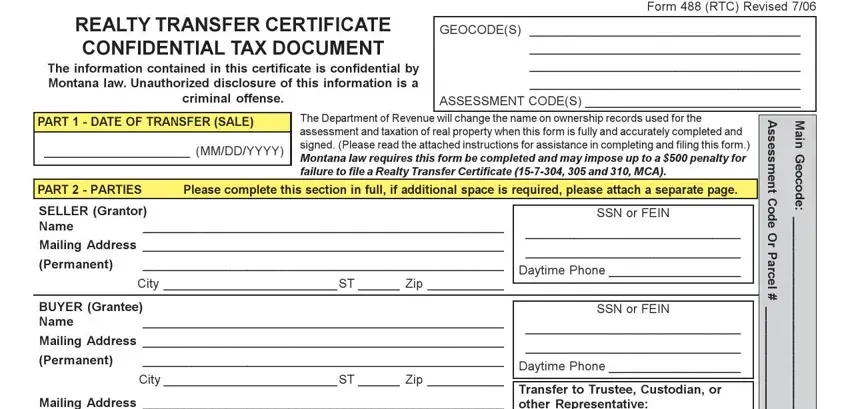

FORM 488(RTC)REVISED 7/06

REALTYTRANSFERCERTIFICATE

CONFIDENTIAL TAX DOCUMENT

WHO MUST FILE: Any party transferring real property regardless of whether the transfer is or is not evidenced by deed or instrument or any party presenting an instrument or deed evidencing a transfer of real estate for recordation. Real estate includes land, growing timber, buildings, structures, fixtures, fences, and improvements affixed to land.

YOU MAY OWE INCOME TAXES: Any gain on this transfer is Montana source income and should be reported to the Department of Revenue on the appropriate income tax return.

WHEN AND WHERE TO FILE:

The completed Realty Transfer Certificate must be filed with the County Clerk & Recorder when the instrument or deed evidencing a transfer of real estate is presented for recording.

If the transfer is by operation of law, then a Realty Transfer Certificate with the required supporting documentation should be filed with the local Department of Revenue Office where the property is located. Please see Part 4 for further detailed information.

The Department of Revenue will change the ownership record when this form is fully and accurately completed and signed.

PART 1 – DATE OF TRANSFER (SALE)

This should be the date on which the instrument or deed was executed (the date the instrument or deed was signed by the Seller (Grantor) and Buyer (Grantee) unless otherwise specified in the deed or date of decedent’s death). Contracts for Deed and Notices of Purchaser’s Interest should use the date the contract or notice was initially signed, not the date the contract was finalized.

PART 2 – PARTIES

Seller (Grantor)/ Buyer (Grantee): Enter the names of the seller (grantor) and buyer (grantee) exactly as they appear on the transferring document. Business organizations, corporations, trusts, etc. should enter their name(s) exactly as it appears on the transferring document.

Addresses: For the seller (grantor) enter the current mailing address. For the buyer (grantee) enter the permanent mailing address. If the tax notice is to be sent to a different mailing address, please complete the additional mailing information.

SSN or FEIN: For individuals, list the social security number of all legal owners named in the transferring document. Business organizations, corporations, trusts, etc. list the federal ID number(s) of the legal entity(ies) named in the transferring document, § 15-1- 301, MCA and 42 USC § 405(c)(2)(C)(i)(iv). The Department of Revenue utilizes personal identification numbers to cross match Realty Transfer Certificates with income tax returns to ascertain taxpayer compliance on gains from real estate sales or transfers and to identify delinquent taxpayers. Additional SSN or FEIN numbers may be provided on an attachment.

Daytime Phone: Enter phone numbers for both the seller (grantor) and buyer (grantee).

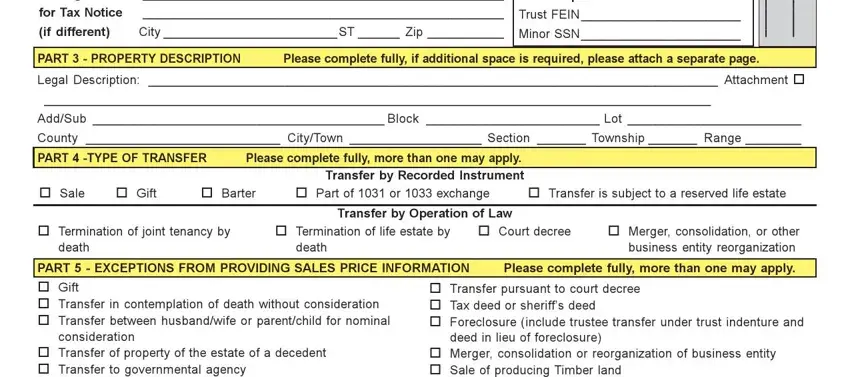

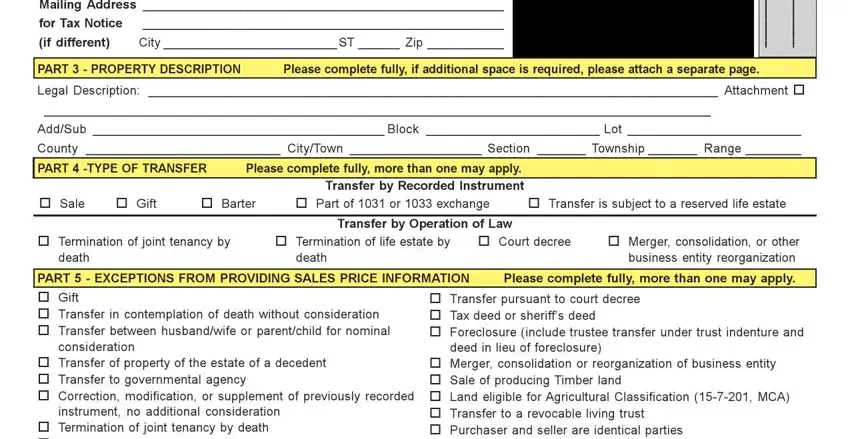

PART 3 – PROPERTY DESCRIPTION

This section identifies the parcel that is being transferred by location and is the legal description found on the instrument or deed conveying the real estate or the abstract to the real estate.

The property description may be provided on an attachment, and be identified by checking the applicable box.

PART 4 – TYPE OF TRANSFER (Please refer to “When and Where to File” above.)

Transfer by Recorded Instrument: Check the box(es) that apply to the type of transfer for which an instrument has been recorded with the County Clerk and Recorder.

Transfer by Operation of Law: Check the box(es) that apply to the type of transfer. A copy of the following applicable documentation must be attached to the Realty Transfer Certificate.

•Termination of Joint Tenancy by Death – death certificate and deed that created the joint tenancy with right of survivorship.

•Court Decree -

•Personal Representative, Special Administrator or Public Administrator – death certificate, order of appointment and letters of administration and an affidavit that their appointment has not been terminated.

•Conservator – Order of Appointment and letter of conservatorship or copy of the order terminating the conservatorship.

•Merger, consolidation or other business reorganization – plan of reorganization.

•Name change only – documents filed with the Secretary of State to accomplish the name change.

PART 5 – EXCEPTION FROM PROVIDING SALES PRICE INFORMATION

If any of the exceptions listed apply to this transfer, please check the appropriate line and do not complete Section 6. If you are unsure whether this transaction should be defined as an exception, or if you have any other questions concerning exception status, please request a determination from your local Department of Revenue Office.

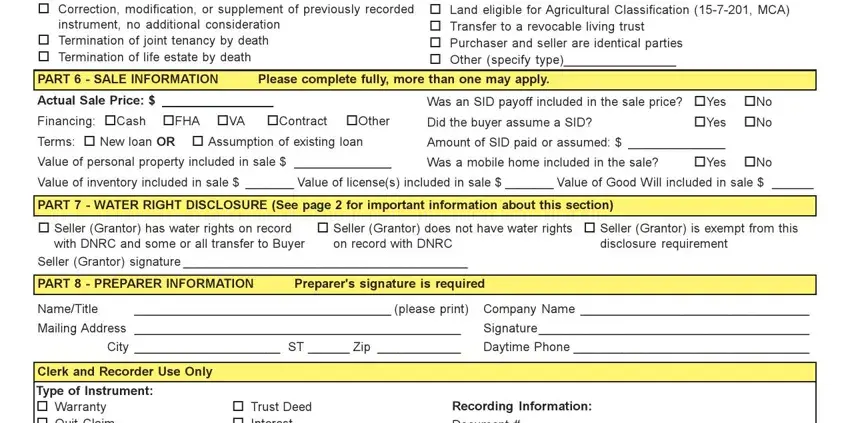

PART 6 – SALE INFORMATION (If there is no exception checked in Part 5, you must complete this section.)

CONFIDENTIALITY: Sale information is confidential and only for official use by the Department of Revenue.

Enter the total purchase price paid for the sale parcel. This should include cash, mortgages, property traded, liabilities assumed, leases, easements and personal property.

Financing: if you paid cash for the entire sale parcel, check the box in front of Cash. If you financed the property by receiving a loan indicate the type by checking the appropriate box; Federal Housing Administration (FHA) Loan, Veterans Administration (VA) Loan or Conventional. If this was a contract for deed or trust indenture, indicate by checking the box in front of Contract. If there was some other type of financing used such as a Montana Board of Housing Loan, trade of property, etc. please indicate by checking the box in front of Other. Also, indicate whether this was a new loan or an assumption of an existing loan.

Personal Property: Enter the dollar amount of any personal property included with the sale of this parcel. Personal property includes furniture and fixtures, business and farm equipment, livestock, recreational vehicles, leases and easements, and mobile homes. Anything that is permanently attached to the real estate should not be included. Negligible personal property included in a residential sale need not be reported.

SID (Special Improvement District – liens levied against the property for amenities like street paving, sewers, water systems, etc.): Please answer the questions by checking the appropriate boxes, also include the amount of the SID paid or assumed.

Value of Inventory: Please provide the value of any business inventory that was included in the sales price.

Value of Licenses: Please provide the value of any licenses included in the sales price i.e. liquor licenses, gambling licenses, etc.

Value of Good Will: Please provide the value of Good Will included in the sale price. (Good Will is defined as “the economic advantage over competitors that a business has acquired by virtue of habitual patronage of customers”.)

PART 7 – WATER RIGHTS DISCLOSURE – This disclosure must be completed and signed by the seller or the seller’s legally appointed agent. Refer to the back of this page (page 2) for further information about the disclosure.

PART 8 – PREPARER INFORMATION

All Realty Transfer Certificates must be signed and dated by the preparer. By his/her signature the preparer indicates the information provided is true and correct to the best of his/her knowledge, that the seller (grantor) and the buyer (grantee) have examined the completed Realty Transfer Certificate and agree the information contained within is correct and accurate.