Handling PDF forms online is easy with our PDF tool. Anyone can fill in Form 4835 here painlessly. Our tool is constantly developing to provide the very best user experience attainable, and that is due to our resolve for continuous improvement and listening closely to testimonials. It just takes a few simple steps:

Step 1: First of all, open the pdf tool by pressing the "Get Form Button" above on this site.

Step 2: This tool helps you customize PDF forms in various ways. Modify it by writing personalized text, correct original content, and put in a signature - all readily available!

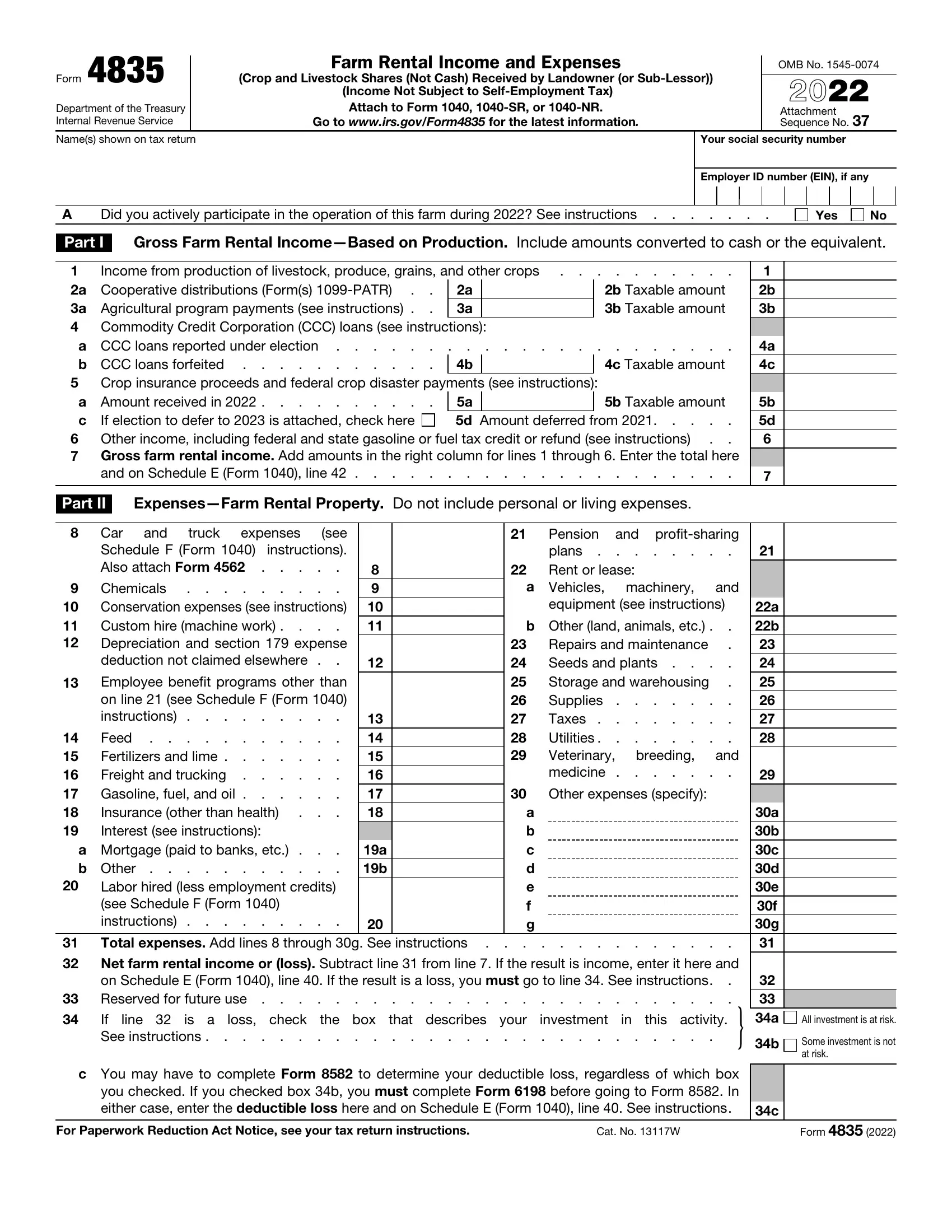

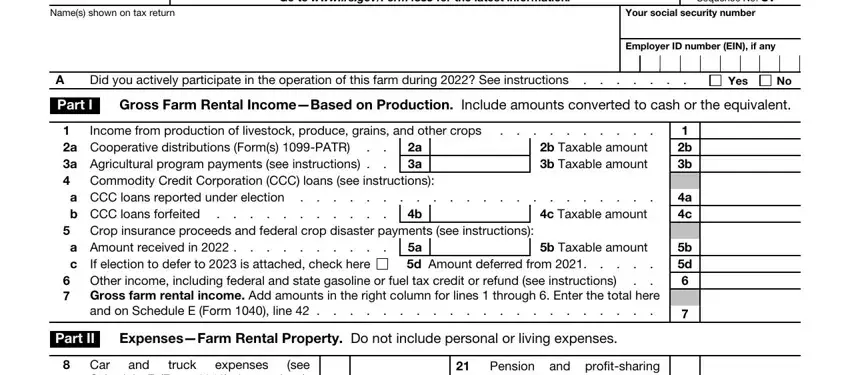

When it comes to fields of this specific form, here's what you should know:

1. When completing the Form 4835, make sure to complete all of the necessary fields within the associated section. This will help facilitate the process, allowing for your details to be handled promptly and accurately.

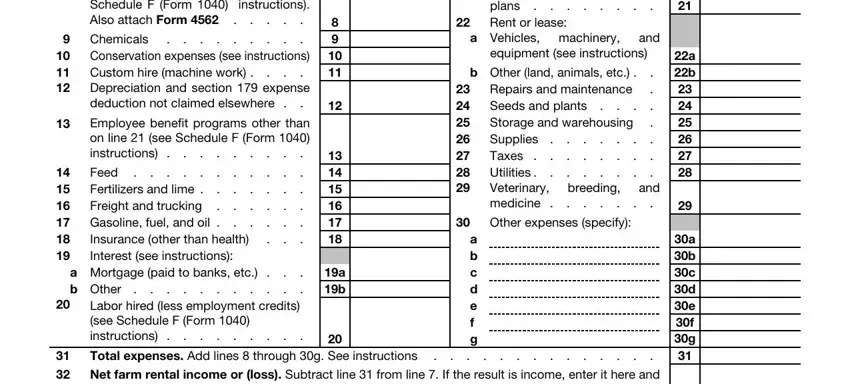

2. Once your current task is complete, take the next step – fill out all of these fields - Car see Schedule F Form, Chemicals, Conservation expenses see, Custom hire machine work, Depreciation and section expense, Employee benefit programs other, Feed Fertilizers and lime, Gasoline fuel and oil, Insurance other than health, a Mortgage paid to banks etc b, Labor hired less employment, a b, Total expenses Add lines through, Pension and profitsharing plans, and Rent or lease with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Be really careful while filling out a b and Rent or lease, since this is the part in which a lot of people make errors.

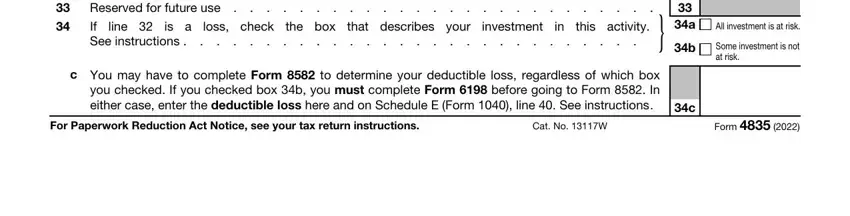

3. This 3rd segment is relatively simple, on Schedule E Form line If the, Reserved for future use, line, If See instructions, is a, loss check, the box, that describes your, investment, this activity, All investment is at risk, Some investment is not at risk, c You may have to complete Form, For Paperwork Reduction Act Notice, and Cat No W - all these fields has to be filled out here.

Step 3: Soon after double-checking your form fields you have filled in, press "Done" and you are good to go! After setting up a7-day free trial account here, you'll be able to download Form 4835 or send it via email right off. The PDF file will also be accessible through your personal cabinet with your each and every change. With FormsPal, you'll be able to fill out forms without being concerned about data incidents or entries being shared. Our secure system ensures that your private details are kept safe.