Whenever you wish to fill out annual return form, you won't have to download any sort of programs - just try using our online tool. In order to make our tool better and less complicated to utilize, we consistently implement new features, considering feedback coming from our users. Here is what you'd need to do to get started:

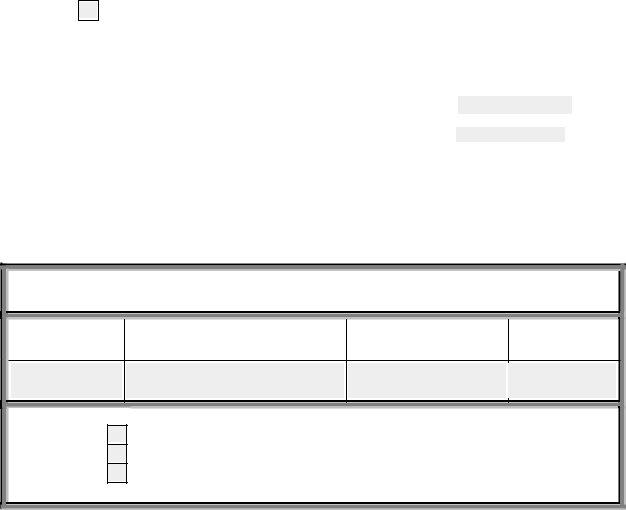

Step 1: Open the PDF form inside our tool by clicking on the "Get Form Button" above on this page.

Step 2: As you start the editor, you will get the form made ready to be filled out. Aside from filling in different blank fields, you may as well do many other things with the PDF, that is adding your own text, modifying the initial text, adding illustrations or photos, signing the document, and more.

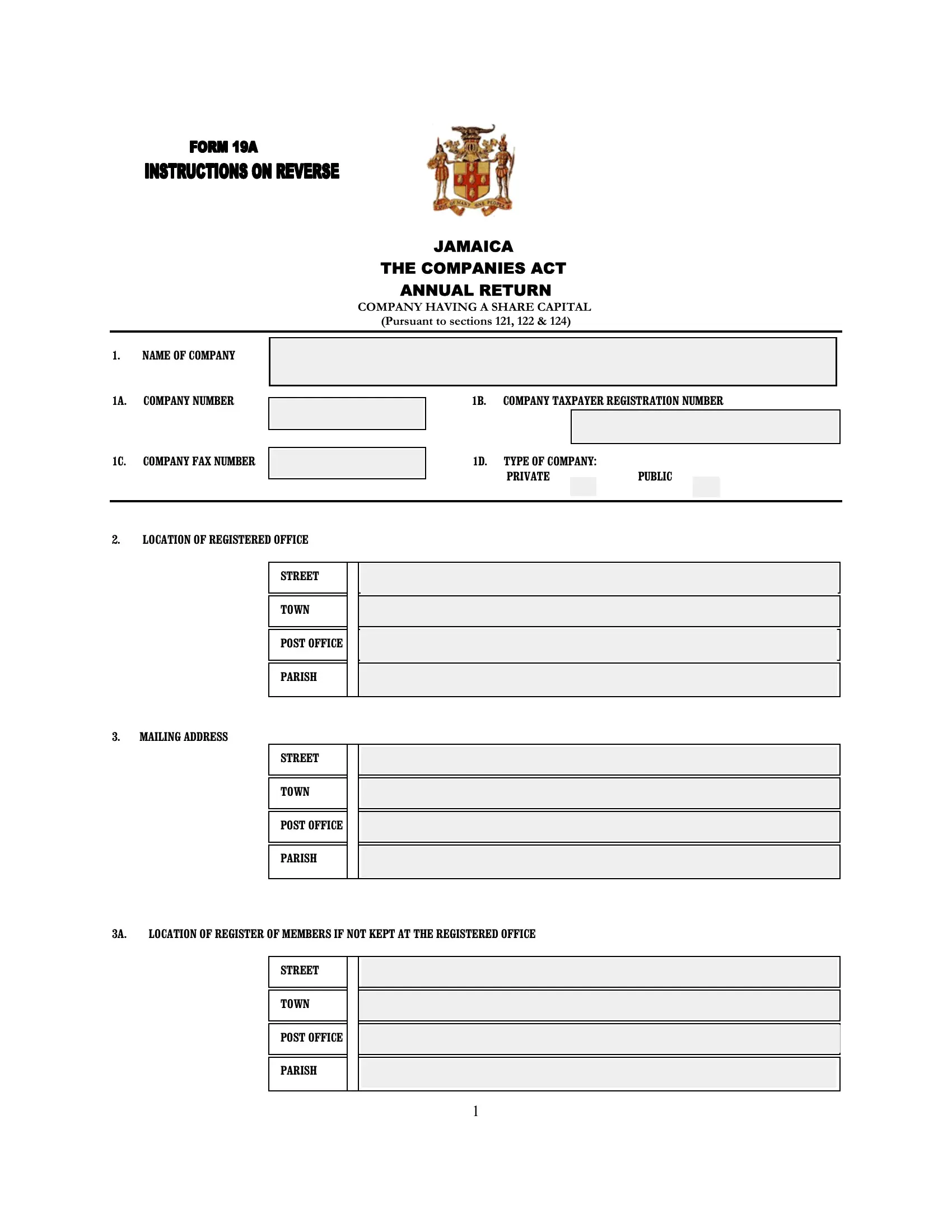

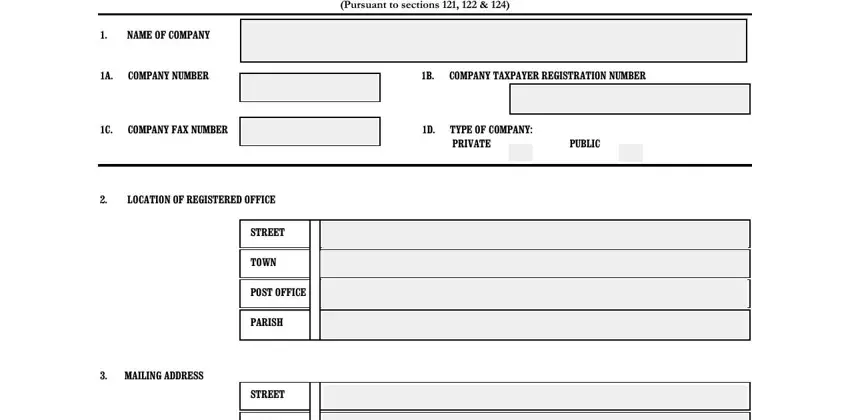

With regards to the blanks of this particular PDF, this is what you need to know:

1. While submitting the annual return form, ensure to incorporate all of the essential blank fields in its relevant area. It will help to expedite the work, enabling your details to be handled without delay and properly.

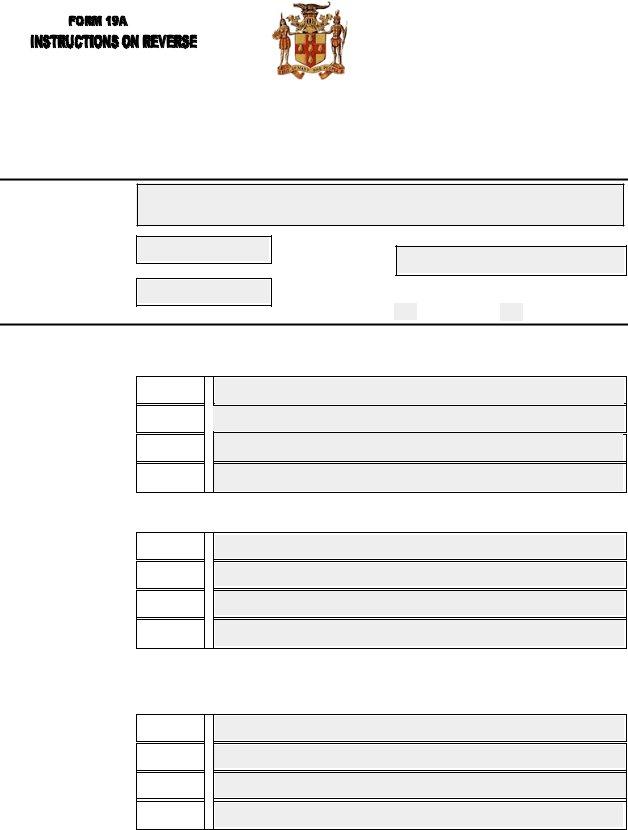

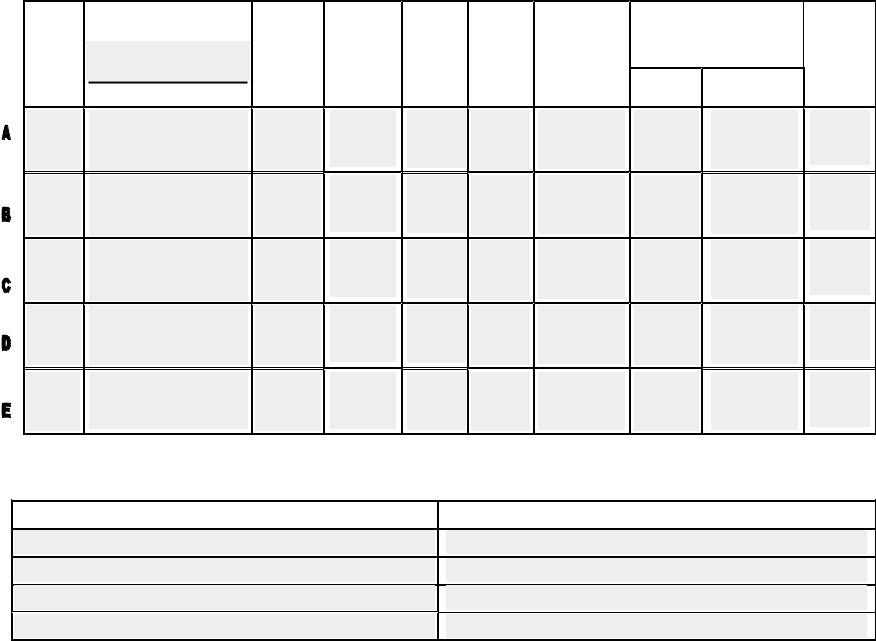

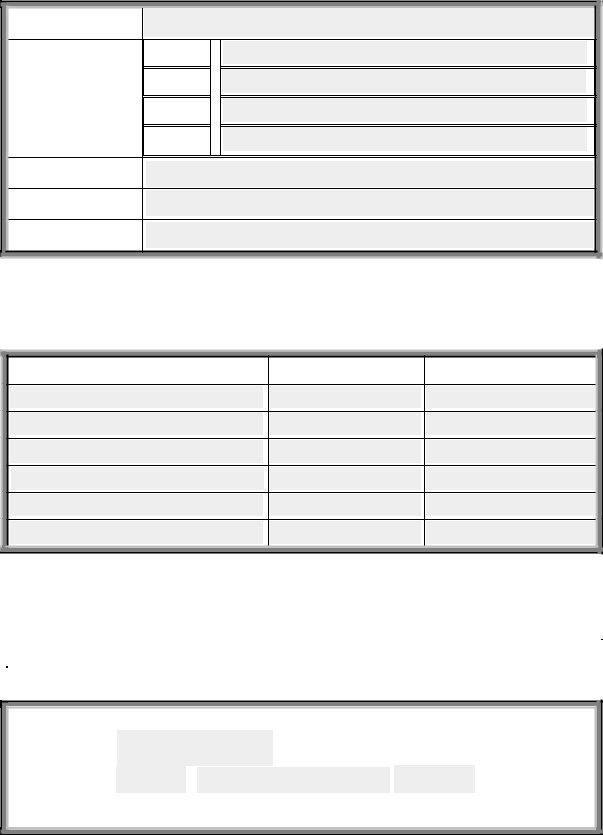

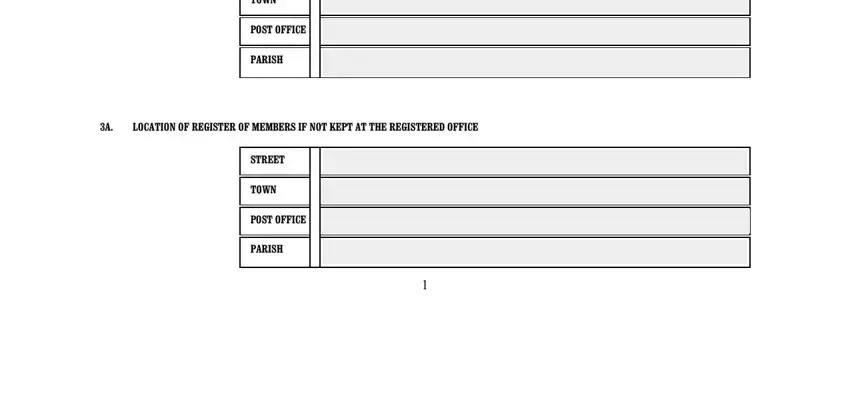

2. Just after the prior array of blanks is filled out, go on to type in the relevant details in these - TOWN, POST OFFICE, PARISH, A LOCATION OF REGISTER OF MEMBERS, STREET, TOWN, POST OFFICE, and PARISH.

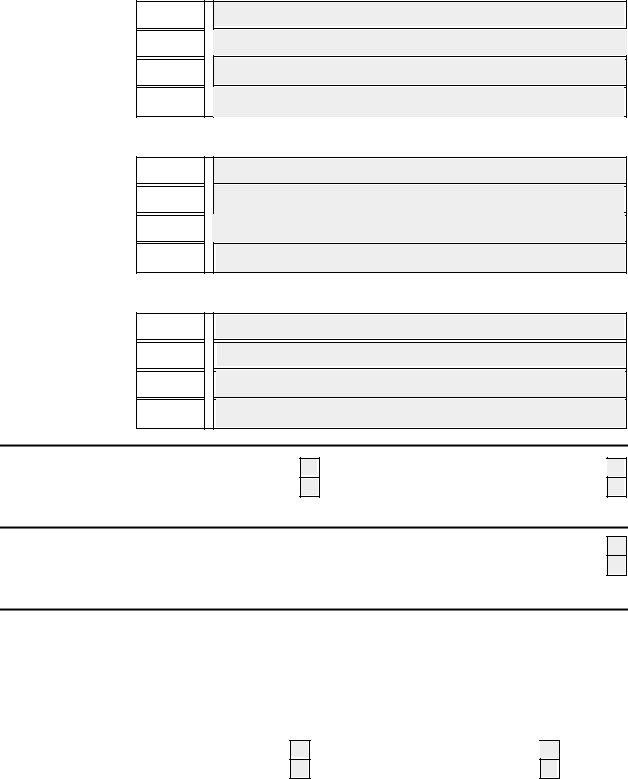

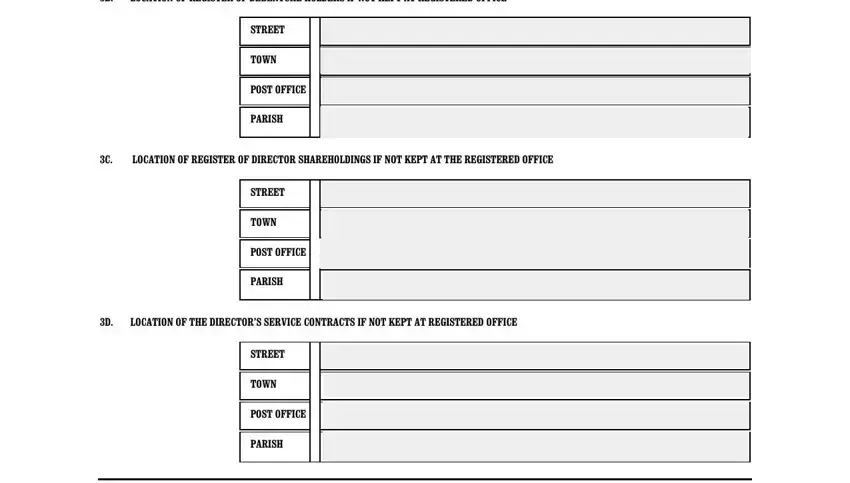

3. Completing B LOCATION OF REGISTER OF, STREET, TOWN, POST OFFICE, PARISH, C LOCATION OF REGISTER OF DIRECTOR, STREET, TOWN, POST OFFICE, PARISH, D LOCATION OF THE DIRECTORS, STREET, TOWN, POST OFFICE, and PARISH is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

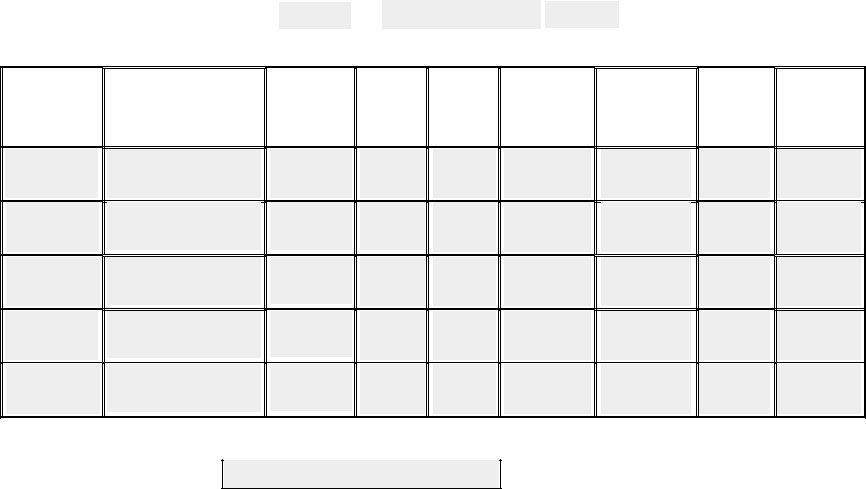

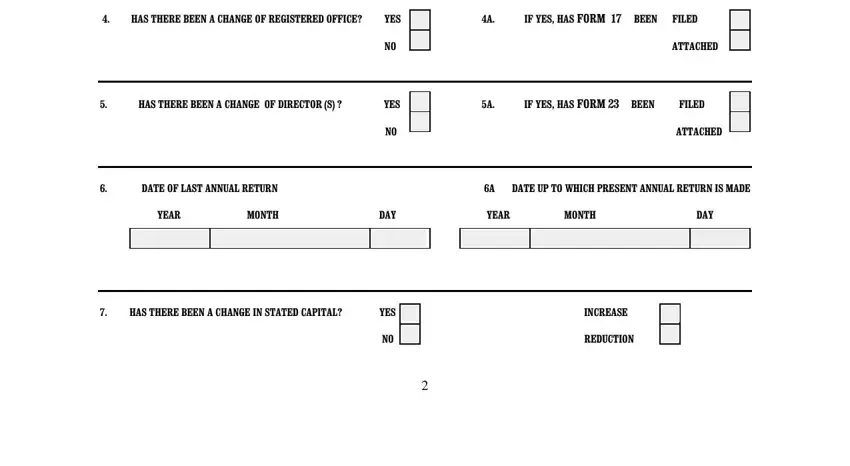

4. This next section requires some additional information. Ensure you complete all the necessary fields - HAS THERE BEEN A CHANGE OF, A IF YES HAS FORM BEEN FILED, ATTACHED, HAS THERE BEEN A CHANGE OF, A IF YES HAS FORM BEEN FILED, ATTACHED, DATE OF LAST ANNUAL RETURN, A DATE UP TO WHICH PRESENT ANNUAL, YEAR MONTH DAY, YEAR MONTH DAY, HAS THERE BEEN A CHANGE IN STATED, INCREASE, and REDUCTION - to proceed further in your process!

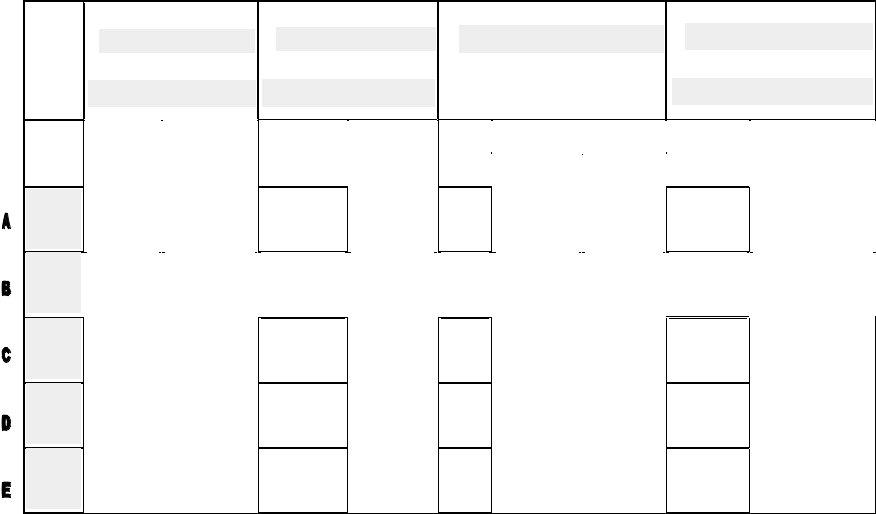

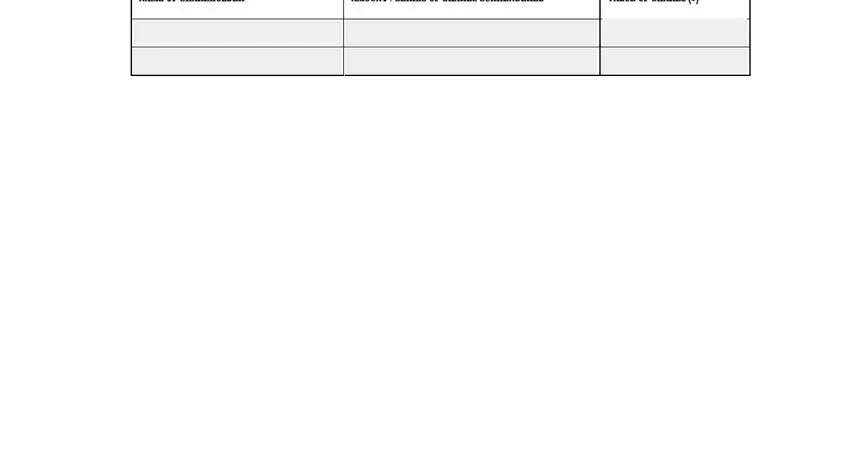

5. To finish your form, the particular section involves a number of additional blank fields. Completing NAME OF SHAREHOLDER, AMOUNT SERIES OF SHARES, and VALUE OF SHARES will wrap up the process and you'll be done in no time!

People who work with this document frequently make errors while completing AMOUNT SERIES OF SHARES in this section. Be sure you revise what you type in right here.

Step 3: Prior to finishing your document, you should make sure that form fields are filled in as intended. Once you verify that it's correct, click “Done." After setting up a7-day free trial account at FormsPal, you will be able to download annual return form or send it through email at once. The PDF document will also be at your disposal through your personal account page with your each and every edit. FormsPal offers protected form editing without personal data record-keeping or distributing. Be assured that your data is in good hands here!