You'll be able to work with what is form 2555 ez without difficulty with our online PDF tool. To maintain our tool on the cutting edge of efficiency, we strive to put into practice user-oriented features and improvements regularly. We're routinely thankful for any suggestions - join us in remolding PDF editing. For anyone who is looking to get started, here's what it will require:

Step 1: Open the PDF in our editor by pressing the "Get Form Button" in the top part of this webpage.

Step 2: When you start the editor, you will find the document all set to be completed. Apart from filling out different fields, you could also perform several other things with the form, specifically putting on any textual content, modifying the initial text, inserting illustrations or photos, affixing your signature to the form, and much more.

This PDF doc needs specific information; to ensure consistency, you should pay attention to the following steps:

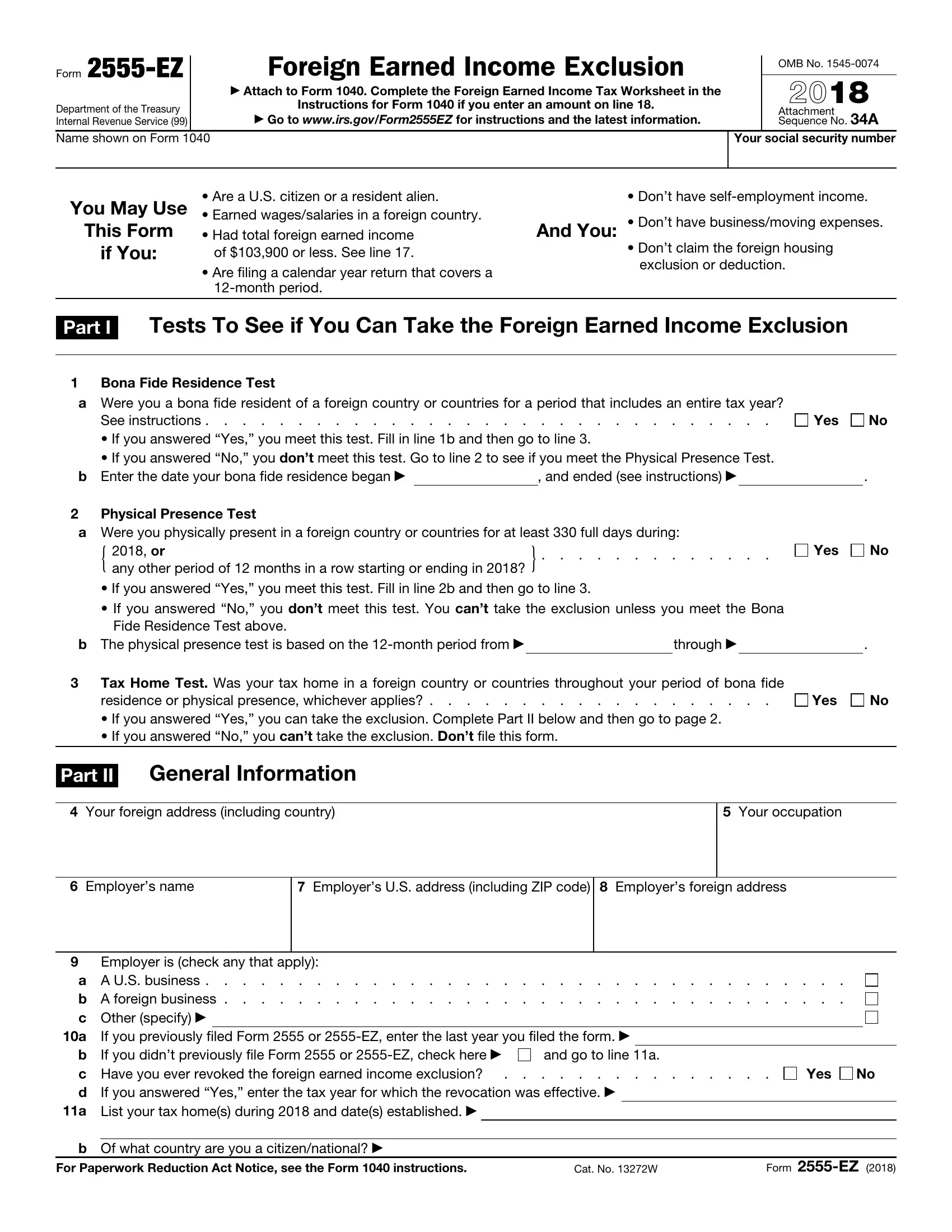

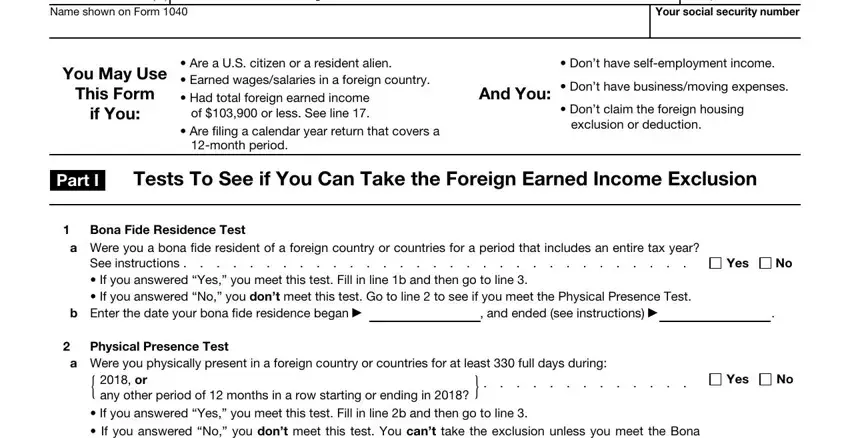

1. The what is form 2555 ez requires particular details to be inserted. Make sure the next blanks are complete:

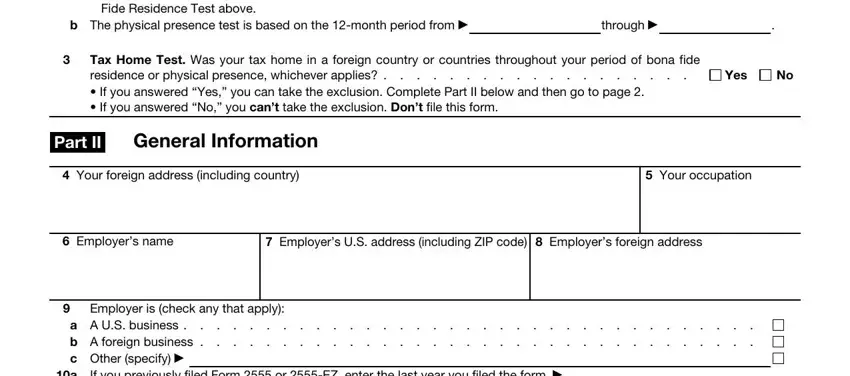

2. Right after the previous array of blanks is completed, go on to type in the relevant details in these - or any other period of months, Fide Residence Test above, b The physical presence test is, through, Tax Home Test Was your tax home in, Yes, Part II General Information, Your foreign address including, Your occupation, Employers name, Employers US address including, Employer is check any that apply, a A US business b A foreign, If you previously filed Form or, and a b c Have you ever revoked the.

It is easy to make errors when completing the Employers US address including, so make sure you take a second look before you'll submit it.

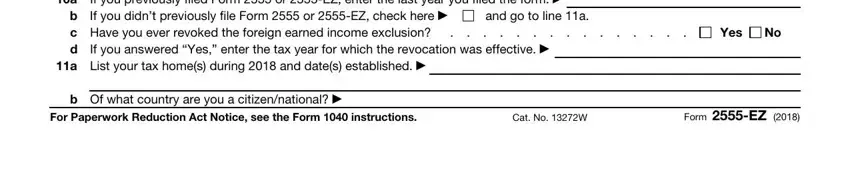

3. This next section is related to If you previously filed Form or, a b c Have you ever revoked the, If you answered Yes enter the tax, and go to line a, Yes, a List your tax homes during and, b Of what country are you a, For Paperwork Reduction Act Notice, Cat No W, and Form EZ - fill in all these fields.

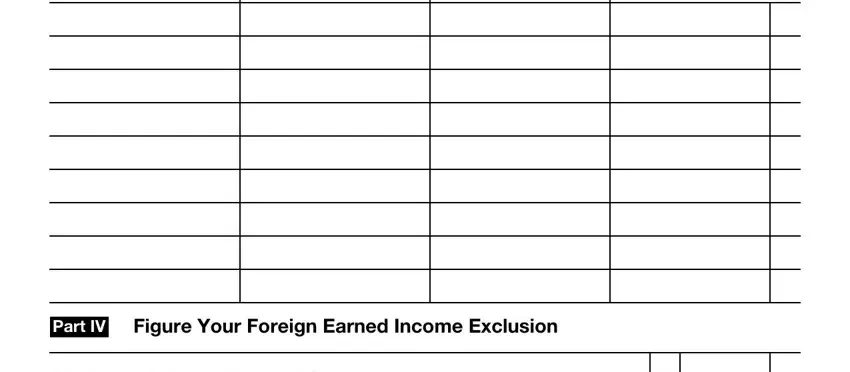

4. The fourth section comes with these blanks to complete: on business attach computation, and Part IV Figure Your Foreign Earned.

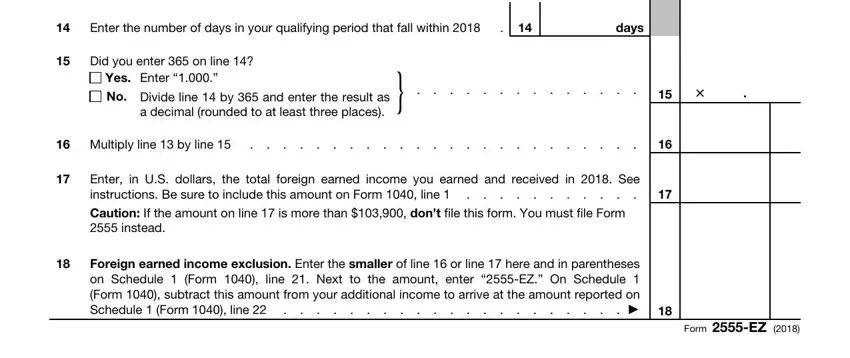

5. Finally, the following final part is what you'll want to wrap up prior to submitting the form. The fields at this point include the following: Enter the number of days in your, Did you enter on line, Yes Enter, No Divide line by and enter the, a decimal rounded to at least, Multiply line by line, Enter in US dollars the total, Foreign earned income exclusion, days, and Form EZ.

Step 3: Just after rereading your fields you've filled in, press "Done" and you're done and dusted! Sign up with us now and immediately access what is form 2555 ez, set for downloading. All modifications you make are kept , which enables you to customize the document at a later point anytime. We don't share or sell any details that you provide when filling out forms at our site.