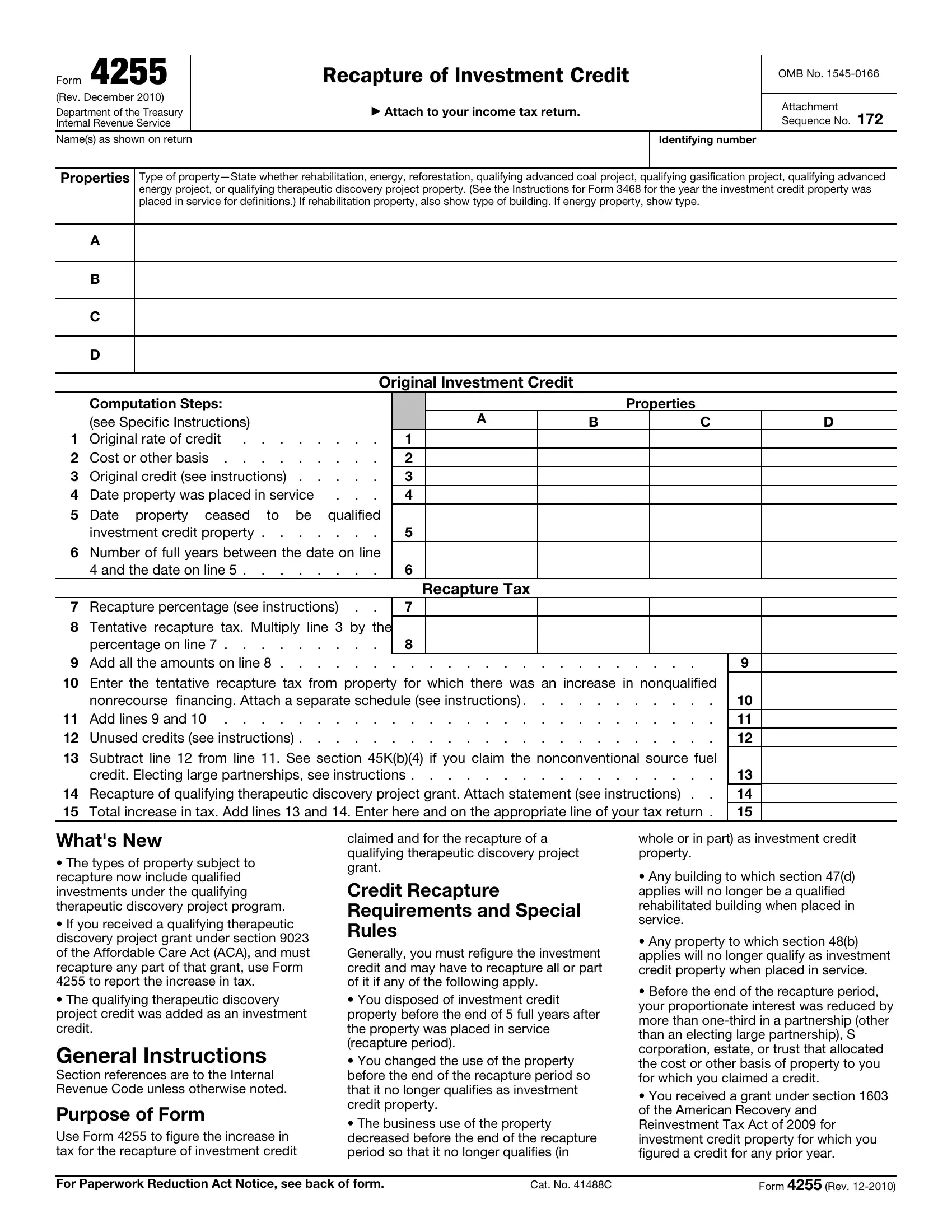

•A net increase in the amount of nonqualified nonrecourse financing occurred for any property to which section 49(a)(1) applied. For more details, see the instructions for line 10.

•You returned leased property (on which you claimed a credit) to the lessor before the end of the recapture period.

•In the case of a project under the Phase II gasification program, failure at any time during the applicable recovery period (as defined in section 168(c)) to attain and maintain the separation and sequestration requirements in section 48B(d)(1)(B). For more information, see Notice 2009-23, 2009-16 I.R.B. 802.

•In the case of a project under the Phase II qualifying advanced coal project program, failure during the applicable recovery period (as defined in section 168(c)) to attain and maintain the separation and sequestration requirements in section 48A (e)(1)(G). For more information, see Notice 2009-24, 2009-16 I.R.B. 817.

Exceptions to recapture. Recapture of the investment credit does not apply to the following.

•A transfer because of the death of the taxpayer.

•A transfer between spouses or incident to divorce under section 1041. However, a later disposition by the transferee is subject to recapture to the same extent as if the transferor had disposed of the property at the later date.

•A transfer of an interest in an electing large partnership.

•A transaction to which section 381(a) applies (relating to certain acquisitions of the assets of one corporation by another corporation).

•A mere change in the form of conducting a trade or business if:

1.The property is retained as investment credit property in that trade or business, and

2.The taxpayer retains a substantial interest in that trade or business.

A mere change in the form of conducting a trade or business includes a corporation that elects to be an S corporation and a corporation whose S election is revoked or terminated.

For more details on the recapture rules, see section 50(a).

Caution. See section 46(g)(4) (as in effect on November 4, 1990) to figure the recapture tax if you made a withdrawal from a capital construction fund set up under the Merchant Marine Act of 1936 to pay the principal of any debt incurred in connection with a vessel on which you claimed investment credit.

Recapture of Qualifying

Therapeutic Discovery

Project Grant

You may have to recapture all or part of a qualifying therapeutic discovery project grant paid under section 9023 of the ACA. If you received a qualifying therapeutic discovery project grant and the amount of the grant is more than the amount of the allowable grant, you must include the difference as an increase in tax as if the investment to which the excess portion of the grant relates had ceased to be a qualified investment immediately after the grant was made. The increase in tax for any recapture of a qualifying therapeutic discovery project grant is imposed on the person to whom the grant was made. In the case of pass-through entities (including partnerships, S corporations, estates, and trusts), the tax is imposed at the entity level.

Basis Adjustment on

Recapture

For property subject to investment credit or qualifying therapeutic discovery project grant recapture, increase the property’s basis as follows.

•For rehabilitation credit property, qualifying advanced coal project property, qualifying gasification project property, qualifying advanced energy project property, or depreciable qualifying therapeutic discovery project property, increase the basis by 100% of the amount, attributable to each such property, of the recapture tax, adjustments to carrybacks and carryforwards under section 39, or adjustments to disallowed passive activity credits.

•For energy property or qualified timber property, increase the basis by 50% of the amount, attributable to each such property, of the recapture tax, adjustments to carrybacks and carryforwards under section 39, or adjustments to disallowed passive activity credits.

If you are a partner or S corporation shareholder, the adjusted basis of your interest in the partnership or stock in the S corporation is adjusted to take into account the adjustment made to the basis of property held by the partnership or S corporation.

For more information, see section 50(c) and Regulations section 1.469-3(f).

Specific Instructions

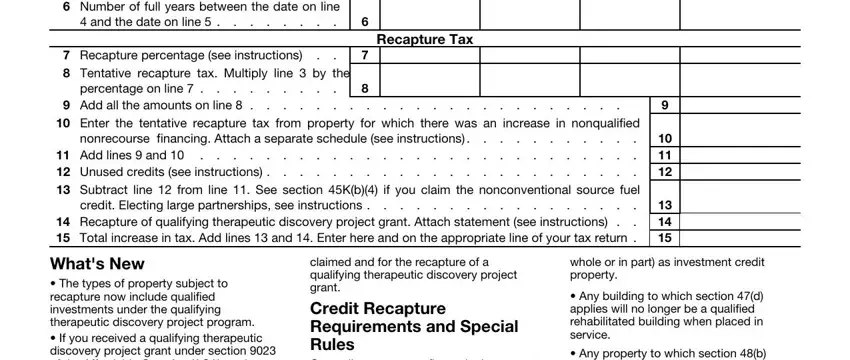

Note. Do not figure the recapture tax on lines 1 through 9 if there is an increase in nonqualified nonrecourse financing related to certain at-risk property. Figure the tentative recapture tax for these properties on separate schedules and enter the recapture tax on line 10. Include any unused credit for these properties on line 12.

Partnerships, S corporations, estates, and trusts. For a partnership, S corporation, estate, or trust that allocated any or all of the investment credit to its partners, shareholders, or beneficiaries, provide the information they need to refigure the credit. See Regulations sections 1.47-4(a) and (c), 1.47-5, and 1.47-6. See the instructions for

Form 1065-B for information on recapture of the investment credit by electing large partnerships.

For a partnership, S corporation, estate, or trust that must recapture any part of a qualifying therapeutic discovery project grant, figure the increase in tax at the entity level. Do not complete lines 1 through 13 to figure this increase in tax. Figure the increase in tax on a separate statement and enter the result on line 14. See the instructions for line 14.

Partners, shareholders, and beneficiaries. If your Schedule K-1 shows recapture of investment credit claimed in an earlier year, you will need your copy of the original Form 3468 to complete lines 1 through 6 of this Form 4255.

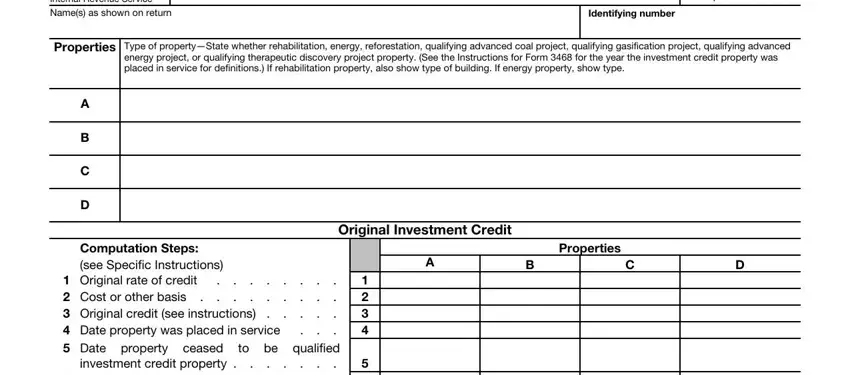

Lines A through D. Describe the property for which you must refigure the credit.

Complete lines 1 through 8 for each property on which you are refiguring the credit. Use a separate column for each item. If you need more columns, use additional Forms 4255 or other schedules that include all the information shown on Form 4255. Enter the total from all the separate sheets on line 9.

Line 1. Enter the rate you used to figure the original credit from the Form 3468 that you filed.

Line 2. Enter the cost or other basis that you used to figure the original credit. If there has been a net increase in nonqualified nonrecourse financing with respect to the property that you have disposed of or that has otherwise ceased to be investment credit property, enter the cost or other basis you used to figure the original credit reduced by the amount of that net increase. If there has been a net decrease in nonqualified nonrecourse financing with respect to the property, enter the cost or other basis you used to figure the original credit plus the amount of that net decrease. For more details, see section 49(b).

Line 3. Enter the amount of the credit determined under section 46. If the credit determined for the property for which you must refigure the credit was limited (for example, by the kilowatt limit in section 48(c)(1)(B)), do not enter on line 3 more than the amount of the applicable limit.

Line 4. Enter the date (month/day/year) on which the property was placed in service, using the first day of the month in which the property is placed in service. For example, if the property was placed in service on February 20, 2008, enter 02/01/2008 on line 4. See Regulations section 1.47-1(c) for more information.