Making use of the online editor for PDFs by FormsPal, you're able to fill in or modify irs form 14134 instructions right here and now. Our tool is continually evolving to grant the very best user experience achievable, and that is due to our dedication to continuous improvement and listening closely to user comments. With some easy steps, you are able to start your PDF editing:

Step 1: Hit the "Get Form" button in the top part of this page to get into our tool.

Step 2: With this advanced PDF editing tool, you're able to do more than simply complete blank form fields. Try each of the features and make your docs look perfect with custom text added in, or adjust the file's original content to excellence - all that comes with an ability to add any pictures and sign the document off.

It really is an easy task to complete the form with this detailed tutorial! Here's what you have to do:

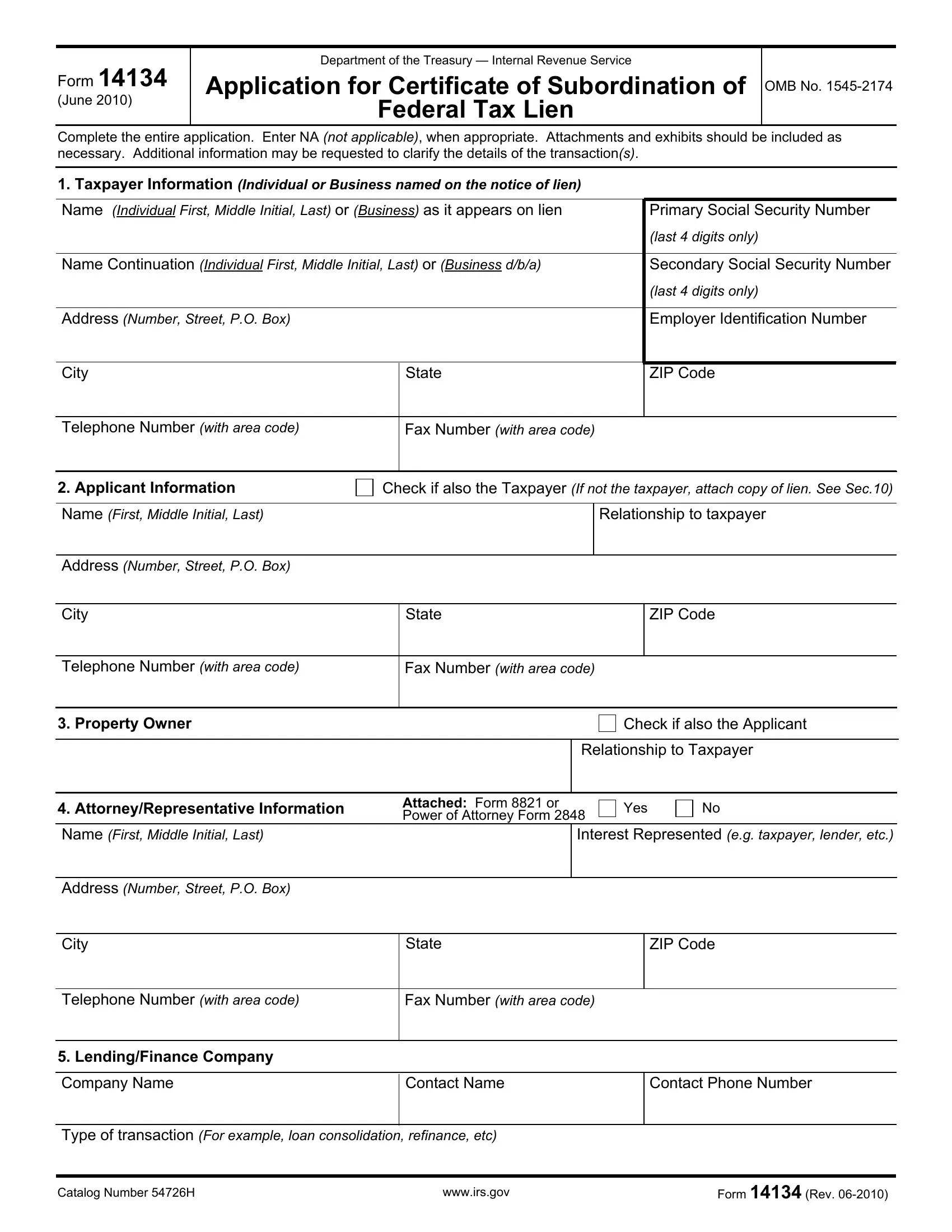

1. The irs form 14134 instructions necessitates specific details to be inserted. Be sure the subsequent blank fields are finalized:

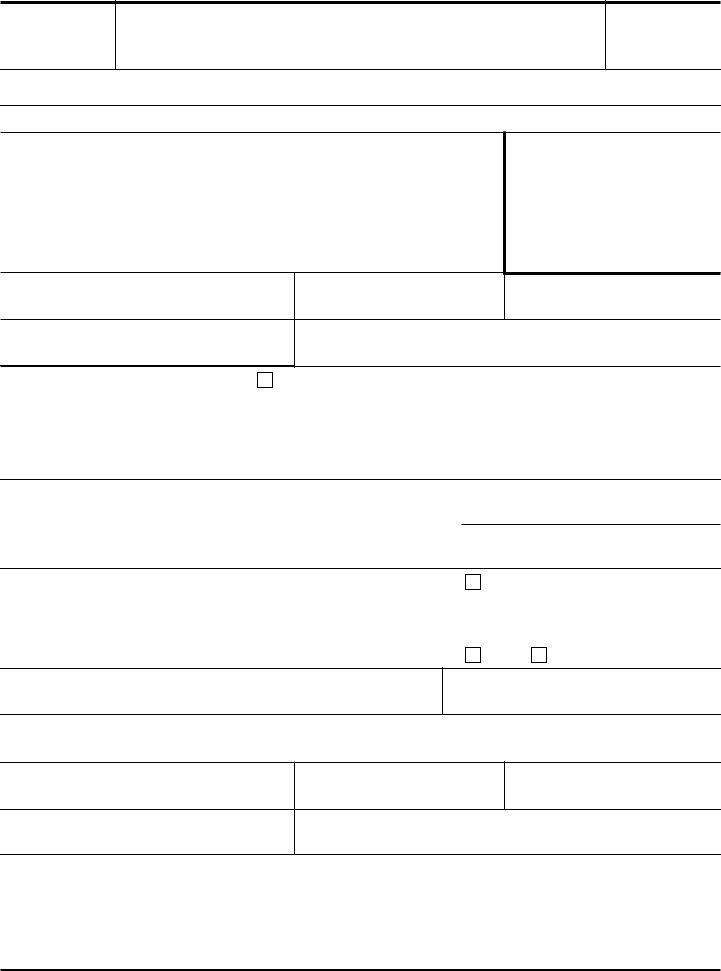

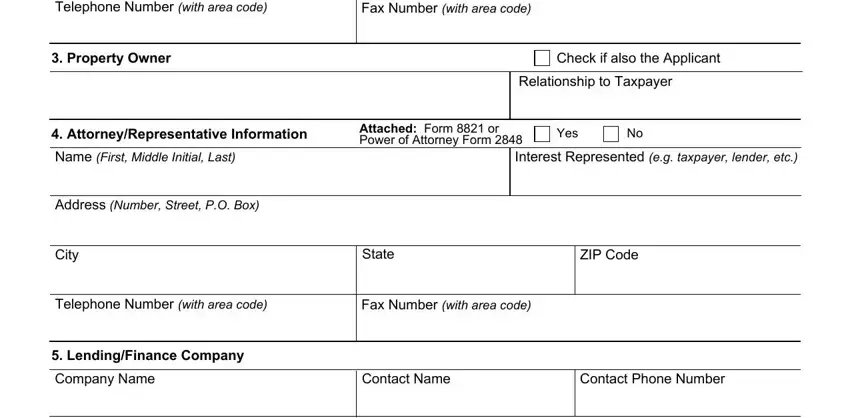

2. Right after this array of fields is completed, go to enter the suitable information in all these: Telephone Number with area code, Fax Number with area code, Property Owner, Check if also the Applicant, Relationship to Taxpayer, AttorneyRepresentative, Address Number Street PO Box, Attached Form or Power of, Yes, Interest Represented eg taxpayer, City, State, ZIP Code, Telephone Number with area code, and Fax Number with area code.

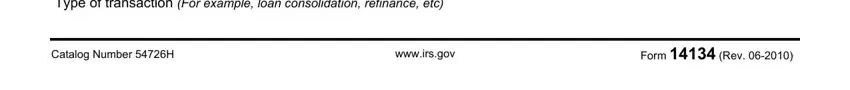

3. This next section is focused on Type of transaction For example, Catalog Number H, wwwirsgov, and Form Rev - fill out all these fields.

As for Type of transaction For example and Catalog Number H, be certain that you take another look in this section. The two of these are thought to be the most important ones in the PDF.

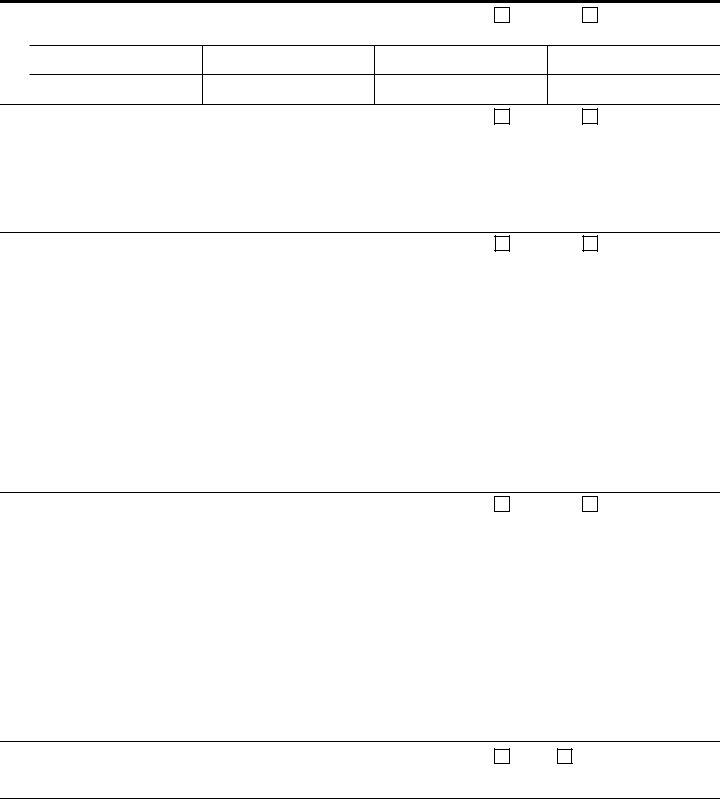

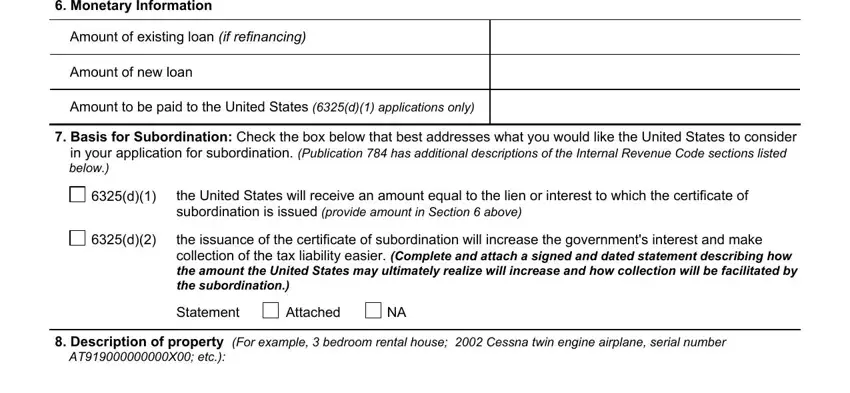

4. Your next part needs your input in the subsequent places: Monetary Information, Amount of existing loan if, Amount of new loan, Amount to be paid to the United, Basis for Subordination Check the, in your application for, the United States will receive an, the issuance of the certificate of, Statement, Attached, Description of property For, and ATX etc. Make certain to give all of the needed information to move further.

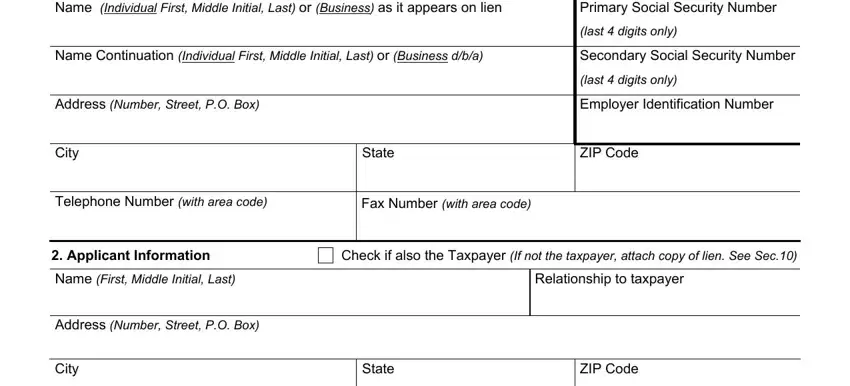

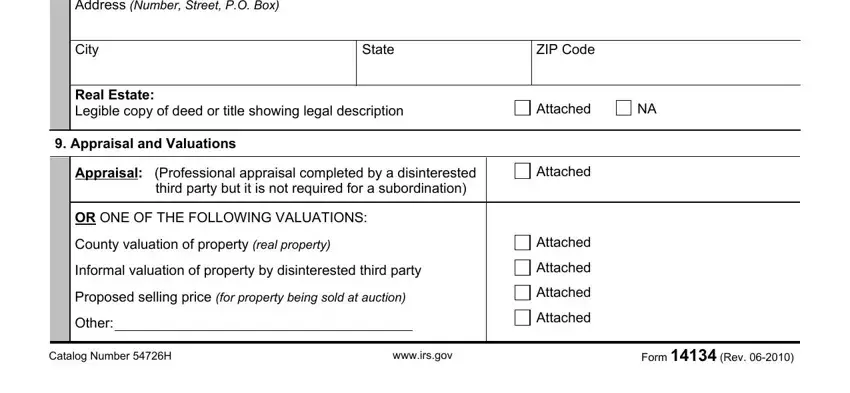

5. To conclude your document, this final segment has several extra fields. Filling in Address of real property If this, City, State, ZIP Code, Real Estate Legible copy of deed, Attached, Appraisal and Valuations, Appraisal Professional appraisal, third party but it is not required, OR ONE OF THE FOLLOWING VALUATIONS, Attached, Attached Attached Attached Attached, Catalog Number H, wwwirsgov, and Form Rev will wrap up everything and you'll be done very fast!

Step 3: After you've looked over the details in the document, click on "Done" to complete your document creation. After creating a7-day free trial account here, it will be possible to download irs form 14134 instructions or email it directly. The PDF form will also be at your disposal from your personal account page with your every single modification. At FormsPal, we do everything we can to be certain that all your details are stored private.