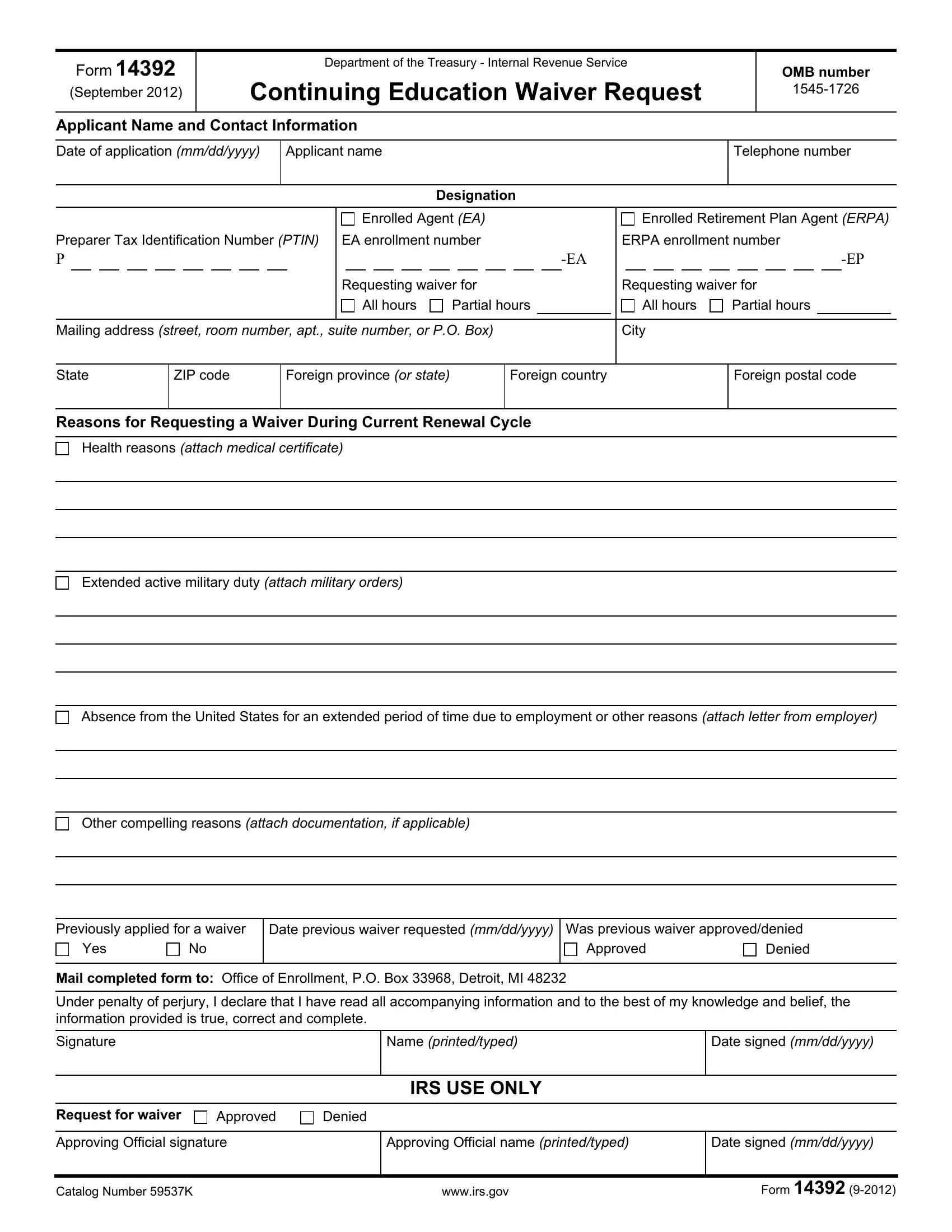

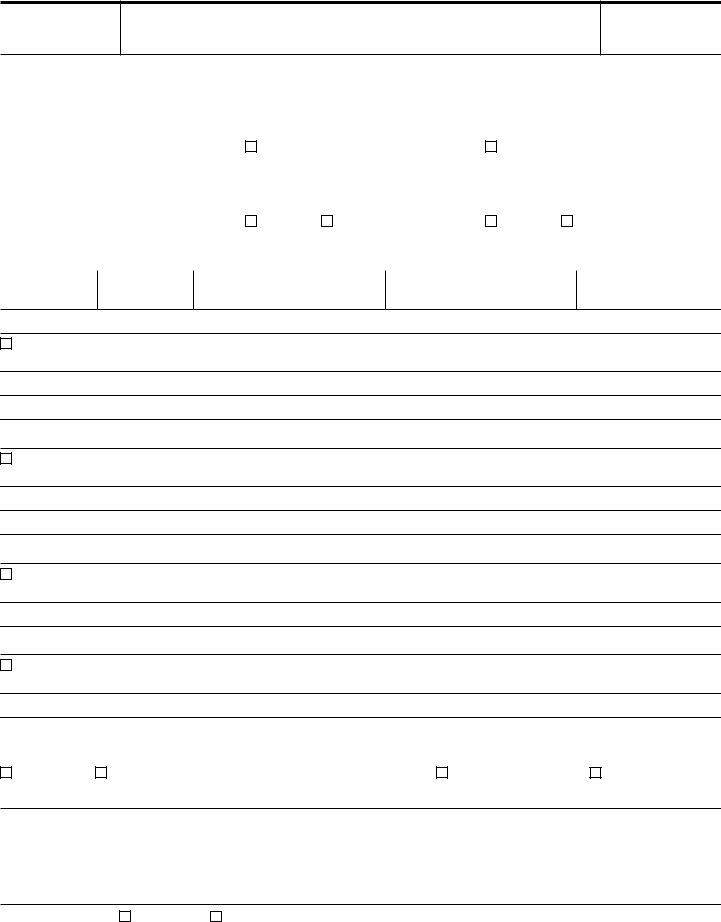

Form 14392

(September 2012)

Department of the Treasury - Internal Revenue Service

Continuing Education Waiver Request

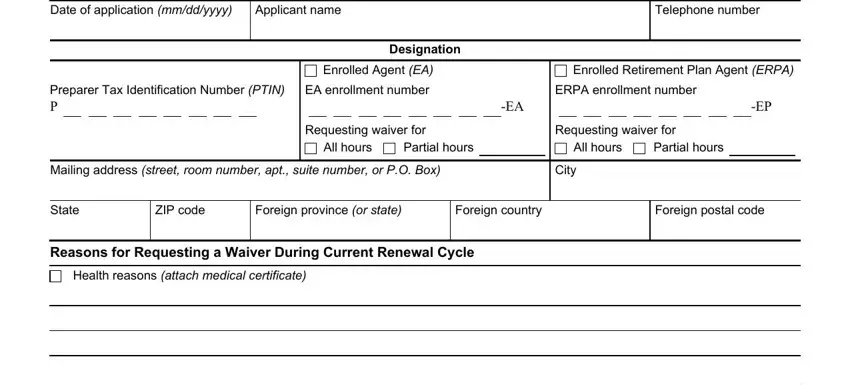

Applicant Name and Contact Information

Date of application (mm/dd/yyyy) |

Applicant name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Designation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enrolled Agent (EA) |

|

|

|

|

|

|

Enrolled Retirement Plan Agent (ERPA) |

Preparer Tax Identification Number (PTIN) |

EA enrollment number |

|

|

|

|

|

ERPA enrollment number |

P |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-EA |

|

|

|

|

|

|

|

|

|

-EP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Requesting waiver for |

|

|

|

|

|

Requesting waiver for |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All hours |

|

|

Partial hours |

|

|

|

|

|

|

All hours |

Partial hours |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address (street, room number, apt., suite number, or P.O. Box) |

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign province (or state)

Reasons for Requesting a Waiver During Current Renewal Cycle

Health reasons (attach medical certificate)

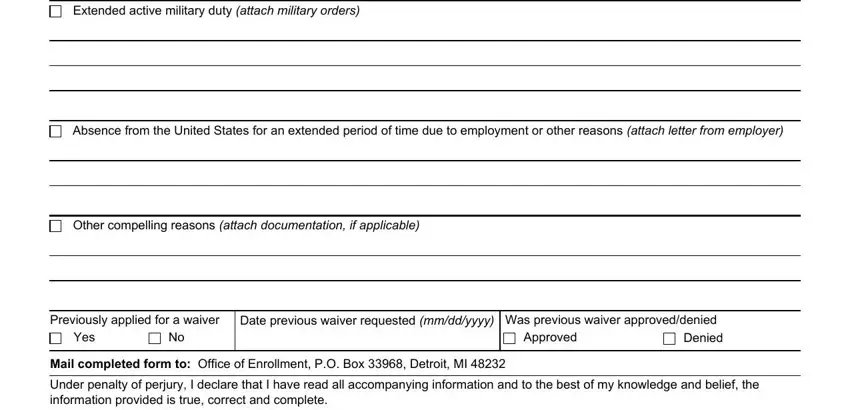

Extended active military duty (attach military orders)

Absence from the United States for an extended period of time due to employment or other reasons (attach letter from employer)

Other compelling reasons (attach documentation, if applicable)

Previously applied for a waiver |

Date previous waiver requested (mm/dd/yyyy) |

Was previous waiver approved/denied |

Yes |

No |

|

Approved |

Denied |

|

|

|

|

|

Mail completed form to: Office of Enrollment, P.O. Box 33968, Detroit, MI 48232

Under penalty of perjury, I declare that I have read all accompanying information and to the best of my knowledge and belief, the information provided is true, correct and complete.

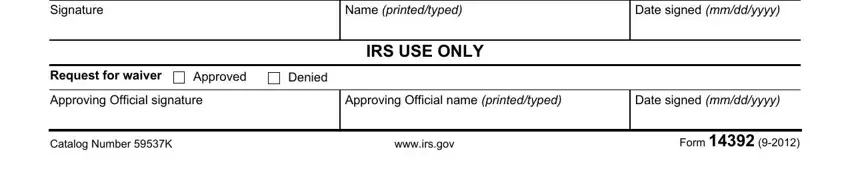

Signature |

Name (printed/typed) |

Date signed (mm/dd/yyyy) |

|

|

|

IRS USE ONLY

Request for waiver |

Approved |

Denied |

|

|

|

|

|

Approving Official signature |

|

Approving Official name (printed/typed) |

Date signed (mm/dd/yyyy) |

|

|

|

|

|

Catalog Number 59537K |

www.irs.gov |

Form 14392 (9-2012) |

Page 2 of 2

Instructions for Form 14392, Continuing Education Waiver Request

Specific Instructions

Name and Contact Information

Full name and address of person requesting waiver

Designation

•Registered Tax Return Preparers (RTRP) must provide their Preparer Tax Identification Number (PTIN)

•Enrolled Agents (EA) must provide both their Enrolled Agent Enrollment Number and their PTIN

•Enrolled Retirement Plan Agents (ERPA) must provide their ERPA Enrollment Number. Additionally, ERPAs should provide their PTIN if they have one.

Reasons for Requesting a Waiver During Current Renewal Cycle

•Health, which prevented, or will prevent, compliance with the continuing education requirements (Supporting documentation such as a medical certificate must be provided with the request).

•Extended active military duty (Supporting documentation such as military orders must be provided with the request).

•Absence from the United States for an extended period of time due to employment or other reasons provided the individual does not practice before the Internal Revenue Service during such absence.

•Other compelling reasons, which will be considered on a case-by-case basis.

General Instructions

A Continuing Education (CE) waiver is typically requested when an individual has not been or will not be able to acquire the required CE credits prior to the renewal deadline for Registered Tax Return Preparers, Enrolled Agents, or Enrolled Retirement Plan Agents. To be considered, a request for a CE waiver must be received no later than the last day of the renewal application period. In addition, those who are granted waivers are required to file timely applications for renewal of enrollment or registration.

Who is Eligible to Request a Waiver

Registered Tax Return Preparers, Enrolled Agents, and Enrolled Retirement Plan Agents may request a waiver of continuing education requirements for a renewal cycle due to health, extended military service, extended absence from the United States, or other reasons (evaluated on a case-by-case basis). You must submit appropriate documentation to support your request. Waivers will not be granted if you have already completed the required continuing education hours for the cycle:

•Enrolled Agents

•72 hours every three years

•Obtain a minimum of 16 hours per year (2 of which must be on ethics)

•Enrolled Retirement Plan Agents

•72 hours every three years

•Obtain a minimum of 16 hours per year (2 of which must be on ethics)

•Registered Tax Return Preparers

•15 hours per year

•2 hours of ethics

•3 hours of federal tax law updates

•10 hours of other federal tax law

Waivers requested for more than one consecutive renewal cycle will be considered on a case-by-case basis.

How to Request a Waiver

Download Form 14392 from www.irs.gov and fill out in its entirety.

Mail completed form to: Office of Enrollment

P.O. Box 33968

Detroit, MI 48232

All RTRP, EA and ERPA waiver requests should be mailed to the Office of Enrollment.

All waiver requests will be processed in 90 days.

Privacy Act and Paperwork Reduction Notice

Privacy Act and Paperwork Reduction Notice: We ask for the information on this form to carry out the laws of the United States. We need it to ensure that continuing education providers are complying with these laws. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Internal Revenue Code section 6103. The time require to complete this form will vary depending on individual circumstances. The estimated average time is 15 minutes.

Privacy Act Notice The primary purpose of this form is to report potential violations of the law by continuing education providers. We are requesting this information under authority of 26 U.S.C. § 7801 and § 7803 and 31 U.S.C. § 330. Providing this information is voluntary, and failure to provide all or part of the information will not affect you. Providing false or fraudulent information may subject you to penalties. We may disclose this information to the Department of Justice to enforce the tax laws, both civil and criminal, and to cities, states, the District of Columbia, and U.S. commonwealths or possessions to carry out their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, and to federal law enforcement and intelligence agencies to combat terrorism.

Catalog Number 59537K |

www.irs.gov |

Form 14392 (9-2012) |