You are able to fill out form 12a pdf instantly with the help of our PDFinity® online PDF tool. FormsPal development team is continuously endeavoring to improve the tool and insure that it is even better for people with its handy features. Take your experience to a higher level with constantly improving and great options we provide! With some easy steps, you'll be able to begin your PDF editing:

Step 1: Access the PDF form in our editor by hitting the "Get Form Button" in the top area of this webpage.

Step 2: As you access the PDF editor, you'll see the document prepared to be completed. Aside from filling in various blanks, it's also possible to perform some other actions with the file, including adding custom words, editing the original textual content, adding images, placing your signature to the PDF, and much more.

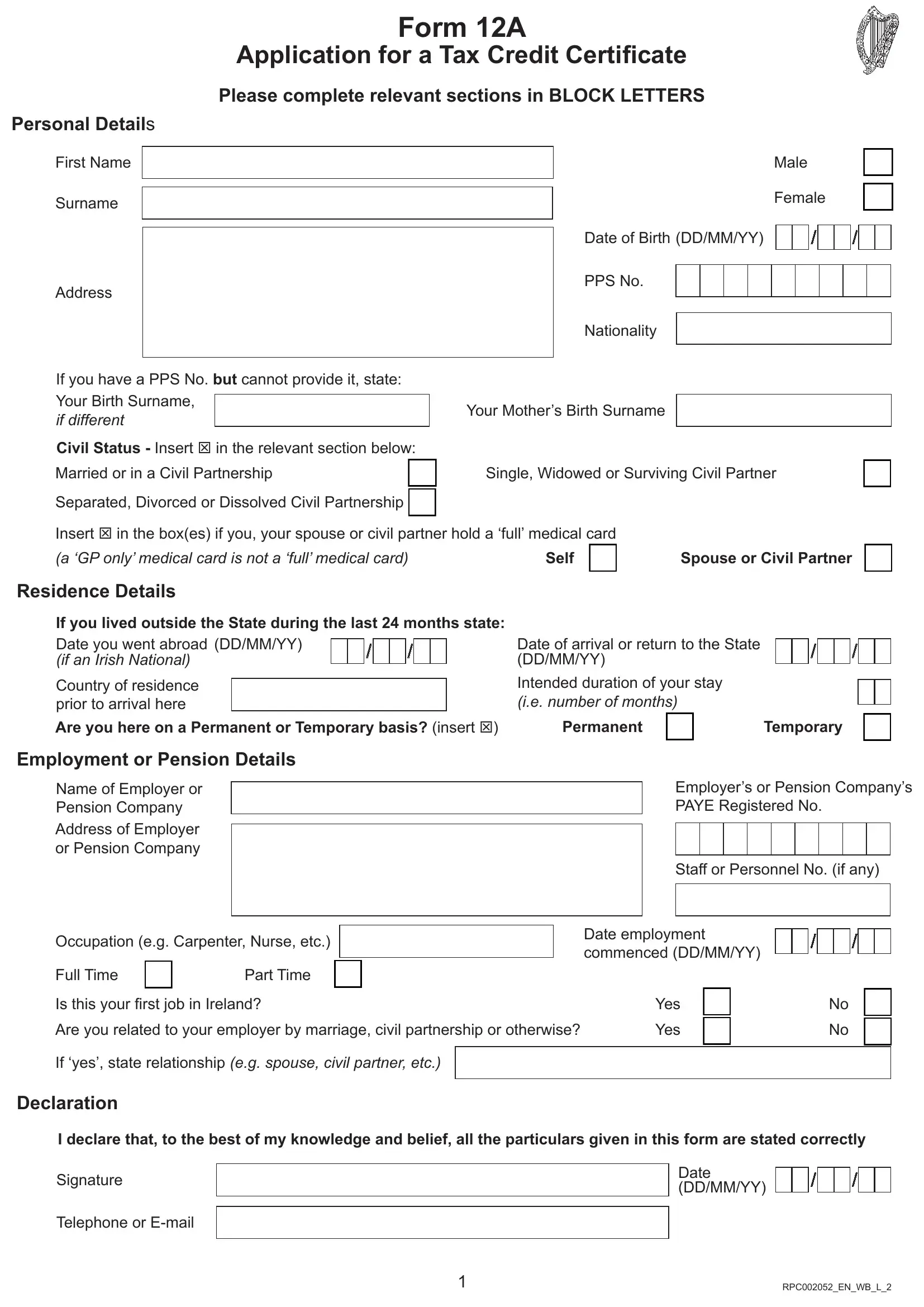

For you to complete this PDF document, make sure you enter the necessary details in each area:

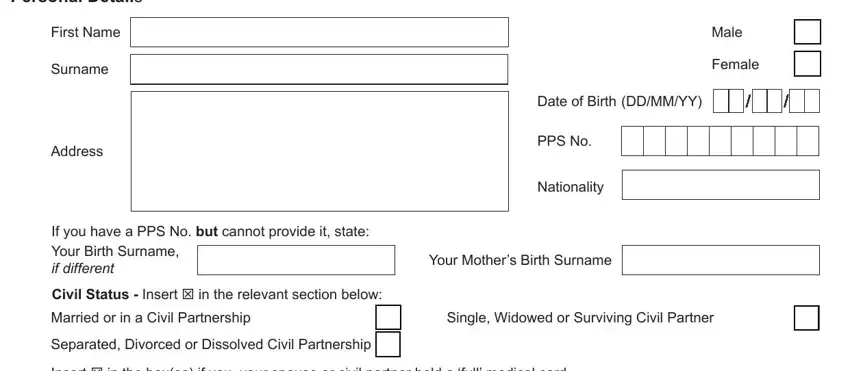

1. To start with, while completing the form 12a pdf, begin with the part containing following fields:

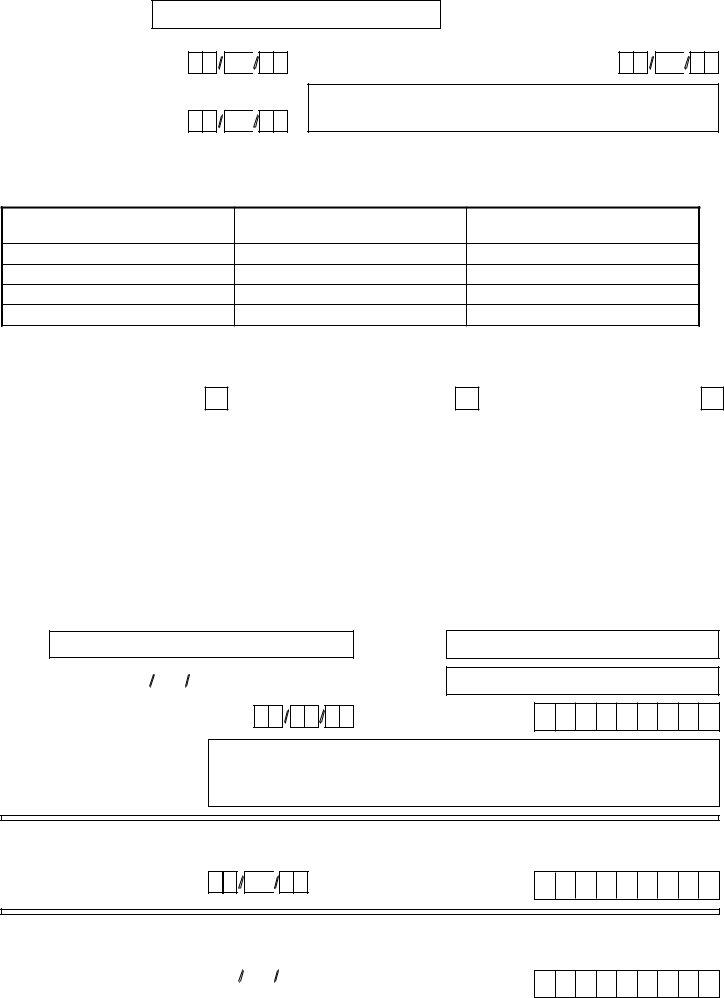

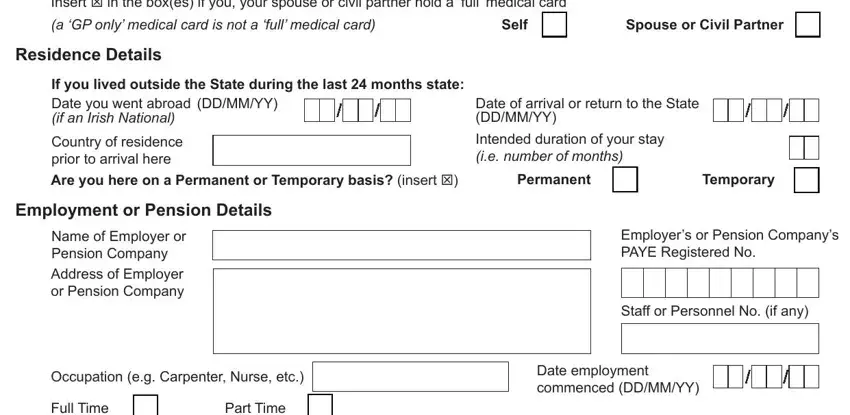

2. Once your current task is complete, take the next step – fill out all of these fields - Insert T in the boxes if you your, a GP only medical card is not a, Self, Spouse or Civil Partner, Residence Details, If you lived outside the State, DDMMYY, Country of residence prior to, Employment or Pension Details, Name of Employer or Pension Company, Address of Employer or Pension, Date of arrival or return to the, Intended duration of your stay ie, Permanent, and Temporary with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

People frequently make mistakes while completing a GP only medical card is not a in this part. Be sure to go over what you enter right here.

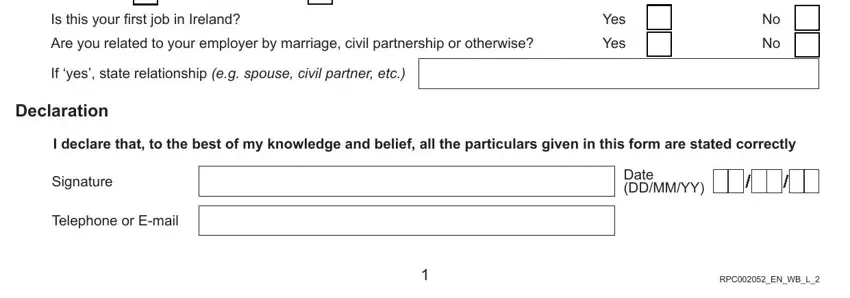

3. Through this part, review Full Time Is this your irst job in, Part Time, Yes, Yes, If yes state relationship eg, Declaration, I declare that to the best of my, Signature, Telephone or Email, Date DDMMYY, and RPCENWBL. All of these have to be taken care of with utmost attention to detail.

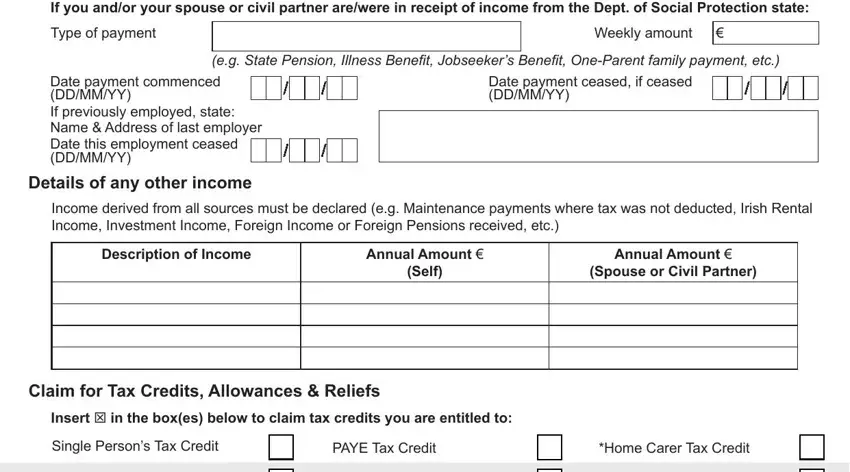

4. It is time to begin working on this next part! Here you will get all of these If you andor your spouse or civil, Type of payment, Weekly amount, eg State Pension Illness Beneit, Date payment commenced DDMMYY If, Details of any other income, Date payment ceased if ceased, Income derived from all sources, Description of Income, Annual Amount, Self, Annual Amount, Spouse or Civil Partner, Claim for Tax Credits Allowances, and Insert T in the boxes below to form blanks to complete.

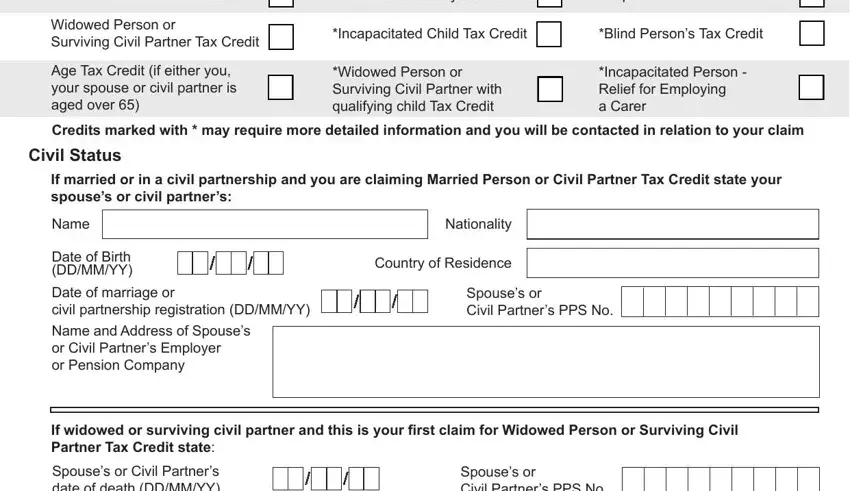

5. As you come close to the finalization of your file, you'll notice just a few extra requirements that need to be met. Mainly, Married or Civil Partner Tax Credit, OneParent Family Tax Credit, Dependent Relative Tax Credit, Widowed Person or Surviving Civil, Age Tax Credit if either you your, Incapacitated Child Tax Credit, Blind Persons Tax Credit, Widowed Person or Surviving Civil, Incapacitated Person Relief for, Credits marked with may require, Civil Status, If married or in a civil, Name, Date of Birth DDMMYY, and Country of Residence must be filled in.

Step 3: Make sure that your information is accurate and then press "Done" to conclude the task. Join FormsPal now and immediately access form 12a pdf, all set for downloading. Every edit you make is conveniently saved , so that you can customize the file at a later point anytime. Here at FormsPal.com, we endeavor to make certain that your information is kept protected.