When property owners in Harris County discover inaccuracies in the appraisal roll for their personal property, the Harris County Appraisal District 25.25PP form offers a recourse for corrections. This form, particularly designed for adjustments in the personal property records, demands meticulous completion and submission to the district's Information and Assistance Division. The form facilitates requests for correction ranging from clerical errors, over-appraisal, to the existence or the location discrepancies of the property. It requires property owners to articulate the nature of the error, whether it be a mathematical mistake, an issue with property description, or a more significant grievance like over-appraisal by more than one-third of the property’s value. Additionally, it emphasizes compliance with tax payments relative to the disputed years and mandates the attachment of substantiating documents. This protection measure ensures that adjustments are made based on concrete evidence, adhering to standards that include certified financial statements and legal documents related to the property's acquisition. By signing the form, property owners not only assert the veracity of the provided information but also initiate a formal request for the Appraisal Review Board to evaluate and rectify the identified inaccuracies, thereby upholding the principles of fairness and accuracy in property valuation.

| Question | Answer |

|---|---|

| Form Name | Form 25 25Pp |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | tx 25 25pp form, harris county 25 25pp, harris county for 25 25pp, hcad fillable 25 25pp |

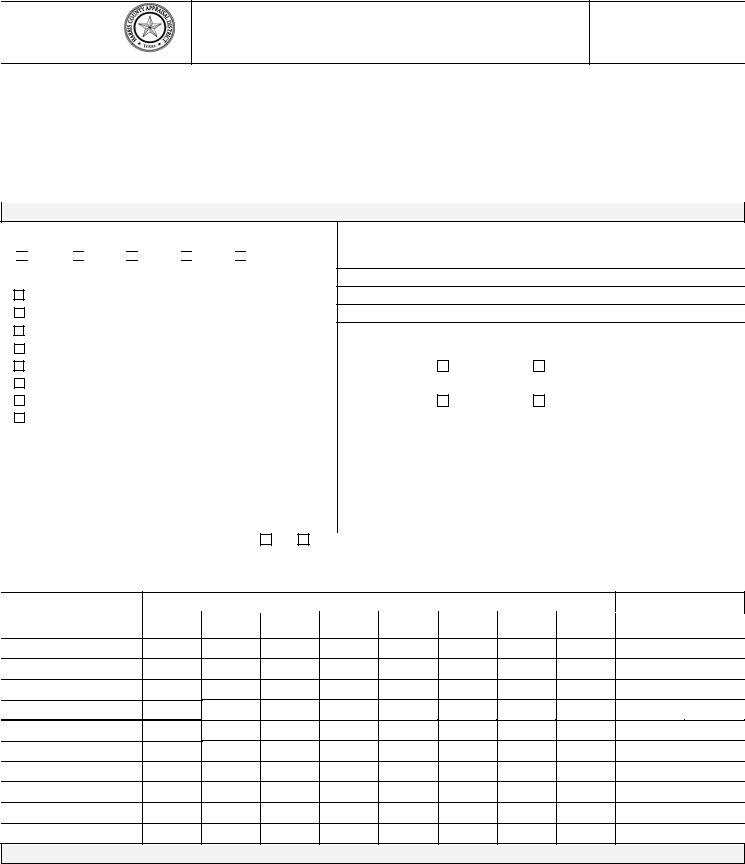

Harris County Appraisal District

25.25PP (12/13)

Personal Property

Correction Request/Motion

Account Number

INSTRUCTIONS: Complete all applicable parts of this form and submit to the Harris County Appraisal District, Information and Assistance Division, P. O. Box 922004, Houston, TX

IMPORTANT: Be sure to attach all relevant documents to be considered.

|

Part I – Owner and Property Identification |

|

Property Owner’s Name |

|

Daytime Telephone Number |

|

|

( ) |

Mailing Address |

|

City, State, ZIP + 4 |

|

|

|

Property Location |

|

Agent’s Name and Code, if any |

|

|

|

Part II – Correction Information: Briefly specify the error to be corrected in the appraisal roll and why.

1.Tax Year – Mark Tax Year(s) to be corrected.

a. 2009 b. 2010 c. 2011 d. 2012 e. 2013

2.Correction Type (mark appropriate box)

a. |

Clerical, Mathematical, Computer, Transcription Error* |

||

b. |

Multiple appraisal with account(s) |

|

|

c. |

Property not located at address shown on roll |

||

d. |

Error in ownership/address/property description |

||

e. |

Property |

||

f. |

Situs not located in the appraisal district |

||

g. |

Property does not exist |

||

h. |

Business closed or sold (give effective date) __________ |

||

*A clerical error involves a mathematical error, a transcription error, a computer error, or an error that results in the appraisal roll not reflecting what the chief appraiser or ARB intended it to reflect. Measurement errors such as inventory estimates or square footage estimates ARE NOT clerical errors unless there was a mathematical error in calculation.

** Your motion must be filed prior to the delinquency date.

3.Explanation – State reasons for the correction below and attach any supporting documentation.*

4.Have you been employed by the Harris County Appraisal District within the current or three preceding calendar years?

Yes |

No |

5.Has supporting documentation been attached?

Yes |

No |

*According to ARB standards, supporting documentation includes items such as CPA statements, certified balance sheets, IRS returns, acquisition records, and receipts, invoices or leases pertaining to the property.

6.Payment of Taxes (mark appropriate box)

Yes

No

Property taxes due for each year in question have not become delinquent and the property owner has complied with Section 25.26 of the Texas Property Tax Code and has not forfeited the right to appeal for

7.Value Information – Provide the correct value of each item for the year or years that you believe should be corrected.

|

2009 |

2010 |

2011 |

2012 |

|||||

Tax Year |

|

|

|

|

|

|

|

|

|

Before |

After |

Before |

After |

Before |

After |

Before |

After |

||

|

|||||||||

|

Correction |

Correction |

Correction |

Correction |

Correction |

Correction |

Correction |

Correction |

|

a.Inventory

b.Supplies/Other

c.Raw Material

d.Work in Process

e.Furniture & Fixtures

f.Machinery & Equipment

g.Computers

h.Leasehold Improvements

i.Vehicles

j.Miscellaneous

2013

Before |

After |

Correction |

Correction |

|

|

Part III – Property Owner/Representative Signature

I affirm under penalty of law that the information stated in this document and all attachments is correct. I request that the Appraisal Review Board (ARB) schedule a hearing to decide whether or not to correct the error in the appraisal roll. I request that the Appraisal Review Board send notice of the time, date, and place fixed for the hearing, not later than 15 days before the scheduled hearing. I understand that if the chief appraiser approves the changes requested, this action constitutes a binding agreement and is not subject to appeal or review by the ARB.

Signature |

Title |

|

|

Name Printed |

Date |

|

|