Handling PDF documents online is always a piece of cake using our PDF tool. Anyone can fill out correction in pan card form 49a here within minutes. FormsPal development team is constantly working to develop the editor and enable it to be even better for people with its multiple features. Enjoy an ever-improving experience today! By taking several basic steps, you can begin your PDF journey:

Step 1: Access the PDF inside our tool by clicking the "Get Form Button" in the top area of this page.

Step 2: With the help of our handy PDF editing tool, you'll be able to accomplish more than simply fill out blank form fields. Try all of the features and make your documents appear perfect with customized text added, or fine-tune the file's original content to excellence - all backed up by an ability to incorporate stunning pictures and sign the document off.

Completing this form requires focus on details. Make sure all mandatory blank fields are done properly.

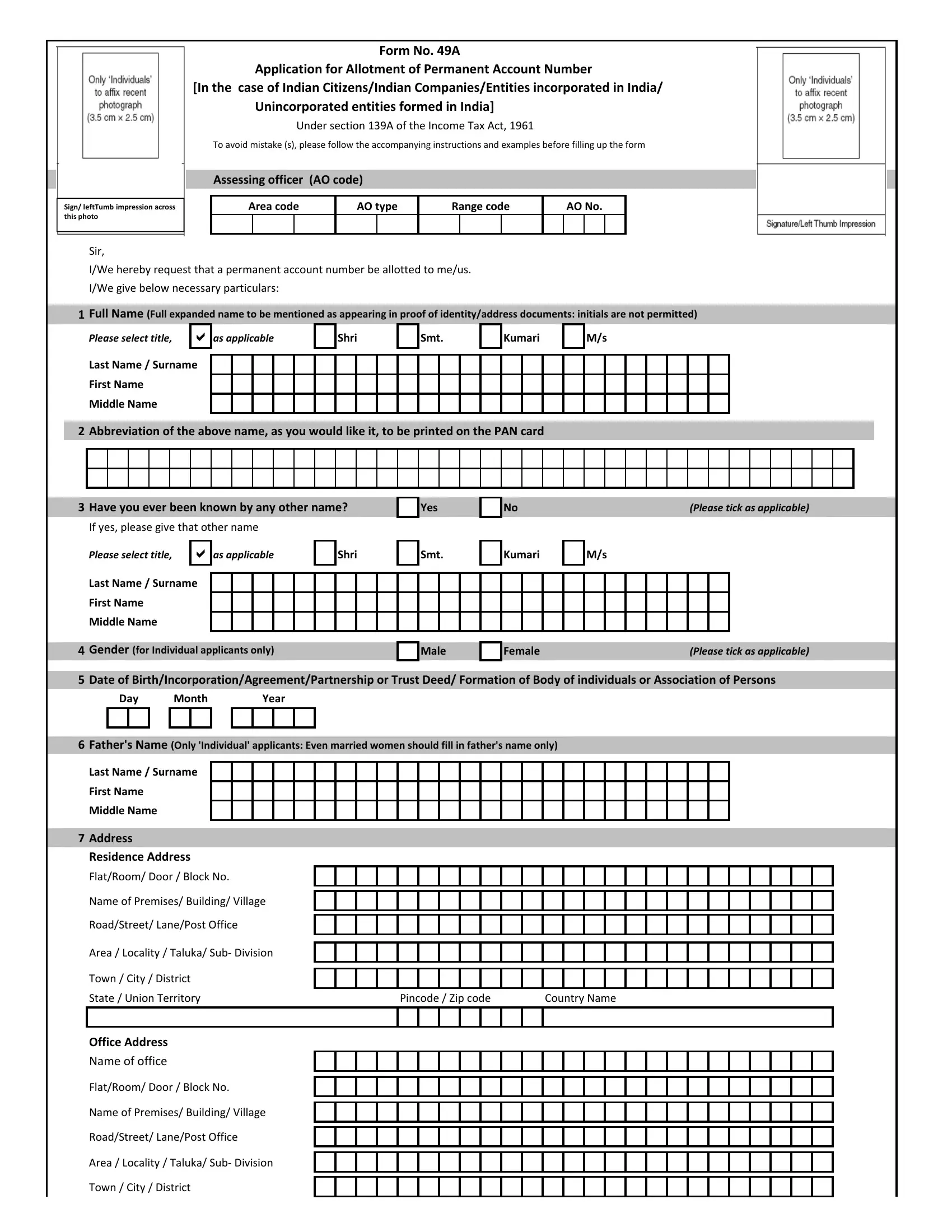

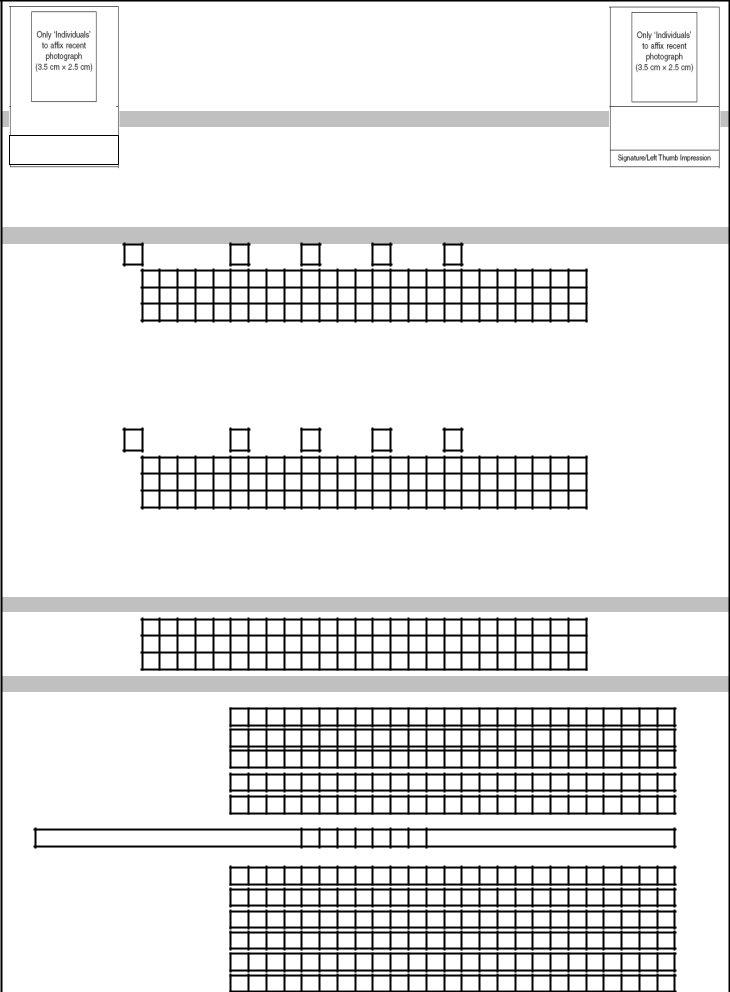

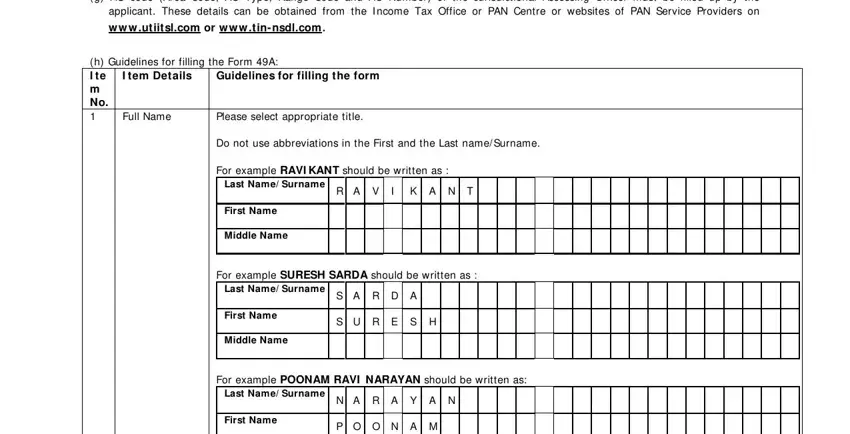

1. To get started, when filling out the correction in pan card form 49a, start with the area that has the subsequent blank fields:

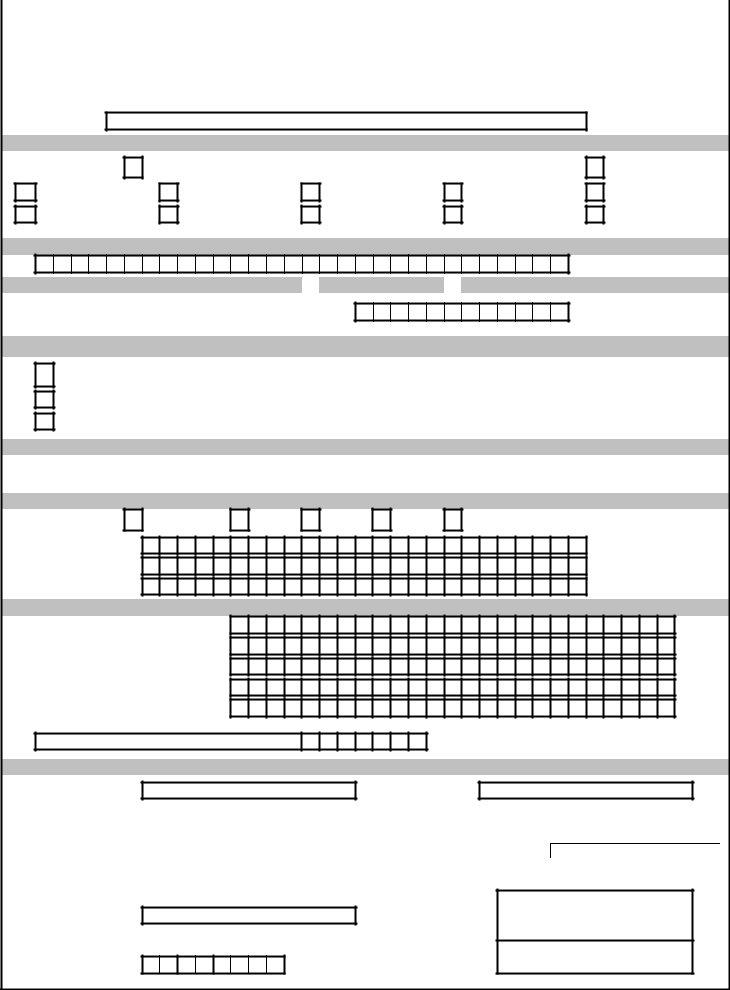

2. When the previous section is complete, you're ready insert the required details in the, I ncome, Tax, from, or TI NFacilitation CentresTI, w w incometaxindiagovin, be paid by applicant, Department, website w, c Those already allotted a ten, However request for a new PAN card, d Applicant will receive an, number can be used for tracking, e For more information, and Website Call Center Email ID allowing you to go to the third part.

It is possible to make errors while filling in the from, therefore make sure you look again prior to when you submit it.

Step 3: Prior to obtaining the next stage, ensure that all blank fields were filled in correctly. Once you confirm that it's good, click on “Done." Acquire your correction in pan card form 49a as soon as you register at FormsPal for a 7-day free trial. Easily gain access to the pdf form from your FormsPal account page, together with any modifications and changes conveniently kept! Whenever you work with FormsPal, you'll be able to fill out forms without having to be concerned about database leaks or records being shared. Our protected system ensures that your personal data is maintained safe.