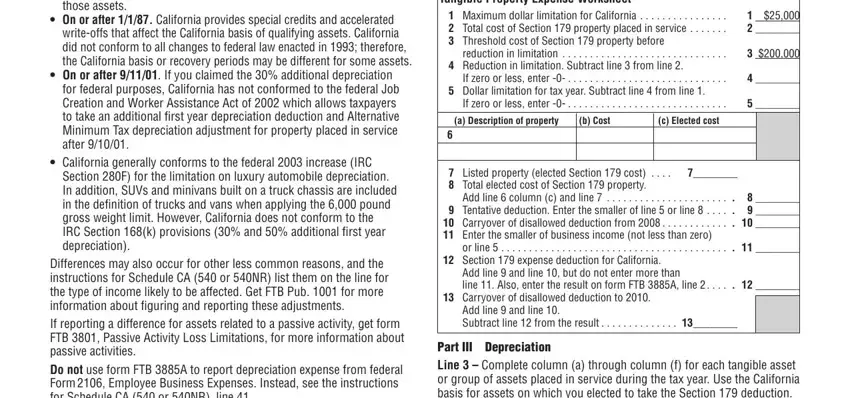

depreciation for those assets in the same manner as in prior years for those assets.

•On or after 1/1/87. California provides special credits and accelerated write-offs that affect the California basis of qualifying assets. California did not conform to all changes to federal law enacted in 1993; therefore, the California basis or recovery periods may be different for some assets.

•On or after 9/11/01. If you claimed the 30% additional depreciation for federal purposes, California has not conformed to the federal Job Creation and Worker Assistance Act of 2002 which allows taxpayers to take an additional first year depreciation deduction and Alternative Minimum Tax depreciation adjustment for property placed in service after 9/10/01.

•California generally conforms to the federal 2003 increase (IRC Section 280F) for the limitation on luxury automobile depreciation. In addition, SUVs and minivans built on a truck chassis are included in the definition of trucks and vans when applying the 6,000 pound gross weight limit. However, California does not conform to the IRC Section 168(k) provisions (30% and 50% additional first year depreciation).

Differences may also occur for other less common reasons, and the instructions for Schedule CA (540 or 540NR) list them on the line for the type of income likely to be affected. Get FTB Pub. 1001 for more information about figuring and reporting these adjustments.

If reporting a difference for assets related to a passive activity, get form FTB 3801, Passive Activity Loss Limitations, for more information about passive activities.

Do not use form FTB 3885A to report depreciation expense from federal Form 2106, Employee Business Expenses. Instead, see the instructions for Schedule CA (540 or 540NR), line 41.

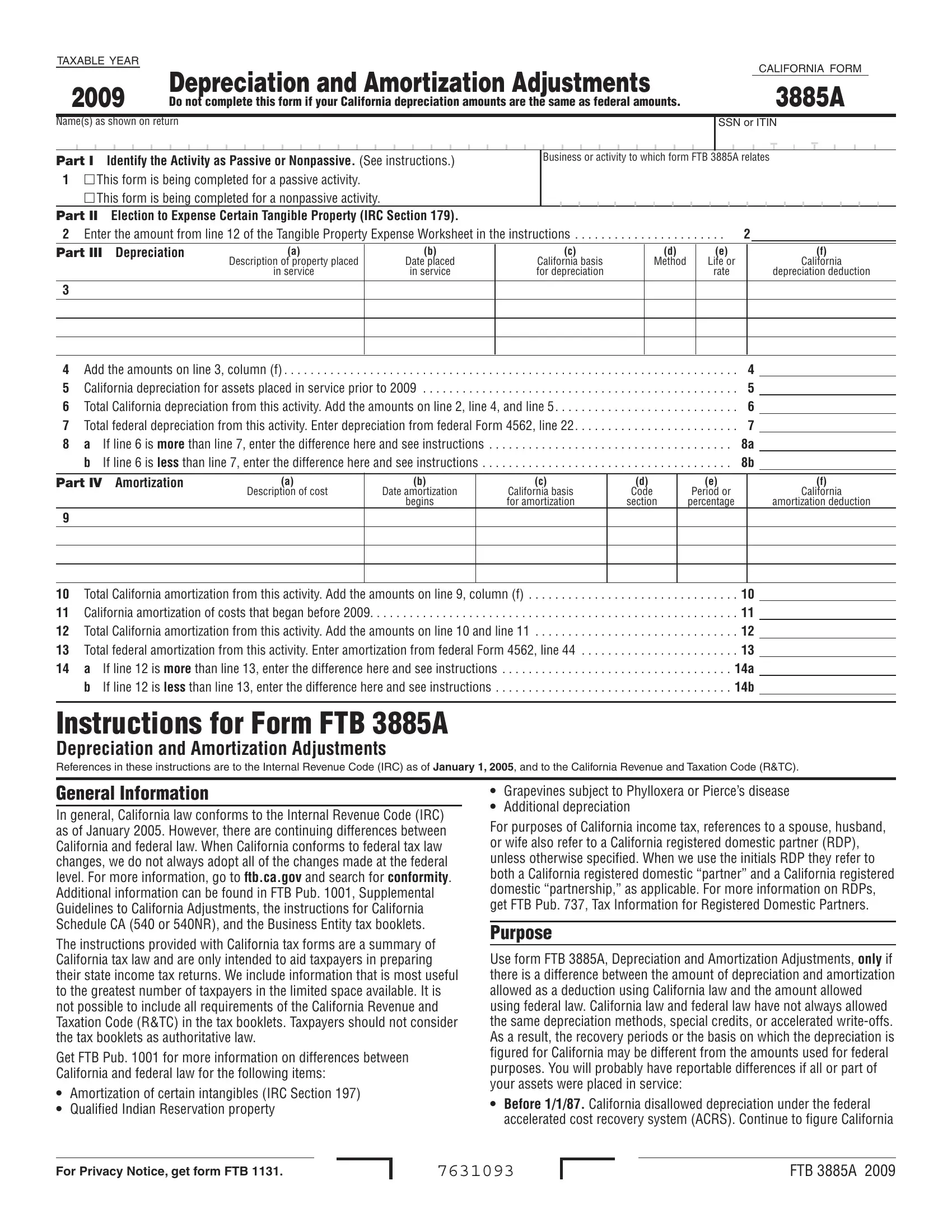

Specific Line Instructions

Prepare and file a separate form FTB 3885A for each business or activity on your return that has a difference between California and federal depreciation or amortization. Enter the name of the business or activity in the space provided at the top of the form. If you need more space, attach additional sheets. However, complete Part II, Election to Expense Certain Tangible Property (IRC Section 179), only once.

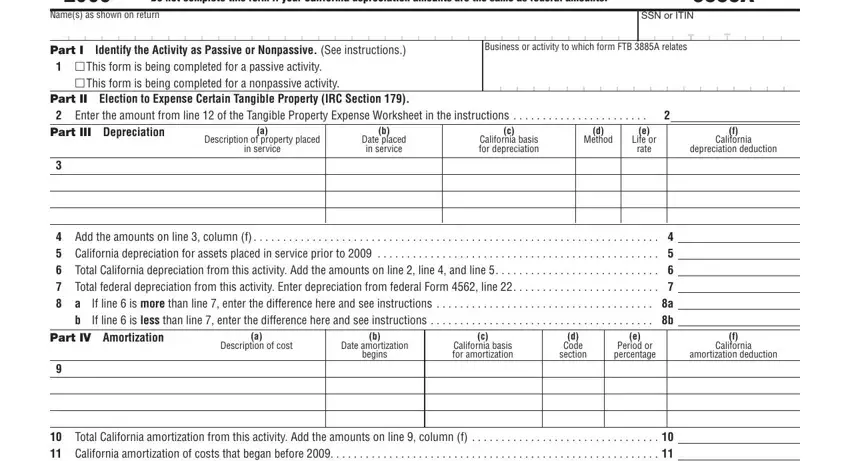

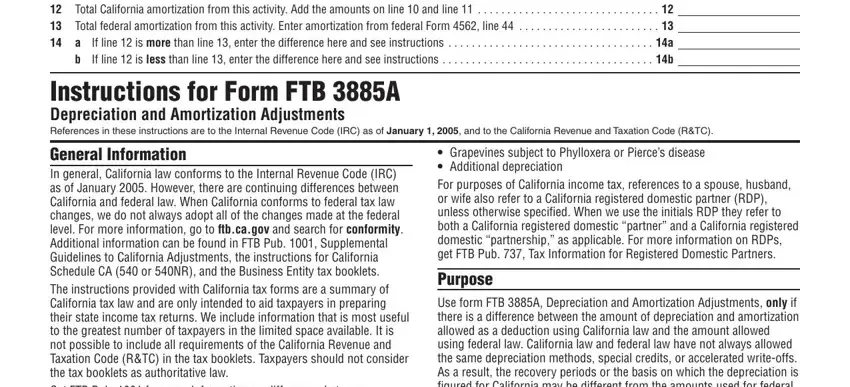

Part I Identify the Activity as Passive or Nonpassive

Line 1 – Check the box to identify the activity as passive or nonpassive. A passive activity is any activity involving the conduct of any trade or business in which you did not materially participate. Get form FTB 3801 for more information.

If the activity is passive, use this form as a worksheet to figure the depreciation adjustment to carry to form FTB 3801. Beginning in 1994, and for federal purposes only, rental real estate activities of persons in real property business are not automatically treated as passive activities. California did not conform to this provision.

Part II Election To Expense Certain Tangible Property

If you qualify, you may elect to expense part of the cost of depreciable personal property used in your trade or business and certain other property described in federal Publication 946, How to Depreciate Property. To qualify, you must have purchased property, as defined in the IRC Section 179(d)(2), and placed it in service during 2009, or have a carryover of unused cost from 2008. If you elect this deduction, you must reduce your California depreciable basis by the IRC Section 179 expense.

Although federal law increased the IRC Section 179 expense to $250,000, under California law, the maximum deduction allowed for 2009 is $25,000.

Complete the worksheet in the next column to figure IRC Section 179 expense for California. Include all assets qualifying for the deduction because the limit applies to all qualifying assets as a group rather than to each asset individually. Refer to federal Form 4562, Depreciation and

Amortization, for more information.

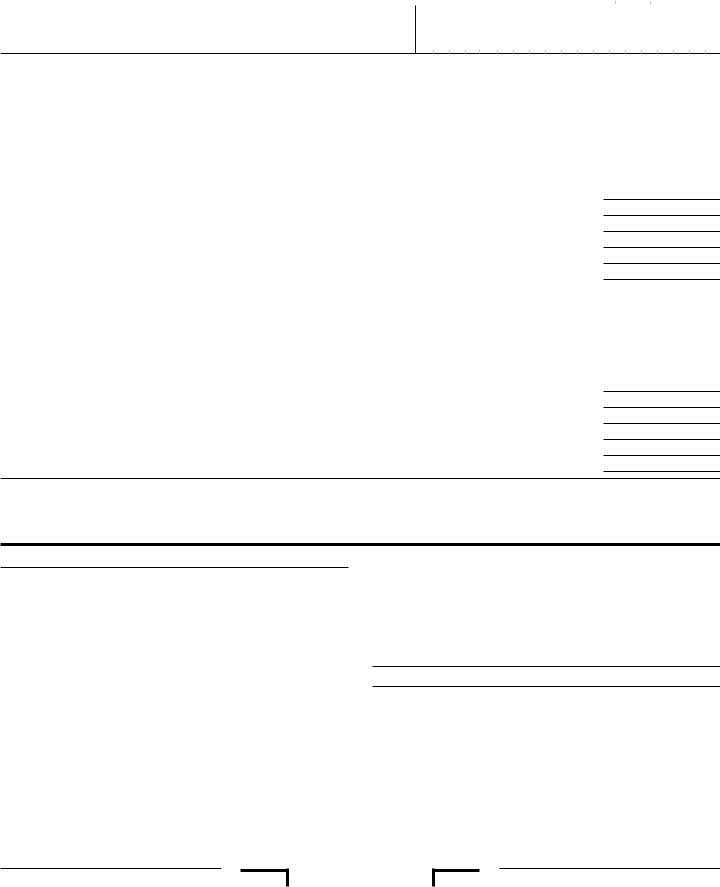

Tangible Property Expense Worksheet |

|

|

1 |

Maximum dollar limitation for California |

1 |

$25,000 |

2 |

Total cost of Section 179 property placed in service |

2 ________ |

3Threshold cost of Section 179 property before

reduction in limitation |

3 |

$200,000 |

4Reduction in limitation. Subtract line 3 from line 2.

If zero or less, enter -0- |

4 ________ |

5Dollar limitation for tax year. Subtract line 4 from line 1.

If zero or less, enter -0- . . |

. . . . . . . . . . . . . . |

. . . . . . . . . . . . . 5 ________ |

|

|

|

(a) Description of property |

(b) Cost |

(c) Elected cost |

6

7 Listed property (elected Section 179 cost) . . . . |

7________ |

8Total elected cost of Section 179 property.

|

Add line 6 column (c) and line 7 |

8 |

________ |

9 |

Tentative deduction. Enter the smaller of line 5 or line 8 |

9 |

________ |

10 |

Carryover of disallowed deduction from 2008 |

10 |

________ |

11Enter the smaller of business income (not less than zero)

|

or line 5 |

. . . . . . . . . |

11 ________ |

12 |

Section 179 expense deduction for California. |

|

|

|

|

Add line 9 and line 10, but do not enter more than |

|

|

|

|

line 11. Also, enter the result on form FTB 3885A, line 2 |

12 ________ |

13 |

Carryover of disallowed deduction to 2010. |

|

|

|

|

|

|

|

Add line 9 and line 10. |

|

|

|

|

Subtract line 12 from the result |

13________ |

|

|

|

|

|

|

|

Part III Depreciation

Line 3 – Complete column (a) through column (f) for each tangible asset or group of assets placed in service during the tax year. Use the California basis for assets on which you elected to take the Section 179 deduction.

It will be the difference between line 6, column (b) and line 6, column (c) of the Tangible Property Expense Worksheet in Part II.

Line 8a and Line 8b – Are you using this form as a worksheet in connection with form FTB 3801?

Yes Enter the amount from line 8a or line 8b on form FTB 3801, Side 2, California Passive Activity Worksheet, column (e).

No Include the amount from line 8a on Schedule CA (540 or 540NR) in column B on line 12 for federal Schedule C, Profit or Loss From Business, activities; on line 17 for federal Schedule E, Supplemental Income and Loss, activities; and on line 18 for federal Schedule F, Profit or Loss From Farming, activities.

Include the amount from line 8b on Schedule CA (540 or 540NR) in column C on line 12 for federal Schedule C activities; on

line 17 for federal Schedule E activities; and on line 18 for federal Schedule F activities.

Part IV Amortization

Line 9 – Complete column (a) through column (f) for intangible assets placed in service during the tax year. Use the California basis and the California recovery period.

Line 14a and Line 14b – Are you using this form as a worksheet in connection with form FTB 3801?

Yes Enter the amount from line 14a or line 14b on form FTB 3801, Side 2, California Passive Activity Worksheet, column (e).

No Include the amount from line 14a on Schedule CA (540 or 540NR) in column B on line 12 for federal Schedule C activities; on

line 17 for federal Schedule E activities; and on line 18 for federal Schedule F activities.

Include the amount from line 14b on Schedule CA (540 or 540NR) in column C on line 12 for federal Schedule C activities; on

line 17 for federal Schedule E activities; and on line 18 for federal Schedule F activities.