When you desire to fill out CALIFORNIA, you won't need to download and install any kind of programs - simply give a try to our PDF tool. We at FormsPal are focused on providing you the perfect experience with our editor by constantly releasing new functions and improvements. With all of these improvements, working with our tool becomes easier than ever! If you're seeking to begin, this is what it takes:

Step 1: Click on the orange "Get Form" button above. It'll open up our editor so that you can start completing your form.

Step 2: With this advanced PDF editor, you may accomplish more than just complete forms. Try all the features and make your docs seem high-quality with custom text added, or fine-tune the original content to perfection - all that backed up by the capability to insert stunning photos and sign the file off.

With regards to the fields of this precise PDF, here is what you should consider:

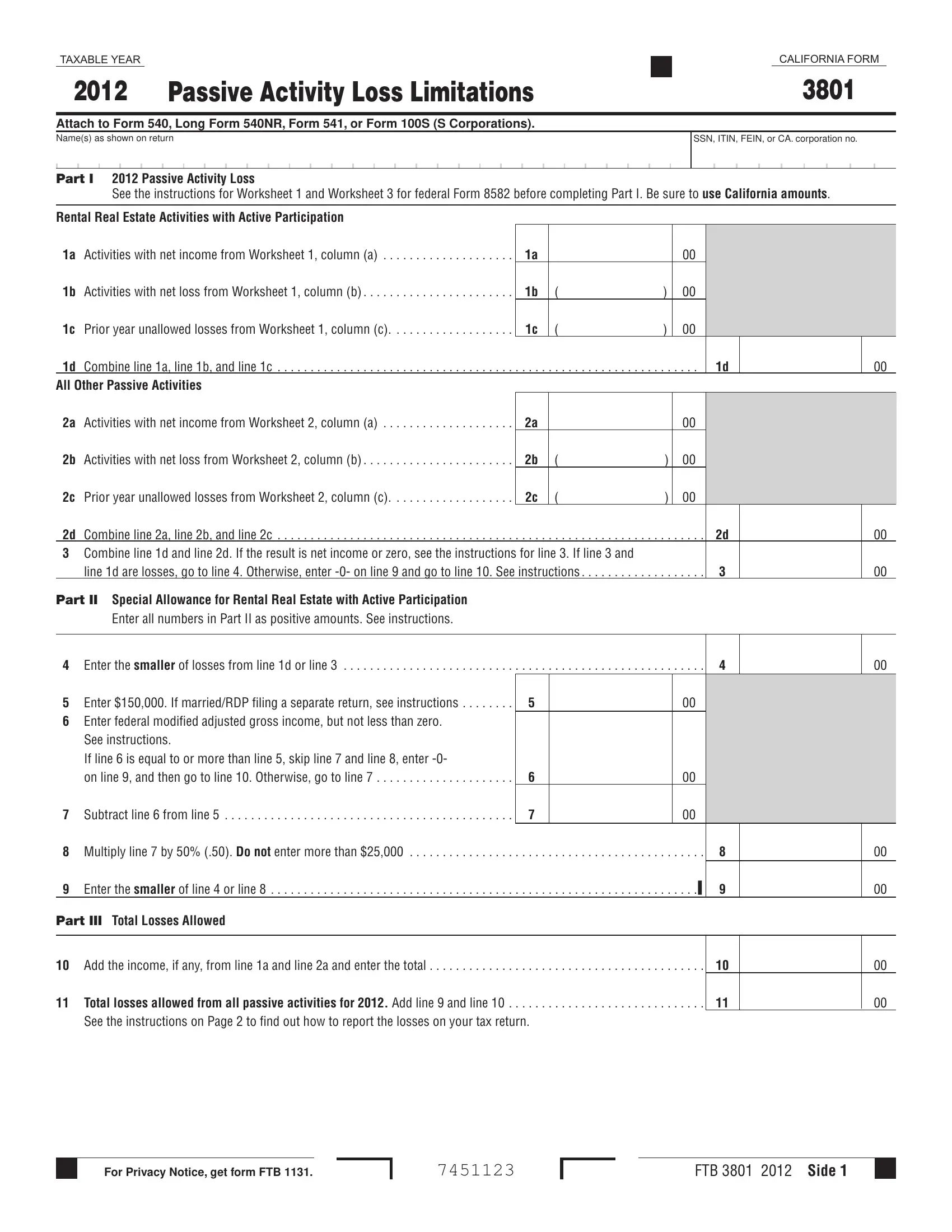

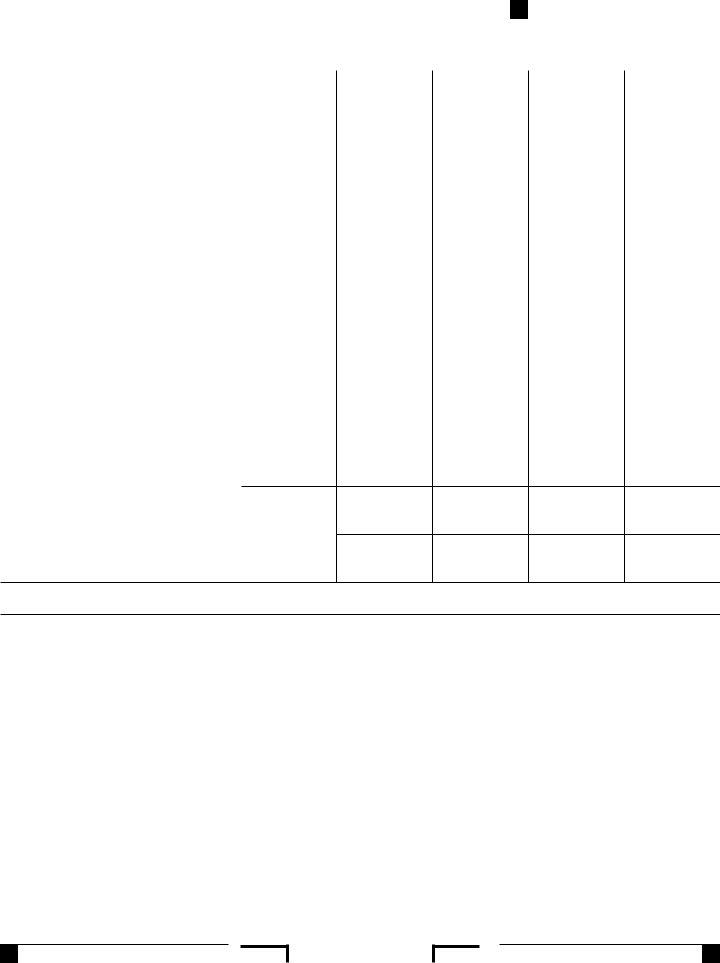

1. The CALIFORNIA needs certain details to be typed in. Ensure that the following blanks are completed:

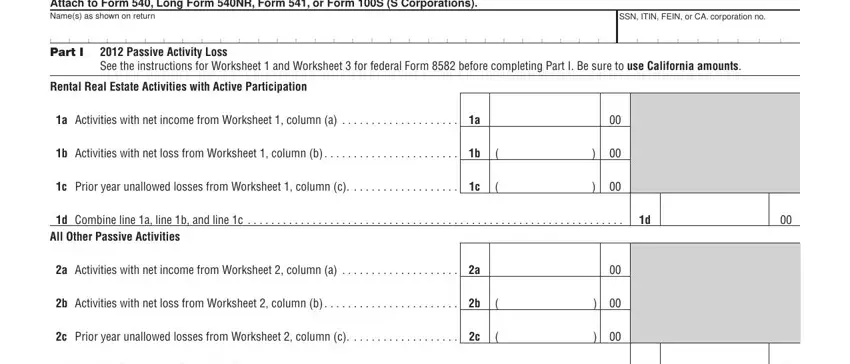

2. Just after this part is completed, go to type in the relevant details in all these - d Combine line a line b and line c, line d are losses go to line, Part II Special Allowance for, Enter all numbers in Part II as, Enter the smaller of losses from, See instructions If line is equal, Subtract line from line, Multiply line by Do not enter, Enter the smaller of line or, Part III Total Losses Allowed, Add the income if any from line a, Total losses allowed from all, and See the instructions on Page to.

People who use this form often get some points wrong when completing Part II Special Allowance for in this area. You need to reread whatever you enter right here.

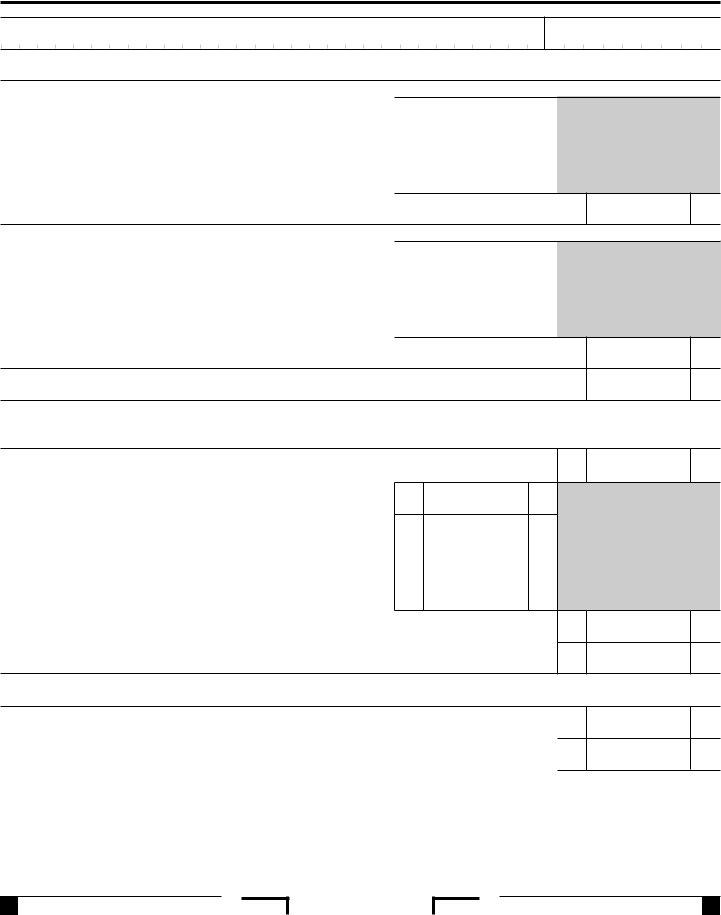

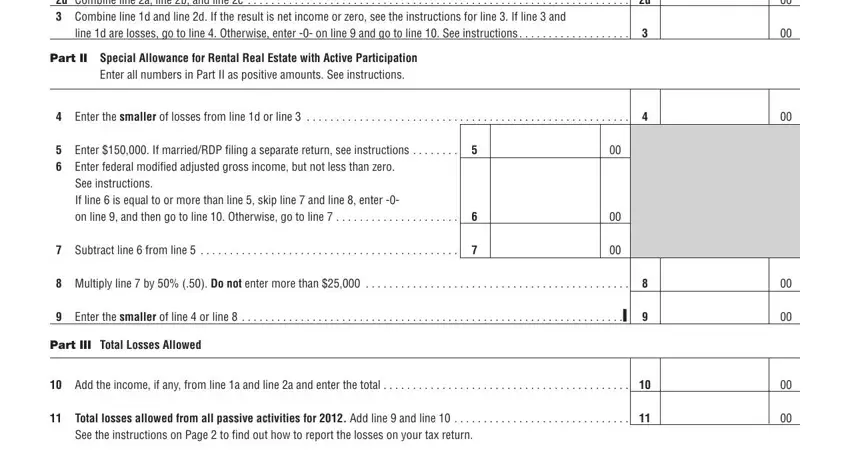

3. This stage is usually hassle-free - fill out all the blanks in which you reported the, activity, California form or schedule if any, California adjustment, Enter your current year federal, PAL rules, federal and California law, California Adjustment Worksheets, Activities, Enter a description of the, Passive or Nonpassive, Enter the passive or, nonpassive character of the, activity for California, and purposes in order to complete the current step.

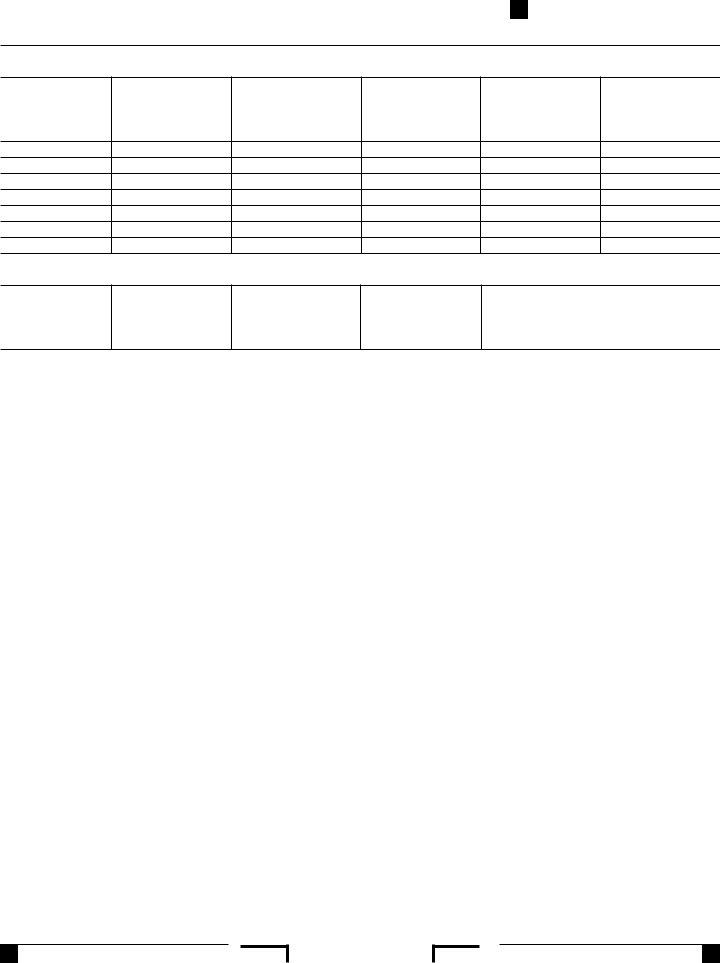

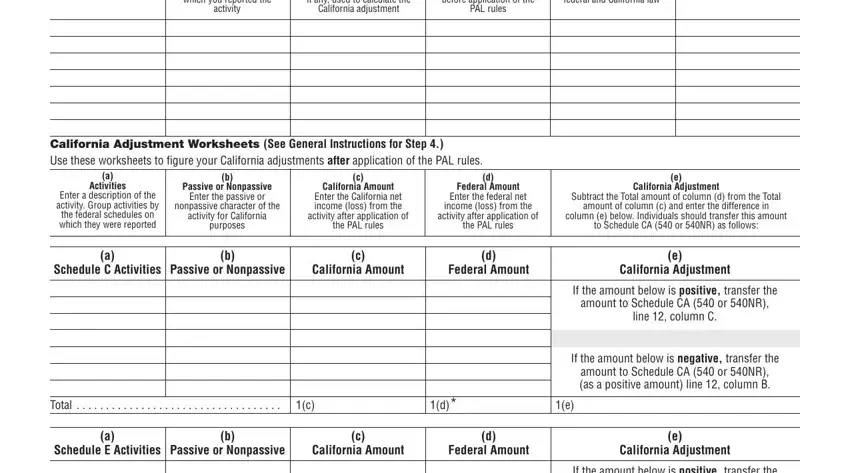

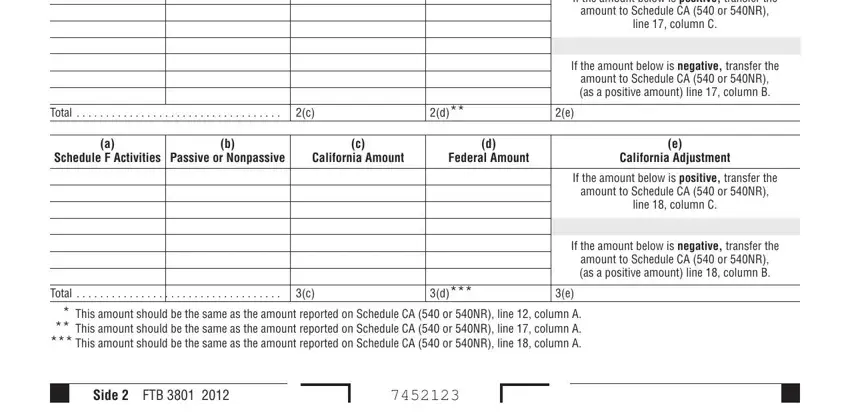

4. All set to fill out the next portion! In this case you will have these If the amount below is positive, amount to Schedule CA or NR, line column C, If the amount below is negative, amount to Schedule CA or NR as a, Total, Schedule F Activities, Passive or Nonpassive, California Amount, Federal Amount, California Adjustment, If the amount below is positive, amount to Schedule CA or NR, line column C, and If the amount below is negative form blanks to fill out.

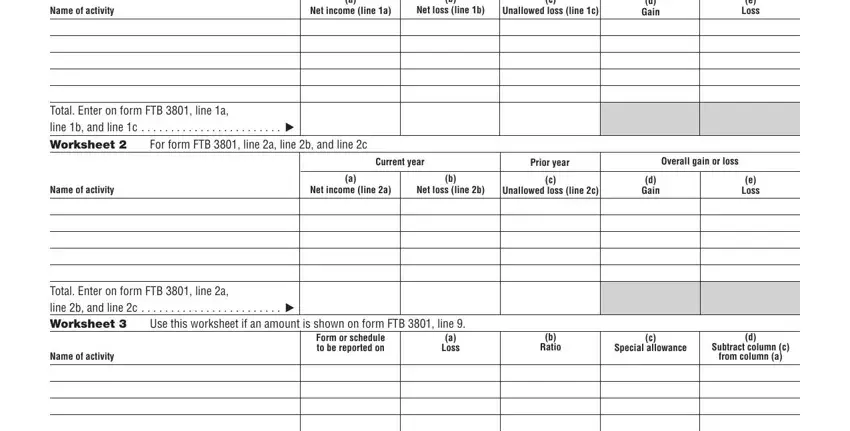

5. To finish your document, this final part requires a number of additional blank fields. Entering Name of activity, Net income line a, Net loss line b, Unallowed loss line c, d Gain, e Loss, Total Enter on form FTB line a, Worksheet, For form FTB line a line b and, Name of activity, Current year, Prior year, Net income line a, Net loss line b, and Unallowed loss line c is going to conclude everything and you'll definitely be done in an instant!

Step 3: Ensure that your information is right and simply click "Done" to continue further. Right after starting afree trial account with us, it will be possible to download CALIFORNIA or email it immediately. The PDF will also be readily accessible via your personal cabinet with all of your edits. FormsPal ensures your information privacy with a secure method that in no way saves or shares any sort of personal data used. Be confident knowing your files are kept protected whenever you work with our tools!