Using PDF forms online is very easy with this PDF tool. Anyone can fill in indiana form application tax exemption here without trouble. To make our editor better and simpler to use, we continuously develop new features, with our users' feedback in mind. Here is what you'll want to do to get started:

Step 1: Click on the orange "Get Form" button above. It'll open up our editor so you could start filling in your form.

Step 2: As you launch the tool, you will find the document made ready to be filled in. Besides filling in various blank fields, you may as well do other sorts of things with the form, including putting on any text, editing the initial textual content, adding illustrations or photos, affixing your signature to the form, and more.

This form will need some specific information; in order to guarantee consistency, you need to take note of the subsequent recommendations:

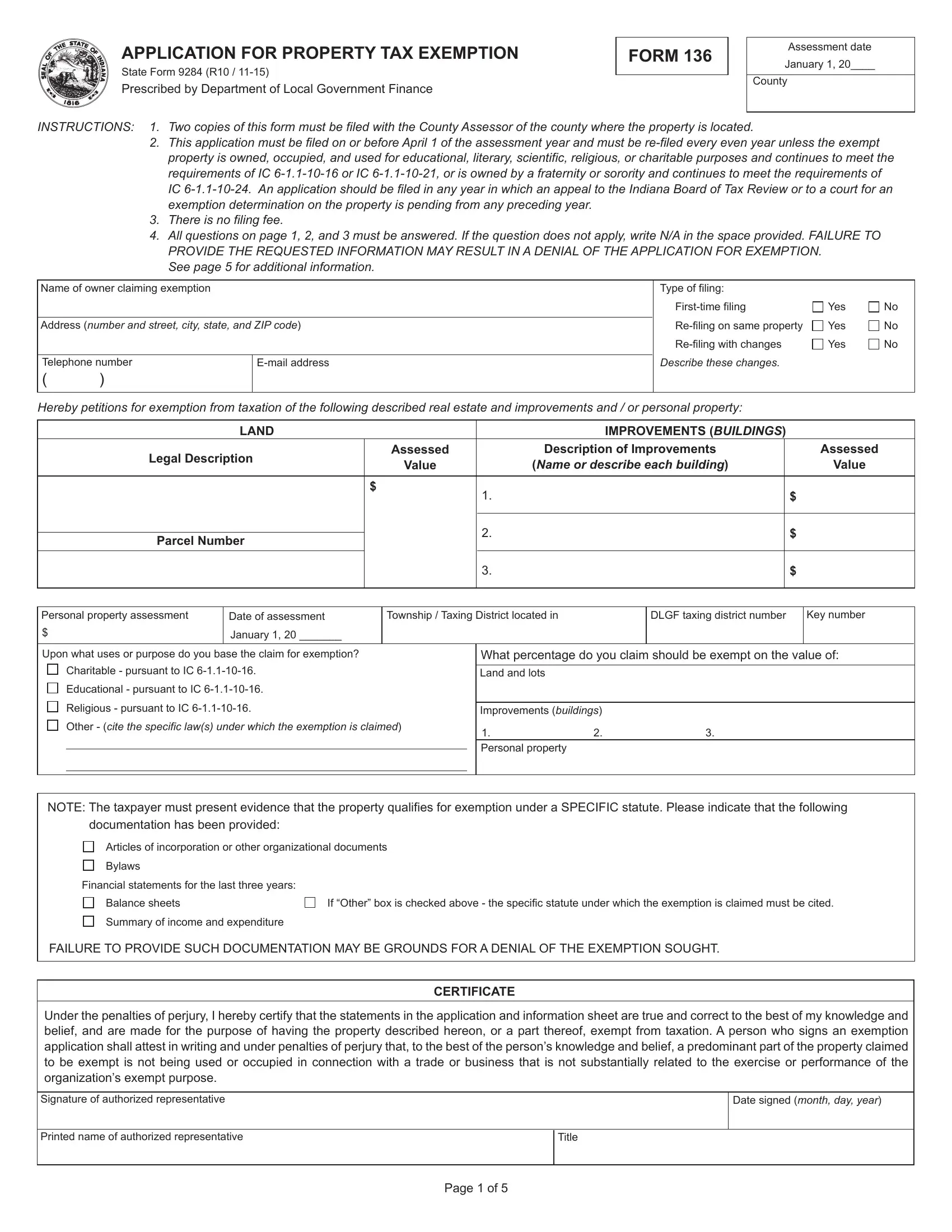

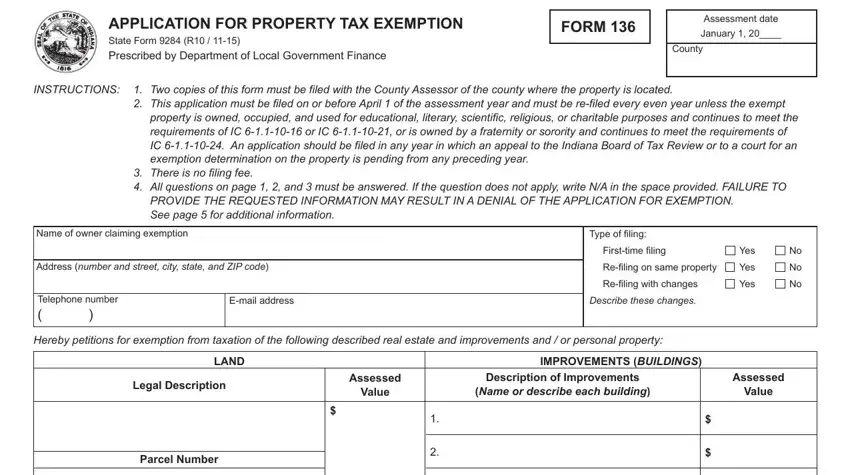

1. The indiana form application tax exemption necessitates certain details to be entered. Ensure the next fields are complete:

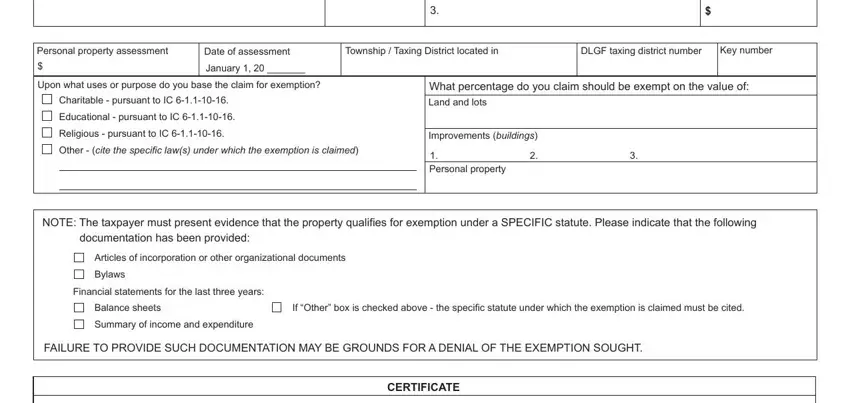

2. After the prior array of fields is filled out, proceed to type in the applicable information in all these: Personal property assessment, Date of assessment, Township Taxing District located, DLGF taxing district number, Key number, January, Upon what uses or purpose do you, What percentage do you claim, Charitable pursuant to IC, Educational pursuant to IC, Religious pursuant to IC, Other cite the specific laws, Land and lots, Improvements buildings, and Personal property.

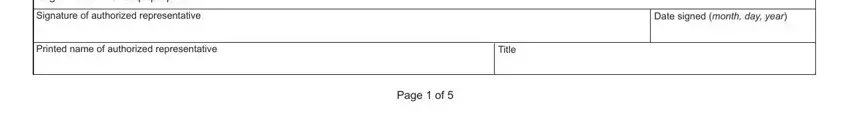

3. In this specific step, check out Under the penalties of perjury I, Signature of authorized, Date signed month day year, Printed name of authorized, Title, and Page of. All these have to be filled in with utmost precision.

As for Page of and Title, make certain you get them right in this current part. Both of these are thought to be the most significant fields in this file.

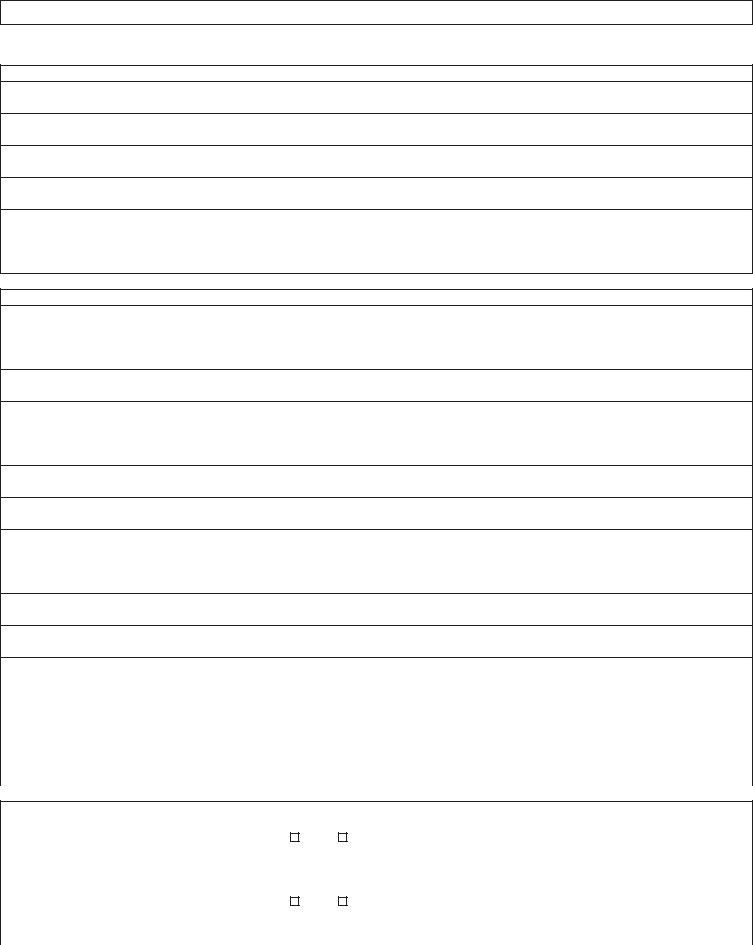

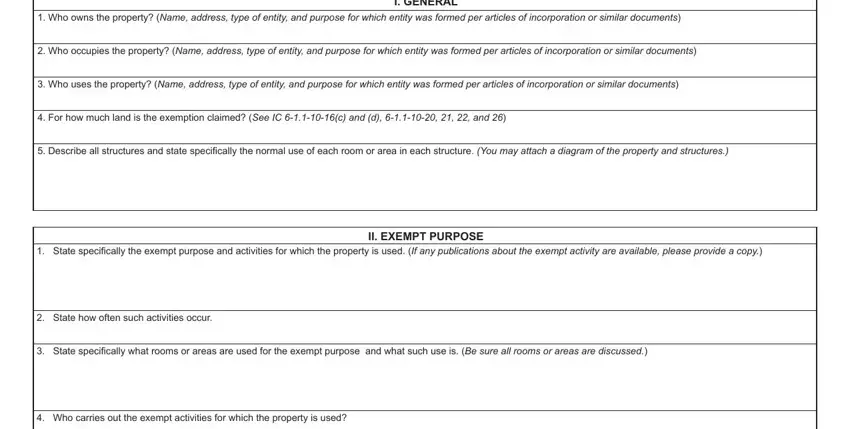

4. Your next subsection requires your involvement in the following areas: Who owns the property Name, I GENERAL, Who occupies the property Name, Who uses the property Name, For how much land is the, Describe all structures and state, State specifically the exempt, II EXEMPT PURPOSE, State how often such activities, State specifically what rooms or, and Who carries out the exempt. Be sure to fill out all of the requested information to move forward.

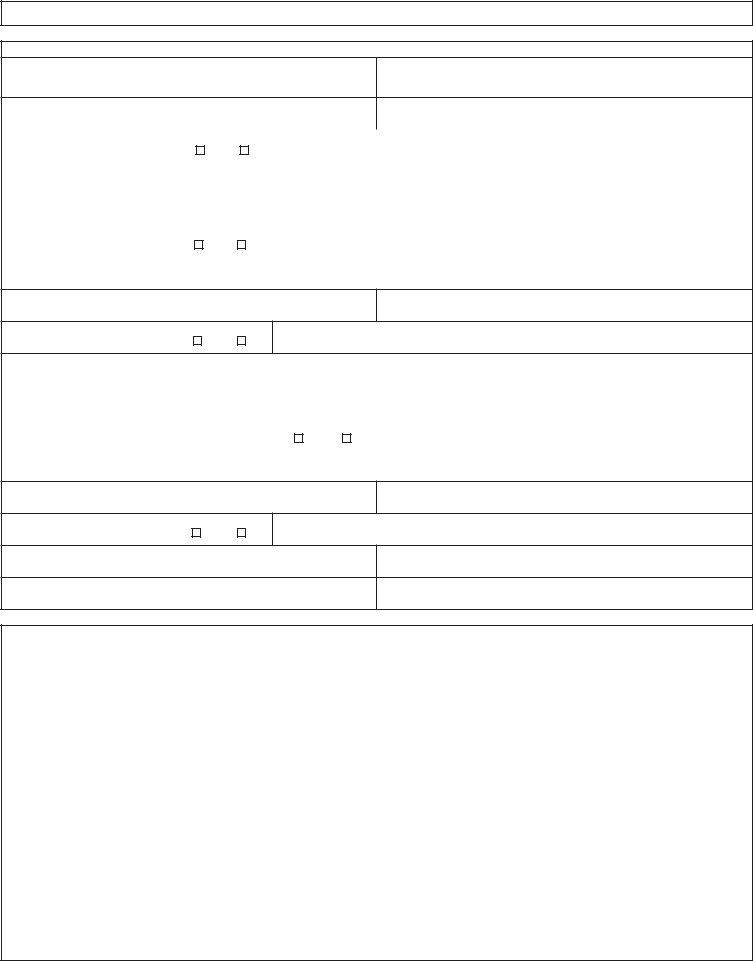

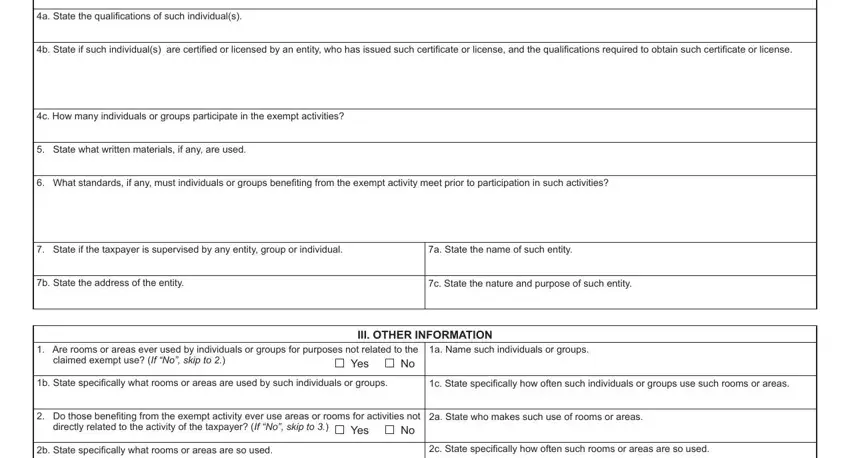

5. The very last notch to finalize this form is integral. Make sure that you fill out the appropriate blank fields, which includes a State the qualifications of such, b State if such individuals are, c How many individuals or groups, State what written materials if, What standards if any must, State if the taxpayer is, a State the name of such entity, b State the address of the entity, c State the nature and purpose of, III OTHER INFORMATION, Are rooms or areas ever used by, Yes, a Name such individuals or groups, b State specifically what rooms or, and c State specifically how often, before using the file. In any other case, it can result in an incomplete and possibly unacceptable form!

Step 3: As soon as you've looked once more at the information you filled in, simply click "Done" to finalize your form. Sign up with us now and immediately access indiana form application tax exemption, prepared for downloading. Every single edit you make is conveniently saved , letting you customize the form later when required. We do not sell or share the information you type in while completing documents at FormsPal.