160 form can be completed online without any problem. Just make use of FormsPal PDF tool to complete the task without delay. To retain our editor on the forefront of practicality, we aim to put into practice user-driven features and improvements regularly. We're at all times looking for feedback - assist us with reshaping how we work with PDF files. To get the process started, take these basic steps:

Step 1: Just hit the "Get Form Button" at the top of this webpage to launch our pdf file editor. There you will find all that is necessary to fill out your document.

Step 2: As soon as you open the tool, you'll notice the document all set to be completed. Aside from filling in various fields, you could also do other actions with the PDF, particularly adding custom text, modifying the initial text, inserting graphics, putting your signature on the form, and more.

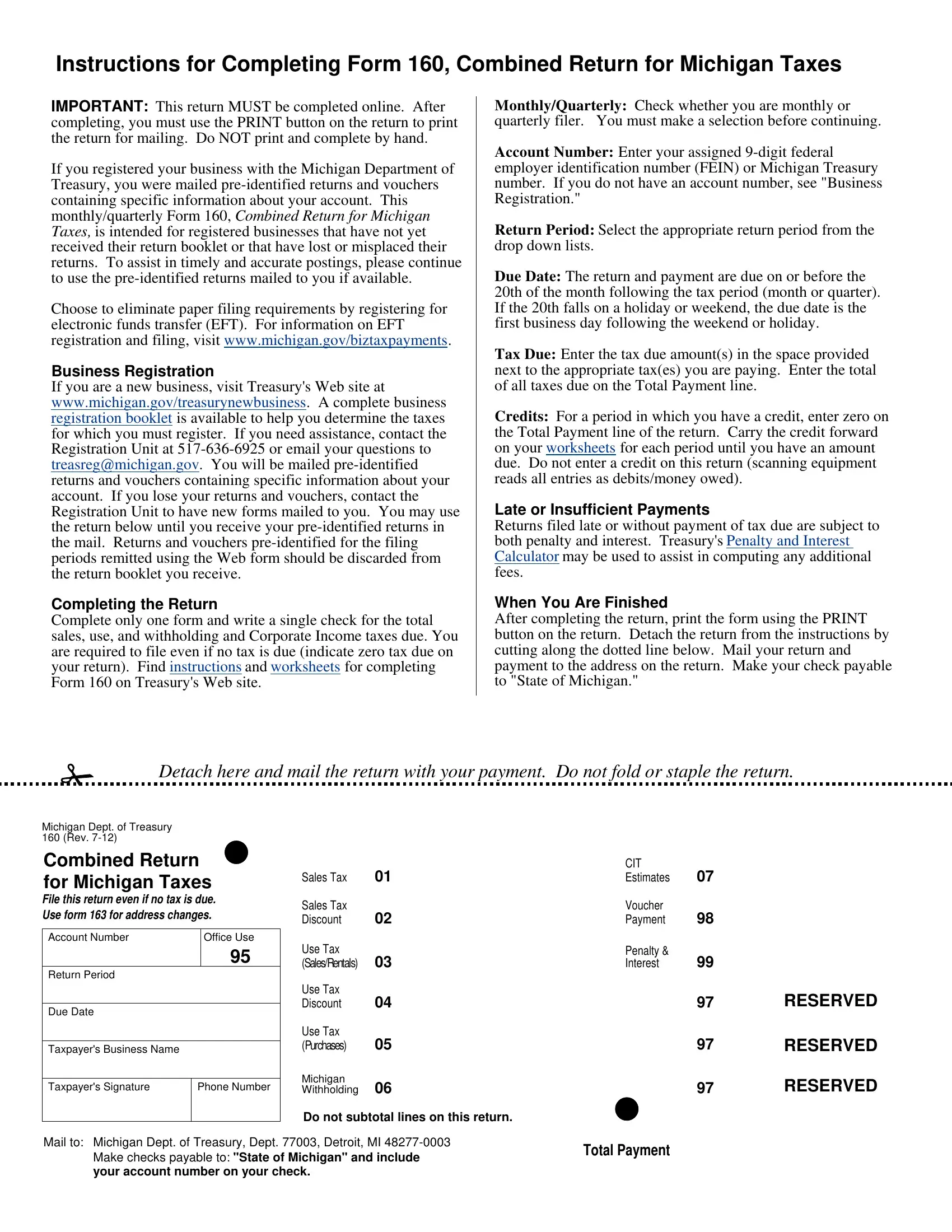

With regards to the blanks of this specific form, here is what you should know:

1. The 160 form usually requires certain information to be typed in. Ensure that the subsequent fields are finalized:

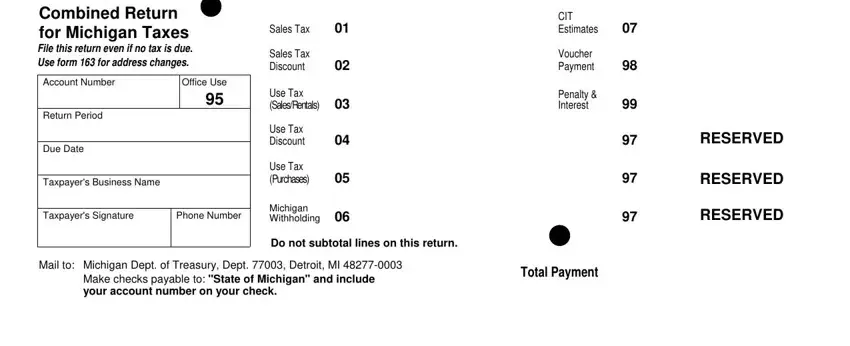

2. Right after completing this part, head on to the next stage and fill out the necessary particulars in all these blanks - Michigan Dept of Treasury Rev, Account Number, Return Period, Due Date, Office Use, Taxpayers Business Name, Taxpayers Signature, Phone Number, Sales Tax, Sales Tax Discount, Use Tax SalesRentals, Use Tax Discount, Use Tax Purchases, Michigan Withholding, and CIT Estimates.

Regarding Return Period and Office Use, be sure you review things here. Those two could be the key fields in the document.

Step 3: As soon as you've looked once again at the details in the file's blanks, click "Done" to conclude your form. Sign up with us right now and instantly access 160 form, set for downloading. Every edit you make is conveniently preserved , letting you change the document further if required. FormsPal ensures your data confidentiality via a secure system that never records or shares any type of personal data involved. You can relax knowing your docs are kept safe when you work with our service!