When you need to fill out 2017 form 4626, you won't need to install any sort of software - just try our PDF editor. To make our editor better and easier to work with, we consistently design new features, with our users' suggestions in mind. If you're looking to get started, here's what it will take:

Step 1: Press the "Get Form" button above. It will open up our tool so you can begin completing your form.

Step 2: With our advanced PDF file editor, it's possible to do more than merely fill out blank form fields. Express yourself and make your documents appear high-quality with customized textual content put in, or modify the original content to excellence - all that accompanied by the capability to insert your personal photos and sign the file off.

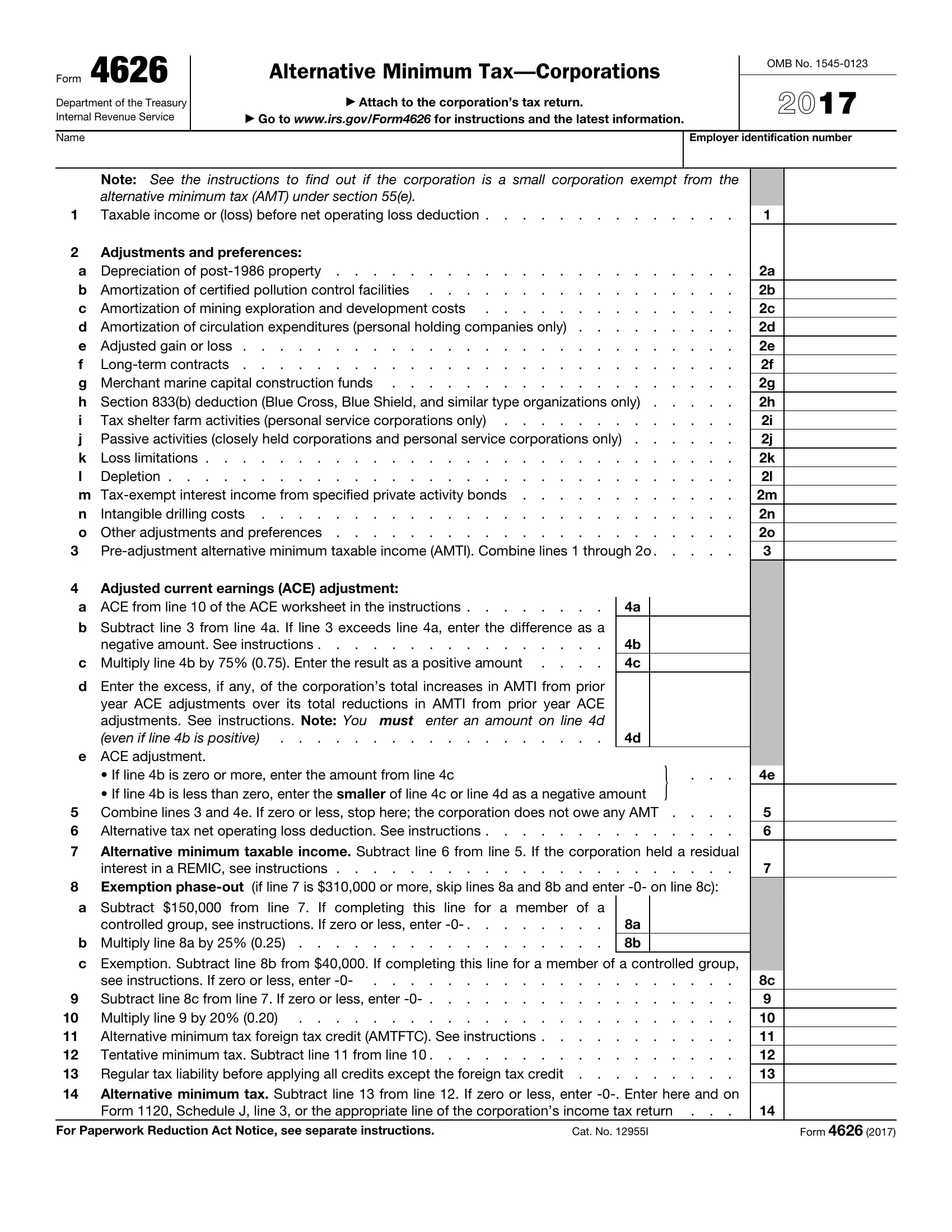

So as to finalize this document, make sure that you type in the right information in each blank field:

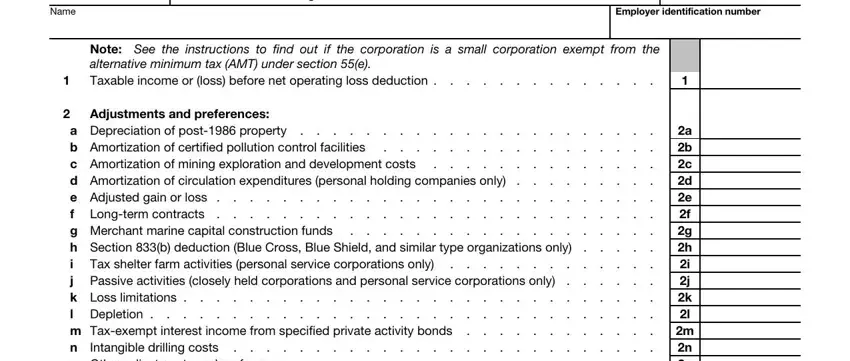

1. You need to fill out the 2017 form 4626 correctly, therefore be attentive when filling in the segments comprising these blanks:

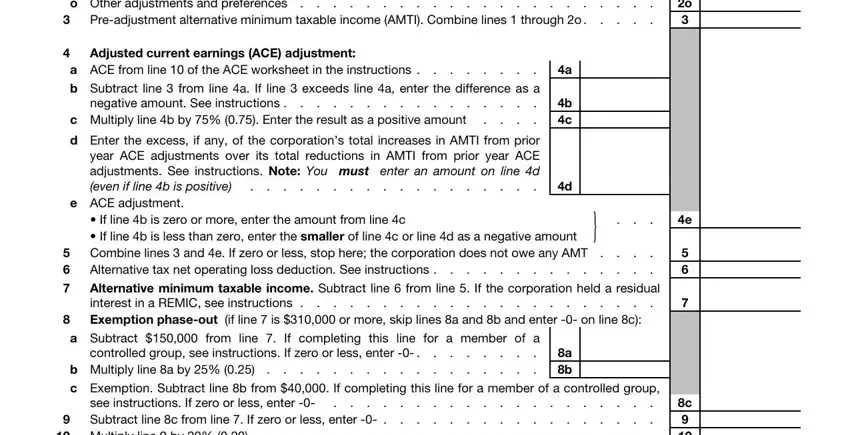

2. Soon after this selection of blanks is completed, go to type in the applicable information in these - a Depreciation of post property, Preadjustment, Adjusted current earnings ACE, a ACE from line of the ACE, Subtract line from line a If line, b c Multiply line b by Enter, Enter the excess if any of the, d e ACE adjustment, b c, a b c d e f g h i j k l m n o, If line b is zero or more enter, Combine lines and e If zero or, Alternative tax net operating loss, a b Multiply line a by, and a b.

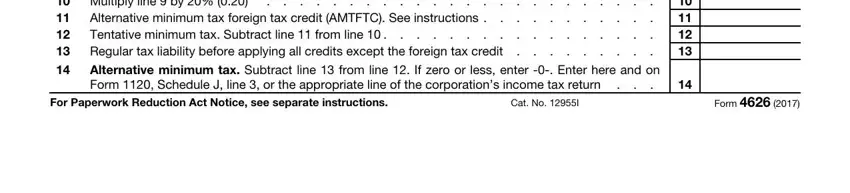

3. This next step should be fairly uncomplicated, Exemption Subtract line b from If, Alternative minimum tax foreign, Multiply line by, Alternative minimum tax Subtract, For Paperwork Reduction Act Notice, Cat No I, and Form - all of these fields will have to be filled out here.

People generally make mistakes when completing For Paperwork Reduction Act Notice in this part. You need to go over what you enter right here.

Step 3: Right after you've reviewed the details in the document, click "Done" to conclude your form at FormsPal. Sign up with FormsPal now and immediately get 2017 form 4626, all set for downloading. All changes you make are kept , letting you customize the file later as required. FormsPal guarantees your information confidentiality via a protected method that in no way records or distributes any kind of private data involved. Rest assured knowing your paperwork are kept protected any time you use our editor!