It is possible to fill out definitions effortlessly by using our PDFinity® online PDF tool. We at FormsPal are aimed at providing you the best possible experience with our tool by constantly presenting new functions and improvements. With all of these updates, working with our tool becomes better than ever! Starting is easy! Everything you need to do is stick to these simple steps directly below:

Step 1: Open the PDF file inside our tool by clicking on the "Get Form Button" above on this page.

Step 2: The editor will give you the capability to change the majority of PDF files in various ways. Change it by writing personalized text, correct original content, and place in a signature - all when you need it!

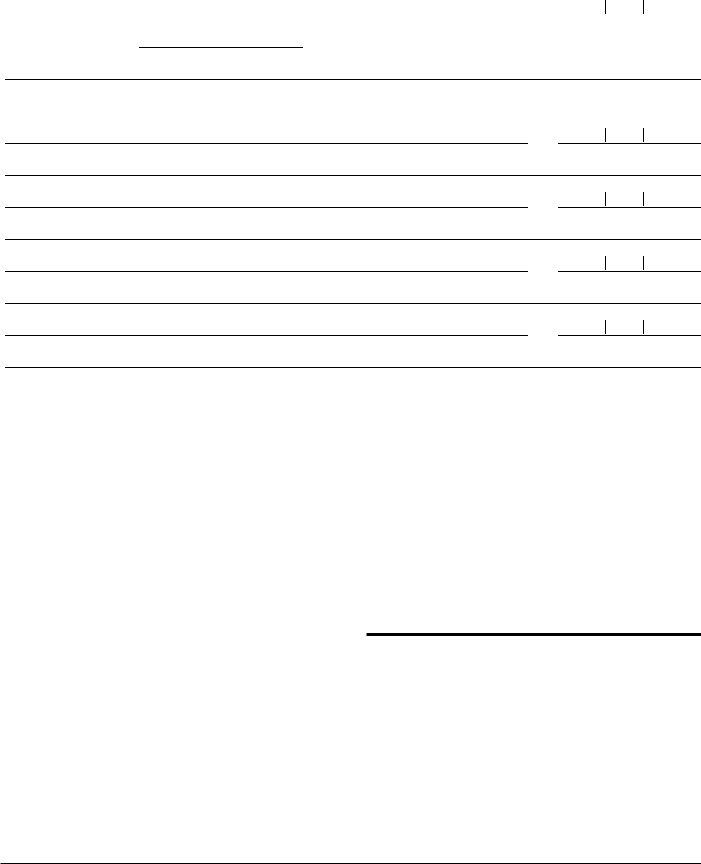

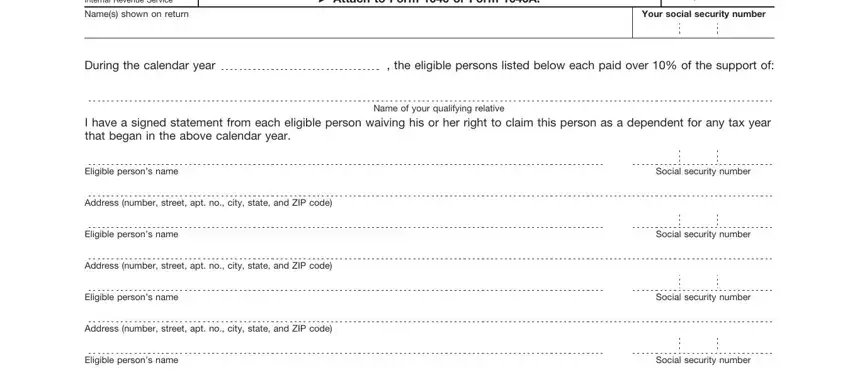

For you to complete this PDF form, make certain you type in the information you need in every blank field:

1. When filling out the definitions, ensure to incorporate all essential blanks within its corresponding section. This will help facilitate the process, allowing for your details to be processed fast and properly.

Step 3: Reread the information you've inserted in the blanks and press the "Done" button. Make a 7-day free trial option at FormsPal and get instant access to definitions - with all changes saved and available in your personal cabinet. At FormsPal.com, we strive to make sure all of your details are kept secure.