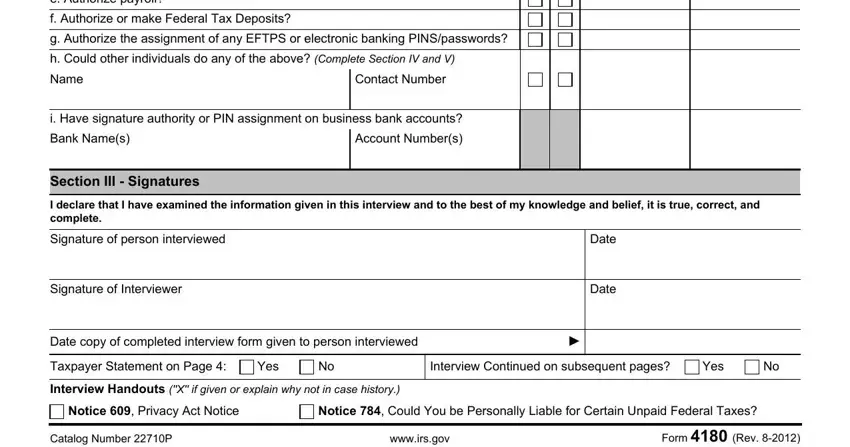

It is easy to create forms with the help of our PDF editor. Enhancing the form report trust form is easy for those who keep up with the next actions:

Step 1: Click the orange button "Get Form Here" on the following page.

Step 2: The file editing page is right now available. Include information or change current content.

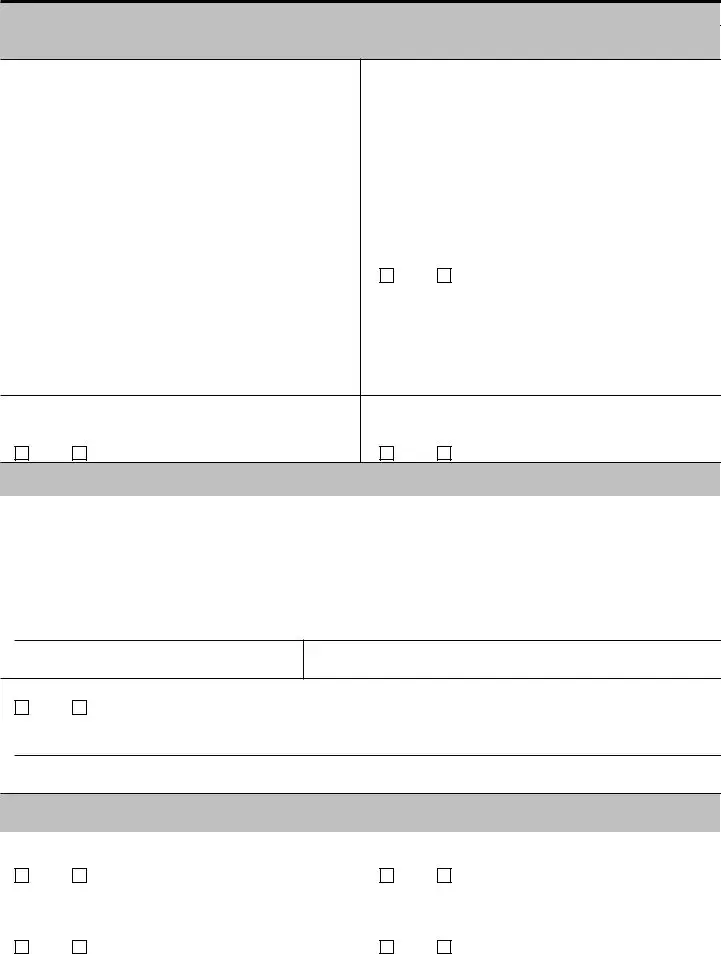

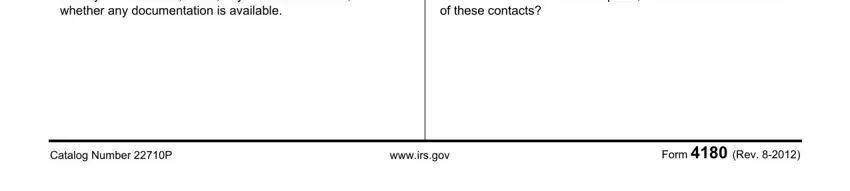

To be able to prepare the document, enter the information the program will request you to for each of the next areas:

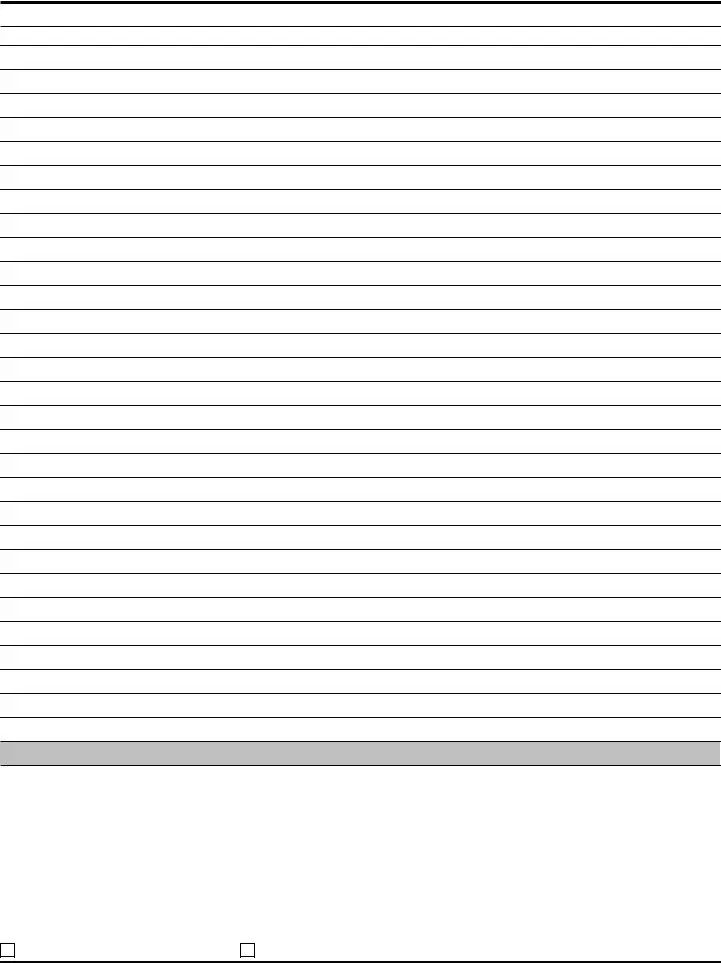

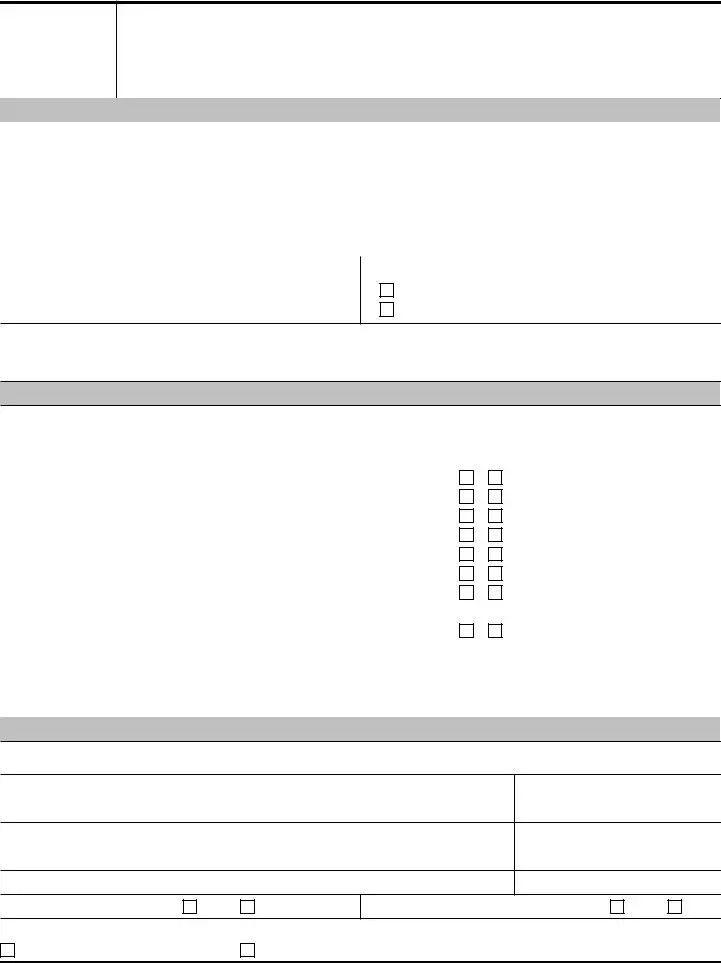

Type in the details in the e Authorize payroll, f Authorize or make Federal Tax, g Authorize the assignment of any, h Could other individuals do any, Name, Contact Number, i Have signature authority or PIN, Bank Names, Account Numbers, Section III Signatures, I declare that I have examined the, Signature of person interviewed, Signature of Interviewer, Date, and Date field.

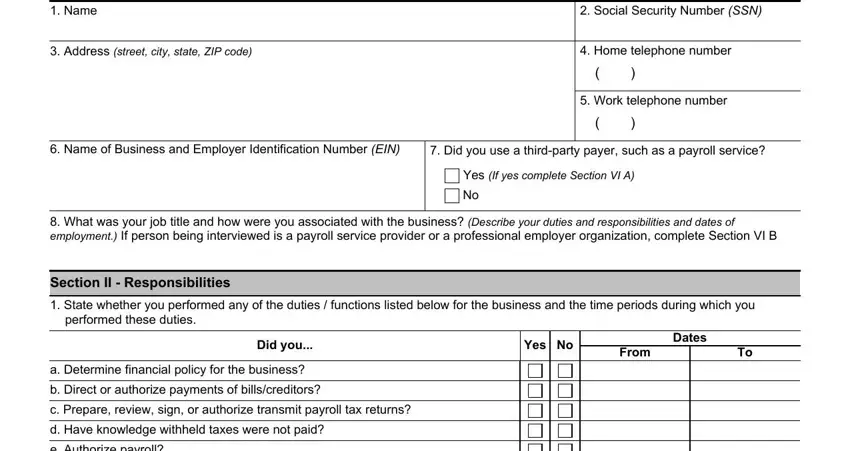

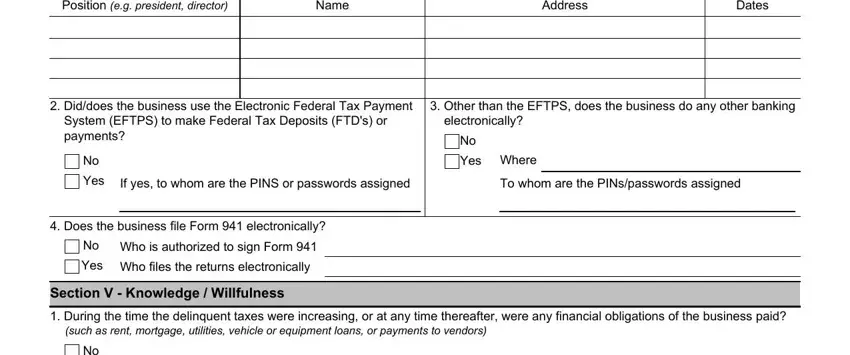

You will have to provide particular particulars inside the field Position eg president director, Name, Address, Dates, Diddoes the business use the, Other than the EFTPS does the, electronically, Yes Where, If yes to whom are the PINS or, To whom are the PINspasswords, Yes, Does the business file Form, Yes, Who is authorized to sign Form, and Who files the returns.

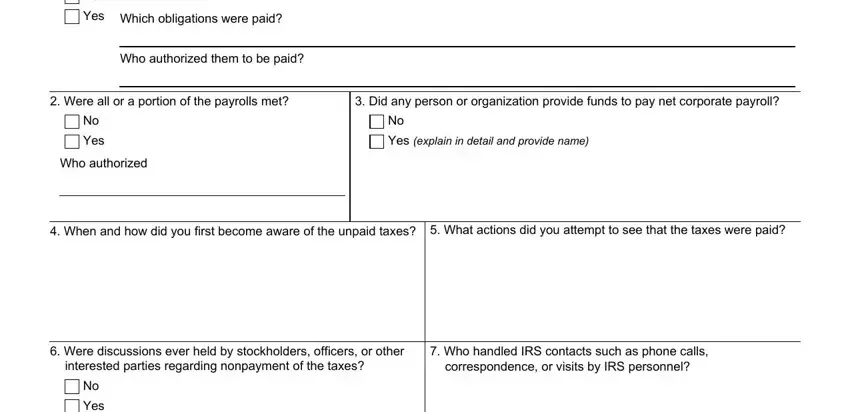

Identify the rights and responsibilities of the parties inside the box Yes Which obligations were paid, Who authorized them to be paid, Were all or a portion of the, Did any person or organization, Yes, Who authorized, Yes explain in detail and provide, When and how did you first become, Were discussions ever held by, interested parties regarding, Who handled IRS contacts such as, and Yes.

End by checking all these fields and filling them out accordingly: Identify who attended dates any, When did these contacts take place, Catalog Number P, wwwirsgov, and Form Rev.

Step 3: Hit the Done button to save your form. Now it is available for transfer to your gadget.

Step 4: Generate duplicates of the file. This may protect you from possible future complications. We cannot see or display your data, as a consequence be sure it will be safe.

No

No