Dealing with PDF forms online is certainly simple with our PDF tool. You can fill out EIN here in a matter of minutes. To make our tool better and more convenient to work with, we constantly come up with new features, with our users' feedback in mind. By taking some easy steps, you are able to start your PDF journey:

Step 1: First of all, open the tool by clicking the "Get Form Button" above on this page.

Step 2: As you launch the tool, you'll notice the document ready to be filled out. Aside from filling in various blank fields, you could also perform various other things with the file, particularly putting on any words, changing the original textual content, inserting graphics, signing the document, and a lot more.

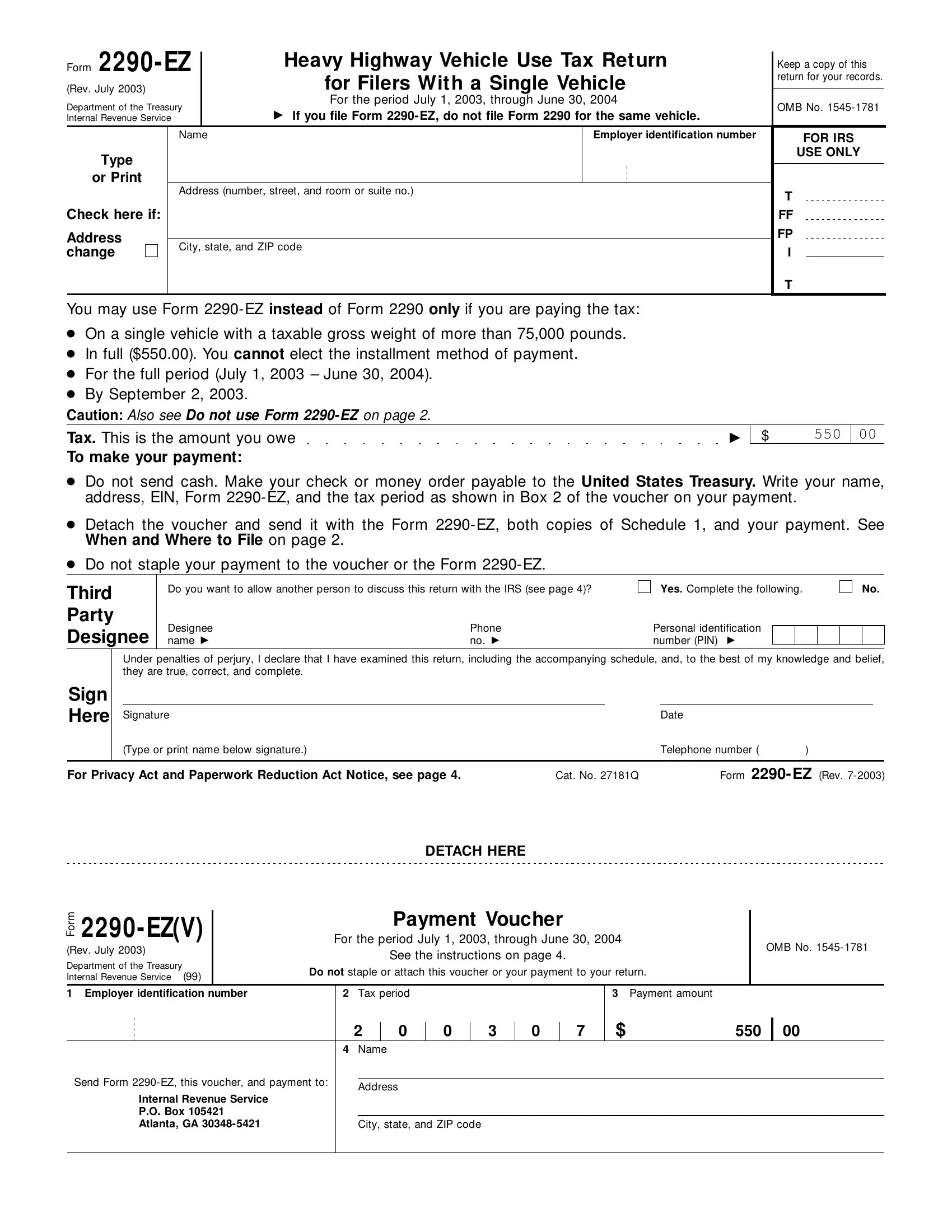

This PDF form will require specific info to be filled out, hence ensure that you take whatever time to type in precisely what is requested:

1. To start with, when completing the EIN, start out with the page with the next fields:

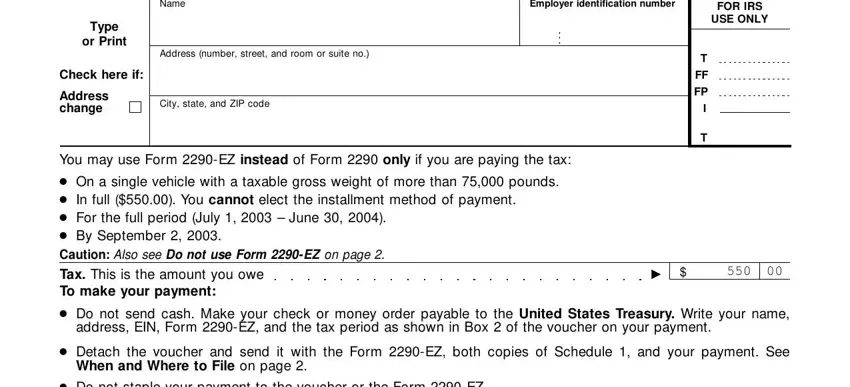

2. Once the previous array of fields is finished, you're ready to add the needed details in Do not staple your payment to the, Third Party Designee, Do you want to allow another, Yes Complete the following, Designee name, Phone no, Personal identification number PIN, Under penalties of perjury I, Sign Here, Signature, Date, Type or print name below signature, Telephone number, For Privacy Act and Paperwork, and Cat No Q so you're able to move on to the next part.

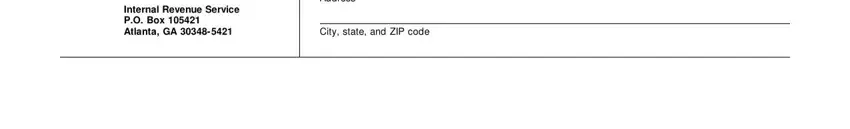

3. Your next stage is going to be hassle-free - fill in all the blanks in Send Form EZ this voucher and, Internal Revenue Service PO Box, Address, and City state and ZIP code to conclude this segment.

It's very easy to make an error when completing the Address, for that reason make sure you take a second look before you decide to send it in.

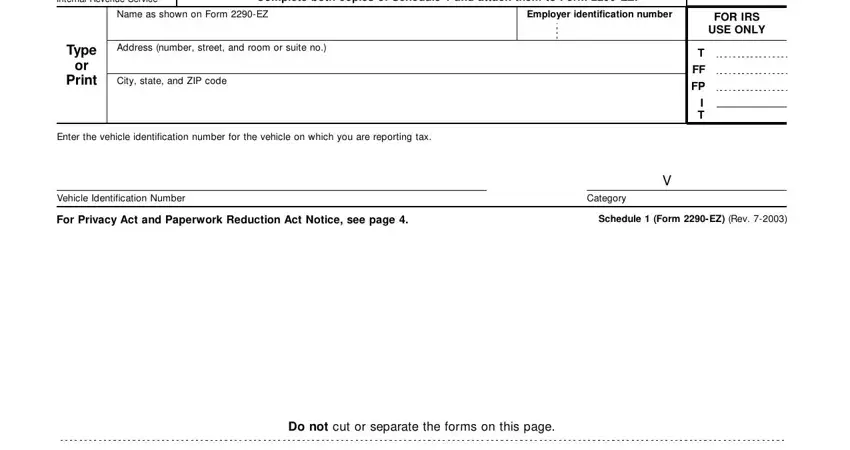

4. All set to start working on this next part! Here you have all these Schedule Form EZ Rev July, Complete both copies of Schedule, Name as shown on Form EZ, Employer identification number, Type, Print, Address number street and room or, City state and ZIP code, Enter the vehicle identification, FOR IRS, USE ONLY, I T, Vehicle Identification Number, Category, and For Privacy Act and Paperwork fields to fill in.

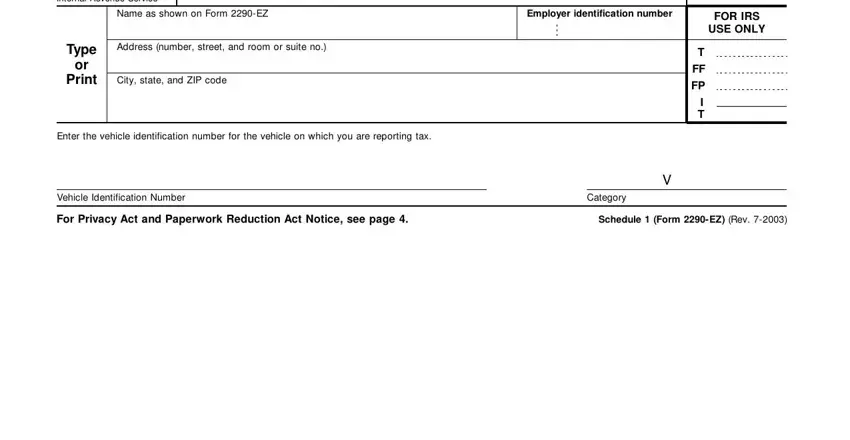

5. Last of all, the following last part is precisely what you'll have to wrap up before closing the document. The fields here are the next: Schedule Form EZ Rev July, This copy will be stamped and, Name as shown on Form EZ, Employer identification number, Type, Print, Address number street and room or, City state and ZIP code, Enter the vehicle identification, FOR IRS, USE ONLY, I T, Vehicle Identification Number, Category, and For Privacy Act and Paperwork.

Step 3: After looking through the form fields you've filled out, click "Done" and you're done and dusted! Join us right now and instantly get access to EIN, prepared for downloading. Each and every modification you make is handily preserved , enabling you to modify the form at a later stage if needed. FormsPal is focused on the privacy of our users; we always make sure that all personal information put into our editor stays confidential.