You are able to fill out Exemption easily with our PDFinity® online tool. The editor is consistently upgraded by our staff, acquiring useful functions and turning out to be better. For anyone who is looking to begin, this is what it will take:

Step 1: Press the "Get Form" button above on this page to get into our editor.

Step 2: This tool gives you the opportunity to change almost all PDF forms in a range of ways. Improve it by writing personalized text, adjust what's already in the file, and include a signature - all when you need it!

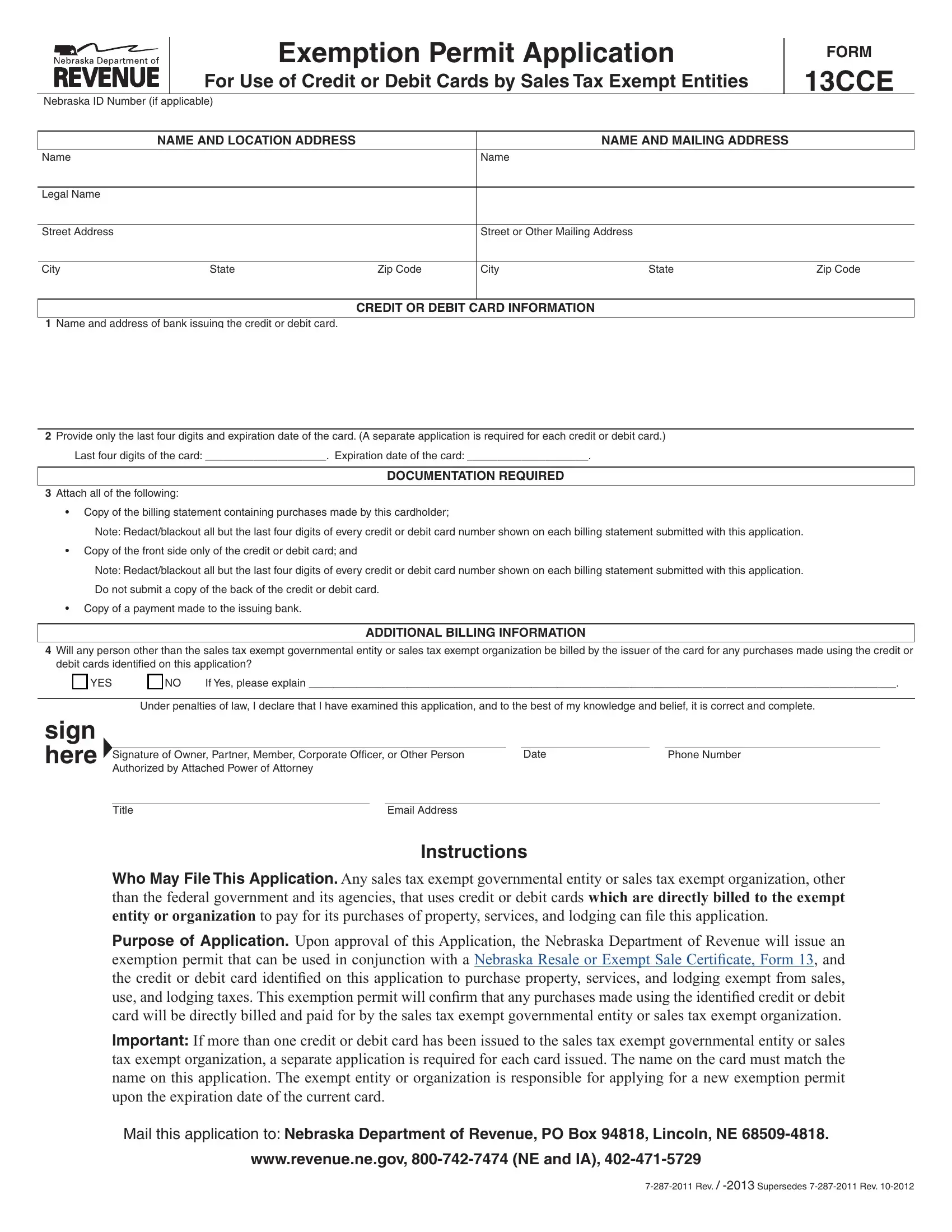

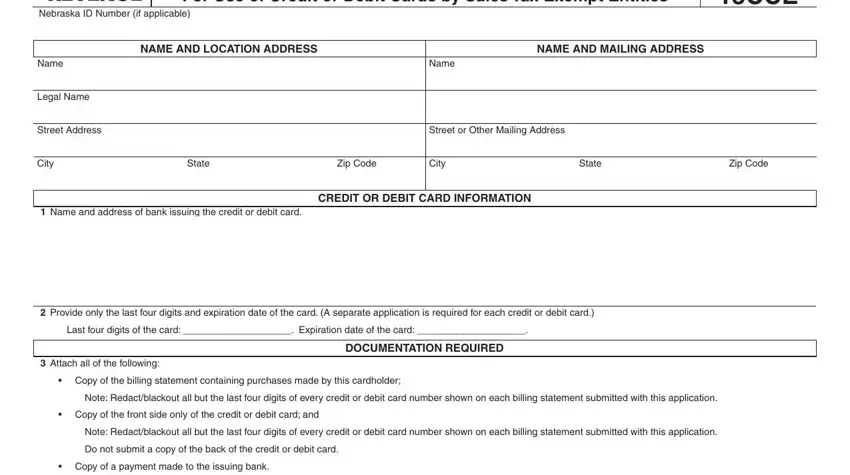

If you want to complete this PDF document, make sure that you enter the required details in every single area:

1. Begin completing your Exemption with a number of necessary blanks. Note all of the important information and make certain nothing is omitted!

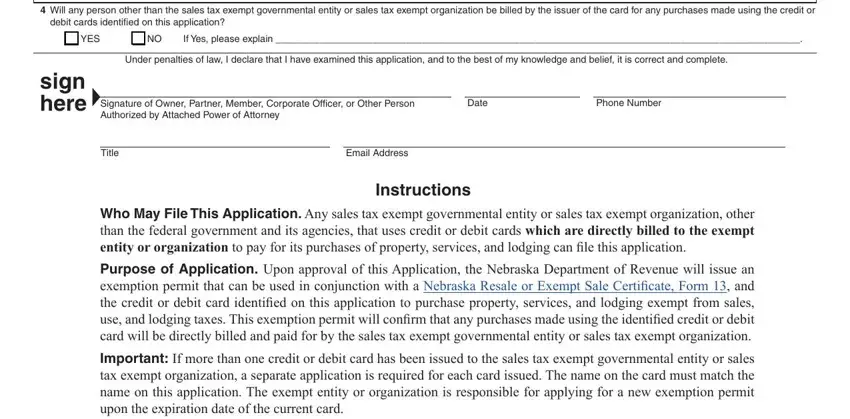

2. Once your current task is complete, take the next step – fill out all of these fields - Will any person other than the, debit cards identified on this, YES, If Yes please explain, Under penalties of law I declare, ADDITIONAL BILLING INFORMATION, sign here, Signature of Owner Partner Member, Date, Title, Email Address, Phone Number, Instructions, and Who May File This Application Any with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Many people often make mistakes while filling in If Yes please explain in this section. You should review everything you enter right here.

Step 3: Reread the information you have typed into the blanks and click the "Done" button. Create a free trial account at FormsPal and acquire instant access to Exemption - which you can then work with as you wish inside your personal account page. FormsPal guarantees your data confidentiality with a secure method that in no way records or shares any kind of private data involved. Rest assured knowing your docs are kept protected when you use our service!