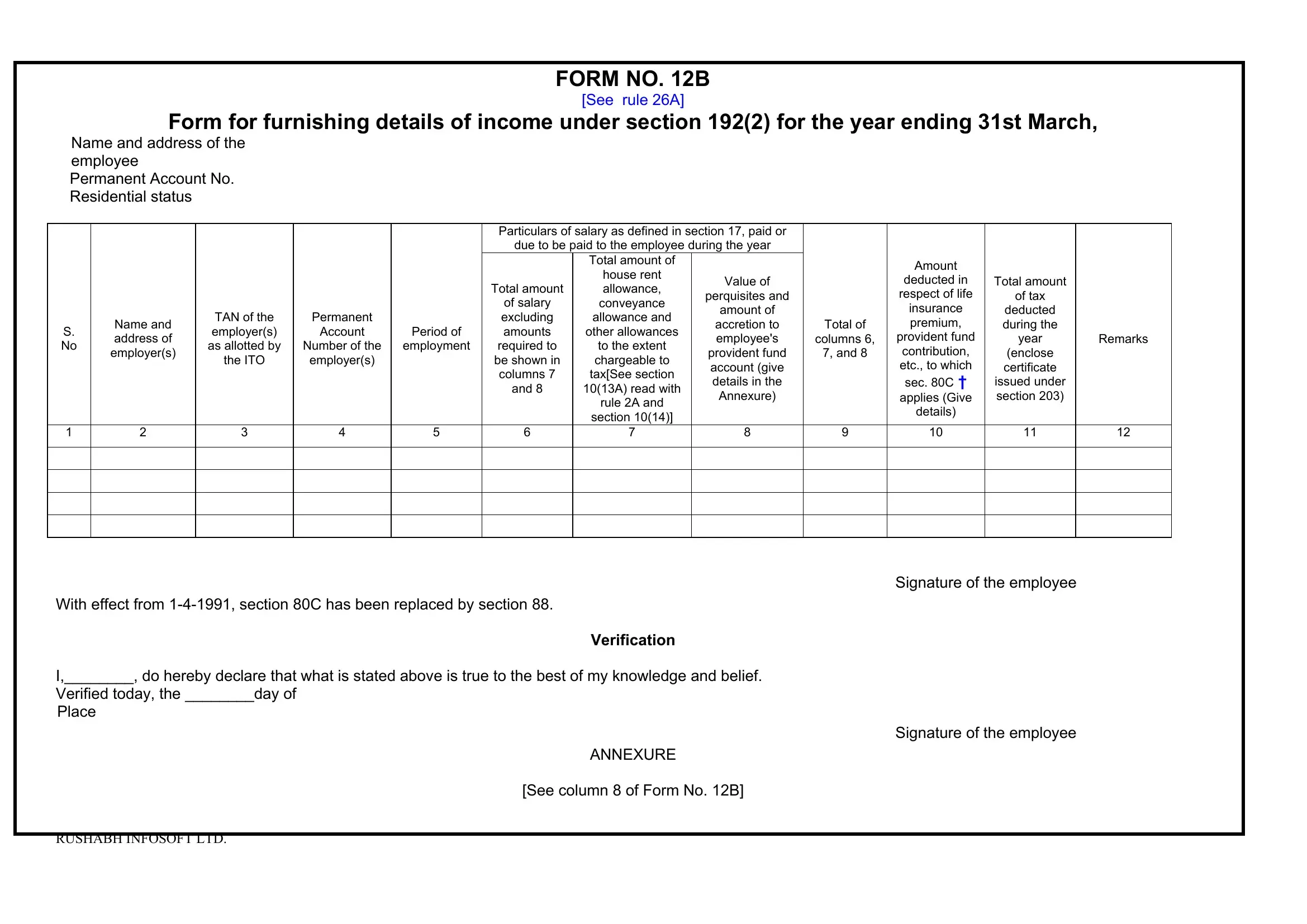

Using PDF files online can be very simple with our PDF tool. Anyone can fill out form 12b word format here painlessly. Our team is dedicated to providing you the absolute best experience with our editor by continuously presenting new features and improvements. With all of these improvements, using our editor becomes easier than ever before! With a few simple steps, you'll be able to begin your PDF journey:

Step 1: Click on the orange "Get Form" button above. It's going to open our pdf tool so you can begin filling in your form.

Step 2: With this online PDF editing tool, it's possible to do more than simply fill out blanks. Try each of the functions and make your forms appear great with customized textual content incorporated, or adjust the file's original content to excellence - all that comes with an ability to incorporate your own photos and sign it off.

Completing this form typically requires attentiveness. Ensure each blank is done accurately.

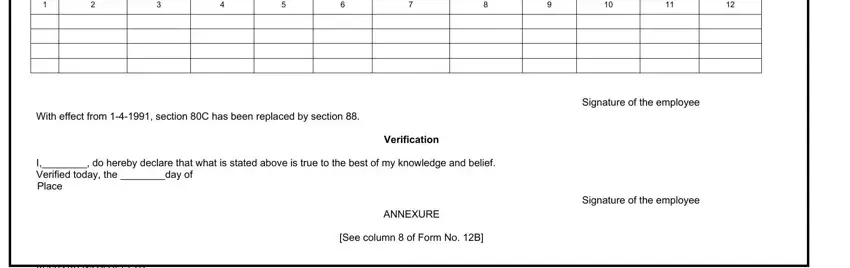

1. Begin filling out the form 12b word format with a selection of necessary blanks. Note all the information you need and make sure absolutely nothing is neglected!

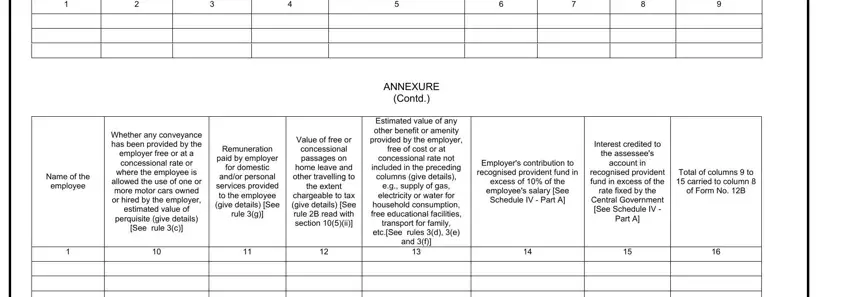

2. Once your current task is complete, take the next step – fill out all of these fields - Name of the, employee, Whether any conveyance has been, employer free or at a concessional, where the employee is, allowed the use of one or more, estimated value of, perquisite give details, See rule c, Remuneration, paid by employer, for domestic, andor personal services provided, rule g, and concessional passages on with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

People generally get some points incorrect when filling out estimated value of in this part. Be sure you re-examine everything you type in here.

3. Completing RUSHABH INFOSOFT LTD is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

4. All set to fill out this fourth part! In this case you'll get these Signature of the employee blank fields to fill out.

Step 3: As soon as you have looked over the details entered, click "Done" to finalize your form. Right after starting a7-day free trial account here, it will be possible to download form 12b word format or send it via email at once. The file will also be available in your personal account with all of your changes. FormsPal provides protected document tools devoid of personal information recording or any sort of sharing. Rest assured that your details are secure here!