You'll be able to complete 4070a form easily with our PDFinity® online PDF tool. The tool is continually maintained by our team, acquiring cool features and becoming better. Starting is effortless! All you should do is adhere to the next basic steps below:

Step 1: Click on the "Get Form" button above on this page to open our tool.

Step 2: With the help of this handy PDF editor, you can accomplish more than merely complete blank form fields. Express yourself and make your forms seem perfect with custom text added in, or tweak the file's original input to excellence - all comes with the capability to add your own images and sign the PDF off.

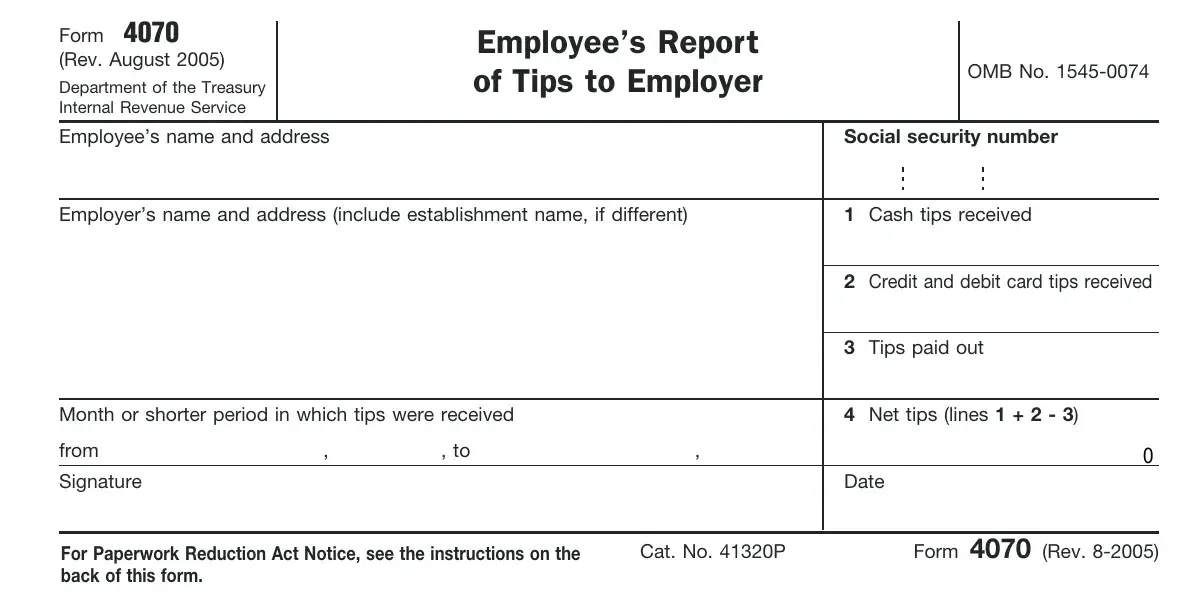

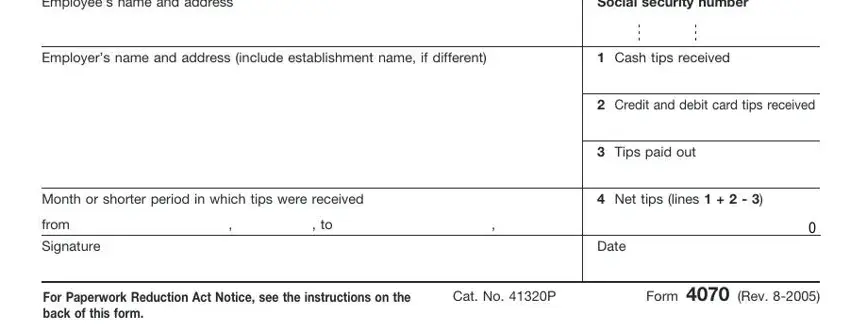

As a way to complete this form, make certain you enter the right details in each field:

1. Whenever submitting the 4070a form, make certain to include all essential fields in the corresponding area. This will help to facilitate the process, which allows your information to be handled fast and appropriately.

Step 3: Soon after double-checking your fields you have filled in, press "Done" and you're all set! Right after getting afree trial account with us, it will be possible to download 4070a form or send it via email immediately. The PDF form will also be accessible through your personal account with your each and every modification. FormsPal guarantees protected document tools with no data record-keeping or any sort of sharing. Feel comfortable knowing that your details are safe here!