When working in the online PDF tool by FormsPal, it is easy to fill out or change Murall here. To make our editor better and less complicated to use, we constantly design new features, with our users' feedback in mind. With some simple steps, you'll be able to begin your PDF journey:

Step 1: Press the "Get Form" button in the top section of this webpage to open our editor.

Step 2: As you access the PDF editor, you will see the document prepared to be completed. Aside from filling in various blanks, it's also possible to perform other sorts of things with the form, namely putting on custom text, modifying the initial textual content, adding illustrations or photos, affixing your signature to the PDF, and a lot more.

Be attentive while completing this pdf. Make sure that every single blank is filled out accurately.

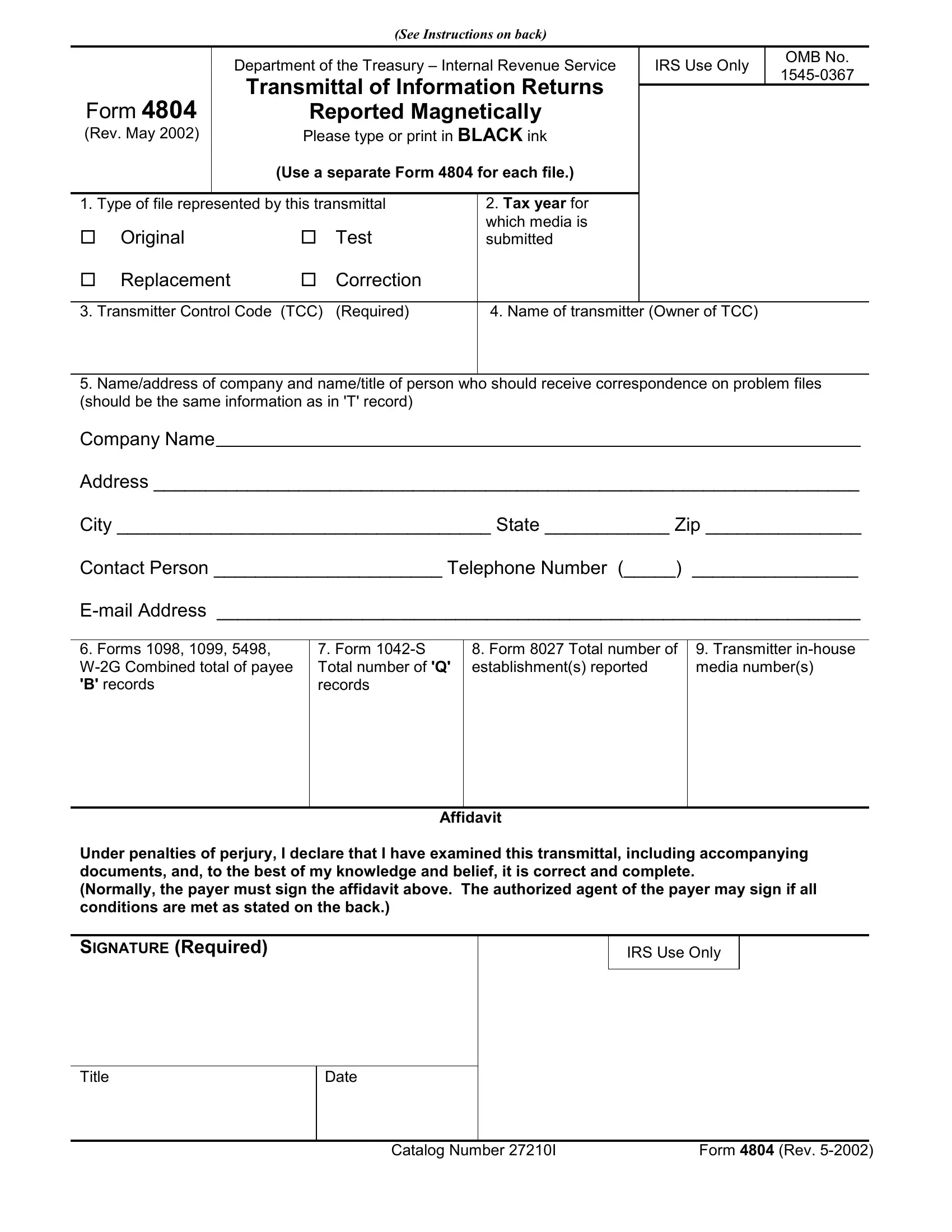

1. Begin completing your Murall with a number of essential blank fields. Gather all of the required information and make sure absolutely nothing is forgotten!

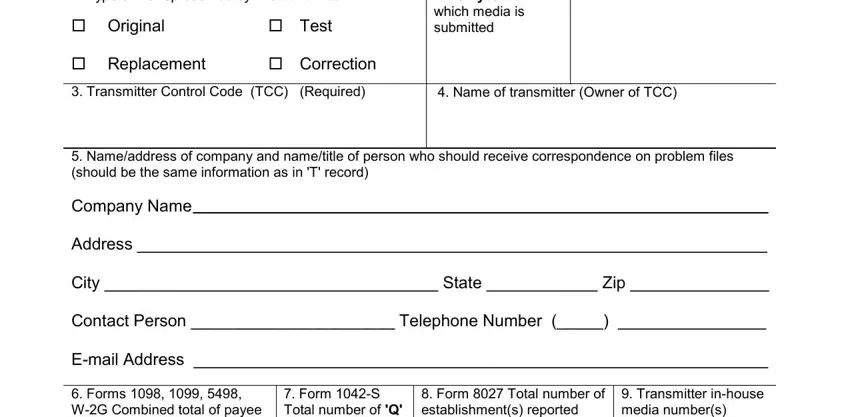

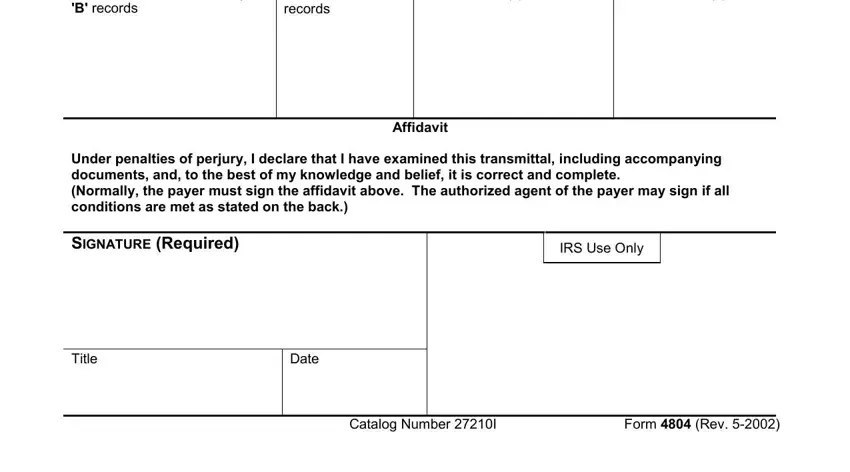

2. Once the last part is completed, go on to type in the relevant details in all these: Transmitter Control Code TCC, Form Total number of, Form S Total number of Q records, Transmitter inhouse media numbers, Affidavit, Under penalties of perjury I, IRS Use Only, Title, Date, and Catalog Number I Form Rev.

It is possible to get it wrong while filling in the Date, thus you'll want to go through it again prior to deciding to send it in.

Step 3: Prior to submitting this document, ensure that all form fields are filled in correctly. The moment you believe it's all good, click “Done." After registering a7-day free trial account here, it will be possible to download Murall or send it through email without delay. The file will also be at your disposal in your personal cabinet with your each and every edit. If you use FormsPal, you can complete forms without needing to get worried about data leaks or data entries getting shared. Our secure software ensures that your private details are kept safely.