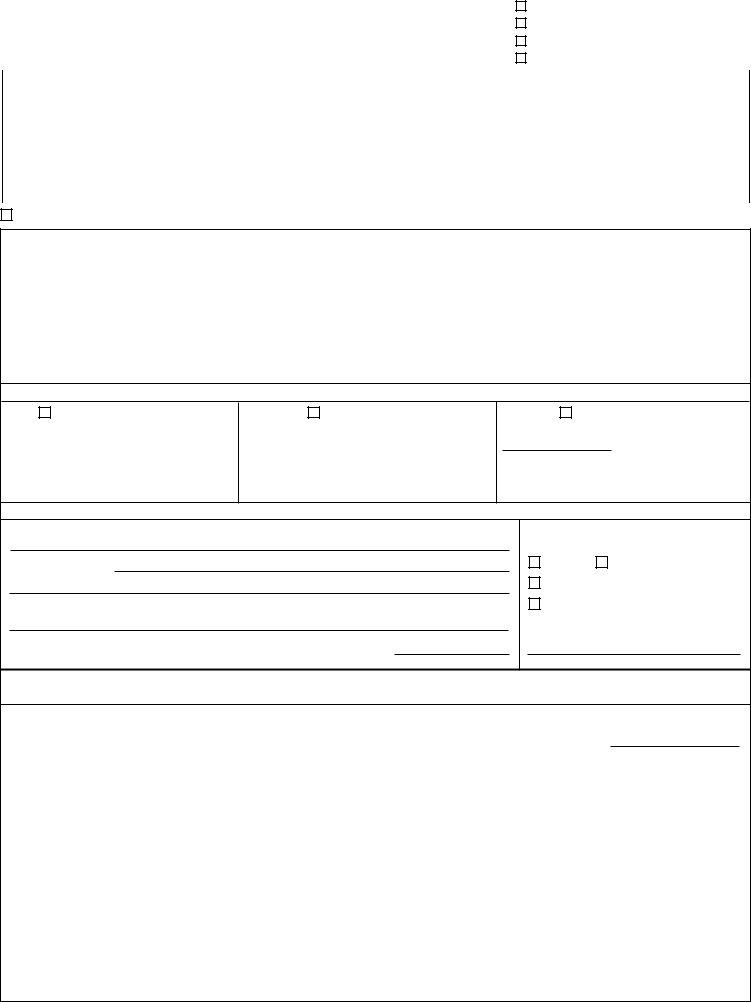

The intricacies of the Form 4101, a crucial document for individuals seeking a refund from various South Carolina Retirement Systems, are manifold and warrant thorough comprehension. This form, which has undergone revisions as recently as December 2006, serves a dual purpose: it not only enables members or alternate payees to request refunds but also outlines the implications of such refunds on future benefits. Eligibility spans several systems, including the State Budget and Control Board South Carolina Retirement System, Police Officers Retirement System, General Assembly Retirement System, and the Judges and Solicitors Retirement System, each requiring the applicant's detailed information and a clear choice among payment methods—lump-sum payment, direct rollover, or partial rollover. Of particular note is the form’s section on tax implications, highlighting the necessity of understanding the federal and state tax repercussions of a refund, especially regarding rollover options, withholding rates, and potential penalties for early withdrawal. The decision to request a refund via Form 4101 thus carries significant financial implications for an individual’s retirement planning strategy, emphasizing the importance of informed decision-making.

| Question | Answer |

|---|---|

| Form Name | Form 4101 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 1099Rs, 1099R, distributions, South_Carolina |

Form 4101 |

REFUND REQUEST |

CHECK ONE: |

Revised 12/06/2006 |

State Budget and Control Board |

South Carolina Retirement System |

Page 1 |

South Carolina Retirement Systems |

Police Officers Retirement System |

|

||

|

Customer Service Refund Claims |

General Assembly Retirement System |

PRINT OR TYPE IN INK |

Box 11960, Columbia, SC |

Judges and Solicitors Retirement System |

|

|

|

Section I MEMBER / ALTERNATE PAYEE INFORMATION

Last Name & Suffix |

First/Middle Name |

|

|

|

|

Date of Birth |

Social Security Number |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

Former/Maiden Name (if applicable) |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

ZIP+4 |

|

|

|

Telephone Number |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here if you are the alternate payee under a Qualified Domestic Relations Order (Member SSN |

) |

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I do hereby apply for a refund of the total amount of contributions plus interest credited to me in the

NOTE: Refunds for members of the SC Retirement System and Police Officers Retirement System are payable within 6 months after demand, but not less than 90 days after termination of employment. All required paperwork must be received from the member and the employer before a refund can be paid.

I terminated from |

on |

||

|

Employer |

|

Date |

Section II For your refund payout, please select ONE of the payment methods below. (See page 2 for detailed explanation.)

Pay the total refund amount (less required federal tax withholding) directly to me.

Direct Rollover

Rollover the taxable portion of my refund to the

trustee/plan named below.

The portion you rollover will not be taxed until you take it out of the eligible plan.

(Information must be provided in Section III)

Partial Rollover

Rollover the Partial Amount of

$to the trustee/plan named

below. Pay the remaining balance directly to me in a

(Information must be provided in Section III)

Section III COMPLETE THIS SECTION IF YOU SELECTED A DIRECT OR PARTIAL ROLLOVER ABOVE.

Account Number With Trustee/Plan (Limit to 25 characters)

Name of Trustee/Plan

P.O. Box or Street Address

Account Types Available

(Check only ONE box)

I R A |

Annuity Plan - 403(b) |

Qualified Plan - 401(k) or 401(a)

City |

|

State |

|

Zip + 4 |

You must attach a legible copy of your current driver's license or special identification card issued by your State Department of Transportation or Public Safety.

Please read all information on page 2 before signing this form IN BLUE INK.

I hereby certify I have read and understand the information on this form, including the tax rules, and I agree to the terms stated.

MEMBER'S OR ALTERNATE PAYEE'S SIGNATURE |

|

Date: |

(Certified copy of legal authorization required with signature other than applicant's)

WITNESS |

|

|

|

|

|

|

|

|

|

|

Date: |

|

|

|

|

(Required only when signed by a mark) |

|

|

|

|

|

|

|

|

|

||

STATE OF |

|

|

|

COUNTY OF |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ACKNOWLEDGED BEFORE ME THIS DATE |

|

|

NOTARY NAME |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

(Please print) |

||

MY COMMISSION EXPIRES |

|

|

|

NOTARY SIGNATURE |

|

||||||||

NOTARY BUSINESS PHONE |

|

|

|

|

|

|

|

|

|

|

|||

Please call SC Retirement Systems Customer Service with any questions: (800)

THE LANGUAGE USED IN THIS DOCUMENT DOES NOT CREATE ANY CONTRACTUAL RIGHTS OR ENTITLEMENTS AND DOES NOT CREATE A CONTRACT BETWEEN THE MEMBER AND THE SOUTH CAROLINA RETIREMENT SYSTEMS. THE SOUTH CAROLINA RETIREMENT SYSTEMS RESERVES THE RIGHT TO REVISE THE CONTENT OF THIS DOCUMENT.

Form 4101

Revised 12/06/2006

Page 2

When you receive a refund you forfeit your retirement service credit and give up rights to any future service retirement or disability retirement benefits. If you return to work for an employer covered by the Retirement Systems after receiving your refund check and rejoin the system, you may request to pay back with interest your withdrawn (refunded) member contributions and interest. When you leave the funds in your retirement account, you retain your years of service credit, which may be added to any future service you may accrue, should you later be employed in a position covered by the Retirement Systems. For current retirement eligibility information, please call South Carolina Retirement Systems Customer Serivce at (800)

SPECIAL TAX RULES

This payment from the South Carolina Retirement Systems is classified as a Qualified Total Distribution under Internal Revenue Code Section 401(a) and will be reported to the Internal Revenue Service on Form 1099R. This distribution may consist of both taxable and nontaxable income.

Rollover

A rollover is a

A rollover may be accomplished by: 1) a direct transfer by the South Carolina Retirement Systems on your behalf to an eligible plan; or 2) a rollover by you to an eligible plan within sixty (60) days of receipt of the distribution. ANY AMOUNT ELIGIBLE FOR ROLLOVER NOT

DIRECTLY TRANSFERRED BY THE SOUTH CAROLINA RETIREMENT SYSTEMS TO AN ELIGIBLE PLAN MUST HAVE FEDERAL TAXES WITHHELD AT A RATE OF TWENTY PERCENT (20%). If you do not choose a direct transfer, you can still decide to rollover all or part of the taxable portion of your refund within 60 days of receipt of the distribution. However, you must find other money to replace the 20% withheld if you want to rollover 100% of the taxable portion of your refund.

A rollover from the Retirement Systems 401(a) plan is not allowed into the South Carolina 457 Deferred Compensation Plan. If you intend to roll over funds from the Retirement Systems 401(a) plan into a governmental 457 plan other than the South Carolina 457 Deferred Compensation Plan, verify with that Plan Administrator that the 457 plan accepts rollovers. If it does accept rollovers from the Retirement Systems 401(a) plan, check the "Other" box and provide the plan name.

Under Age 59 1/2 and Do Not Elect Rollover

If you do not take advantage of a rollover as indicated above and are under the age of 59 1/2 at the time of distribution, your distribution will be subject to regular income tax in the year you receive the payment, plus THERE WILL BE A 10% PENALTY TAX ON THE TAXABLE PORTION OF YOUR DISTRIBUTION. The 10% penalty tax will be due when your income tax return is filed. This tax penalty does not apply to distributions due to death, disability, separation from service in or after the year in which you reach age 55, or distribution pursuant to a

The Pension Protection Act of 2006 provides for the waiver of the 10 percent early withdrawal penalty tax if a qualified public safety employee, as defined by the Pension Protection Act, receives a distribution from a qualified retirement plan after separation from service in or after the year in which the employee reaches age 50. Note: A Qualified Public Safety Employee Certification (Form 7507) must be completed by your current employer.

Born Before 1936 and Do Not Elect Rollover

If you were born before 1936, the ordinary income portion of your distribution may be eligible for

This special tax treatment discussed above requires that your refund must be a

Withholding

A taxable distribution eligible for rollover but paid directly to you will generally be subject to an automatic federal withholding rate of 20%.

South Carolina Income Taxes

The taxable portion of this refund will be subject to South Carolina income taxes in the year in which you receive your refund. The above federal provisions (except for the additional 10% penalty tax and the mandatory 20% withholding) also apply in computing South Carolina income taxes.

The tax laws are complex and always changing. You should consult your personal tax advisor with regard to the application of all federal and state taxes on benefits received from the South Carolina Retirement Systems.

Please notify us, in writing, should your address change prior to the payment of your refund or prior to the receipt of your 1099R. For tax reporting purposes, 1099Rs are mailed no later than January 31 each year for the previous calendar year's refund. If you return to work for an employer covered by the Retirement Systems prior to receiving your refund check, your refund request will be canceled.