You may fill out Form 308B I easily by using our PDFinity® PDF editor. FormsPal expert team is always working to improve the tool and help it become much easier for clients with its handy features. Take your experience to a higher level with continuously improving and great possibilities available today! For anyone who is seeking to start, here is what it's going to take:

Step 1: Access the PDF form inside our tool by clicking on the "Get Form Button" in the top part of this page.

Step 2: As soon as you open the file editor, you'll notice the form ready to be filled out. In addition to filling in various blanks, it's also possible to do some other things with the PDF, that is putting on any textual content, editing the initial textual content, adding images, affixing your signature to the document, and more.

In order to complete this form, make sure that you provide the necessary details in every field:

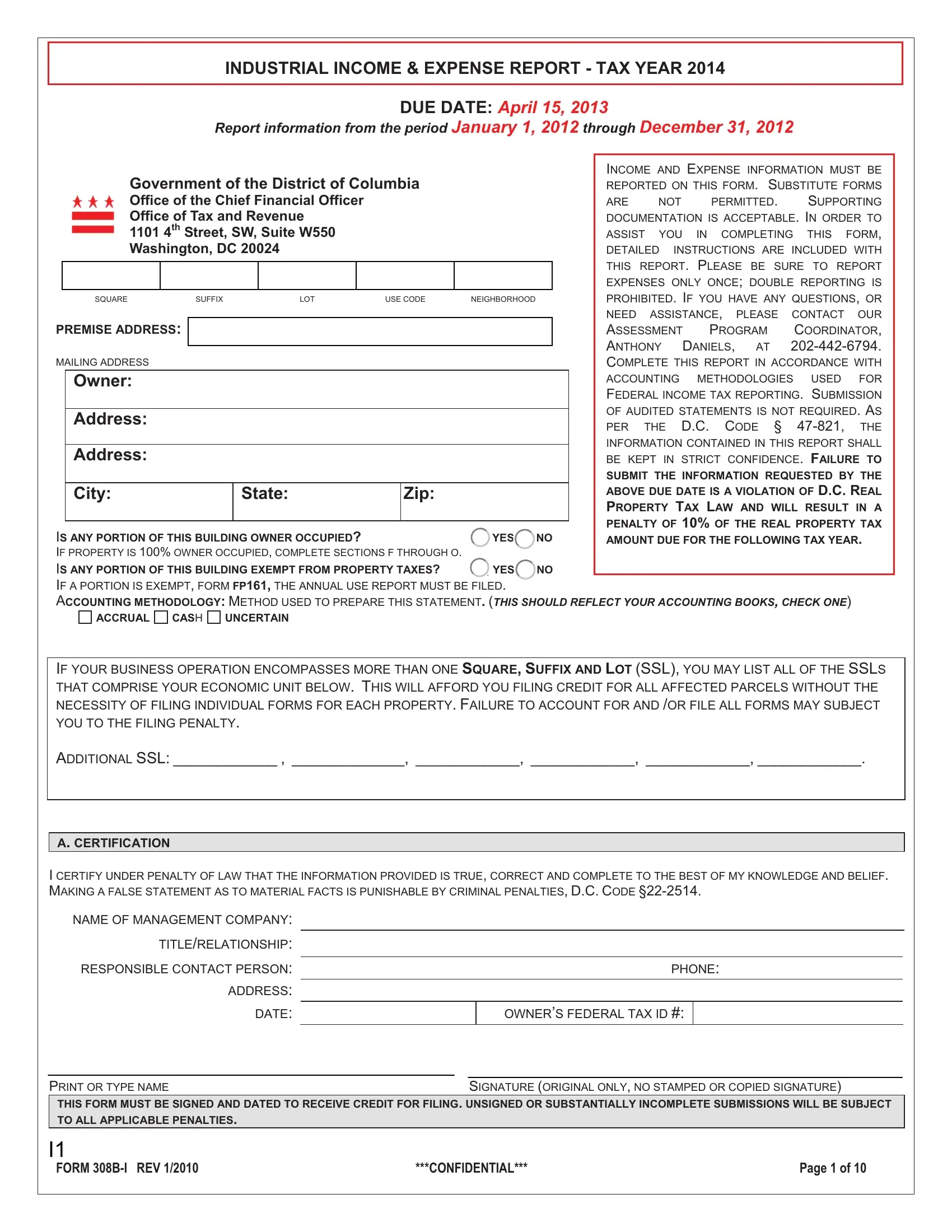

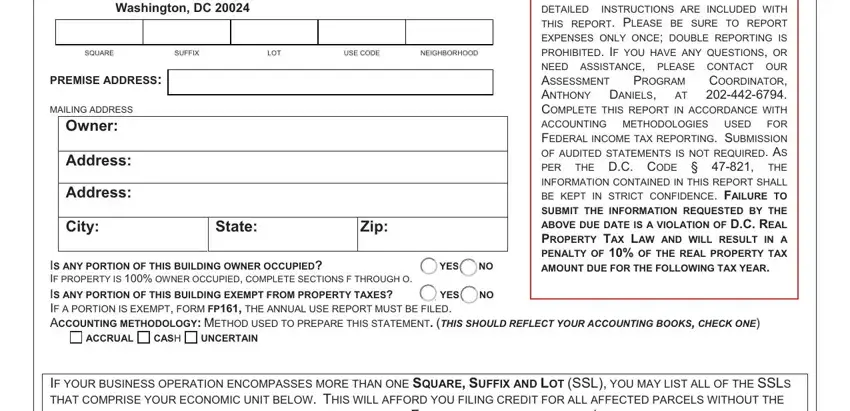

1. The Form 308B I necessitates certain information to be typed in. Make certain the next blanks are complete:

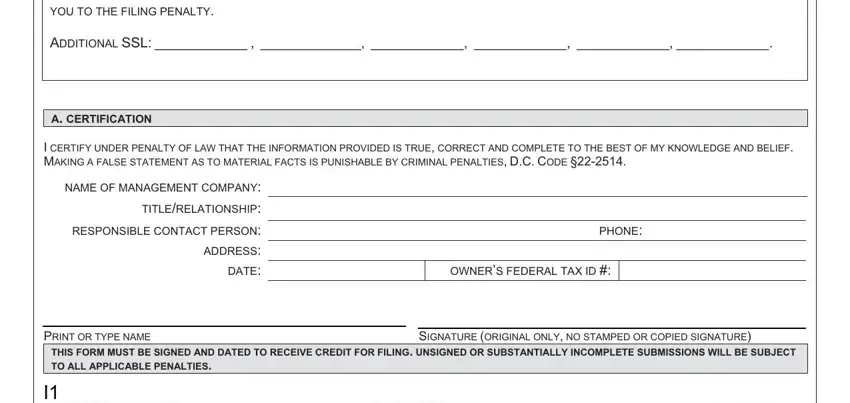

2. Once this segment is done, you'll want to put in the needed particulars in IF YOUR BUSINESS OPERATION, ADDITIONAL SSL, A CERTIFICATION, I CERTIFY UNDER PENALTY OF LAW, NAME OF MANAGEMENT COMPANY, TITLERELATIONSHIP, RESPONSIBLE CONTACT PERSON, ADDRESS, DATE, PHONE, OWNERS FEDERAL TAX ID, PRINT OR TYPE NAME, SIGNATURE ORIGINAL ONLY NO STAMPED, THIS FORM MUST BE SIGNED AND DATED, and I FORM BI REV CONFIDENTIAL Page in order to progress further.

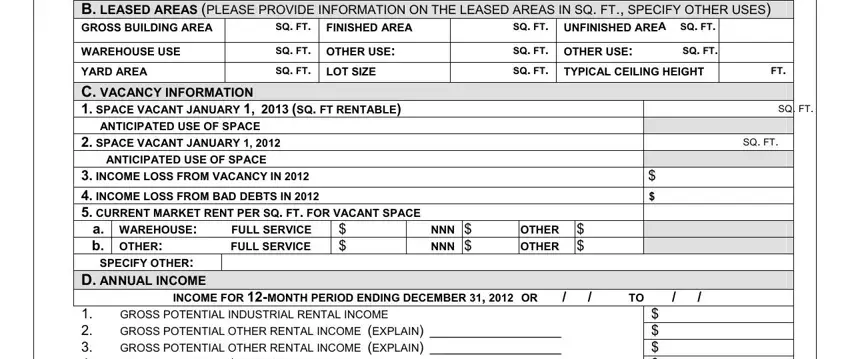

3. Completing PLEASE ROUND ALL AMOUNTS TO THE, SQ FT UNFINISHED AREA SQ FT SQ FT, SQ FT FINISHED AREA SQ FT OTHER, SQ FT, SQ FT, ANTICIPATED USE OF SPACE, SPACE VACANT JANUARY, ANTICIPATED USE OF SPACE, INCOME LOSS FROM VACANCY IN, a WAREHOUSE FULL SERVICE b OTHER, NNN NNN, OTHER OTHER, SPECIFY OTHER D ANNUAL INCOME, INCOME FOR MONTH PERIOD ENDING, and GROSS POTENTIAL INDUSTRIAL RENTAL is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

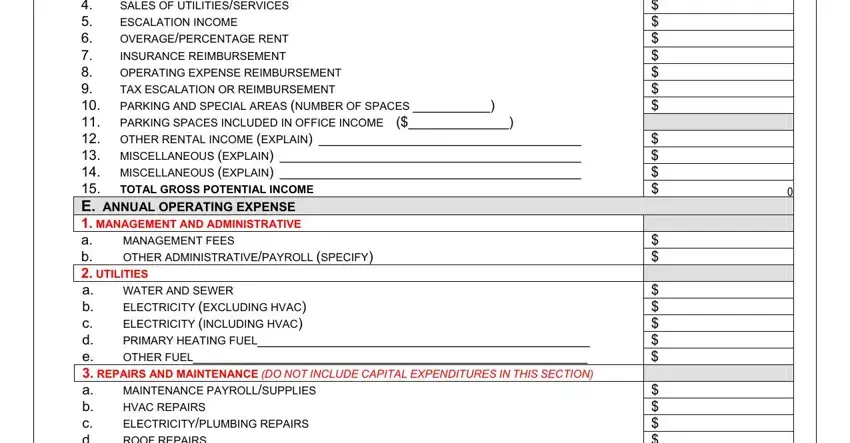

4. This specific paragraph comes with the next few form blanks to fill out: TOTAL GROSS POTENTIAL INCOME, GROSS POTENTIAL INDUSTRIAL RENTAL, OTHER RENTAL INCOME, MAINTENANCE PAYROLLSUPPLIES HVAC, and MANAGEMENT FEES OTHER.

Concerning MANAGEMENT FEES OTHER and MAINTENANCE PAYROLLSUPPLIES HVAC, be certain you get them right in this current part. Those two are the most significant ones in the PDF.

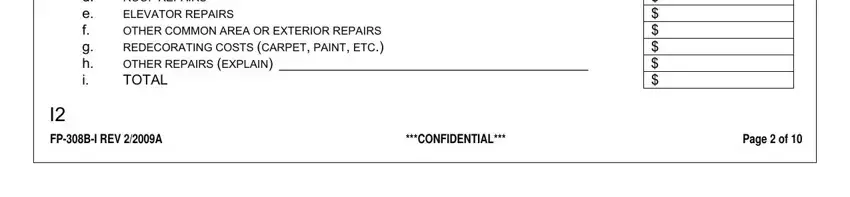

5. This form has to be concluded with this particular part. Further one can find a comprehensive listing of blanks that need accurate information in order for your document submission to be faultless: OTHER RENTAL INCOME, MAINTENANCE PAYROLLSUPPLIES HVAC, FPBI REV A, and CONFIDENTIAL Page of.

Step 3: Once you have looked once more at the information in the document, simply click "Done" to conclude your form at FormsPal. Right after getting a7-day free trial account with us, you'll be able to download Form 308B I or email it right off. The PDF file will also be readily available through your personal account with all of your edits. FormsPal is committed to the personal privacy of our users; we make certain that all personal data entered into our tool is kept secure.