Understanding the intricacies of tax documentation and compliance is essential for businesses to navigate their fiscal responsibilities effectively. Among the plethora of forms required for tax purposes, the Form 1300A, particularly with its accompanying Schedule E, stands out for those dealing with the depreciation of assets categorized as "other assets." This form is designed to aid businesses in accurately calculating and reporting the depreciation values of their assets over time, a critical process for financial management and tax reporting. It involves detailed guidelines on asset classification, cost entry, and how to calculate their depreciated value, referencing the Historical Cost Value Estimate Worksheet along with the Business Personal Property Percent Good Schedule, available through specific platforms like www.tad.org. By meticulously describing and summing up assets in the designated boxes (EA through EJ) and then transferring these figures to the rendition form, businesses ensure their asset depreciation is accounted for correctly. With a structured timeline that dictates submission between January 1st and April 15th of the reporting year, compliance with these guidelines not only supports accurate financial reporting but also leverages strategic tax planning benefits.

| Question | Answer |

|---|---|

| Form Name | Form 1300A |

| Form Length | 6 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 30 sec |

| Other names | texas form 1300a, business personal property form 1300a, tarrant county form 1300a, tarrant appraisal district form 1300a |

Complete and attach "Schedule E" included with this form.

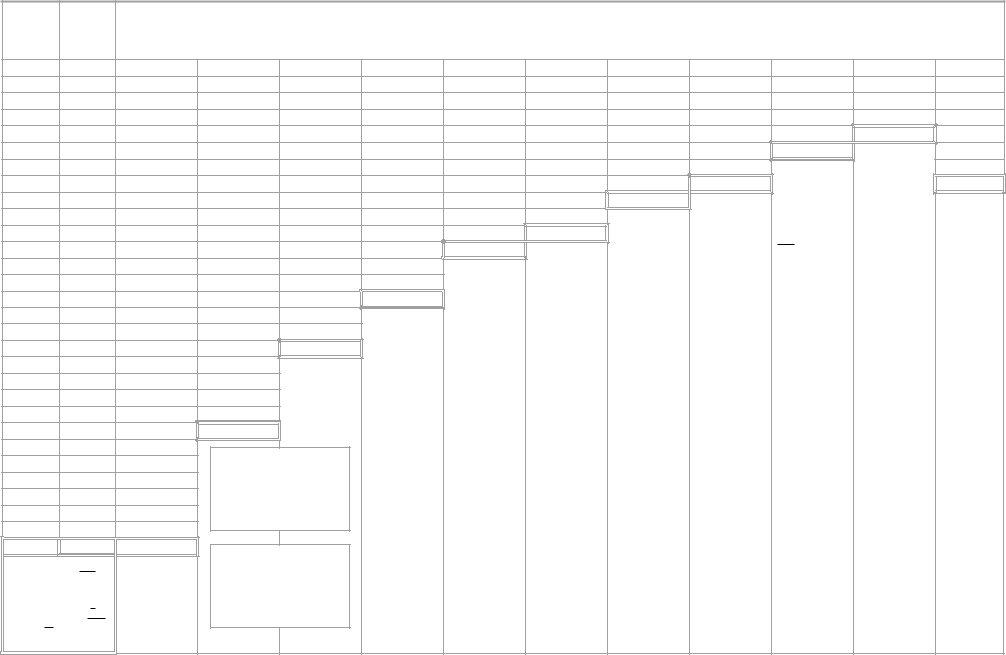

2013 SCHEDULE - E |

FOR THE DEPRECIATION OF |

3.3.E OF FORMS 1300A & B |

|

|

"OTHER ASSETS" AT STEP |

For guidance on asset classification, cost entry, and value calculation, please see your Form 1300A or B - Step 3.3 Historical Cost Value Estimate Worksheet and the Business Personal Property Percent Good Schedule at www.tad.org. DESCRIBE assets then Total Box(es) EA thru EJ in E2 at the bottom of this form then transfer to Box E2 on your rendition and attach this form.

3 |

YEAR DESCRIBE: |

|

|||

LIFE |

|

|

|

||

YR |

|

HISTORICAL |

% |

DEPRECIATED |

|

|

COST |

|

GOOD |

VALUE |

|

|

|

|

|||

|

|

|

|

|

|

12 |

|

|

|

X .67 = |

|

11 |

|

|

|

X .44 = |

|

10 |

|

|

|

X .30 = |

|

09 |

|

|

|

X .10 = |

|

PRIOR |

|

|

|

X .07 = |

|

|

|

|

|

|

|

|

|

TOTAL BOX EA |

|

||

|

|

|

|

|

|

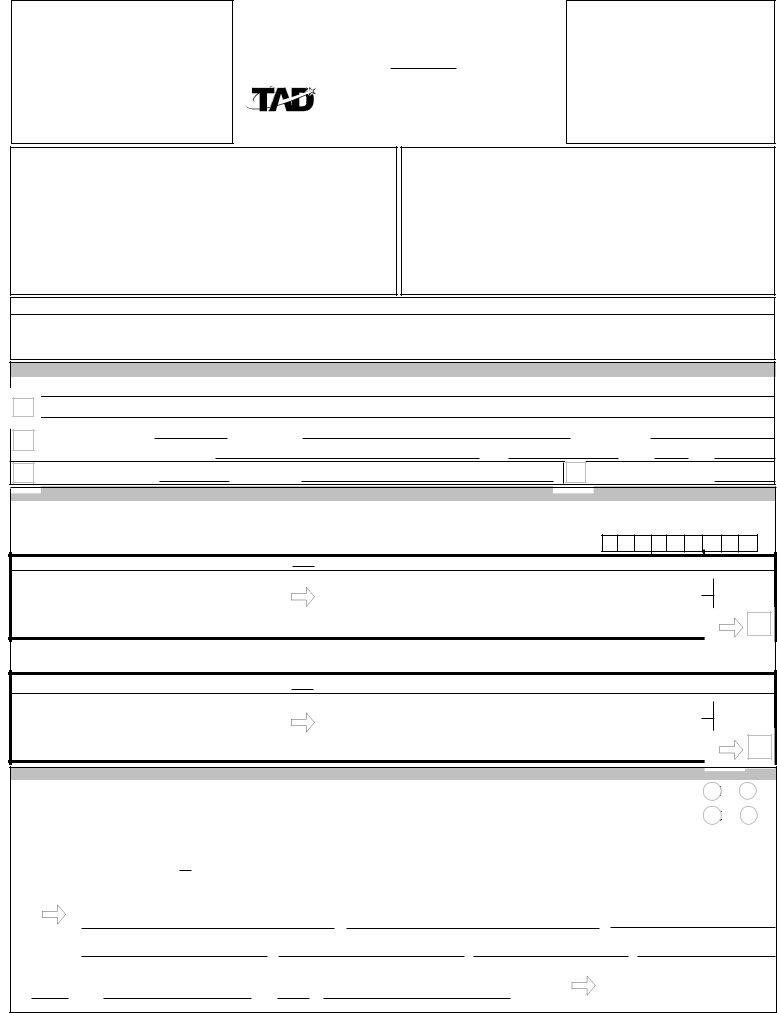

20 YLEARIFE |

DESCRIBE: |

|

|||

|

|

|

|||

YR |

HISTORICAL |

% |

DEPRECIATED |

||

COST |

|

GOOD |

VALUE |

||

|

|

|

|||

12 |

|

|

|

X .95 = |

|

11 |

|

|

|

X .90 = |

|

10 |

|

|

|

X .86 = |

|

09 |

|

|

|

X .81 = |

|

08 |

|

|

|

X .77 = |

|

07 |

|

|

|

X .74 = |

|

06 |

|

|

|

X .70 = |

|

05 |

|

|

|

X .66 = |

|

04 |

|

|

|

X .63 = |

|

03 |

|

|

|

X .60 = |

|

02 |

|

|

|

X .57 = |

|

01 |

|

|

|

X .54 = |

|

00 |

|

|

|

X .51 = |

|

99 |

|

|

|

X .49 = |

|

98 |

|

|

|

X .46 = |

|

97 |

|

|

|

X .44 = |

|

96 |

|

|

|

X .42 = |

|

95 |

|

|

|

X .40 = |

|

94 |

|

|

|

X .38 = |

|

93 |

|

|

|

X .36 = |

|

92 |

|

|

|

X .32 = |

|

91 |

|

|

|

X .29 = |

|

90 |

|

|

|

X .26 = |

|

4 |

YEAR DESCRIBE: |

|

|||||

LIFE |

|

|

|

|

|

||

YR |

|

HISTORICAL |

|

% |

|

DEPRECIATED |

|

|

COST |

|

GOOD |

|

VALUE |

||

|

|

|

|

||||

|

|

|

|

|

|

|

|

12 |

|

|

|

X .75 = |

|

|

|

11 |

|

|

|

X .56 = |

|

|

|

10 |

|

|

|

X .42 = |

|

|

|

09 |

|

|

|

X .32 = |

|

|

|

08 |

|

|

|

X .16 = |

|

|

|

PRIOR |

|

|

|

X .08 = |

|

|

|

|

|

|

|

|

|

||

|

|

TOTAL BOX EB |

|

|

|||

|

|

|

|

|

|||

15 YLEARIFE |

DESCRIBE: |

|

|||||

|

|

% |

|

DEPRECIATED |

|||

YR |

HISTORICAL |

|

|

||||

COST |

|

GOOD |

VALUE |

||||

|

|

|

|||||

12 |

|

|

|

X .93 = |

|

||

11 |

|

|

|

X |

.87 = |

|

|

|

|

|

|

|

|||

10 |

|

|

|

X .81 = |

|

||

09 |

|

|

|

X .76 = |

|

||

08 |

|

|

|

X .71 = |

|

||

07 |

|

|

|

X .66 = |

|

||

06 |

|

|

|

X .62 = |

|

||

05 |

|

|

|

X .58 = |

|

||

04 |

|

|

|

X .54 = |

|

||

03 |

|

|

|

X .50 = |

|

||

02 |

|

|

|

X .47 = |

|

||

01 |

|

|

|

X .44 = |

|

||

00 |

|

|

|

X .41 = |

|

||

99 |

|

|

|

X .38 = |

|

||

98 |

|

|

|

X .36 = |

|

||

97 |

|

|

|

X .31 = |

|

||

96 |

|

|

|

X .27 = |

|

||

95 |

|

|

|

X .23 = |

|

||

94 |

|

|

|

X .20 = |

|

||

93 |

|

|

|

X .17 = |

|

||

92 |

|

|

|

X .15 = |

|

||

91 |

|

|

|

X .13 = |

|

||

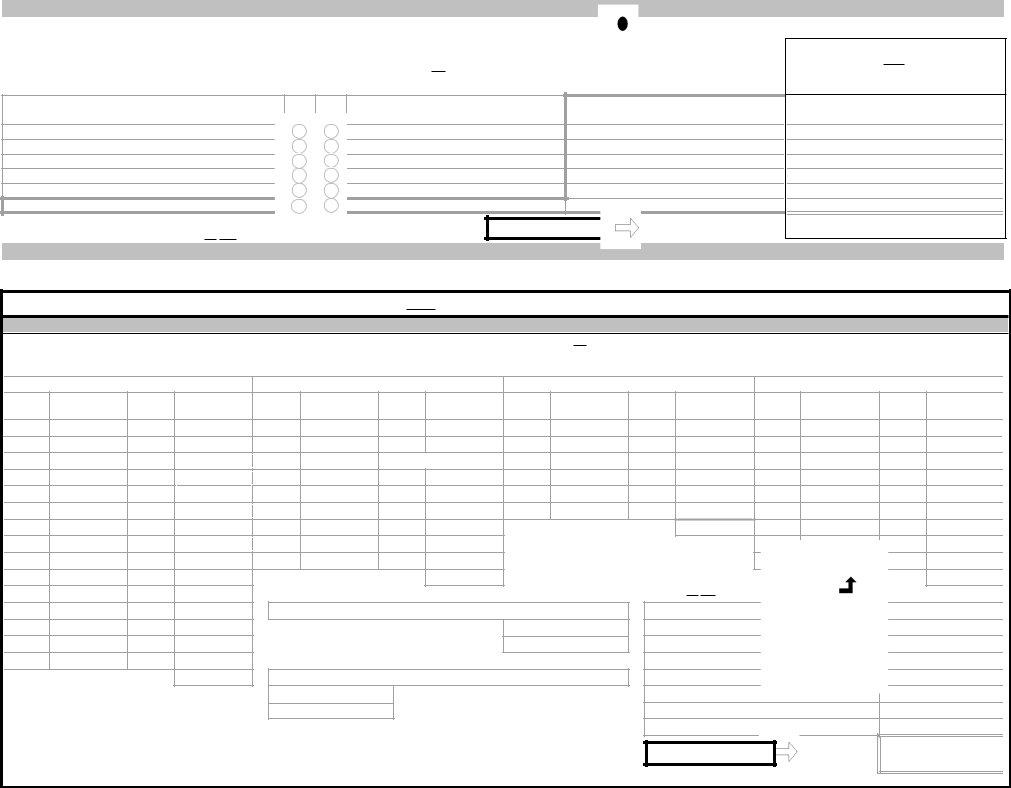

5 |

YEAR DESCRIBE: |

|

|||

LIFE |

|

|

|

||

YR |

|

HISTORICAL |

% |

DEPRECIATED |

|

|

COST |

|

GOOD |

VALUE |

|

|

|

|

|||

|

|

|

|

|

|

12 |

|

|

|

X .80 = |

|

11 |

|

|

|

X .64 = |

|

10 |

|

|

|

X .51 = |

|

09 |

|

|

|

X .41 = |

|

08 |

|

|

|

X .33 = |

|

07 |

|

|

|

X .20 = |

|

06 |

|

|

|

X .12 = |

|

PRIOR |

|

|

|

X .09 = |

|

|

|

TOTAL BOX EC |

|

||

|

|

|

|

|

|

12 YLEARIFE |

DESCRIBE: |

|

|||

YR |

HISTORICAL |

% |

DEPRECIATED |

||

COST |

|

GOOD |

VALUE |

||

|

|

|

|||

12 |

|

|

|

X .92 = |

|

11 |

|

|

|

X .84 = |

|

10 |

|

|

|

X .77 = |

|

09 |

|

|

|

X .71 = |

|

08 |

|

|

|

X .65 = |

|

07 |

|

|

|

X .59 = |

|

06 |

|

|

|

X .54 = |

|

05 |

|

|

|

X .50 = |

|

04 |

|

|

|

X .46 = |

|

03 |

|

|

|

X .42 = |

|

02 |

|

|

|

X .38 = |

|

01 |

|

|

|

X .35 = |

|

00 |

|

|

|

X .29 = |

|

99 |

|

|

|

X .24 = |

|

98 |

|

|

|

X .20 = |

|

97 |

|

|

|

X .17 = |

|

96 |

|

|

|

X .14 = |

|

PRIOR |

|

|

X .12 = |

|

|

TOTAL BOX EH

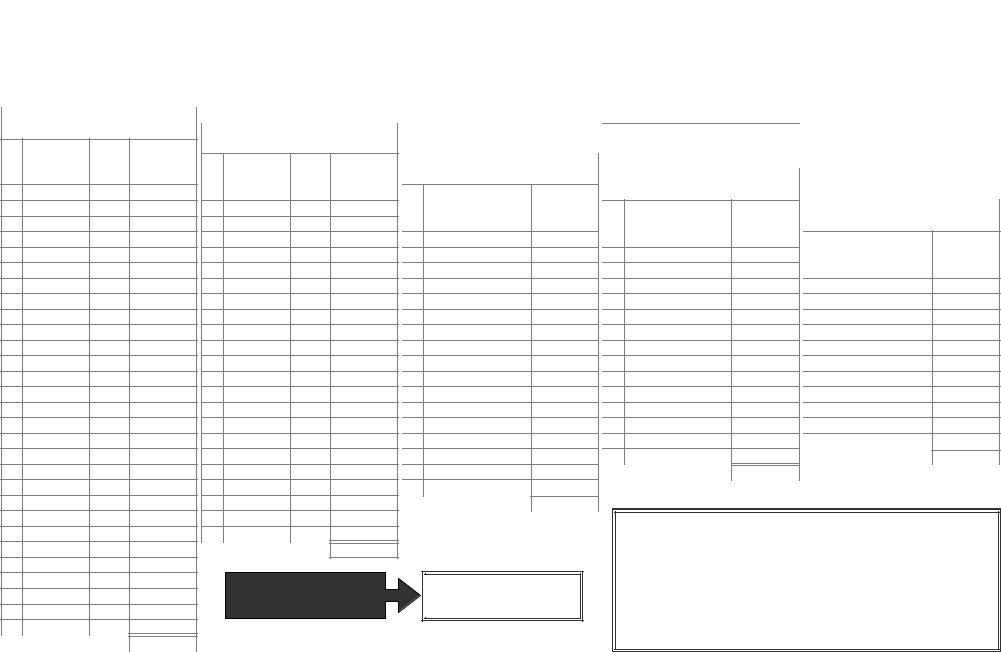

6 |

YEAR DESCRIBE: |

|

|||

LIFE |

|

|

|

||

YR |

|

HISTORICAL |

% |

DEPRECIATED |

|

|

COST |

|

GOOD |

VALUE |

|

|

|

|

|||

|

|

|

|

|

|

12 |

|

|

|

X .83 = |

|

11 |

|

|

|

X .69 = |

|

10 |

|

|

|

X .58 = |

|

09 |

|

|

|

X .48 = |

|

08 |

|

|

|

X .40 = |

|

07 |

|

|

|

X .33 = |

|

06 |

|

|

|

X .22 = |

|

05 |

|

|

|

X .15 = |

|

PRIOR |

|

|

|

X .10 = |

|

|

|

|

|

|

|

|

|

TOTAL BOX ED |

|

||

|

|

|

|

|

|

10 YLEARIFE |

DESCRIBE: |

|

|||

YR |

HISTORICAL |

% |

DEPRECIATED |

||

COST |

|

GOOD |

VALUE |

||

|

|

|

|||

12 |

|

|

|

X .90 = |

|

11 |

|

|

|

X .81 = |

|

10 |

|

|

|

X .73 = |

|

09 |

|

|

|

X .66 = |

|

08 |

|

|

|

X .59 = |

|

07 |

|

|

|

X .53 = |

|

06 |

|

|

|

X .48 = |

|

05 |

|

|

|

X .43 = |

|

04 |

|

|

|

X .39 = |

|

03 |

|

|

|

X .35 = |

|

02 |

|

|

|

X .28 = |

|

01 |

|

|

|

X .22 = |

|

00 |

|

|

|

X .18 = |

|

99 |

|

|

|

X .14 = |

|

PRIOR |

|

|

X .11 = |

|

|

|

|

|

|

|

|

TOTAL BOX EG

7 |

YEAR DESCRIBE: |

|

||

LIFE |

|

|

||

YR |

|

HISTORICAL |

% |

DEPRECIATED |

|

COST |

GOOD |

VALUE |

|

|

|

|||

|

|

|

|

|

12 |

|

|

X .86 = |

|

11 |

|

|

X .73 = |

|

10 |

|

|

X .63 = |

|

09 |

|

|

X .54 = |

|

08 |

|

|

X .46 = |

|

07 |

|

|

X .40 = |

|

06 |

|

|

X .34 = |

|

05 |

|

|

X .24 = |

|

04 |

|

|

X .17 = |

|

03 |

|

|

X .12 = |

|

PRIOR |

|

|

X .11 = |

|

|

|

|

|

|

|

|

TOTAL BOX EE |

|

|

|

|

|

|

|

8 |

YEAR DESCRIBE: |

|

||

LIFE |

|

|

||

YR |

|

HISTORICAL |

% |

DEPRECIATED |

|

COST |

GOOD |

VALUE |

|

|

|

|||

12 |

|

|

X .88 = |

|

11 |

|

|

X .77 = |

|

10 |

|

|

X .67 = |

|

09 |

|

|

X .59 = |

|

08 |

|

|

X .51 = |

|

07 |

|

|

X .45 = |

|

06 |

|

|

X .39 = |

|

05 |

|

|

X .34 = |

|

04 |

|

|

X .26 = |

|

03 |

|

|

X .19 = |

|

02 |

|

|

X 14 = |

|

PRIOR |

|

|

X .11 = |

|

TOTAL BOX EF

89 |

X .24 = |

|

88 |

X .21 = |

|

87 |

X .19 = |

|

86 |

X .17 = |

|

85 |

X .15 = |

|

84 |

X .14 = |

|

PRIOR |

X .12 = |

|

TOTAL BOX EJ

PRIOR |

X .12 = |

TOTAL BOX E I

TRANSFER THIS NUMBER TO STEP 3.3.E2 OF YOUR RENDITION FORM.

TOTAL BOX E2

FORM 1300E (REV

FILER'S COMMENTS / NOTES:

*AFTER JANUARY 1ST AND NOT LATER THAN APRIL 15TH OF THIS YEAR, RETURN YOUR COMPLETED RENDITION FROM TO:

WWW

*AFTER JANUARY 1ST AND NOT LATER THAN APRIL 15TH OF THIS YEAR, RETURN YOUR COMPLETED RENDITION FROM TO: