Dealing with PDF files online is a piece of cake using our PDF editor. You can fill out california ftb 3536 here effortlessly. Our tool is constantly evolving to grant the very best user experience attainable, and that is due to our resolve for constant enhancement and listening closely to customer comments. Starting is simple! All that you should do is take the next easy steps down below:

Step 1: First of all, open the pdf tool by clicking the "Get Form Button" in the top section of this site.

Step 2: With the help of this advanced PDF file editor, you're able to do more than merely complete blank form fields. Express yourself and make your forms look perfect with customized text incorporated, or adjust the original input to excellence - all that supported by the capability to add any photos and sign the file off.

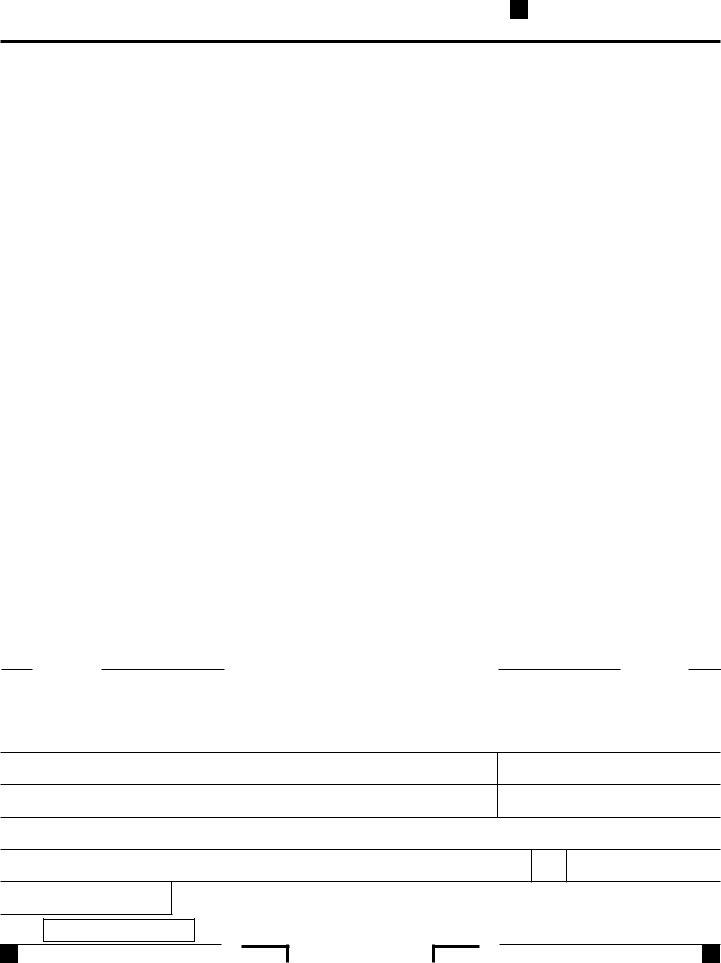

Completing this PDF usually requires attention to detail. Ensure all necessary blanks are filled out correctly.

1. The california ftb 3536 will require certain information to be typed in. Ensure the subsequent blanks are complete:

Step 3: Before getting to the next step, double-check that all blank fields are filled in right. When you’re satisfied with it, click “Done." Find your california ftb 3536 when you register online for a 7-day free trial. Immediately gain access to the pdf file from your FormsPal account page, together with any edits and adjustments being conveniently preserved! If you use FormsPal, you can easily fill out documents without the need to get worried about database breaches or data entries being shared. Our secure software ensures that your personal information is kept safely.