You'll be able to fill out requester effectively in our PDFinity® online tool. Our team is devoted to providing you the best possible experience with our tool by constantly releasing new features and improvements. With these improvements, working with our editor gets easier than ever before! It merely requires several easy steps:

Step 1: Firstly, open the pdf tool by pressing the "Get Form Button" above on this site.

Step 2: With this online PDF editor, it is possible to accomplish more than just fill in blank form fields. Edit away and make your docs seem great with customized text incorporated, or optimize the file's original input to perfection - all comes along with the capability to insert just about any pictures and sign the PDF off.

It's an easy task to fill out the pdf following our detailed guide! Here's what you should do:

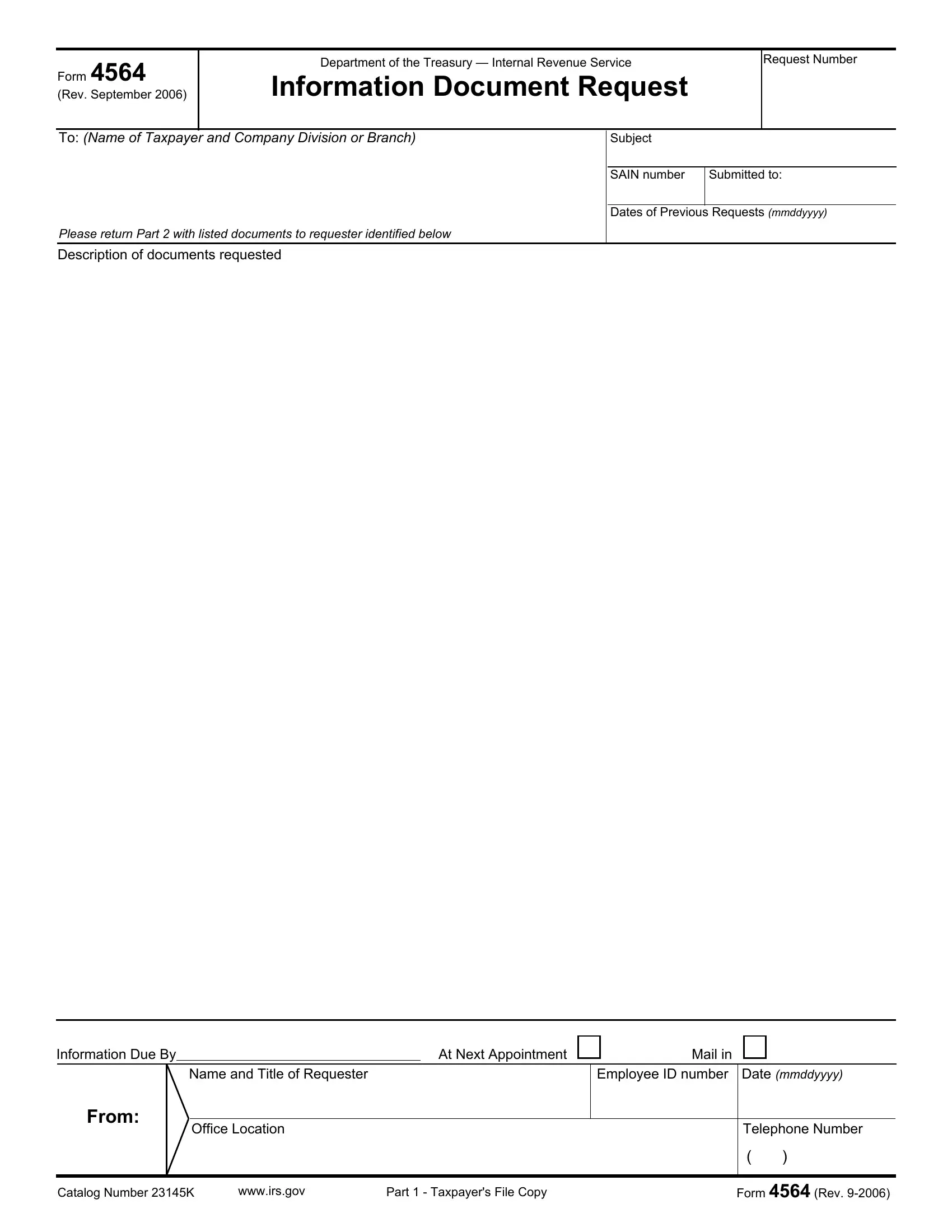

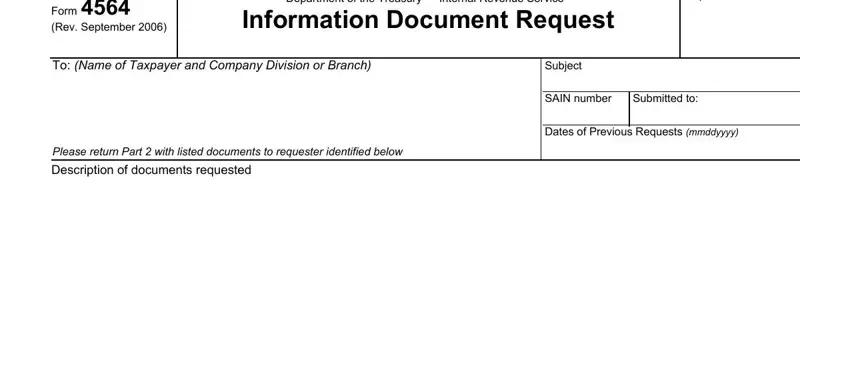

1. It is very important fill out the requester correctly, hence be mindful while filling in the areas including these blank fields:

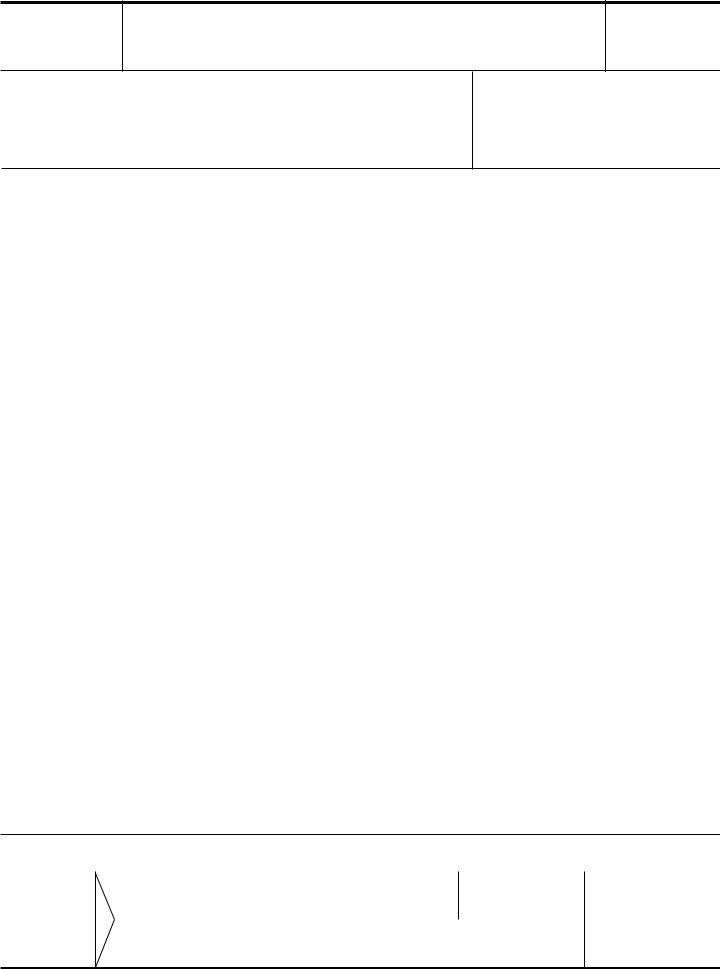

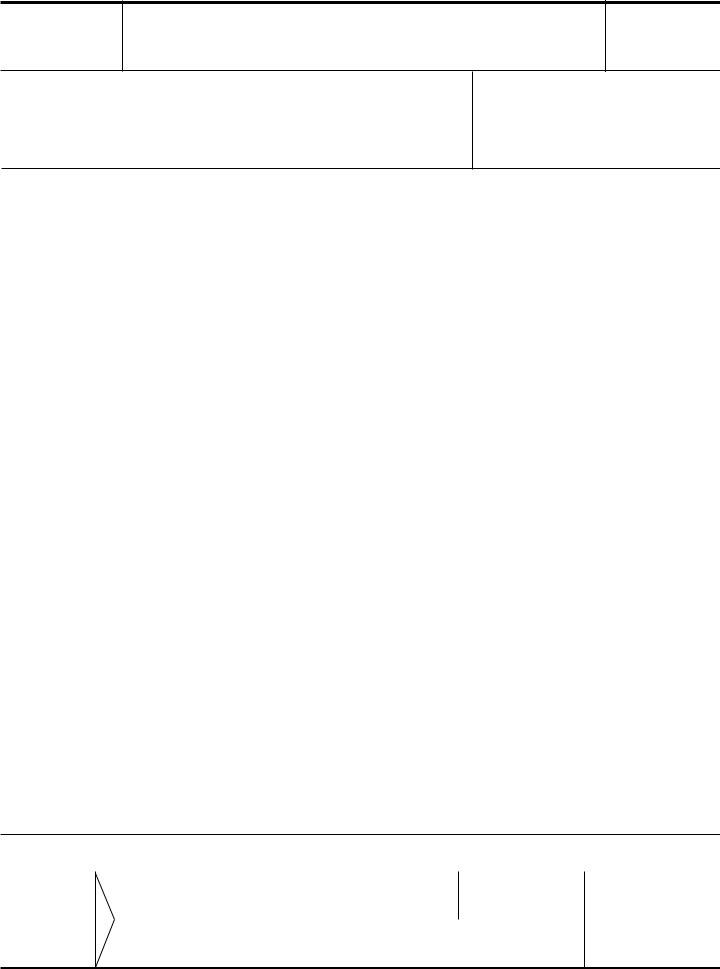

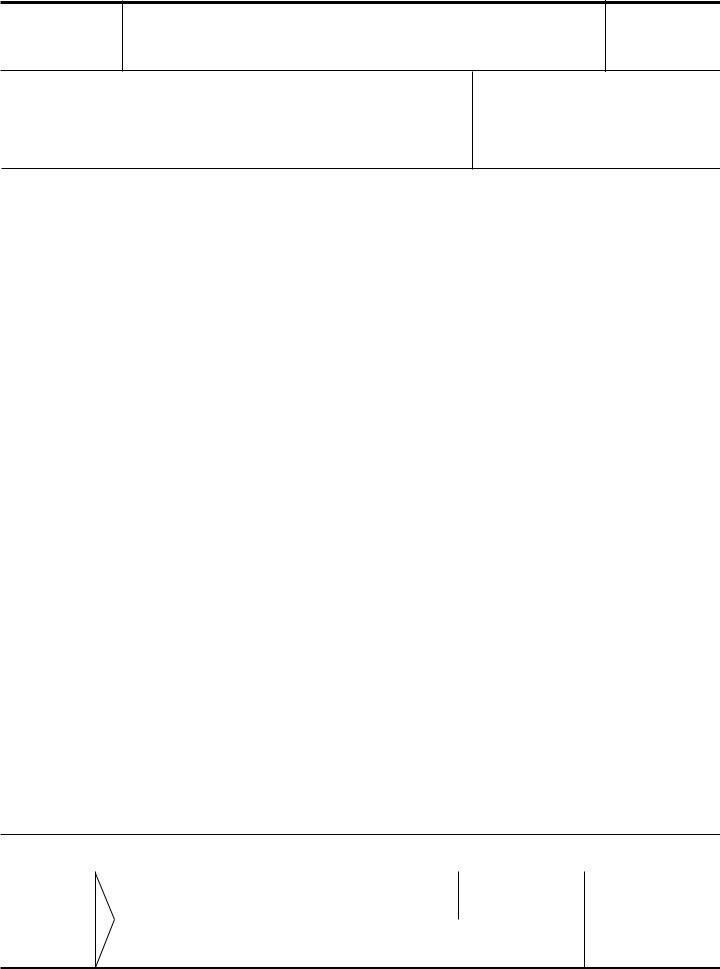

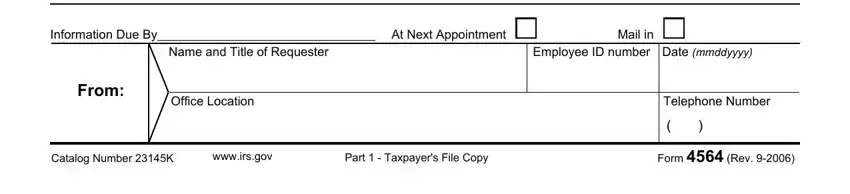

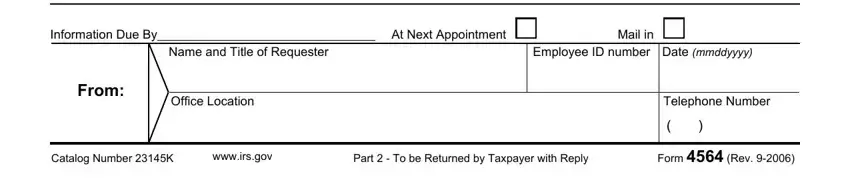

2. After the previous segment is finished, you should insert the necessary details in Information Due By, At Next Appointment, Mail in, Name and Title of Requester, Employee ID number Date mmddyyyy, From, Office Location, Catalog Number K, wwwirsgov, Part Taxpayers File Copy, Telephone Number, and Form Rev in order to progress further.

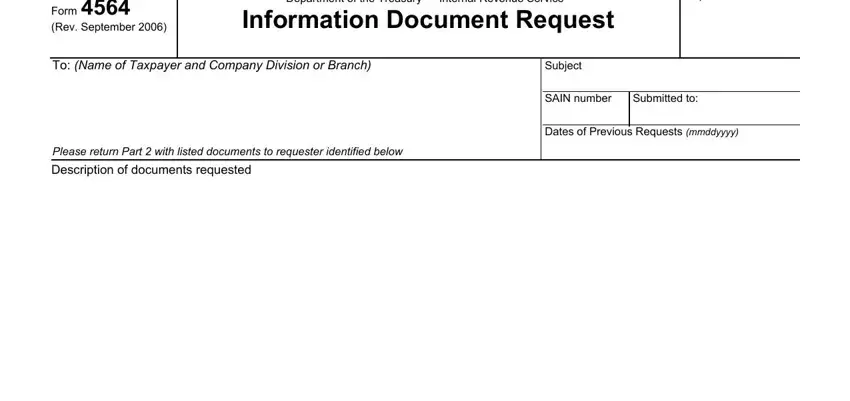

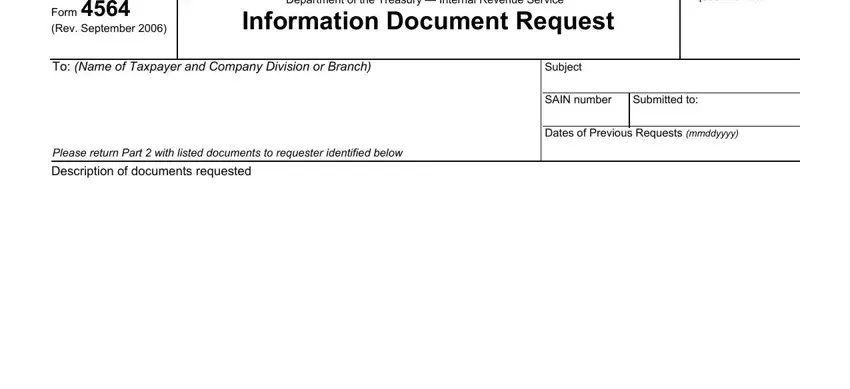

3. This stage will be simple - fill out every one of the form fields in Form Rev September, Department of the Treasury, Request Number, Information Document Request, To Name of Taxpayer and Company, Subject, Please return Part with listed, Description of documents requested, SAIN number, Submitted to, and Dates of Previous Requests mmddyyyy to conclude this process.

4. This next section requires some additional information. Ensure you complete all the necessary fields - Information Due By, At Next Appointment, Mail in, Name and Title of Requester, Employee ID number Date mmddyyyy, From, Office Location, Telephone Number, Catalog Number K, wwwirsgov, Part To be Returned by Taxpayer, and Form Rev - to proceed further in your process!

5. The last notch to submit this PDF form is critical. Make sure you fill in the required fields, for example Form Rev September, Department of the Treasury, Request Number, Information Document Request, To Name of Taxpayer and Company, Subject, Please return Part with listed, Description of documents requested, SAIN number, Submitted to, and Dates of Previous Requests mmddyyyy, before finalizing. Neglecting to accomplish that can generate a flawed and possibly unacceptable paper!

Always be really attentive while filling in Please return Part with listed and Form Rev September, since this is the section where most people make mistakes.

Step 3: Check everything you have inserted in the blank fields and then press the "Done" button. Right after getting afree trial account here, it will be possible to download requester or send it through email without delay. The form will also be readily available from your personal account page with all your adjustments. FormsPal offers safe document editor with no personal information recording or any kind of sharing. Be assured that your data is safe here!