Form 13661 is a IRS Tax form that is used to report income earned from self-employment. This form is used by taxpayers who are considered self-employed and must file Form 1040 Schedule C or C-EZ. The form is also used to report income earned from partnerships, S corporations, estates, and trusts. The deadline to file this form is April 15th, and it must be filed along with your federal tax return. There are several sections on the form that require information such as gross receipts, business expenses, net profit or loss, and other related information. It is important to understand all of the sections in order to accurately complete the form. If you have any questions about filling out Form 13661, please contact a tax professional for assistance.

| Question | Answer |

|---|---|

| Form Name | Form 13661 |

| Form Length | 8 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min |

| Other names | reasonable accommadation form ihs, irs reasonable accommodation form, form13661, form 13661 |

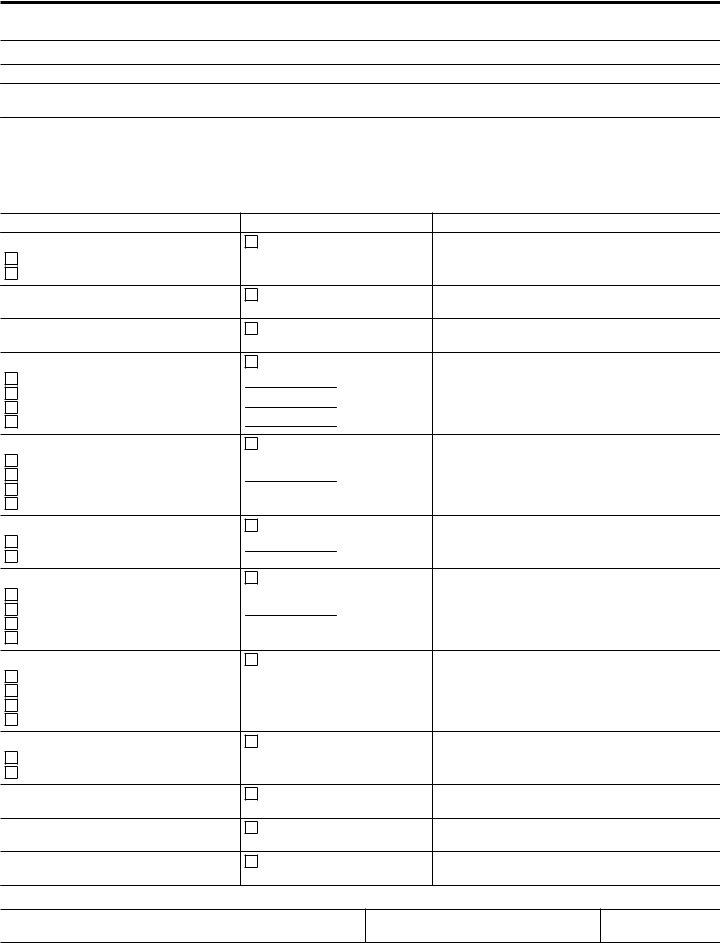

Reasonable Accommodation Request

Document 12986 – Nondisclosure of GINA Protected Information (Provided for your information)

Part I – Written Reasonable Accommodation Request

To be completed by applicant for employment, employee, or IRS Official to document reasonable accommodation request.

Part II – Deciding Official Documentation

To be completed by Deciding Official for use in information tracking purposes. Part II, items 5, 6, and 7, may be provided to Health Care Practitioner, Social Worker, or Rehabilitation Counselor as supplemental information.

Part

To be completed by Health Care Practitioner, Social Worker, or Rehabilitation Counselor.

Part

To be completed by Health Care Practitioner, Social Worker, or Rehabilitation Counselor.

Part IV – Denial of Reasonable Accommodation Request

To be completed by Deciding Official to document the denial of reasonable accommodation.

Note: Please be advised if there is not enough space to write information relevant to the RA request for the section of the form you are filling out (Parts I, II, III or IV) the employee and/or manager are encouraged to write the additional information as an attachment.

Privacy Act Statement

Collection of the requested information is authorized by Section 501 of the Rehabilitation Act, 29 U.S.C. § 791.The information you furnish will be used for the purpose of facilitating your request. Additionally, the information may be used to disclose information to: appropriate Federal, state or local agencies when relevant to civil, criminal or regulatory investigations or prosecutions when necessary to adjudicate a claim for benefits; a Federal agency in connection with a decision in hiring, retention or the grantingof a security clearance. It may also be used in an administrative or judicial proceeding affecting an employee's personnel rights and in any criminal prosecutions for willfully making false or fraudulent statements in violation of U.S.C. § 1001. Additional uses may include disclosure to the Department of Justice for the purpose of litigating any civil, administrative, or judicial proceeding where the United States, the IRS, or its employees (in their official capacities or where the government has decided to represent them) are parties. It may also be used in response to subpoena from a third party provided that (1) IRS is a party in interest, (2) the records are relevant and necessary to the litigation, and (3) not otherwise privileged. This information may be provided to professional associations, such as state bar disciplinary authorities, for use in connection with their administration of standards of conduct. Further, it may be disclosed tocontractors when necessary to perform work associated with reasonable accommodation and to those Federal agencies that oversee property and procurement matters. Furnishing the requested information is required to establish that you have a covered disability, the functional limitations of your disability, and the need for reasonable accommodation. Failure to fully complete the form or refusal to provide the requested documentation may lead to a breakdown in the reasonable accommodation process and could result in a determination that you are not entitled to reasonable accommodation.

Form 13661 (Rev |

Catalog Number 39619X |

publish.no.irs.gov |

Department of the Treasury - Internal Revenue Service |

Nondisclosure of GINA Protected Information

The Genetic Information and Nondiscrimination Act of 2008 (GINA) prohibits employers and other entities covered by GINA Title II from requesting, requiring, or purchasing genetic information of employees or their family members, except as specifically allowed by this law. GINA has specific exceptions for requests under the Family and Medical Leave Act and the Rehabilitation Act, as explained below. To comply with GINA, we are asking that you not provide any genetic information when responding to this request for medical information, unless the information is allowable as explained below.

“Genetic information”, as defined by GINA, includes information concerning the manifestation of disease/disorder in family members (“family medical history”), information about an individual’s or family member’s genetic tests, the fact that an individual or an individual’s family member sought or received genetic services, and genetic information of a fetus carried by an individual or an individual’s family member or an embryo lawfully held by an individual or family member receiving assistive reproductive services.

Family and Medical Leave Act (FMLA)

The general prohibition against requesting or requiring genetic information does not apply where an employer requests medical information of an employee who invokes the FMLA to attend to the employee’s own serious health condition or where an employee complies with the employer’s return to work certification requirements. See 29 CFR 1635.8(b)(1)(i)(D)(2). An employer does not violate GINA by asking an employee seeking FMLA leave to care for a seriously ill family member to provide family medical history to comply with the certification provisions of the FMLA. See 29 CFR 1635.8(b)

(3).

Further, GINA permits disclosure of relevant genetic information consistent with the requirements of the FMLA to persons with a need to know the information because of responsibilities relating to the handling of FMLA requests. See 29 CFR 1635.9(b)(5).

Rehabilitation Act

The general prohibition against requesting or requiring genetic information does not apply where an employer requests documentation to support a request for reasonable accommodation as long as the request for documentation is lawful. Such a request is lawful only where the disability and/or the need for accommodation is not obvious; the documentation required contains no more information than what is sufficient to establish that an individual has a disability and needs reasonable accommodation; and the documentation relates only to the impairment that the individual claims to be a disability that requires reasonable accommodation. See 29 CFR 1635.8(b)(1)(i)(D)(1); see also 29 CFR 1635.8(b)(1)(i)(B).

Form 13661 (Rev |

Catalog Number 39619X |

publish.no.irs.gov |

Department of the Treasury - Internal Revenue Service |

Reasonable Accommodation Request

Part I – Written Reasonable Accommodation Request (A Separate Attachment May Be Submitted If Additional Space Is Needed)

To be completed by applicant, employee, or IRS official

1.Applicant/Employee information Last name

First name

2.Occupational

SEID Series

Grade

3. Operating Division/Function

4. Contact information |

|

|

|

|

|

|

|

Office phone number |

FAX number |

Post of Duty (POD) |

Tour of Duty / Shift (work hours) |

|

|

|

|

Email address |

|

Preferred method / time to contact (cell phone or email, hours) |

|

|

|

|

|

5.Mailing address (where you receive official correspondence)

Address 1 |

Address 2 (home) |

|

|

Room #

Mail Stop

City

State

ZIP code

6.Manager's contact information Manager's name

Telephone number

Email address

7.Medical condition (Describe your medical condition requiring accommodation.)

8.Job functions affected (Describe how your medical condition limits your ability to perform your current duties, participate in the application process, or access a benefit of employment.)

9.Accommodation requested (Based on your condition and job functions affected, what accommodations would help you to perform effectively)

10. Additional comments

I affirm that all statements made above are true to the best of my knowledge and belief.

Signature of Applicant/Employee

Date signed

Return Part I to FAX

Form 13661 (Rev |

Catalog Number 39619X |

publish.no.irs.gov |

Department of the Treasury - Internal Revenue Service |

Part I

Page 4

Reasonable Accommodation Request

Part

To be completed by Deciding Official

1. |

Name of Applicant/Employee |

|

|

2. Date of Applicant/Employee oral request |

(if different from written |

|

|

|

|

|

request) |

|

|

|

|

|

|

|

|

|

3. |

Deciding Official |

|

|

|

|

|

Last name |

|

First name |

Title |

|

SEID |

|

|

|

|||||

|

|

|

|

|

|

|

Phone number (Including Area Code)

Email address

4.What duties or functions of the job are limited by the applicant/employee's medical condition?

(Refer to the Position Description, Critical Job Elements (CJE), applicant requirements, or other relevant documentation)

5.Does this limitation affect an essential function of the job or participation in the application process? (See RAC if essential job function worksheet is needed)

Yes

No (please explain answer)

6.Will the requested accommodation allow the applicant/employee to successfully perform the essential job functions or participate in the application process

Yes

No

Not sure (please explain answer)

7. List any alternative accommodation recommendations

8.Does Management need medical documentation to make a decision on the request? Note: The ADAAA of 2008 does not require extensive medical review.

Yes (explain)

No

I affirm that all statements made above are true to the best of my knowledge and belief.

Signature of Deciding Official

Date signed

To Be Completed After Review of Accommodation Request |

|

|

|

|

|

Part |

||

|

|

|

Approved (describe accommodation granted) |

|

|

Denied If denied, complete Part IV. |

|

|

|

|

|

Signature of Deciding Official |

Date signed |

|

|

|

|

Deciding Official Last name

First name

Title

SEID

Phone number (Including Area Code)

Return Part II to assigned Reasonable Accommodation Coordinator Provide Copy of Part II to the individual

Form 13661 (Rev |

Catalog Number 39619X |

publish.no.irs.gov |

Department of the Treasury - Internal Revenue Service |

Part II

Page 5

Reasonable Accommodation Request

Part

To be completed by a Health Care Practitioner, Social Worker, or Rehabilitation Counselor

Name of Applicant/Employee

Instructions

We have been requested to consider a reasonable accommodation for the individual named above. An accommodation is a modification made to a job and/or the work environment that enables a qualified employee/applicant with a disabilityto successfully perform the essential duties or functions of the position. We request that you provide medical information which reflects:

•that the individual has one or more physical or mental impairment that substantially limit(s) one or more of his/her major life activities (e.g., walking, speaking, breathing, hearing, seeing, thinking, sitting, standing, reaching, interacting with others, learning, performing manual tasks, caring for oneself, concentrating, lifting, working, sleeping)

•that there is a relationship between the limiting medical condition(s) and the recommended accommodations.

Medical Documentation

For your information, a copy of the appropriate job description is attached.

1.Have you made a diagnosis that relates to this reasonable accommodation request? Please state the diagnosis. (If additional space is needed, please attach a separate sheet.)

2.Please explain the impact of this medical condition on major life activities. (i.e. describe what limitations result from this condition, and address any workplace safety concerns that may result from the condition; fill out Part

3. What is the anticipated duration of this medical condition

Certification

Name of Health Care Practitioner, Social Worker, Rehabilitation Counselor

Telephone number

Best Method and time to contact

I understand that an IRS medical consultant may contact me for additional information.

Signature

Date signed

Return Part

Form 13661 (Rev |

Catalog Number 39619X |

publish.no.irs.gov |

Department of the Treasury - Internal Revenue Service |

Part

Page 6

Reasonable Accommodation Request

Part

To be completed by a Health Care Practitioner, Social Worker, or Rehabilitation Counselor

Name of Applicant/Employee

Instructions

1.The following table indicates the major life activity that is affected by the applicant/employee's medical condition. Major life activities are those basic activities that the average person in the general population can perform with little or no difficulty.

2.Indicate only the major activity affected by the applicant / employee's medical condition by circling or checking the appropriate block.

Indicate the specific limitation of the applicant / employee resulting from their condition. Quantify their limitation in order for the agency to determine appropriate workplace accommodations

Activity

Sensory

Seeing / Vision

Hearing

Breathing / Respiratory

Speaking

Basic Mobility

Walking

Climbing stairs

Sitting

Standing

Secondary Mobility

Squatting / kneeling Twisting (neck / waist) Bending / stooping Reaching above shoulder

Physical Exertion

Pushing / pulling

Lifting / Carrying

Fine Motor Skills

Keyboard use

Repetitive use of hands

Grasping

Fine finger motions

Cognitive

Thinking

Learning

Comprehending

Concentrating

Caring for self

Mental / emotional

Sleeping

Other / Bodily Functions

Extent of Limitation |

Detailed Explanation |

Limited to:

Limited to:

Limited to:

Limited to:

Hours per day Distance

% of day

Limited to:

Hours per day

Limited to:

Number of pounds

Limited to:

Hours per day

Limited to:

Limited to:

Limited to:

Limited to:

Limited to:

Certification

Name of Health Care Practitioner, Social Worker, Rehabilitation Counselor |

Signature |

Date signed |

Return Part

Form 13661 (Rev |

Catalog Number 39619X |

publish.no.irs.gov |

Department of the Treasury - Internal Revenue Service |

Part

Page 7

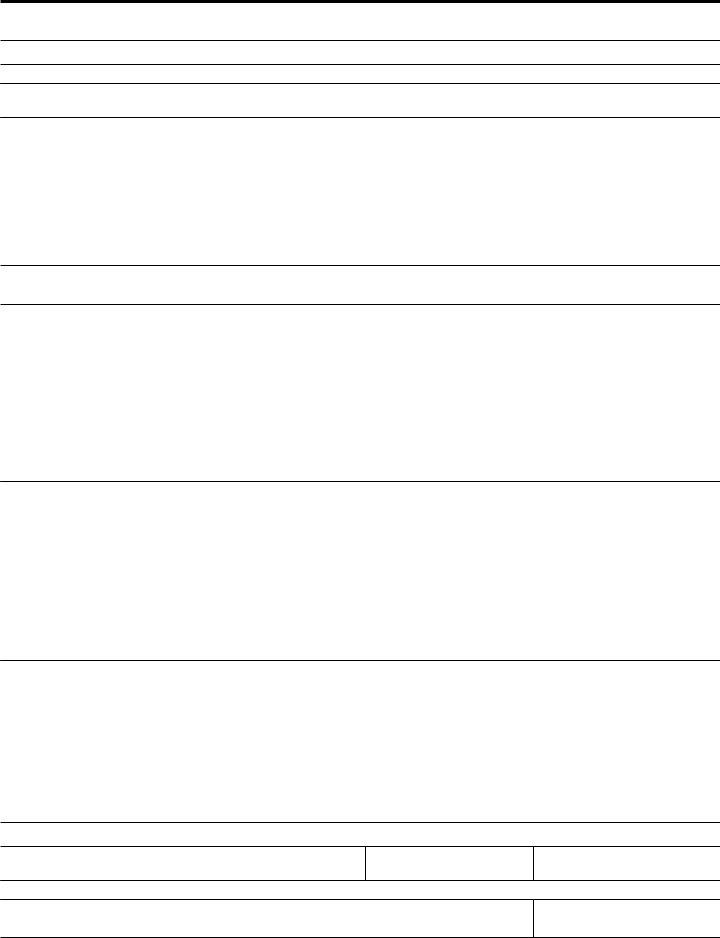

Reasonable Accommodation Request

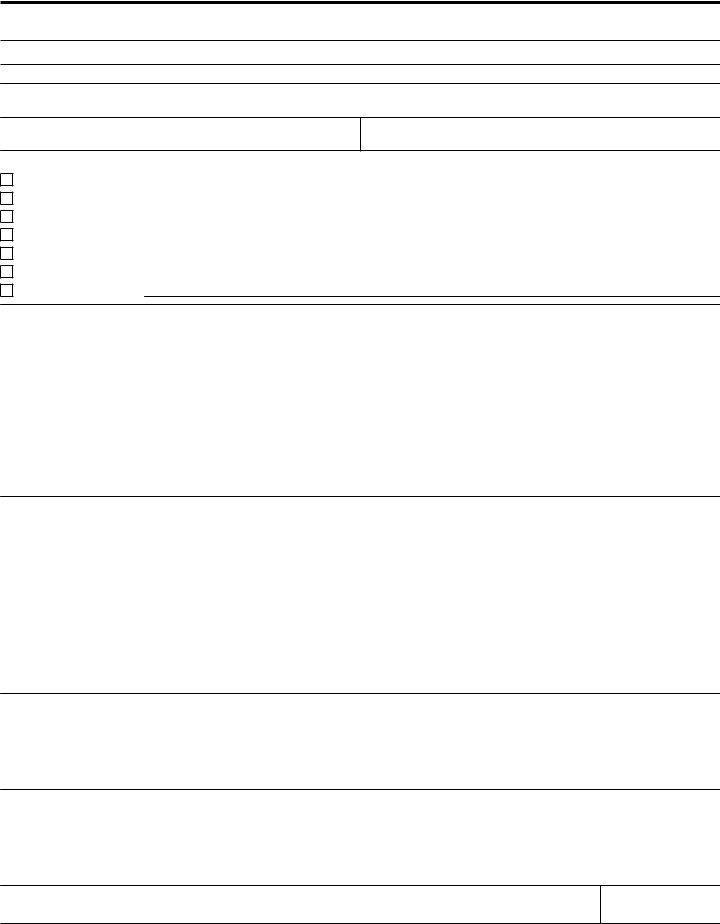

Part IV – Denial of Reasonable Accommodation Request (A Separate Attachment May Be Submitted If Additional Space Is Needed)

To be completed by Deciding Official

Name of Applicant/Employee

Accommodation requested

Accommodation offered to Applicant/Employee

1.Reason for denial (check all that apply)

Accommodation Ineffective/Inappropriate

Accommodation Would Cause Undue Hardship

Employee did not accept an alternative accommodation offered

Medical Documentation Inadequate

Accommodation Would Require Removal of Essential Function

Accommodation Would Require Lowering of Performance or Production Standard

Other (Please identify)

2.Detailed reason(s) for the denial of reasonable accommodation (e.g., why accommodation is ineffective or causes undue hardship)

3.If the individual did not accept an alternative accommodation, explain how the alternative accommodation addresses the limitation, and why you believe the chosen accommodation would be effective

4.If an individual wishes reconsideration, they should:

•First, ask the Deciding Official to reconsider the decision within fifteen (15) workdays of receiving the written denial (Additional information may be presented to support this request).

•If the Deciding Official does not reverse the decision, the individual may initiate a final appeal within fifteen (15) workdays of receiving the denial of the request for reconsideration to the Business Operating Division (BOD) Commissioner or his/her executive level designee.

5.If an individual wishes to file an EEO Complaint, or pursue MSPB and union grievance procedures, they must take the following steps:

•EEO Complaint. Contact the EEO counselor within 45 days from the date of the receipt of a copy of the RA Request, Part IV, Denial of Request for Reasonable Accommodation.

•Collective Bargaining Claim. File a grievance in accordance with the provisions of the National Agreement.

•MSPB Appeal. Initiate an appeal within 30 days of an appealable adverse action as defined in 5 C.F.R. 1201.3.

Signature of Deciding Official (If denied)

Date signed

Return Part IV to assigned Reasonable Accommodation Coordinator

Provide Copy of Parts II and IV to Individual (If Denied)

Form 13661 (Rev |

Catalog Number 39619X |

publish.no.irs.gov |

Department of the Treasury - Internal Revenue Service |

Part IV