When you wish to fill out form 14654 instruction, you don't have to install any sort of software - just try using our PDF editor. We are aimed at making sure you have the perfect experience with our editor by consistently releasing new functions and improvements. With all of these improvements, using our tool gets easier than ever! All it takes is just a few easy steps:

Step 1: Simply click on the "Get Form Button" in the top section of this site to get into our pdf file editing tool. There you will find everything that is needed to work with your file.

Step 2: Using our online PDF editing tool, you may accomplish more than simply fill out blank form fields. Express yourself and make your forms appear great with customized textual content incorporated, or fine-tune the file's original content to excellence - all accompanied by an ability to insert stunning pictures and sign the document off.

Pay close attention while filling out this pdf. Make sure that every single blank field is filled in accurately.

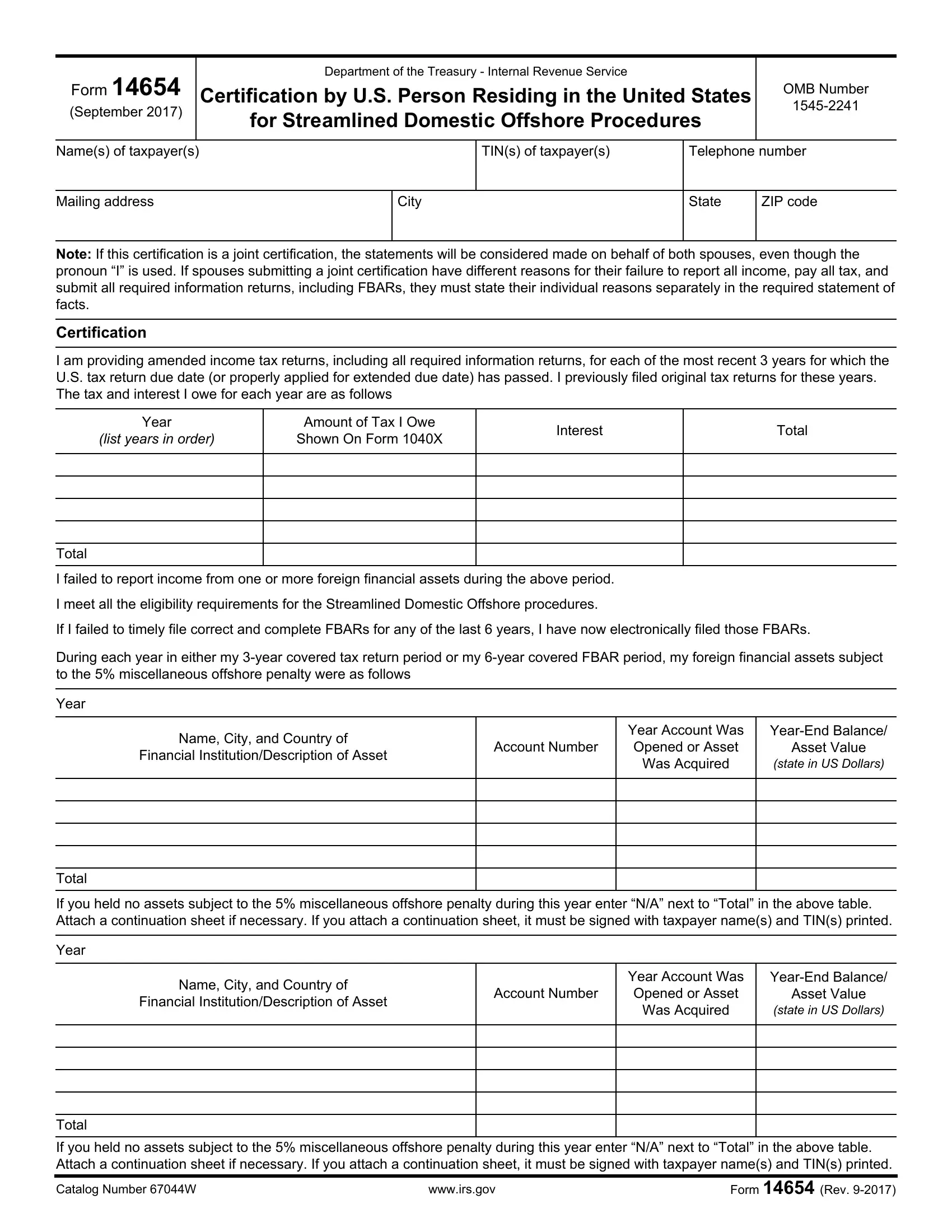

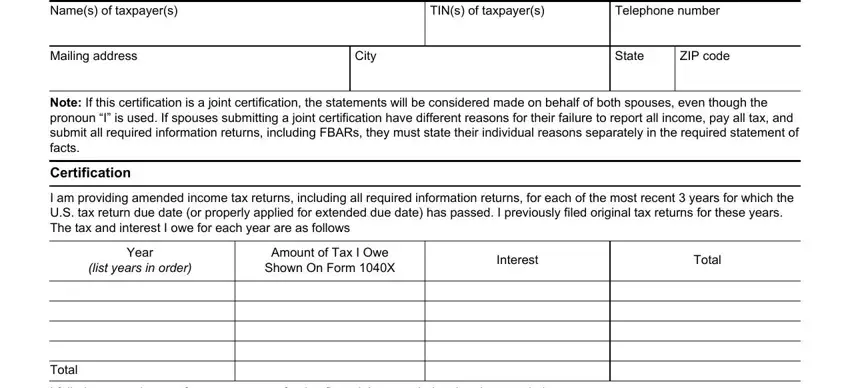

1. To start with, once filling in the form 14654 instruction, beging with the part that contains the subsequent blank fields:

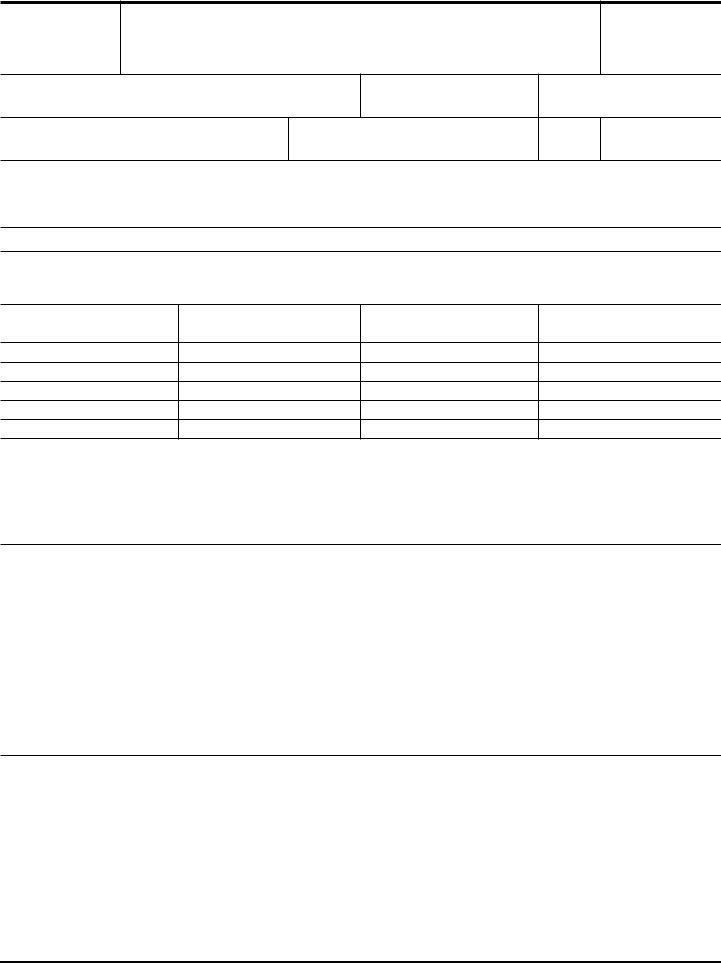

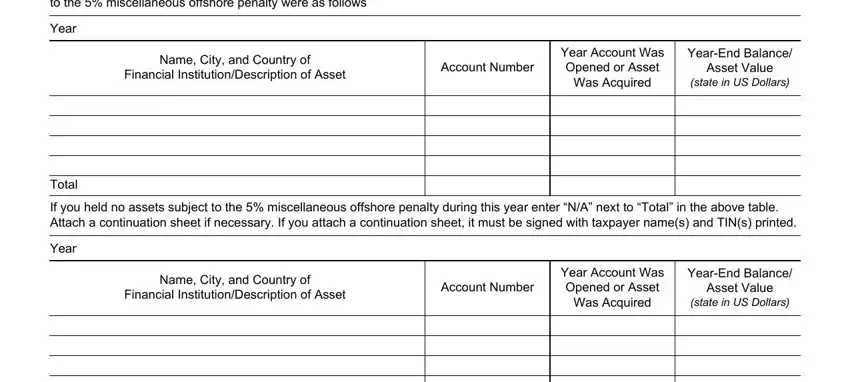

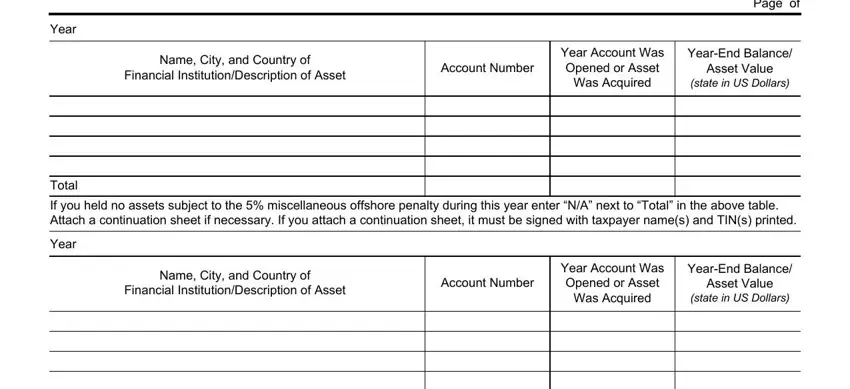

2. Immediately after the prior section is completed, go to enter the suitable details in all these: During each year in either my year, Name City and Country of, Financial InstitutionDescription, Account Number, Year Account Was Opened or Asset, YearEnd Balance, Asset Value, Was Acquired, state in US Dollars, Year, Total, If you held no assets subject to, Name City and Country of, Financial InstitutionDescription, and Account Number.

In terms of Account Number and Was Acquired, be sure you do everything properly in this section. The two of these are viewed as the most important fields in the PDF.

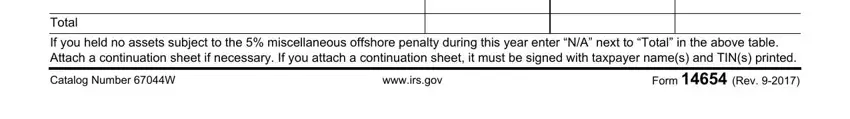

3. The following section is all about Total, If you held no assets subject to, Catalog Number W, wwwirsgov, and Form Rev - complete each of these empty form fields.

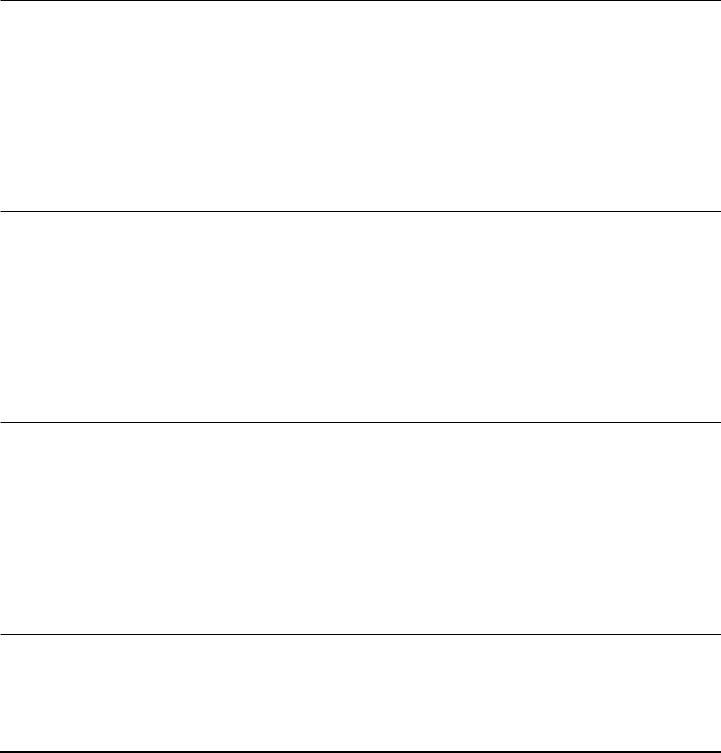

4. It is time to proceed to this next portion! In this case you will have all these Name City and Country of, Financial InstitutionDescription, Account Number, Year Account Was Opened or Asset, YearEnd Balance, Asset Value, Was Acquired, state in US Dollars, Page of, Year, Total, If you held no assets subject to, Name City and Country of, Financial InstitutionDescription, and Account Number blanks to fill in.

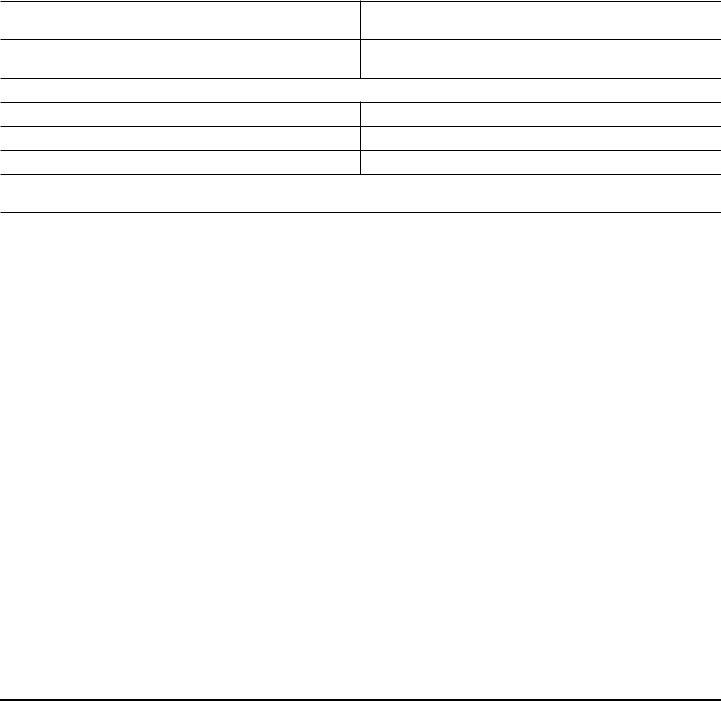

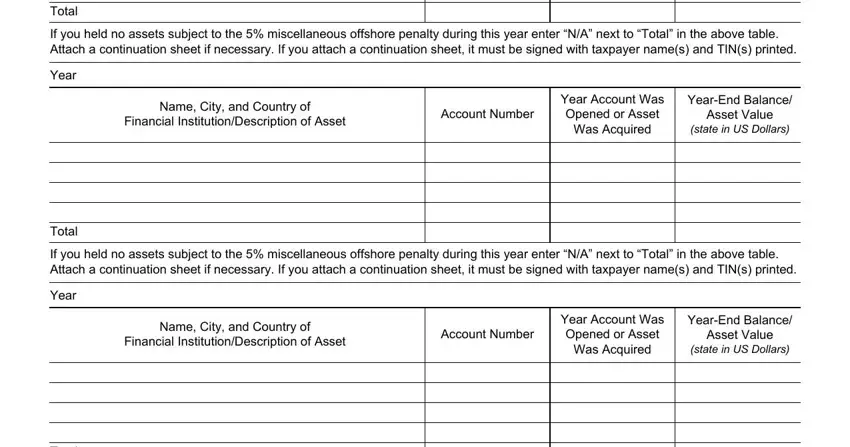

5. This last step to conclude this form is critical. You need to fill out the necessary blank fields, including Total, If you held no assets subject to, Name City and Country of, Financial InstitutionDescription, Account Number, Year Account Was Opened or Asset, YearEnd Balance, Asset Value, Was Acquired, state in US Dollars, Year, Total, If you held no assets subject to, Name City and Country of, and Financial InstitutionDescription, before finalizing. Or else, it could produce an unfinished and probably incorrect document!

Step 3: Once you have looked again at the details in the blanks, click "Done" to finalize your document generation. Join FormsPal right now and easily gain access to form 14654 instruction, all set for download. All modifications you make are saved , letting you modify the file further anytime. FormsPal guarantees safe form completion devoid of data record-keeping or any sort of sharing. Feel safe knowing that your details are secure here!