It is possible to fill out proof of claim easily with our online tool for PDF editing. We are committed to giving you the ideal experience with our editor by continuously adding new features and upgrades. With these updates, working with our tool becomes easier than ever before! To get the process started, go through these easy steps:

Step 1: Press the "Get Form" button in the top part of this page to open our PDF tool.

Step 2: With our handy PDF editor, it is easy to do more than just fill out blank fields. Try all of the functions and make your docs look sublime with custom textual content incorporated, or modify the file's original content to perfection - all comes with the capability to incorporate any type of photos and sign the PDF off.

Concentrate when filling in this document. Ensure every blank is filled in properly.

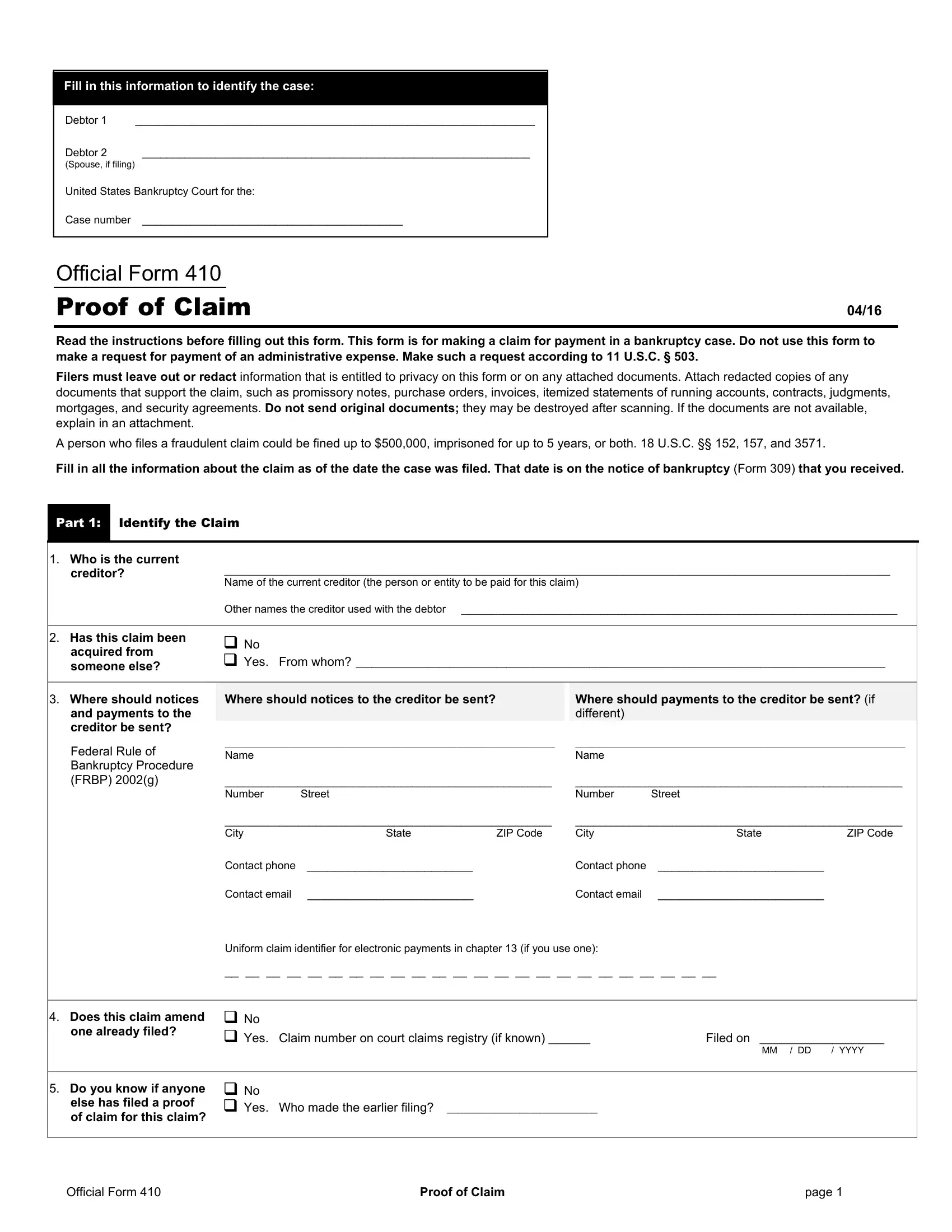

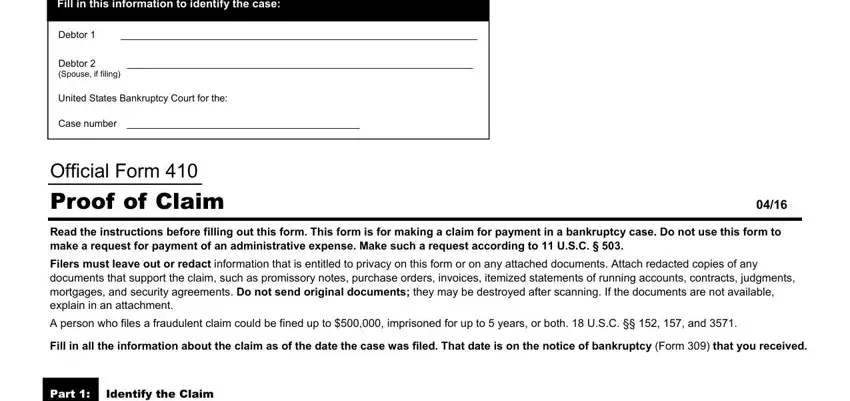

1. To start off, while filling in the proof of claim, beging with the area that includes the following fields:

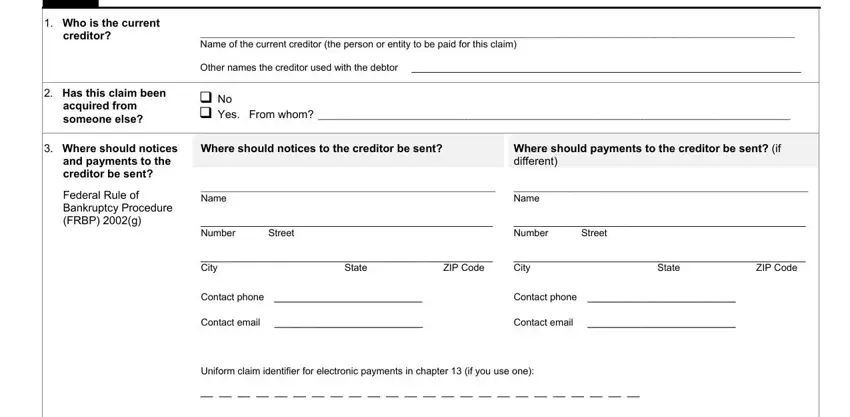

2. Soon after this part is completed, go on to type in the relevant details in these: Who is the current, creditor, Name of the current creditor the, Other names the creditor used with, Has this claim been, acquired from someone else, No Yes From whom, Where should notices, Where should notices to the, Where should payments to the, and payments to the creditor be, Federal Rule of Bankruptcy, Name, Name, and Number.

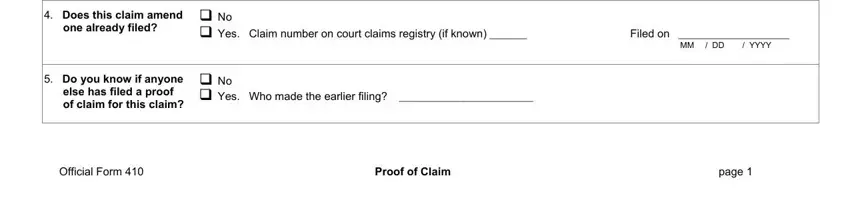

3. The next part should be relatively straightforward, Does this claim amend, one already filed, No Yes Claim number on court, Filed on, YYYY, Do you know if anyone, else has filed a proof of claim, No Yes Who made the earlier, Official Form, Proof of Claim, and page - these form fields must be completed here.

Always be extremely careful while filling in Do you know if anyone and Filed on, since this is the section in which most users make mistakes.

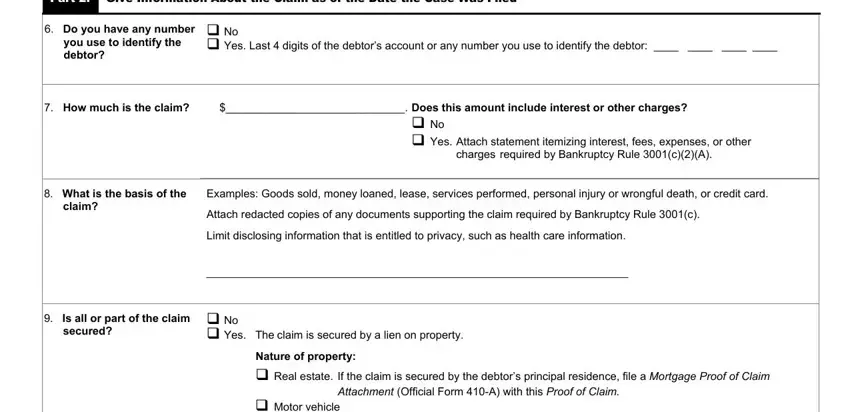

4. This next section requires some additional information. Ensure you complete all the necessary fields - Part Give Information About the, Do you have any number, you use to identify the debtor, No Yes Last digits of the, How much is the claim, Does this amount include interest, No Yes Attach statement, charges required by Bankruptcy, What is the basis of the, Examples Goods sold money loaned, claim, Attach redacted copies of any, Limit disclosing information that, Is all or part of the claim secured, and No Yes The claim is secured by a - to proceed further in your process!

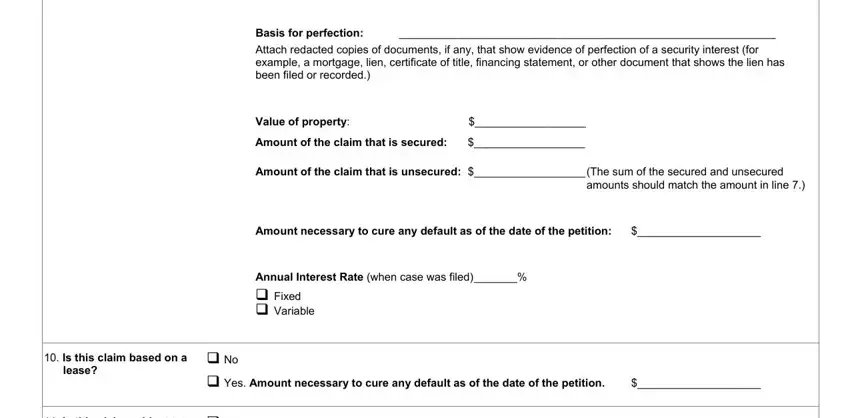

5. Finally, the following last part is what you should finish before closing the PDF. The blanks at this stage are the next: Basis for perfection, Attach redacted copies of, Value of property, Amount of the claim that is secured, Amount of the claim that is, amounts should match the amount in, Amount necessary to cure any, Annual Interest Rate when case was, Is this claim based on a, lease, No Yes Amount necessary to cure, Is this claim subject to a, and No Yes Identify the property.

Step 3: Ensure that the information is right and press "Done" to conclude the project. Try a 7-day free trial plan at FormsPal and get direct access to proof of claim - downloadable, emailable, and editable from your FormsPal account page. FormsPal guarantees your data privacy with a secure method that never records or distributes any type of sensitive information used. Be confident knowing your paperwork are kept safe when you use our tools!