You'll be able to fill out hawaii n 288c without difficulty by using our online PDF editor. Our tool is consistently developing to grant the very best user experience possible, and that is thanks to our commitment to continual improvement and listening closely to feedback from users. To get the ball rolling, go through these easy steps:

Step 1: Simply click the "Get Form Button" in the top section of this site to start up our pdf file editing tool. This way, you will find all that is needed to work with your file.

Step 2: This editor offers the capability to work with your PDF document in various ways. Enhance it with personalized text, correct existing content, and put in a signature - all at your disposal!

Filling out this form requires focus on details. Ensure that each and every blank is filled in correctly.

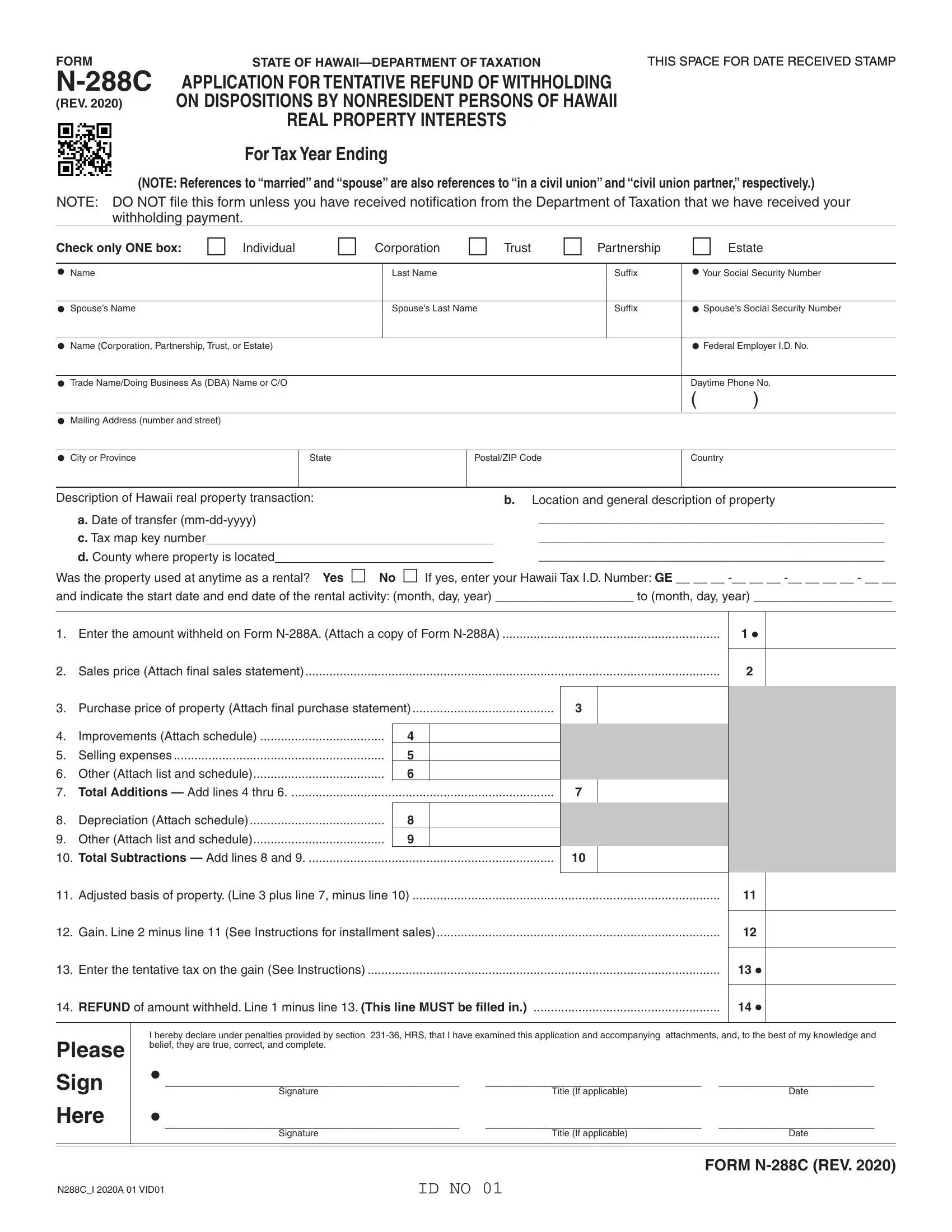

1. It's important to complete the hawaii n 288c accurately, hence be mindful while filling in the segments comprising these specific blanks:

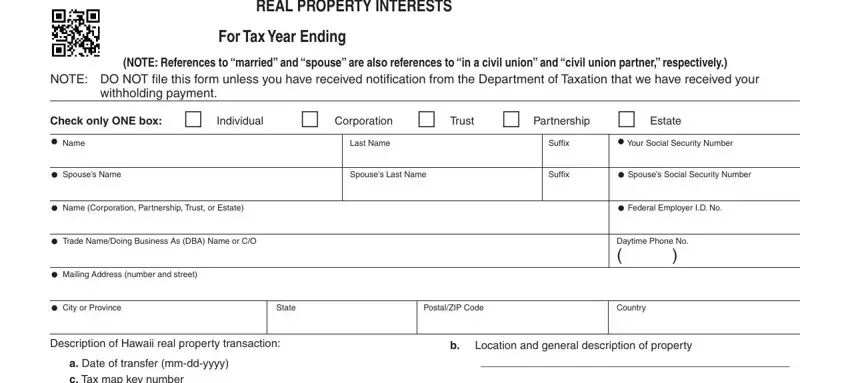

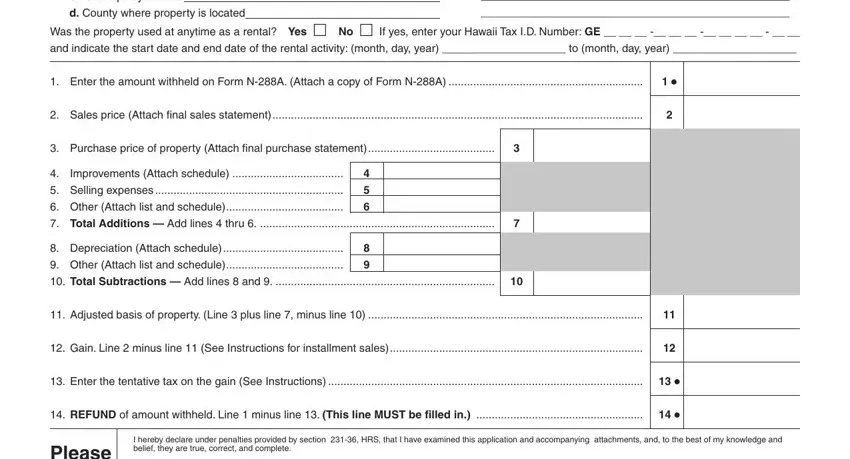

2. Once this section is completed, proceed to enter the suitable information in all these: a Date of transfer mmddyyyy c Tax, d County where property is located, Was the property used at anytime, Enter the amount withheld on Form, Sales price Attach final sales, Purchase price of property Attach, Improvements Attach schedule, Selling expenses, Other Attach list and schedule, Total Additions Add lines thru, Depreciation Attach schedule, Other Attach list and schedule, Total Subtractions Add lines, Adjusted basis of property Line, and Gain Line minus line See.

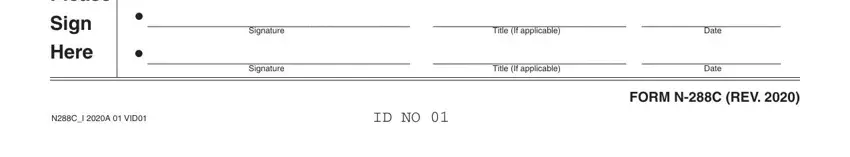

3. The third stage is going to be easy - fill in all of the blanks in Please, Sign, Here, Title If applicable, Signature, Date, Signature, Title If applicable, Date, NCI A VID, ID NO, and FORM NC REV to complete this segment.

As for ID NO and Title If applicable, ensure you take another look here. Both of these are viewed as the most significant fields in the file.

Step 3: Right after you have looked over the details in the blanks, click on "Done" to finalize your document generation. Sign up with us today and easily access hawaii n 288c, prepared for download. Each and every change you make is conveniently saved , enabling you to edit the document later on if needed. Here at FormsPal.com, we aim to make sure that all of your information is maintained private.