You'll be able to prepare OMB effortlessly using our PDFinity® online PDF tool. In order to make our tool better and easier to work with, we continuously work on new features, considering feedback coming from our users. For anyone who is looking to get going, this is what it's going to take:

Step 1: Just click on the "Get Form Button" in the top section of this webpage to open our pdf form editing tool. This way, you will find everything that is necessary to work with your document.

Step 2: As soon as you launch the editor, you'll notice the form made ready to be filled in. Aside from filling in different fields, you might also do various other things with the file, particularly putting on custom textual content, editing the initial textual content, inserting graphics, affixing your signature to the document, and much more.

Be mindful when filling in this pdf. Ensure all mandatory areas are filled in accurately.

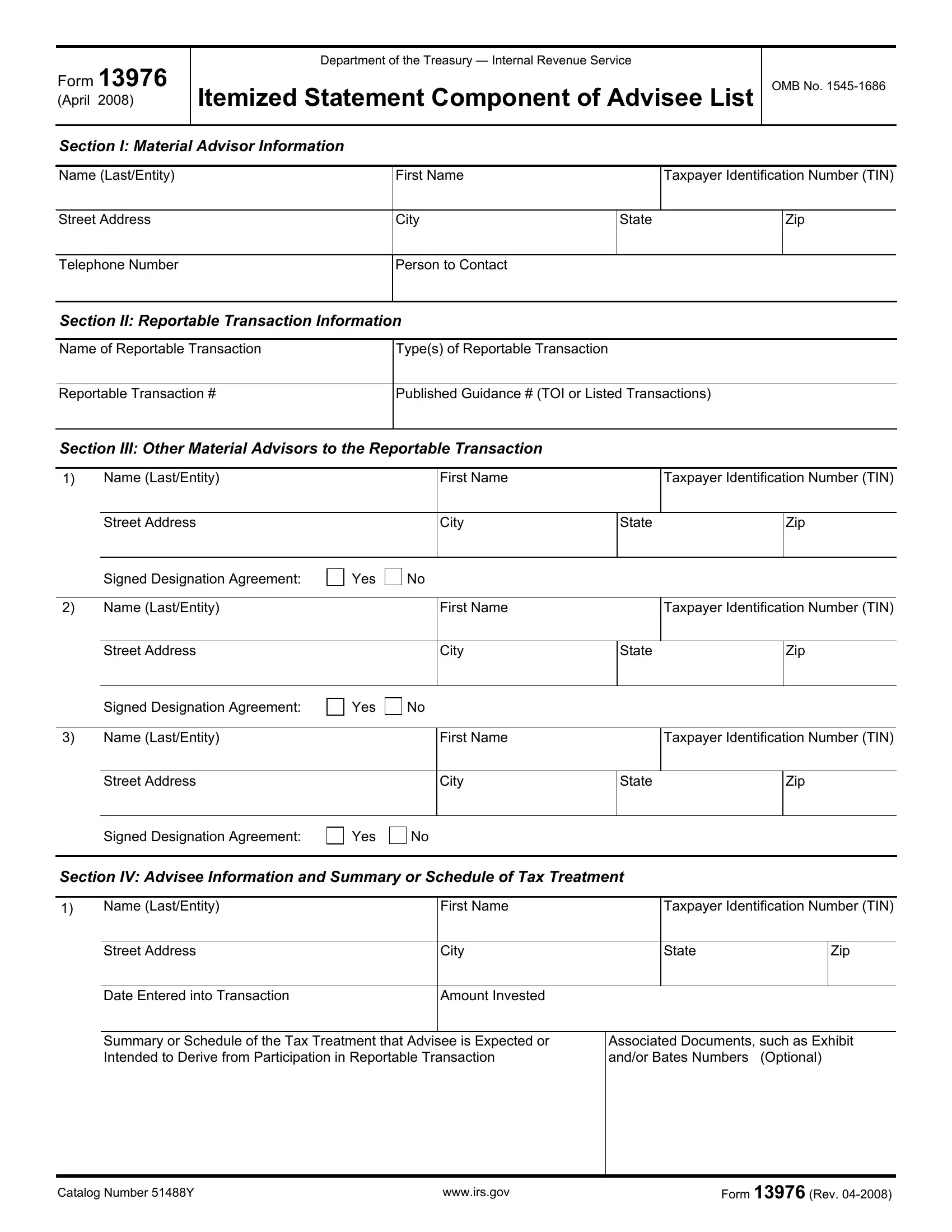

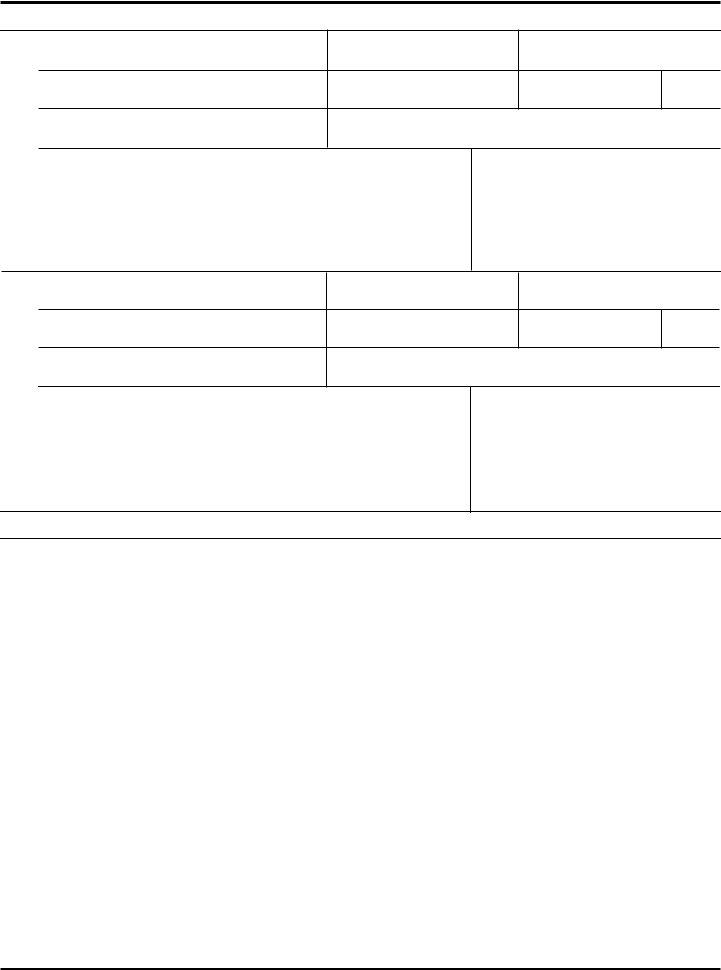

1. First of all, while filling out the OMB, beging with the page containing next fields:

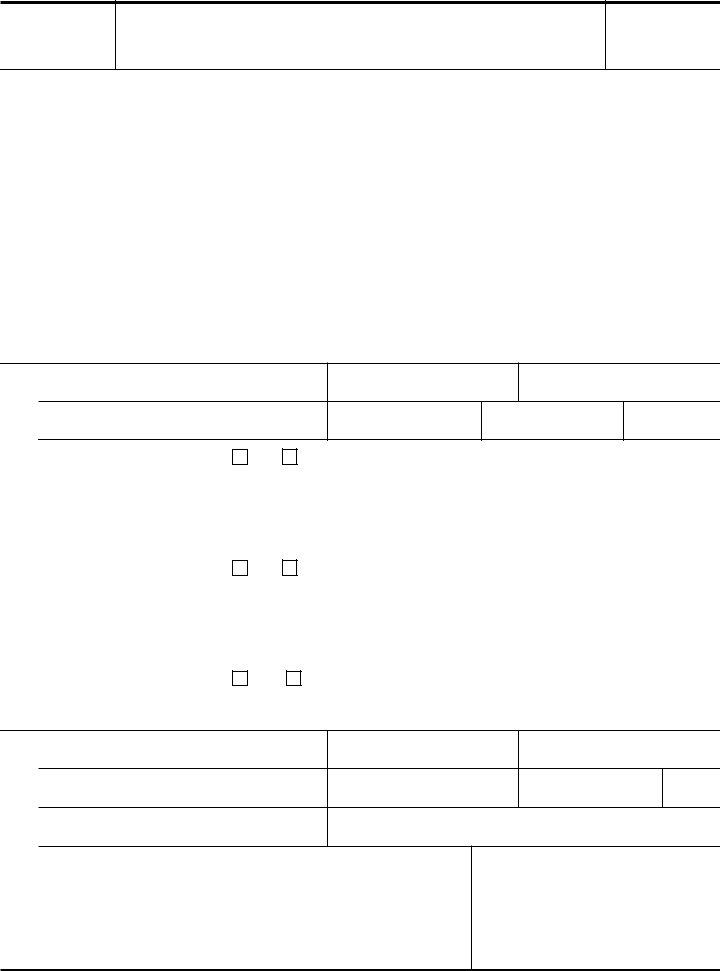

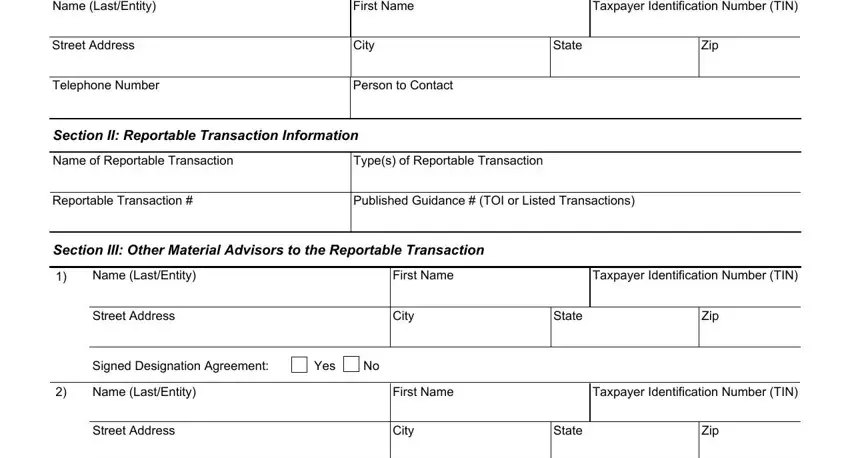

2. Your next stage is to fill out these fields: Signed Designation Agreement, Yes, Name LastEntity, First Name, Taxpayer Identification Number TIN, Street Address, City, State, Zip, Signed Designation Agreement, Yes, Section IV Advisee Information and, Name LastEntity, First Name, and Taxpayer Identification Number TIN.

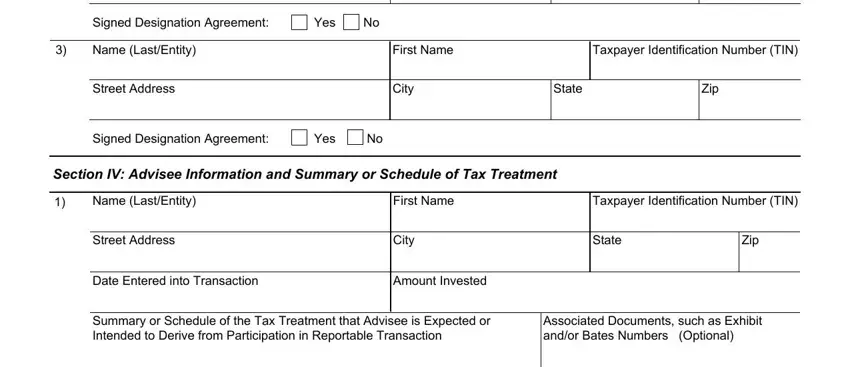

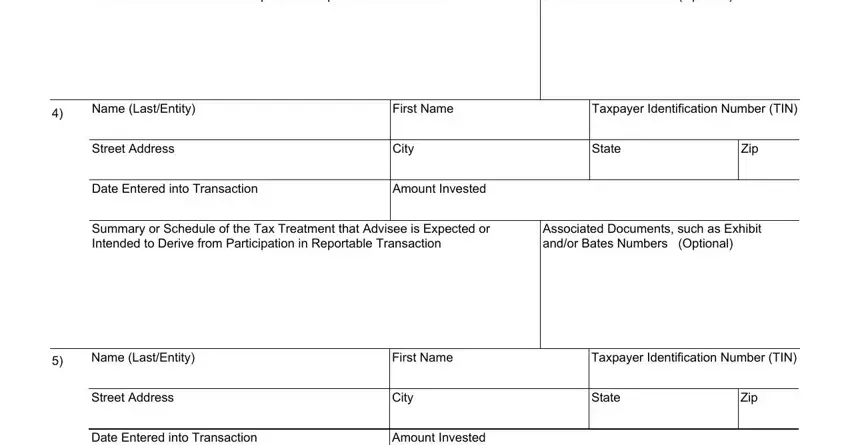

3. This 3rd part should be relatively easy, Name LastEntity, First Name, Taxpayer Identification Number TIN, Street Address, City, State, Zip, Date Entered into Transaction, Amount Invested, Summary or Schedule of the Tax, Associated Documents such as, Name LastEntity, First Name, Taxpayer Identification Number TIN, and Street Address - every one of these form fields will need to be filled out here.

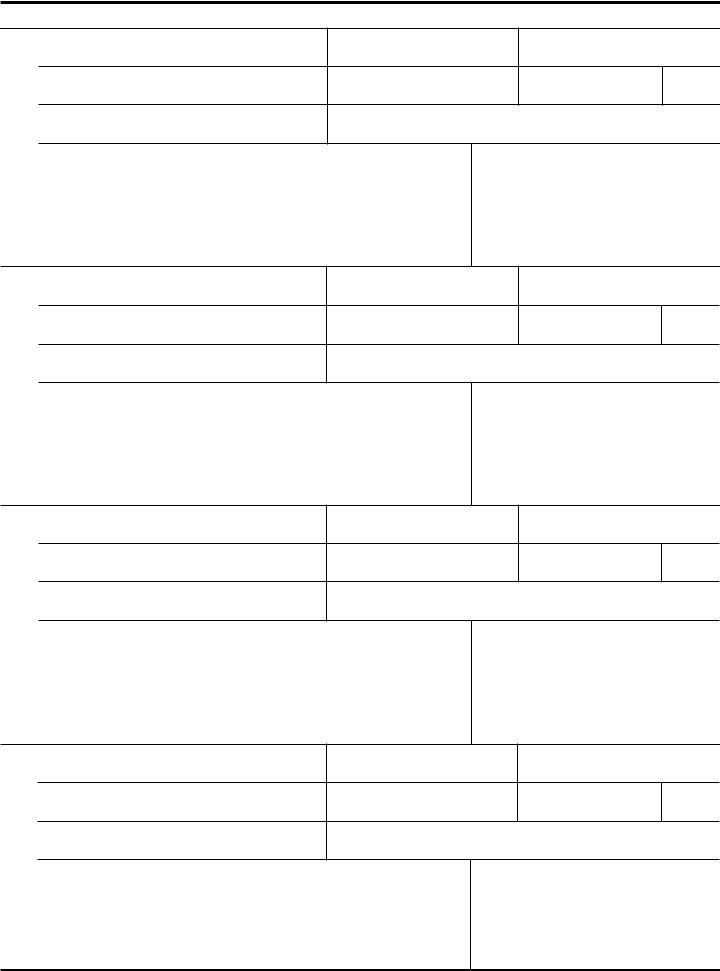

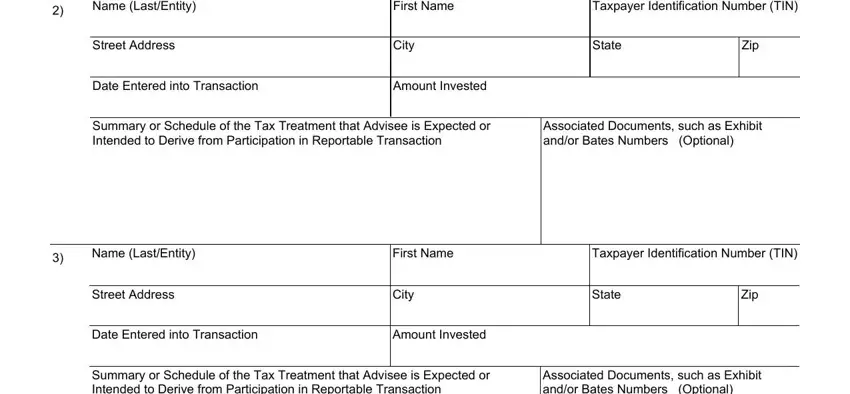

4. To move onward, this section requires completing a couple of blank fields. Included in these are Summary or Schedule of the Tax, Associated Documents such as, Name LastEntity, First Name, Taxpayer Identification Number TIN, Street Address, City, State, Zip, Date Entered into Transaction, Amount Invested, Summary or Schedule of the Tax, Associated Documents such as, Name LastEntity, and First Name, which are crucial to continuing with this PDF.

It is possible to get it wrong when filling in your Summary or Schedule of the Tax, consequently make sure to reread it before you'll finalize the form.

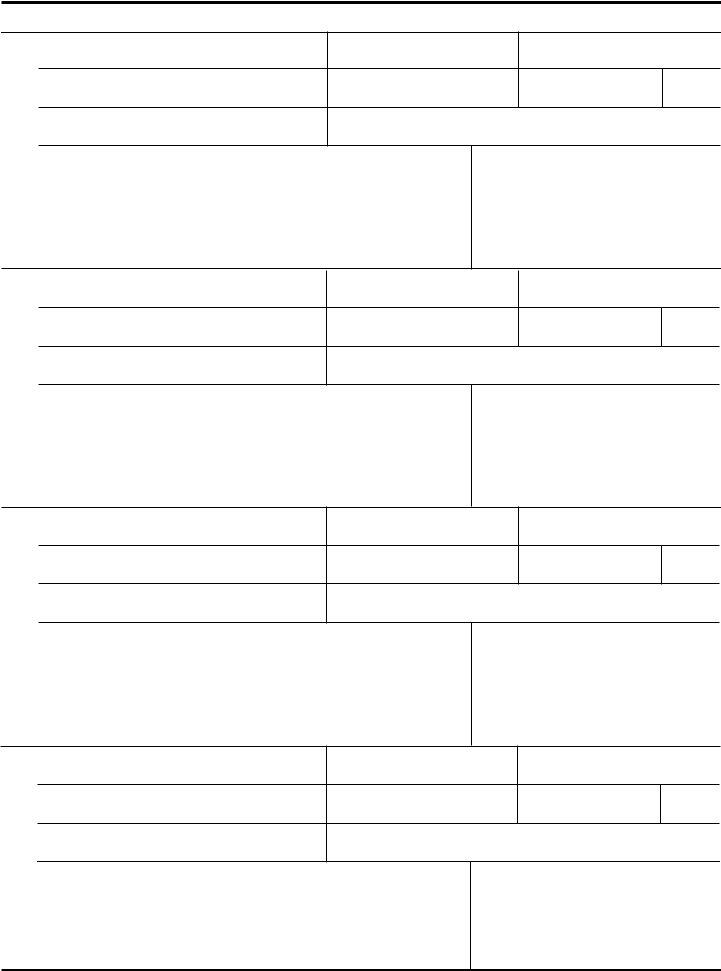

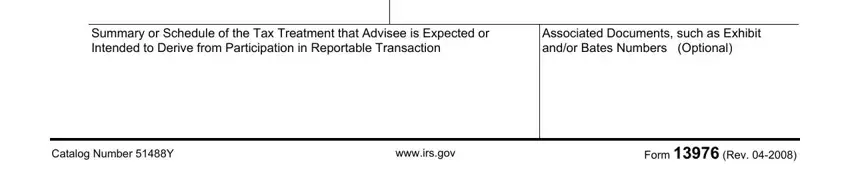

5. This final notch to finish this document is critical. Be certain to fill out the required form fields, particularly Date Entered into Transaction, Amount Invested, Summary or Schedule of the Tax, Associated Documents such as, Catalog Number Y, wwwirsgov, and Form Rev, before finalizing. In any other case, it can result in a flawed and potentially unacceptable form!

Step 3: Check that your details are accurate and then just click "Done" to proceed further. Try a 7-day free trial account with us and get immediate access to OMB - downloadable, emailable, and editable from your FormsPal account. FormsPal guarantees risk-free form editing without personal data recording or any sort of sharing. Rest assured that your information is in good hands with us!