Engaging with the formalities of tax disputes can often seem daunting, especially when it involves seeking relief from financial burdens imposed by tax assessments, penalties, interests, or fines. One pivotal document in this context within Maharashtra, India, is the 311 form, a crucial tool for businesses and individuals aiming to navigate the complexities of the Maharashtra Value Added Tax Act, 2002. This form is essentially an application for the grant of stay against orders of assessment, penalty, interest, or fine under section 26 of the aforementioned act. Applicants are required to provide details such as the name of the dealer, registration numbers under the M.V.A.T. and C.S.T. Acts, the address of the place of business, type and period of the order, dues as per the order, and the quantum of relief sought. Additionally, it outlines the applicant's intention to file an appeal and the request to stay the recovery of the amount payable as per the order appealed against until the final resolution of the stay petition. This document not only serves as a formal plea for relief but also sets the stage for the appeal process by highlighting the key areas of dispute and the financial relief sought. Comprehensive and meticulous completion of the 311 form is an essential first step for those seeking to challenge the decisions related to value-added tax assessments in Maharashtra, thereby offering a reprieve while the appeal is being considered.

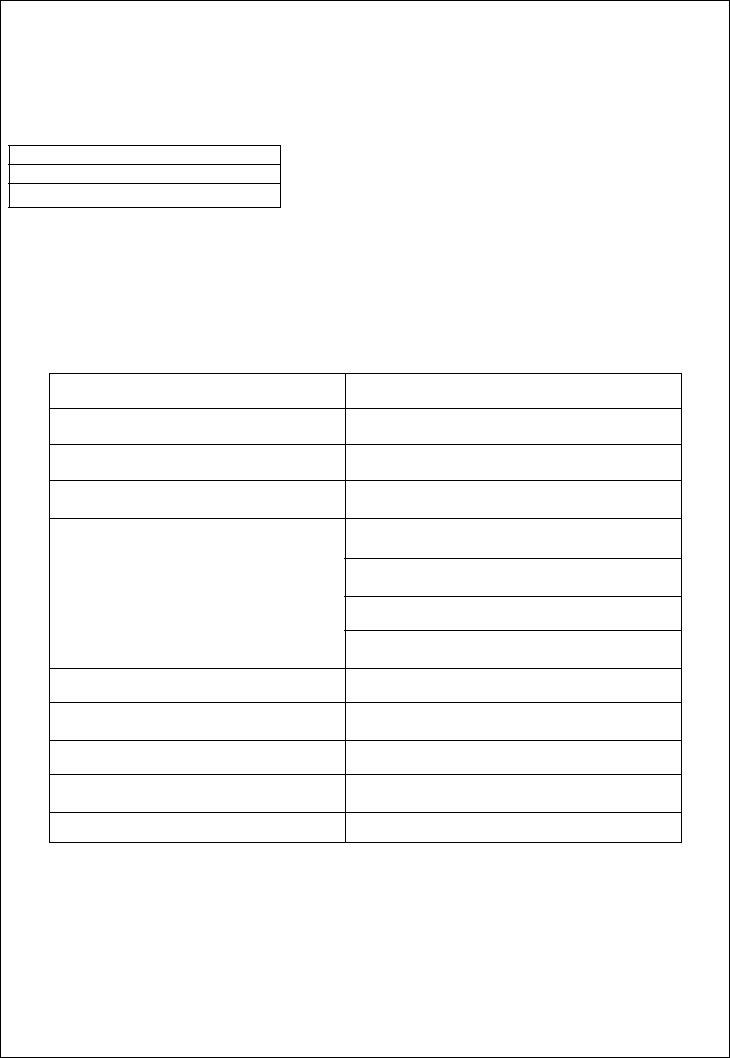

| Question | Answer |

|---|---|

| Form Name | Form 311 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | LTD, 311 form, undersigned, form 311 mvat in word |

(See rule 32)

Applicant for grant of stay against order of assessment, penalty, interest or fine under

section 26 of the Maharashtra Value Added Tax Act, 2002

To

Subject: Applicant for a grant of stay against order of assessment, penalty interest of fine under section 26 of the Maharashtra Value Added Tax Act, 2002.

Sir

I/ We the undersigned hereby apply for grant of stay against recovery of amount payable as per the Order appealed against regarding penalty interest or fine under section 26 of the Maharashtra Value Added Act, 2002. The necessary details are its under

1.Name of the dealer

2.R.C No.M.V.A.T.Act.2002

3.R.C. No. C.S.T. Act, 1956

4.Address of the place of business

5.Type of Order

6.Period of order

7.Dues as per order

8.Quantum of relief sought in the appeal

9.Balance Payable

I / We propose to file apple against the referred to herein above. I /We expect if the appeal is decided in our favour the demand interest and penalty world get reduced by the quantum of relief mentioned in column No. 9 above I / We therefore pray that recovery Pursuant to the order (s) under reference should be stayed till the disposal of this stay petition.

RUSHABH INFOSOFT LTD.

Date _____________ |

Signature _________________________ |

|

Name of the applicant |

Place ______________ |

|

|

__________________________ |

|

Status ________________________ |

RUSHABH INFOSOFT LTD.