You can fill in form download 402 effortlessly in our PDFinity® PDF editor. In order to make our tool better and more convenient to utilize, we continuously design new features, considering feedback from our users. Getting underway is easy! All you need to do is follow the next simple steps below:

Step 1: Firstly, access the pdf editor by clicking the "Get Form Button" in the top section of this site.

Step 2: After you launch the tool, you will get the document made ready to be completed. Other than filling out different blanks, you might also perform some other actions with the form, including adding custom textual content, editing the initial text, adding illustrations or photos, affixing your signature to the PDF, and more.

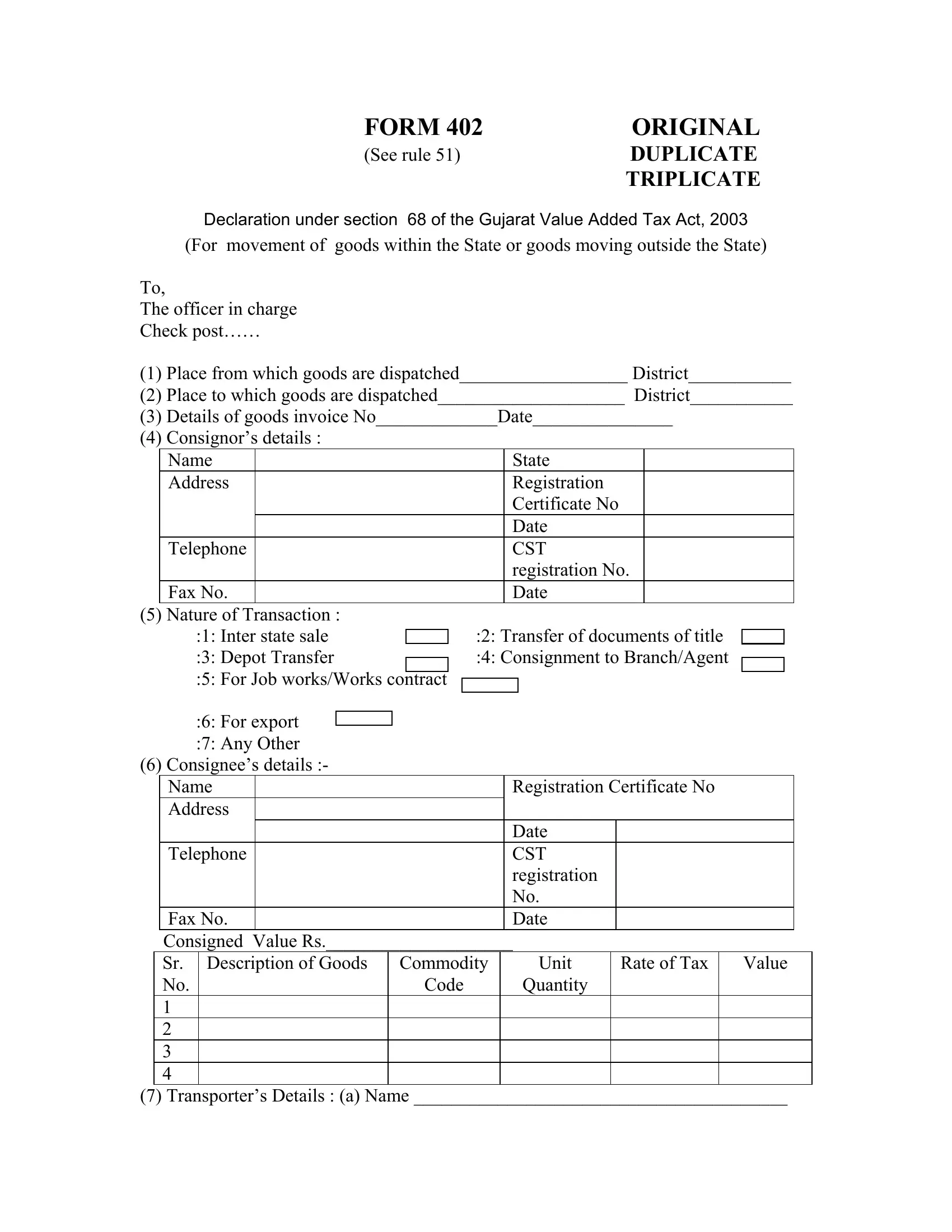

This document will need you to type in specific information; to guarantee consistency, take the time to consider the recommendations below:

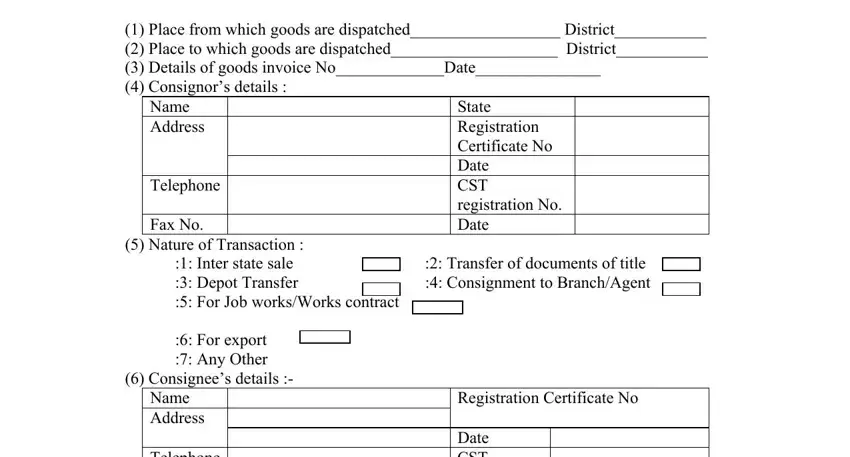

1. The form download 402 necessitates certain details to be inserted. Be sure that the following fields are completed:

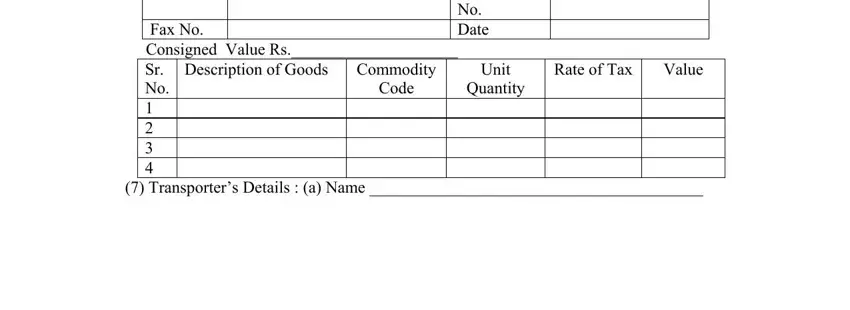

2. Once your current task is complete, take the next step – fill out all of these fields - Fax No, Date CST registration No Date, Consigned Value Rs, Sr No, Description of Goods, Commodity, Unit, Rate of Tax, Value, Code, Quantity, and Transporters Details a Name with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

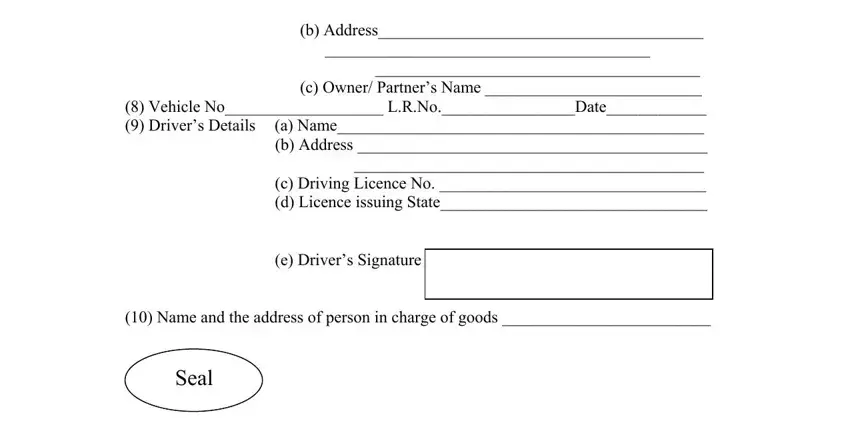

3. This part is going to be easy - fill out every one of the form fields in b Address c Owner Partners Name, e Drivers Signature, Seal, and Place Date in order to complete this process.

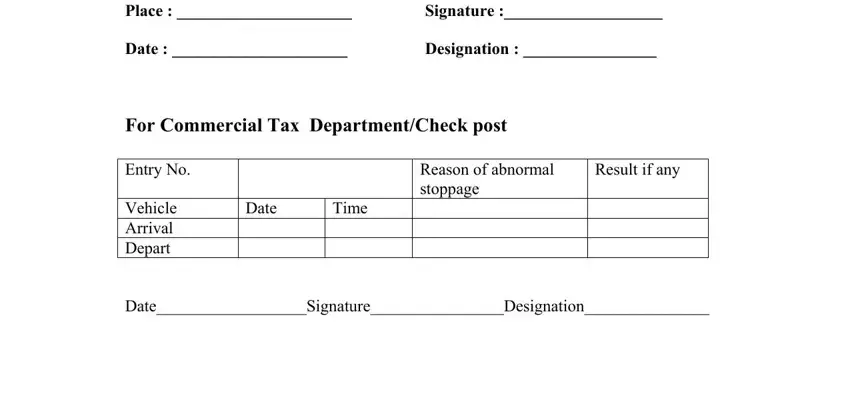

4. Completing Place Date, Signature, Designation, For Commercial Tax DepartmentCheck, Result if any, Date, Vehicle Arrival Depart, Time, and Reason of abnormal stoppage is essential in the next part - ensure to be patient and be attentive with each empty field!

As for Result if any and Reason of abnormal stoppage, ensure you don't make any mistakes here. Both these are viewed as the most significant ones in the file.

Step 3: Before submitting this form, you should make sure that all blanks are filled out right. The moment you believe it's all fine, click “Done." Join us right now and instantly use form download 402, set for download. All alterations you make are kept , making it possible to modify the form at a later stage as required. FormsPal is dedicated to the confidentiality of all our users; we always make sure that all information handled by our tool is kept confidential.