When individuals decide to sell their homes, navigating the financial and tax implications of this decision becomes paramount. The 2119 form, officially known as "Sale of Your Home," plays a critical role in this process. Required by the Department of the Treasury and managed by the Internal Revenue Service (IRS), this document is designed for attachment to Form 1040 during the tax year in which the sale occurred. Its purpose is not only to report the sale but also to calculate any gain from the transaction, taking into account the selling price, associated expenses, and the adjusted basis of the home sold. The form is especially significant for individuals who haven't bought or built a new main home immediately after the sale or are considering doing so within a specified period. Part II of the form addresses the one-time exclusion of gain for people age 55 or older, a provision that offers substantial tax relief under certain conditions. Furthermore, Part III delves into specifics like adjusted sales price, taxable gain, and the adjusted basis of a new home, tailoring the tax implications to the seller’s next steps. As such, Form 2119 stands as a vital document for homeowners navigating the complexities of selling their residence while ensuring compliance with tax laws and potentially minimizing tax liabilities.

| Question | Answer |

|---|---|

| Form Name | Form 2119 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | Y9511710 form 2119 tax year 2012 |

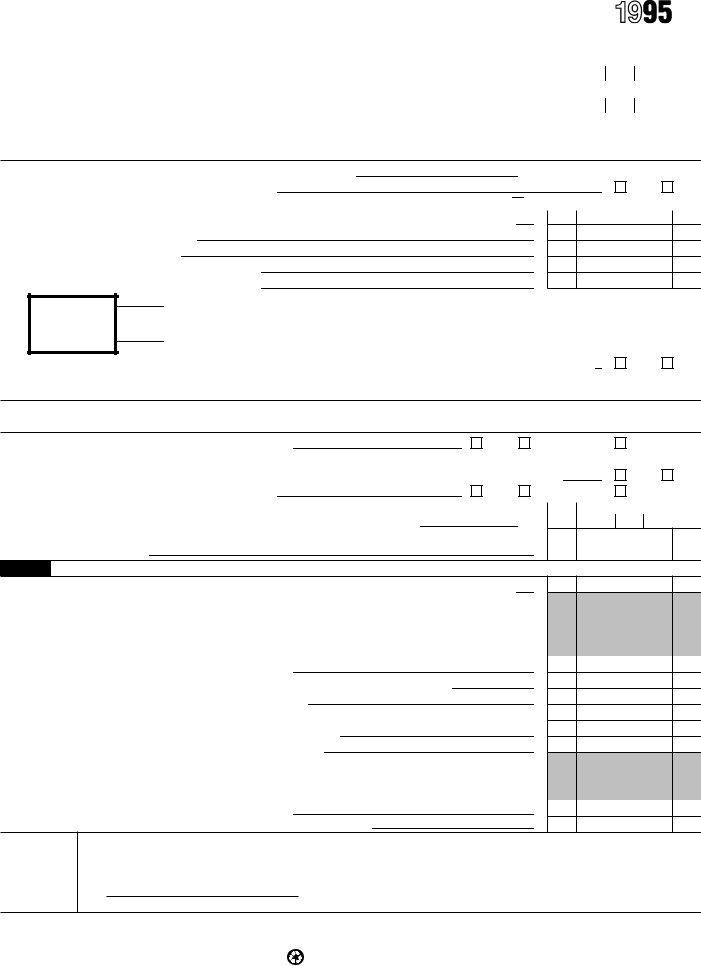

Form 2 1 1 9 |

Sale of Your Home |

|

OMB No. |

|

|

|

|||

|

▶ Attach to Form 1040 for year of sale. |

|

|

|

Department of the Treasury |

▶ See separate instructions. |

▶ Please print or type. |

|

Attachment |

Internal Revenue Service |

|

Sequence No. 20 |

||

Your first name and initial. If a joint return, also give spouse’s name and initial. |

Last name |

Your social security number |

||

|

|

|

||

Fill in Your Address |

Present address (no., street, and apt. no., rural route, or P.O. box no. if mail is not delivered to street address) |

Spouse’s social security number |

||

Only If You Are Filing |

|

|

|

|

This Form by Itself |

|

|

|

|

City, town or post office, state, and ZIP code |

|

|

|

|

and Not With Your |

|

|

|

|

|

|

|

|

|

Tax Return |

|

|

|

|

Part I Gain on Sale

1Date your former main home was sold (month, day, year)

2 Have you bought or built a new main home?

3 If any part of either main home was ever rented out or used for business, check here ▶ 4 Selling price of home. Do not include personal property items you sold with your home

5 Expense of sale (see page 3)

6 Subtract line 5 from line 4

7 Adjusted basis of home sold (see page 3) 8 Gain on sale. Subtract line 7 from line 6

▶ |

1 |

/ |

/ |

|

|

Yes |

No |

and see page 3.

4

5

6

7

8

Is line 8 more than zero?

Yes |

|

▶ |

If line 2 is “Yes,” you must go to Part II or Part III, whichever applies. If line 2 is |

|

|||

|

|

|

“No,” go to line 9. |

No |

|

▶ |

Stop; see Loss on the Sale of Your Home on page 1. |

|

9 If you haven’t replaced your home, do you plan to do so within the replacement period (see page 1)? |

Yes |

●If line 9 is “Yes,” stop here, attach this form to your return, and see Additional Filing Requirements on page 1.

●If line 9 is “No,” you must go to Part II or Part III, whichever applies.

No

Part II

10 Who was age 55 or older on the date of sale? |

You |

Your spouse |

Both of you |

11Did the person who was 55 or older own and use the property as his or her main home for a total of at least 3

years of the |

|

Yes |

No |

|

12 At the time of sale, who owned the home? |

You |

Your spouse |

Both of you |

|

13Social security number of spouse at the time of sale if you had a different spouse from the

one above. If you were not married at the time of sale, enter “None” |

▶ |

13 |

14Exclusion. Enter the smaller of line 8 or $125,000 ($62,500 if married filing separate return).

Then, go to line 15 |

14 |

Part III Adjusted Sales Price, Taxable Gain, and Adjusted Basis of New Home

15If line 14 is blank, enter the amount from line 8. Otherwise, subtract line 14 from line 8

●If line 15 is zero, stop and attach this form to your return.

●If line 15 is more than zero and line 2 is “Yes,” go to line 16 now.

●If you are reporting this sale on the installment method, stop and see page 4.

●All others, stop and enter the amount from line 15 on Schedule D, col. (g), line 4 or line 12.

16

17If line 14 is blank, enter amount from line 16. Otherwise, add lines 14 and 16

18Adjusted sales price. Subtract line 17 from line 6

19a Date you moved into new home ▶ |

/ |

/ |

b Cost of new home (see page 4) |

20Subtract line 19b from line 18. If zero or less, enter

21Taxable gain. Enter the smaller of line 15 or line 20

●If line 21 is zero, go to line 22 and attach this form to your return.

●If you are reporting this sale on the installment method, see the line 15 instructions and go to line 22.

●All others, enter the amount from line 21 on Schedule D, col. (g), line 4 or line 12, and go to line 22.

22Postponed gain. Subtract line 21 from line 15

23Adjusted basis of new home. Subtract line 22 from line 19b

15

16

17

18

19b

20

21

22

23

Sign Here

Only If You

Are Filing

This Form by Itself and Not With Your Tax Return

Under penalties of perjury, I declare that I have examined this form, including attachments, and to the best of my knowledge and belief, it is true, correct, and complete.

Your signature |

Date |

Spouse’s signature |

Date |

||

▶ If a joint return, both must sign. |

|

▶ |

|

|

|

|

|

|

|

||

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 11710J |

Form 2119 (1995) |

Printed on recycled paper |

|

|