YYYY)

/

OR, if unknown |

Surname |

|

|

|

First name(s) |

/

Insert ⌧ in the box(es) to indicate for 2010 if you and/or your spouse were: |

Self |

Spouse |

10. Permanently Incapacitated

11.A Proprietary Director, i.e. owned/controlled more than 15% of the share capital of a company

12. A holder of a 'full' Medical Card

13. Entitled to an exemption from PRSI

(a) State reason - Self

(b) State reason - Spouse

Official use only

Line |

|

Self |

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

Page 2 |

FOR OFFICE USE ONLY |

9067281935 ANY PANEL(S) OR SECTION(S) THAT DO NOT REQUIRE AN ENTRY SHOULD BE LEFT BLANK. 2010120E

PPS No. |

|

|

|

|

|

|

|

|

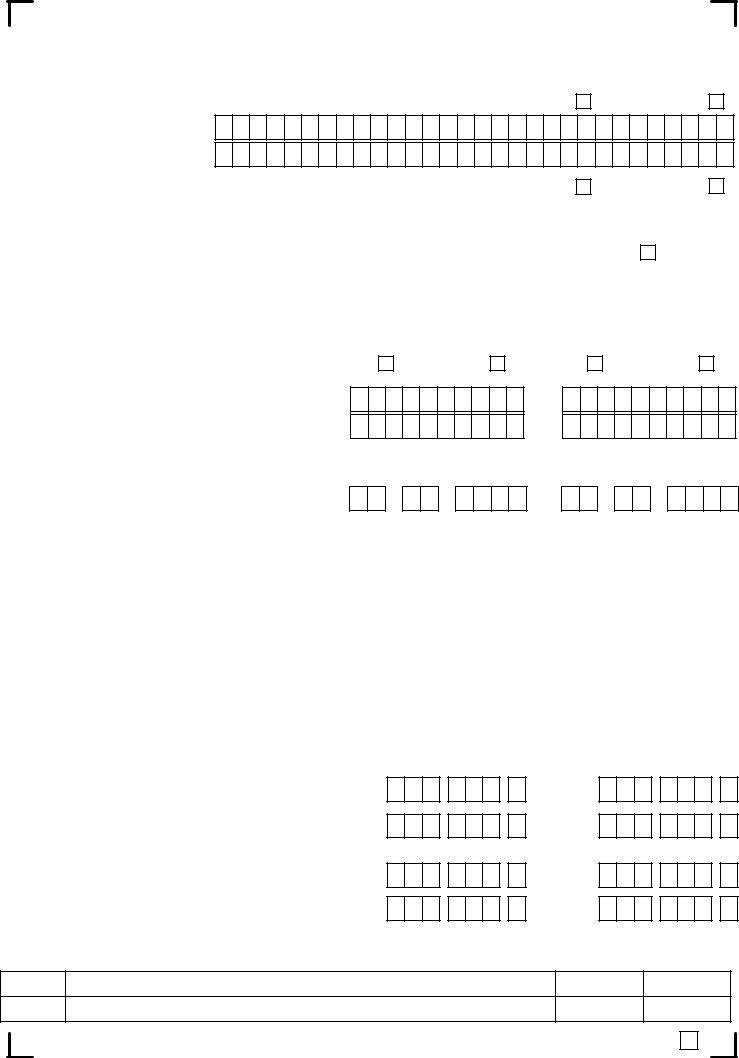

Self |

Spouse |

Insert ⌧ in the box(es) to indicate for 2010 if you and/or your spouse were:

14. Entitled to an exemption from Health Contribution

(a) State reason - Self

(b) State reason - Spouse

15. A farmer

Expression of Doubt

22.If you have a genuine doubt about the tax treatment of any item in the return, insert ⌧ in the box and enclose a letter setting out clearly the point at issue.

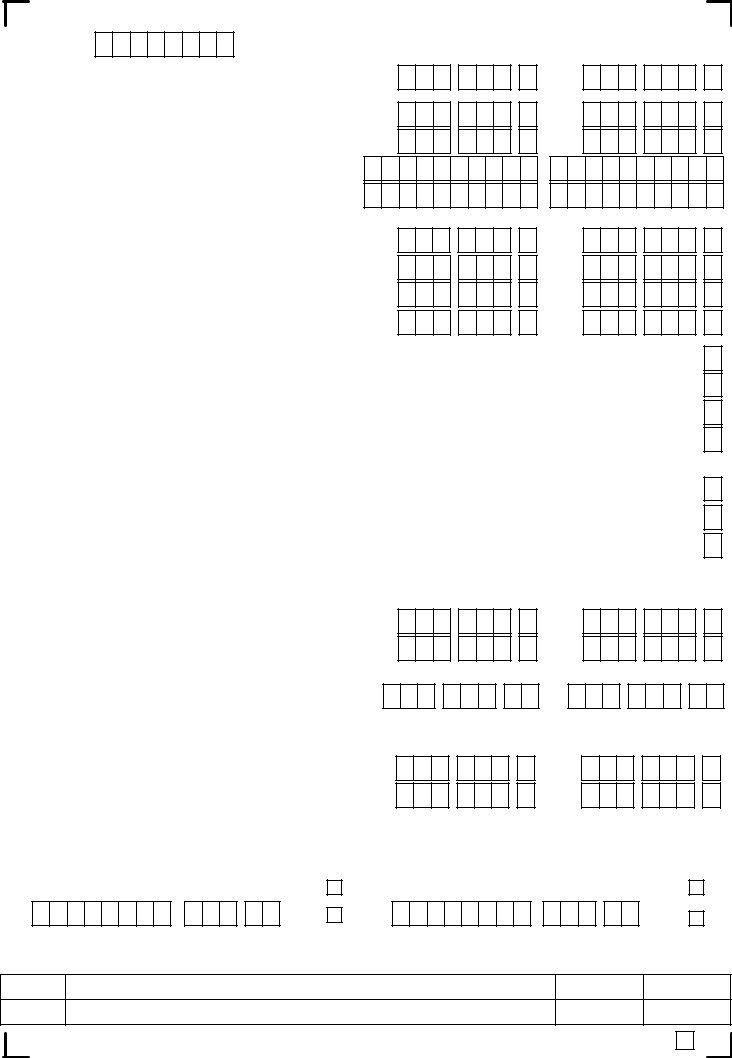

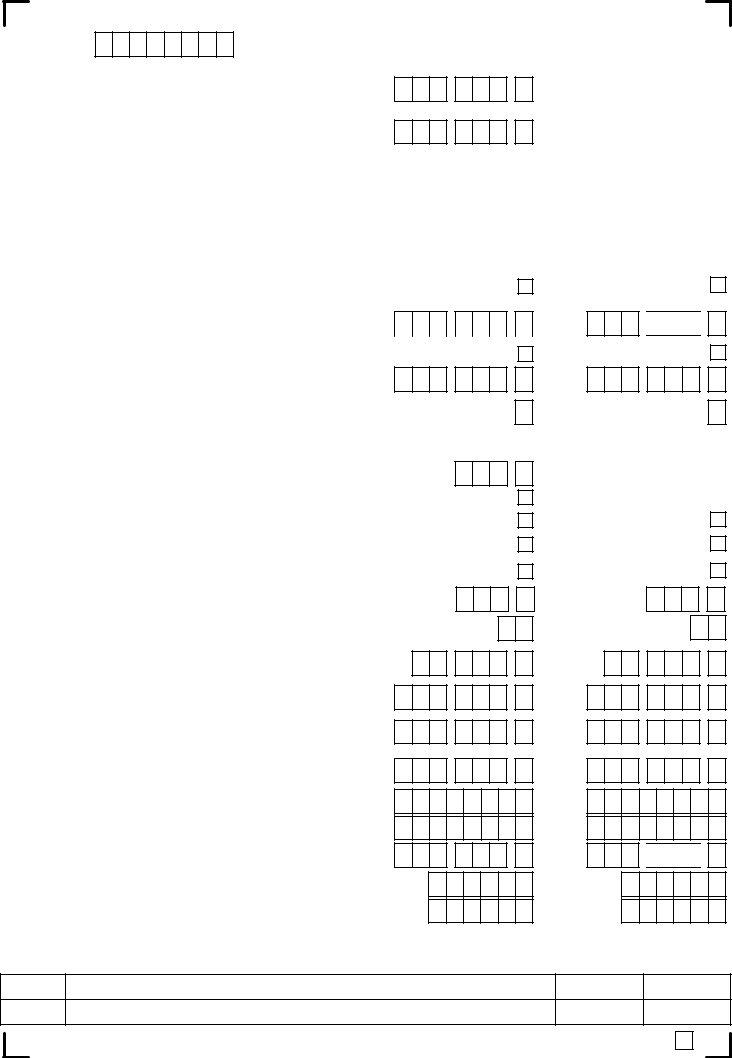

B - INCOME FROM TRADES, PROFESSIONS OR VOCATIONS

(Including Farming & Partnership Income) |

Primary Trade |

Subsidiary Trade |

||

|

Self |

Spouse |

Self |

Spouse |

101.Insert ⌧ in the box(es) to indicate to whom the income in each column refers

102. Description of Trade, Profession or Vocation (you must clearly describe the trade)

Do not submit accounts with this return. Instead you MUST give an extract of information from the accounts in Extracts From Accounts, Lines

103.If this source of income ceased during the year 2010 state the date of cessation (DD/MM/YYYY)

/

/

/

/

Profit assessable in 2010 |

|

|

|

, |

|

|

|

. |

|

|

|

|

|

, |

|

|

|

. |

|

|

|

104. |

(a) Amount of adjusted net profit for accounting period |

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

00 |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(b) Amount of adjusted net loss for accounting period |

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

105. |

(a) Enter the assessable profit even if this is the same as the |

|

|

|

, |

|

|

|

. |

|

|

|

|

|

, |

|

|

|

. |

|

|

|

adjusted net profit per Line 104(a) - (if a loss show 0.00) |

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

00 |

|

||||

|

This should include income assessable under S. 98A(4), |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Reverse Premiums in trading situations) where appropriate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

. |

|

|

|

|

|

, |

|

|

|

. |

|

|

106. |

Balancing Charges |

|

|

|

|

|

|

00 |

|

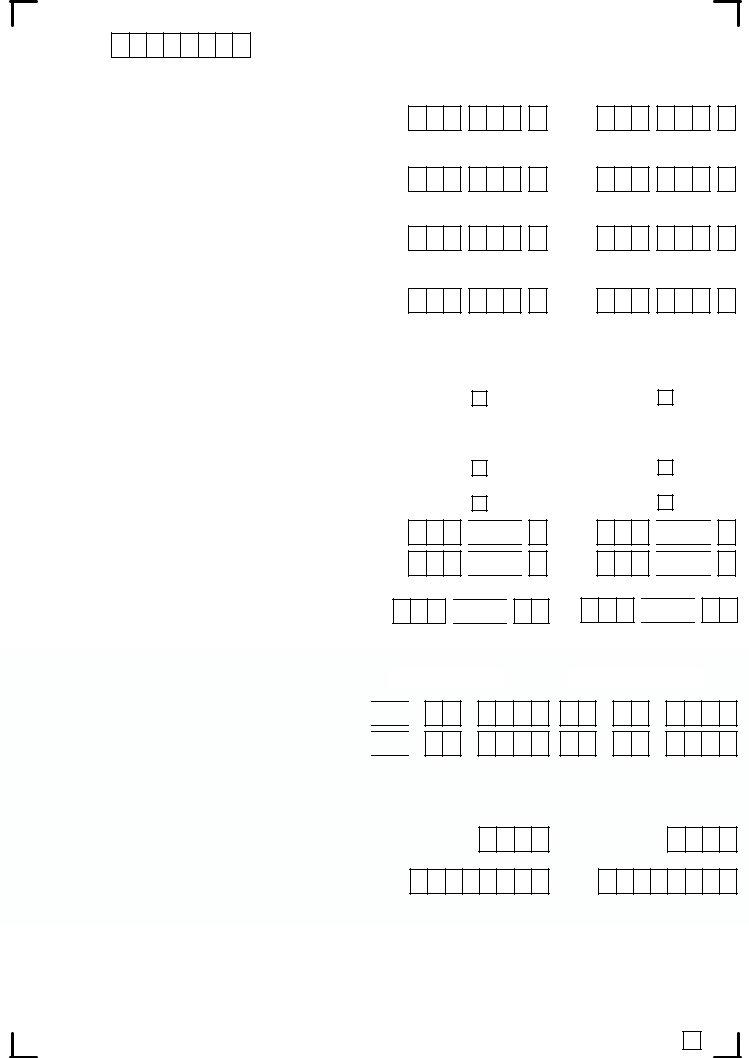

|

|

|

|

|

|

00 |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

107. |

Unused Capital Allowances from a prior year |

|

|

|

, |

|

|

|

. |

|

|

|

|

|

, |

|

|

|

. |

|

|

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

00 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Allowances for the year 2010

109.Machinery and Plant

110.(a) Industrial Buildings and/or Farm Buildings Allowance (other than (b) below)

(b)Farm Buildings Allowance in respect of expenditure incurred by farmers to comply with the requirement of the EU Nitrates Directive 91/676/EEC

111.Other

Official use only

Line

,

,

,

,

.00

.00

.00

.00

,

,

,

,

Self

. 00

. 00

. 00

. 00

Spouse

Page 3 |

FOR OFFICE USE ONLY |

5576281936 ANY PANEL(S) OR SECTION(S) THAT DO NOT REQUIRE AN ENTRY SHOULD BE LEFT BLANK. 2010120E

PPS No.

Primary Trade |

Subsidiary Trade |

Losses |

|

112. (a) If you wish to claim, under S. 381, to set any loss made in the trade in the year 2010 against your other income, enter the amount of the loss. Claim to be made on or before 31/12/2012.

, |

. 00 |

, |

.00

(b)If there are no/insufficient profits and you wish to claim unused current year Capital Allowances in computing a loss made in the trade in the year 2010 (S. 392), enter the amount of unused Capital Allowances. Claim to be made on or before 31/12/2012.

(c)Total loss for offset against other income

(by virtue of S. 381 and/or S. 392)

Unused losses from a prior year

,

,

.00

.00

,

,

.00

.00

113.(a) Amount of unused losses from a prior year (S. 382) other than residential development land losses where the relevant claim was not made to and received by Revenue before 7/4/2009

,

.00

,

.00

Election under Section 657B

114.To elect under S. 657B to have the aggregate of all 'specified payments' received and chargeable in 2010 treated as

arising in six equal instalments, chargeable in the year of assessment 2010 and the five succeeding years insert ⌧ in the box. Election to be made on or before 31/10/2011.

(This election cannot be altered and is irrevocable.)

Review of Income Tax Year 2009

(Only complete this section if a review of 2009 is required)

116. (a) If there was a change in Accounting Date (S. 65(3)) insert ⌧ in the box

(b) If a cessation of trade took place in 2010 (S. 67(1)(a)(ii)) insert ⌧ in the box

(c)Profits assessed in 2009 year of assessment

(d)Revised profits assessable in 2009 year of assessment

Credit for Professional Services Withholding Tax (PSWT)

117.Gross withholding tax in the basis period for 2010 on fees for Professional Services.

Do not include credit for Relevant Contracts Tax paid.

EXTRACTS FROM ACCOUNTS

Accounts Information Period (must be completed)

,. 00 ,. 00

,.

Primary Trade

,. 00 ,. 00

,.

Subsidiary Trade

118. |

From |

(DD/MM/YYYY) |

119. |

To |

(DD/MM/YYYY) |

/

/

/ |

/ |

/ |

/ |

/ |

/ |

Extracts From Accounts, on pages 5 and 6, must be completed in all cases where you or your spouse are in receipt of trading or professional income, except where either Lines 120 or 121 apply.

120.If you have previously submitted accounts information relating to this return state the income tax return with which accounts were submitted (YYYY)

121.Where the income arises from a partnership, enter the tax reference of the partnership

Official use only

Line |

|

Self |

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

Page 4 |

FOR OFFICE USE ONLY |

3778281938

PPS No. Income

ANY PANEL(S) OR SECTION(S) THAT DO NOT REQUIRE AN ENTRY SHOULD BE LEFT BLANK. 2010120E

Primary Trade |

Subsidiary Trade |

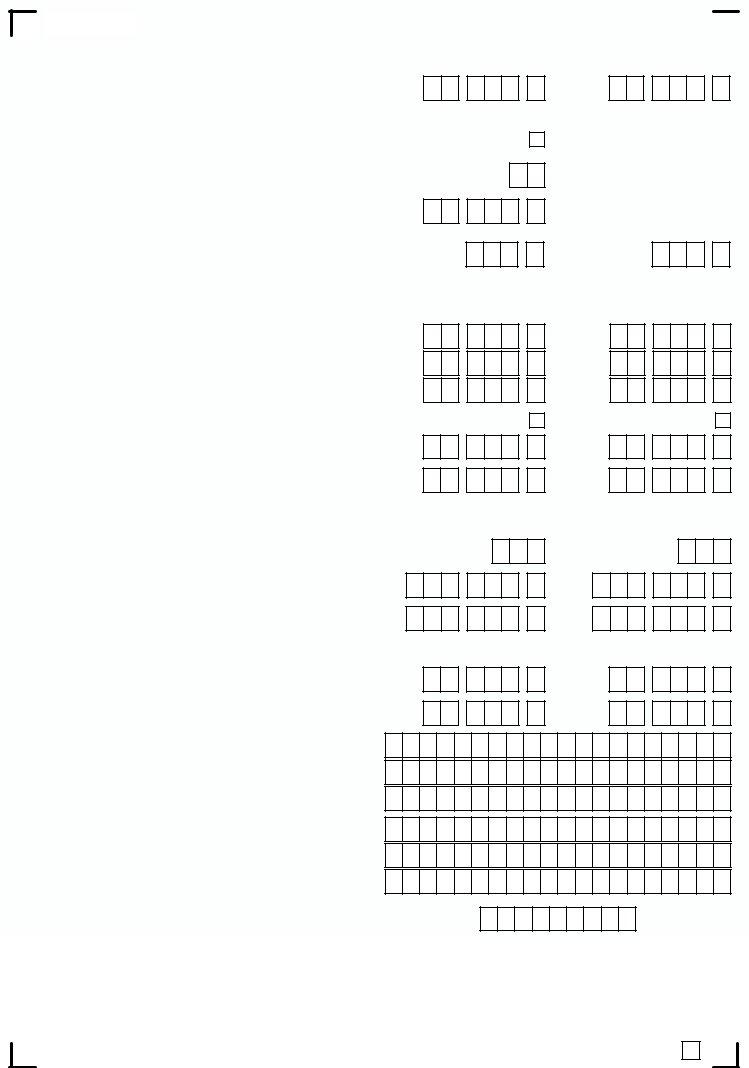

122.Sales/Receipts/Turnover

123.Receipts from Government Agencies (GMS, etc.)

124.Other Income including tax exempt income

Trading Account Items

,

,

,

.00

.00

.00

,

,

,

.00

.00

.00

125.Purchases

126.Gross Trading Profits

Expenses and Deductions

,

,

.00

.00

,

,

.00

.00

127Salaries/Wages, Staff costs

128.

129.Consultancy, Professional fees

130.Motor, Travel and Subsistence

131.Repairs/Renewals

132.Depreciation, Goodwill/Capital

133.(a) Provisions including bad debts - positive

(b)If negative, state amount here

134.Other Expenses (Total)

Capital Account and Balance Sheet Items

135.Cash/Capital introduced

136.Drawings (Net of Tax and Pension contributions)

137.(a) Closing Capital Balance - positive

(b)If negative, state amount here

138.Stock, Work in progress, Finished goods

139.Debtors and Prepayments

140.Cash/Bank (Debit)

141.Bank/Loans/Overdraft (Credit)

142.Client Account Balances (Debit)

143.Client Account Balances (Credit)

Official use only

Line

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|||||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|||||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|||||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|||||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|||||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|||||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|||||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|||||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|||||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

, |

|

|

|

. |

|

|

|

|

|

|

|

|

00 |

|

||

|

|

|

|||||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|||||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|||||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|||||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|||||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|||||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|||||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|||||||

|

|

|

, |

|

|

|

. |

00 |

|

|

Self |

|

|

|

Spouse |

||||

Page 5 |

FOR OFFICE USE ONLY |

7542281931 ANY PANEL(S) OR SECTION(S) THAT DO NOT REQUIRE AN ENTRY SHOULD BE LEFT BLANK. 2010120E

PPS No.

144.Creditors and Accruals

145.Tax Creditors

146.(a) Net Assets - positive

(b) If negative, state amount here

Extracts from Adjusted Net Profit/Loss Computation Profit/Loss per Accounts

147.Net Profit per Accounts

148.Net Loss per Accounts

Adjustments made to Profit/Loss per Accounts

Primary Trade

,

,

,

,

,

,

.00

.00

.00

.00

.00

.00

Subsidiary Trade

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|

||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|

||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|

||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|

||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|

||||

|

|

|

, |

|

|

|

. |

00 |

149. |

Motor Expenses |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

||

150. |

Donations (Political and Charitable)/Entertainment |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

, |

|

|

|

||

|

|

|

|

|

|

|

||

151. |

Light, Heat and Phone |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

, |

|

|

|

||

|

|

|

|

|

|

|

||

152. |

Net gain on sale of fixed/chargeable assets |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

, |

|

|

|

||

|

|

|

|

|

|

|

||

153. |

Net loss on sale of fixed/chargeable assets |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

, |

|

|

|

||

|

|

|

|

|

|

|

||

C - IRISH RENTAL INCOME |

|

|

|

|

|

|

|

|

|

|

|

Self |

|||||

202.Where the registration requirements of Part 7 of the Residential Tenancies Act 2004

have been complied with in respect of all tenancies which existed in relation to residential premises in the year 2010, insert ⌧ in the box

203.Number of properties let

204. |

Area in hectares, if applicable |

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|||

205. |

Gross Rent Receivable |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

||

206. |

Expenses |

|

|

|

|

|

|

|

|

|

(a) Repairs |

|

|

|

, |

|

|

|

|

|

(b) Allowable interest |

|

|

|

|

|

|

||

|

|

|

|

, |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

(d) Exempt rental income from the leasing of farm land, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

|

under S. 664 |

|

|

|

|

|

|

||

|

(e) Other |

|

|

|

|

|

|

||

|

|

|

|

, |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

207.Amount of chargeable income after expenses but before

Capital Allowances and losses |

, |

|

|

|

|||

(if a loss show 0.00) |

|

|

|

|

|

|

|

208. (a) Capital Allowances brought forward from a prior year |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

(b) Capital Allowances for the year 2010 |

|

|

|

, |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

(c) Capital Allowances used against rental income in |

|

|

|

, |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

||

the year 2010 |

|

|

|

|

|

|

|

Official use only |

|

|

|

|

|

|

|

Line |

|

|

|

|

|

|

|

.00

.00

.00

.00

.00

.

.00

.00

.00

.00

.00

.00

.00

.00

.00

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|

||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|

||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|

||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|

||||

|

|

|

, |

|

|

|

. |

00 |

|

|

Spouse |

|

|

||||

|

|

, |

|

|

|

. |

|

|||||

|

|

|

, |

|

|

|

|

. |

|

|

||

|

|

|

|

|

|

|

|

00 |

||||

|

|

|

|

|

|

|

|

|

||||

|

|

|

, |

|

|

|

|

. |

|

00 |

||

|

|

|

|

|

|

|

|

|

||||

|

|

|

, |

|

|

|

|

. |

|

00 |

||

|

|

|

|

|

|

|

|

|

||||

|

|

|

, |

|

|

|

|

. |

|

00 |

||

|

|

|

|

|

|

|

|

|

||||

|

|

|

, |

|

|

|

|

. |

|

00 |

||

|

|

|

, |

|

|

|

|

. |

|

|

||

|

|

|

|

|

|

|

|

00 |

||||

|

|

|

, |

|

|

|

|

. |

|

|

||

|

|

|

|

|

|

|

|

00 |

||||

|

|

|

, |

|

|

|

|

. |

|

|

||

|

|

|

|

|

|

|

|

00 |

||||

|

|

|

, |

|

|

|

|

. |

|

|

||

|

|

|

|

|

|

|

|

00 |

||||

Self |

|

Spouse |

||||||||||

Page 6 |

FOR OFFICE USE ONLY |

1346281937 ANY PANEL(S) OR SECTION(S) THAT DO NOT REQUIRE AN ENTRY SHOULD BE LEFT BLANK. 2010120E

PPS No. |

|

|

|

|

|

|

|

|

Self |

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

209.If you wish to elect under S. 305(1)(b) to set any unused Capital Allowances (not already

of Buildings for 2010 against your other income state the amount of unused Capital Allowance available for offset below:

(a) To which S. 409A applies (restricted to €31,750) |

|

|

, |

|

|

|

. |

00 |

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(b) To which S. 409A does not apply (no restriction applies) |

|

|

|

, |

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

|

, |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

210. Losses - Amount of unused losses from a prior year |

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00

.00

.00

D - INCOME FROM IRISH EMPLOYMENTS, OFFICES (INCLUDING DIRECTORSHIPS), PENSIONS, etc.

INCOME FROM FOREIGN OFFICES OR EMPLOYMENTS ATTRIBUTABLE TO THE DUTIES OF THOSE OFFICES AND EMPLOYMENTS EXERCISED IN THE STATE

212.(a) Gross amount of income from Irish employments, offices and

,

.00

,

.00

(b)Gross amount of income from Irish Proprietary

Directorships subject to PAYE

213.(a) Income attributable to the performance in the State of the duties of foreign offices and foreign employments subjected to PAYE deduction

(b)Income attributable to the performance in the State

of the duties of foreign offices and foreign employments not subjected to PAYE deduction

(c)If you are resident and

214.Gross amount of income from Public Sector employment where PRSI was paid under Class B, C, or D

215.Gross amount of income from certain Public Sector employment (Members of the Oireachtas, Judiciary, etc.)

216.Income from Irish employment not subjected to PAYE (include payments received on commencement/cessation of employment, restrictive covenants, etc.)

,

,

,

,

,

.00

.00

.00

.00

.00

,

,

,

,

,

.00

.00

.00

.00

.00

(a)Amount chargeable to tax

(b)Nature of Payment(s)

217.Amount of Top Slicing Relief (TSR) claimed in 2010

218.Allowable Deductions incurred in Employment

(a)Nature of employment(s)

,. 00

,. 00

,. 00

,. 00

(b)Expenses

(c)Superannuation Contributions/AVC (where not deducted by Employer)

(d)Capital Allowances

(e)Total of (b) + (c) + (d) above

(f)Amount of total at (e) referring to Proprietary Directorship income/salary

(g)Amount of total at (e) referring to Employment income/salary

Official use only

Line

,

,

,

,

,

,

.00

.00

.00

.00

.00

.00

,

,

,

,

,

,

Self

. 00

. 00

. 00

. 00

. 00

. 00

Spouse

Page 7 |

FOR OFFICE USE ONLY |

8262281931 ANY PANEL(S) OR SECTION(S) THAT DO NOT REQUIRE AN ENTRY SHOULD BE LEFT BLANK. 2010120E

PPS No.

219.Taxable Benefits (not taxed at source under PAYE)

(a) PRSAs

(Note to include this in Line 507(c) on page 11)

(b)Shares/Securities

(Note to include all share awards in 2010)

(c)Other Specify

Self

,

,

,

.00

.00

.00

Spouse

,

,

,

.00

.00

.00

Social Welfare Payments, Benefits or Pensions received

220.Illness/Occupational Injury/Jobseekers Benefits Enter taxable amount

221.Carer’s Allowance paid by Dept. of Social Protection

222.

223.Other taxable Social Welfare Payments, Benefits or Pensions

Irish Pensions received

,

,

,

,

.00

.00

.00

.00

,

,

,

,

.00

.00

.00

.00

224. |

Early Farm Retirement Pension (subject to PAYE) |

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

225. |

Employment pension (subject to PAYE) |

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

226. |

Employment pension (not subjected to PAYE) |

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

227. |

'Annuity' pension payable under an RAC or a PRSA |

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

228.Distributions from Approved Retirement Funds, Approved Minimum Retirement Funds & PRSA (Part 30 Chs 2 & 2A)

(a) Distributions received from an Approved Retirement |

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

, |

|

|

|

Fund (S. 784A) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

(b) Distributions received from an Approved Minimum |

|

|

|

, |

|

|

|

. |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

||||

Retirement Fund (S. 784C) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

||||||||||

(c) Distributions received from a PRSA (S. 787G) |

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Levy - Gross Income from Employment/Pension

.00

.00

.00

.00

.00

.00

.00

Gross amount of all employment and occupational pension income, before any deduction for superannuation, other pension contributions, or permanent health benefit. This is the Gross Income for Income Levy as shown in the Income Levy Certificate(s) 2010.

229.Gross income for Income Levy for the year 2010

230.Amount of Income Levy deducted in 2010

PAYE Tax deducted/refunded

231.(a) Total of all PAYE tax deducted per P60(s)/P45(s) include amount of tax deducted from distributions received from an Approved Retirement Fund, Approved Minimum Retirement Fund & PRSA. Note: In respect of Proprietary Directorships, only tax

remitted to Revenue should be entered here

(b)PAYE Tax refunded for the Income Tax year 2010

(c)PAYE Tax underpaid (amount collected by reducing your tax credits for 2010)

Directorships

,

,

,

,

,

.00

.00

.

.00

.00

,

,

,

,

,

.00

.00

.

.00

.00

232. If you and/or your spouse held proprietary directorships in the year 2010, state each company's tax number and the percentage

shareholding in each company |

|

|

|

|

|

Insert ⌧ in the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Insert ⌧ in the |

||||||||||

|

Company Tax Number |

% |

|

|

|

Company Tax Number |

% |

|

|

|

||||||||||||||||||||||

|

|

|

|

box if Spouse |

|

|

|

box if Spouse |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

.

Official use only

Line

.

Self Spouse

Page 8 |

FOR OFFICE USE ONLY |

6990281937 ANY PANEL(S) OR SECTION(S) THAT DO NOT REQUIRE AN ENTRY SHOULD BE LEFT BLANK. 2010120E

PPS No.

Share Options |

Self |

Spouse |

234.Share options exercised, released or assigned in 2010

(a)Enter total chargeable amount

(b)Enter amount of Relevant Tax on a Share Option (RTSO) paid

E - FOREIGN INCOME (enter amounts in €)

,

,

.00

.00

,

,

.00

.00

Foreign tax deducted should only be entered below if it is available as a credit against Irish Tax. If the foreign tax is only allowed as a deduction, the amount of income returned below should be net of this foreign tax. Where the foreign tax was refunded (or is refundable) by the foreign jurisdiction the gross amount of income should be returned below and the foreign tax should not be entered in this return. See Guide to Completing 2010 Pay and File Returns for more information on the taxation of foreign income.

301.Great Britain and Northern Ireland Dividends

Net amount received |

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

302.Foreign Pensions

|

(a) Amount of State Welfare Pension(s) |

|

|

|

|

, |

|

|

|

|

|

. |

00 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

(b) Amount of all Other Pension(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

, |

|

|

|

. |

00 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

312. |

Foreign Rental Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

(a) Number of foreign properties let |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(b) Income from Foreign Rents (enter gross amount receivable) |

|

|

|

|

, |

|

|

|

|

|

|

. |

|

||

|

|

|

|

|

|

|

|

|

|

|

00 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

(c) Expenses |

|

|

|

|

, |

|

|

|

|

|

|

. |

|

||

|

|

|

|

|

|

|

|

|

|

|

00 |

|||||

|

(i) Expenses relating to this income (excluding interest) |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

, |

|

|

|

|

|

|

. |

|

|||

|

(ii) Allowable Interest |

|

|

|

|

|

|

|

|

|

|

00 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

(d) Net profit on Foreign Rental properties |

|

|

|

|

, |

|

|

|

|

|

|

. |

|

||

|

|

|

|

|

|

|

|

|

|

|

00 |

|||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

(e) Capital Allowances |

|

|

|

|

, |

|

|

|

|

|

|

. |

|

||

|

|

|

|

|

|

|

|

|

|

|

00 |

|||||

|

(including Capital Allowances forward) |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

, |

|

|

|

|

|

|

. |

|

||

|

(f) Losses - Amount of unused losses from a prior year |

|

|

|

|

|

|

|

|

|

|

00 |

||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

, |

|

|

|

|

|

|

. |

|

|

|

||

|

(g) Amount of foreign tax deducted |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

F - INCOME FROM FEES, COVENANTS, DISTRIBUTIONS, etc. |

|

|

|

|

|

|

|

|

||||||||

401. (a) Amount of Income from Fees, Commissions, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||

|

(b) Description of Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

402. |

Irish Untaxed Income |

|

|

|

|

, |

|

|

|

|

|

|

. |

|

||

|

|

|

|

|

|

|

|

|

00 |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

403.Irish Deposit Interest

(a)Gross Deposit Interest received on which DIRT was deducted

(i) taxable at 25% |

|

|

|

, |

|

|

|

. |

00 |

(ii) taxable at 28% |

|

|

|

, |

|

|

|

. |

|

|

|

|

|

|

|

00 |

|||

|

|

|

|

|

|

|

|

|

|

(b) Gross Interest received from Special Share |

|

|

|

, |

|

|

|

. |

|

|

|

|

|

|

|

|

|||

Account(s)/Special Term Share Account(s)/Special |

|

|

|

|

|

|

00 |

||

|

|

|

|

|

|

|

|

|

|

Savings Account(s) on which DIRT was deducted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(c) Gross interest received where DIRT was not deducted |

|

|

|

, |

|

|

|

. |

|

|

|

|

|

|

|

00 |

|||

by virtue of S. 256(1A) or S.256(1B) |

|

|

|

|

|

|

Official use only

Line

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

. |

|

00 |

||

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

, |

|

|

|

|

. |

|

00 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

. |

|

00 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

. |

|

00 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

. |

|

00 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

, |

|

|

|

|

. |

|

00 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|||||

|

|

|

|

|

|

, |

|

|

|

|

|

00 |

||||||

|

|

|

|

|

|

|

|

|

|

|

. |

|

||||||

|

|

|

|

|

|

, |

|

|

|

|

00 |

|||||||

|

|

|

|

|

|

. |

|

|

|

|

|

|||||||

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

||||

|

|

|||||||||||||||||

|

|

|

|

, |

|

|

|

. |

|

00 |

||||||||

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

. |

|

00 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

. |

|

00 |

||

|

Self |

|

|

Spouse |

||||||||||||||

Page 9 |

FOR OFFICE USE ONLY |

5821281939 ANY PANEL(S) OR SECTION(S) THAT DO NOT REQUIRE AN ENTRY SHOULD BE LEFT BLANK. 2010120E

PPS No.

404.(a) Gross amount of Dividends from Irish Resident Companies (from which Dividend Withholding Tax was deducted)

(b)Gross amount of Dividends from Irish Resident Companies (from which Dividend Withholding Tax was not deducted)

405.Settlement, Covenant, Estate income, Maintenance Payments, etc.

(a) Type(s) of payment(s)

Self

,

,

.00

.00

Spouse

,

,

.00

.00

(b)Gross amount received/receivable, where tax was not deducted

(c)Gross amount received/receivable, where tax was deducted

406.Income from

(a)Gross amount of royalties or other sums received, where tax was not deducted

(b)Gross amount of royalties or other sums received, where tax was deducted

407.Gross amount of Other Income received where Irish Standard Rate Tax was deducted at source, e. g. Annuities

,

,

,

,

,

.00

.00

.00

.00

.00

,

,

,

,

,

.00

.00

.00

.00

.00

G - EXEMPT INCOME

413.(a) Income received under

(b)If you do not wish to avail of

,

.00

,

.00

414.Childcare Services

I confirm that I have notified the relevant person recognised by the Health Service Executive that I am providing Childcare Services

and elect to have the gross income, before expenses, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

in respect of these services exempted from income tax |

|

|

, |

|

|

|

. |

00 |

|

|

|

, |

|

|

|

. |

00 |

(to elect enter the gross income received) |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H - ANNUAL PAYMENTS, CHARGES AND INTEREST PAID |

|

|

|

|

||||

|

|

, |

|

|

|

|||

501. |

Gross amount of Rents, etc. payable to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

502. |

Clawback of Employers’ Tax Relief at Source (TRS) |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

If you are an employer and have paid medical insurance |

|

|

|

, |

|

|

|

|

premiums on behalf of employees, enter amount of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medical Insurance premiums paid, (excluding contributions |

|

|

|

|

|||

|

made by employees and net of |

|

|

|

|

|||

503. (a) Gross amount of Maintenance Payments paid in 2010 |

|

|

|

, |

|

|

|

where tax was deducted |

|

|

|

|

|

|

|

(b) Gross amount of Maintenance Payments paid in 2010 |

|

|

|

, |

|

|

|

|

|

|

|

|

|

||

where tax was not deducted |

|

|

|

|

|

|

Official use only

Line

.00

.00

.00

.00

,

,

,

,

Self

. 00

. 00

. 00

. 00

Spouse

Page 10 |

FOR OFFICE USE ONLY |

9722281933 ANY PANEL(S) OR SECTION(S) THAT DO NOT REQUIRE AN ENTRY SHOULD BE LEFT BLANK. 2010120E

PPS No.

504. |

(a) Gross amount of Deed(s) of Covenant in favour of |

|

Permanently Incapacitated individual(s) |

|

(b) Gross amount of Deed(s) of Covenant in favour of |

|

person(s) aged 65 or over |

505. |

Gross amount of payment of other Charges/Annuity(ies) |

|

where tax was deducted |

506. |

Retirement Annuity Contracts (RACs) |

|

(a) If you are claiming relief in respect of RACs |

|

state the source(s) of your |

Self

,

,

,

.00

.00

.00

Spouse

,

,

,

.00

.00

.00

(b) Amount of RACs paid in 2010 (for which relief has |

not been claimed or granted in 2009) |

(c) Insert ⌧ in the box if a once off payment |

(d) Amount paid between 1/1/2011 and 31/10/2011 for which |

relief has not already been granted and for which relief |

is being claimed in 2010 |

(e) Amount paid in a prior year, for which relief |

has not been obtained |

(f) Total amount of RAC relief claimed in 2010 |

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

, |

|

|

|

. |

00 |

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

, |

|

|

|

. |

00 |

507.Personal Retirement Savings Accounts (PRSAs)

Only complete if you, or your employer on your behalf, made PRSA contributions.

(a)If you are a member of an Occupational or Statutory Pension scheme state the amount of contributions to that scheme from 1/1/2010 - 31/12/2010, (for which no further relief is due)

(b)PRSA contributions deducted by your employer from your salary, (for which no further relief is due)

(c)PRSA contributions made on your behalf by your employer (Note to include this in Line 219(a) on page 8)

(d)PRSA contributions paid directly by you to a PRSA provider

(e)Amount paid between 1/1/2011 and 31/10/2011 for which relief has not already been granted and for which relief is being claimed in 2010

(f)Amount paid in a prior year, for which relief

has not been obtained

(g) Total amount of PRSA relief claimed in 2010

,

,

,

,

,

,

,

.00

.00

.00

.00

.00

.00

.00

,

,

,

,

,

,

,

.00

.00

.00

.00

.00

.00

.00

Official use only

Line |

|

Self |

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

Page 11 |

FOR OFFICE USE ONLY |

7527281934 ANY PANEL(S) OR SECTION(S) THAT DO NOT REQUIRE AN ENTRY SHOULD BE LEFT BLANK.

2010120E

PPS No.

508.Overseas Pension Plans: Migrant Member Relief

(a)Amount paid by 'relevant migrant member' in

respect of a 'qualifying overseas pension plan' in 2010

(b)Amount paid between 1/1/2011 and 31/10/2011 for which relief has not already been granted and for which relief is being claimed in 2010

Self

,

,

.00

.00

|

|

Spouse |

|

|

||||

|

|

|

|

|

|

|

. |

|

|

|

|

, |

|

|

|

00 |

|

|

|

|

|

|

||||

|

|

|

, |

|

|

|

. |

00 |

(c) Amount paid in a prior year, for which relief has |

|

|

|

, |

|

|

|

. |

00 |

not been obtained |

|

|

|

|

|

|

|||

|

|

|

|||||||

(d) Total amount of Migrant Member Relief claimed in 2010 |

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

510.Interest Relief on Certain Unsecured Home Loans

In respect of interest paid on unsecured Home Loans used for the purchase, repair, development or improvement of your main residence, taken out on or after 1/1/2004, complete the following:

(a)Insert ⌧ in the box to confirm interest claimed at (d) below is not in respect of a secured home loan (mortgage) taken out with a lending provider in the State

(b)If you received Tax Relief at Source (TRS) in respect of

another loan in 2010, state the amount of interest on which TRS |

, |

. 00 |

|||

|

|

|

|

|

|

relief granted |

|

|

|

|

|

|

|

|

|

|

|

(c) Insert ⌧ in the box if you are entitled to |

|

|

|

|

|

|

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|

||||

|

|

|

, |

|

|

|

. |

00 |

,. 00

(d) State the amount of interest paid in 2010 |

, |

. 00 |

(excluding interest at (b) above) |

(e)State the number of tax years

I - CLAIM FOR TAX CREDITS, ALLOWANCES, RELIEFS AND HEALTH EXPENSES

,

.00

513.(a) Home Carer Tax Credit - Amount due for 2010

(b)If you qualify on the

514.PAYE Tax Credit - Insert ⌧ in the box if claimed

515.(a) Blind Person’s Tax Credit - Insert ⌧ in the box to indicate if due

(b)Guide Dog - Insert ⌧ in the box to indicate if self and/or spouse has a Guide Dog

516.(a) Dependent Relative Tax Credit - Amount claimed

(b)Number of Dependent Relatives

517.Employing a Carer to care for an incapacitated individual - Amount claimed

518.Permanent Health Benefit (not health/medical insurance)

- Amount paid (where not deducted from gross pay by employer)

519.(a) Seed Capital Scheme - Amount of relief claimed in 2010 Note: If you are claiming relief for prior years you should

submit full details to your Revenue office

(b)(i) Business Expansion Scheme Relief - Amount of relief claimed in 2010

(ii)Enter relevant RICT3 certificate number, or, if appropriate, the Designated Fund's reference number

,

,

,

,

.00

.00

.00

.00

.00

.00

,

,

,

,

.00

.00

.00

.00

.00

520.(a) Film Relief

-Amount of investment on which relief is claimed in 2010

(b)Enter all relevant Film3 certificate numbers

Official use only

Line

,

.00

,. 00

Self Spouse

Page 12 |

FOR OFFICE USE ONLY |

|

6963281937 ANY PANEL(S) OR SECTION(S) THAT DO NOT REQUIRE AN ENTRY SHOULD BE LEFT BLANK. 2010120E

PPS No. |

|

|

|

|

|

|

|

|

Self |

Spouse |

|

|

|

|

|

|

|

|

|

|

|

521.Qualifying Tuition Fees - Amount on which relief is claimed in respect of the 2010 academic year (do not include registration or exam fees)

, |

. 00 |

, |

. 00 |

522.

523.(a) Incapacitated Child Tax Credit - To claim this tax credit state the number of incapacitated children

|

(b) Amount of tax credit being claimed |

, |

. 00 |

|

|

|

|

524. |

Service Charges paid in the year 2009 |

|

. 00 |

|

(as a fixed annual charge or under a “tag system”) to a |

|

|

|

Local Authority/Private Contractor |

|

|

525. |

Medical Insurance Premiums - Paid by your employer |

|

|

|

If your Employer paid premiums on your behalf, to an authorised insurer, in 2010 state: |

. 00 |

|

|

(a) Amount of the gross premium |

, |

|

|

|

|

|

|

(b) Amount of |

, |

. 00 |

|

|

|

|

|

(c) Amount of any contribution made by you |

, |

. 00 |

|

|

|

|

526. |

Trade Union Subscriptions - Insert ⌧ in the box to claim |

|

|

527. |

Purchase of New Shares in a Company by an Employee |

, |

. 00 |

|

- Amount of relief claimed |

||

529. |

Job Assist Allowance - Amount claimed |

, |

. 00 |

|

|

||

. 00 |

, |

. 00 |

, |

. 00 |

, |

. 00 |

, |

. 00 |

, |

. 00 |

530.Seafarer Allowance

(a) Number of days out of the State

(b) Amount of salary for this employment |

, |

. 00 |

|

|

|

(c) Amount claimed |

, |

. 00 |

|

|

531.Rent Tax Credit

(a) Amount of rent paid if under 55 years of age in 2010 |

, |

. 00 |

|

|

|

(b) Amount of rent paid if 55 years of age or over in 2010 |

, |

. 00 |

|

|

|

(c) Address of Rented Property |

|

|

, |

. 00 |

, |

. 00 |

, |

. 00 |

, |

. 00 |

(d) Name and address of landlord/agency rent is paid to

(e) PPS No. of landlord

Official use only

Line |

|

Self |

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

Page 13 |

FOR OFFICE USE ONLY |

3432281935 ANY PANEL(S) OR SECTION(S) THAT DO NOT REQUIRE AN ENTRY SHOULD BE LEFT BLANK. 2010120E

PPS No.

|

|

|

|

|

|

Self |

|

|

|

|

532. Year of Marriage Review if married in 2010 |

|

|

|

|

|

|

|

|

|

|

(a) To claim for relief under S. 1020 insert ⌧ in the box |

|

|

|

|

|

|

|

|

|

|

(b) Amount of spouse's income for 2010 |

|

|

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

(c) Amount of repayment claimed in respect of self |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(d) Amount of repayment claimed in respect of spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your spouse will have to make a separate claim for relief under S. 1020 in his/her return.

Spouse

.00

.00

.00

533.Approved Sports Bodies - Amount of Donations made in 2010

534.Approved Charities - Amount of Donations made in 2010

535.Other Approved Bodies - Amount of Donations made in 2010

,

,

,

.00

.00

.00

,

,

,

.00

.00

.00

Health Expenses - Health Expenses incurred by you (and your spouse if you are taxed under Joint Assessment). Complete and retain Form Med 1

Nursing Home expenses - Enter details in relation to maintenance/treatment in 2010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

536. (a) Amount of expenses |

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|||||

(b) Name and address of Nursing Home |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deductions (Sums received/receivable in respect of Nursing Home expenses)

537. |

From any public/local authority (e.g. Local Health Office) |

|

|

, |

|

|

|

. |

00 |

|

|

|

|

|

|

|

|

|

|||

538. |

Under any policy of medical insurance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

, |

|

|

|

. |

00 |

|||

|

|

|

|

|

|

|

|

|||

539. |

Compensation claim, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

, |

|

|

|

. |

00 |

|||

|

|

|

|

|

|

|

|

|||

540. |

Total Deductions (Nursing Home expenses only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

, |

|

|

|

. |

00 |

|||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|