It is possible to fill in Form 500 Nol easily with the help of our PDFinity® editor. To make our tool better and more convenient to utilize, we consistently come up with new features, with our users' suggestions in mind. Here's what you'd want to do to start:

Step 1: First of all, access the pdf tool by pressing the "Get Form Button" above on this site.

Step 2: With our advanced PDF editor, you're able to accomplish more than just complete forms. Express yourself and make your docs seem high-quality with custom textual content incorporated, or fine-tune the original input to perfection - all that comes along with an ability to incorporate any graphics and sign the file off.

This form will involve some specific details; in order to ensure correctness, be sure to take heed of the subsequent tips:

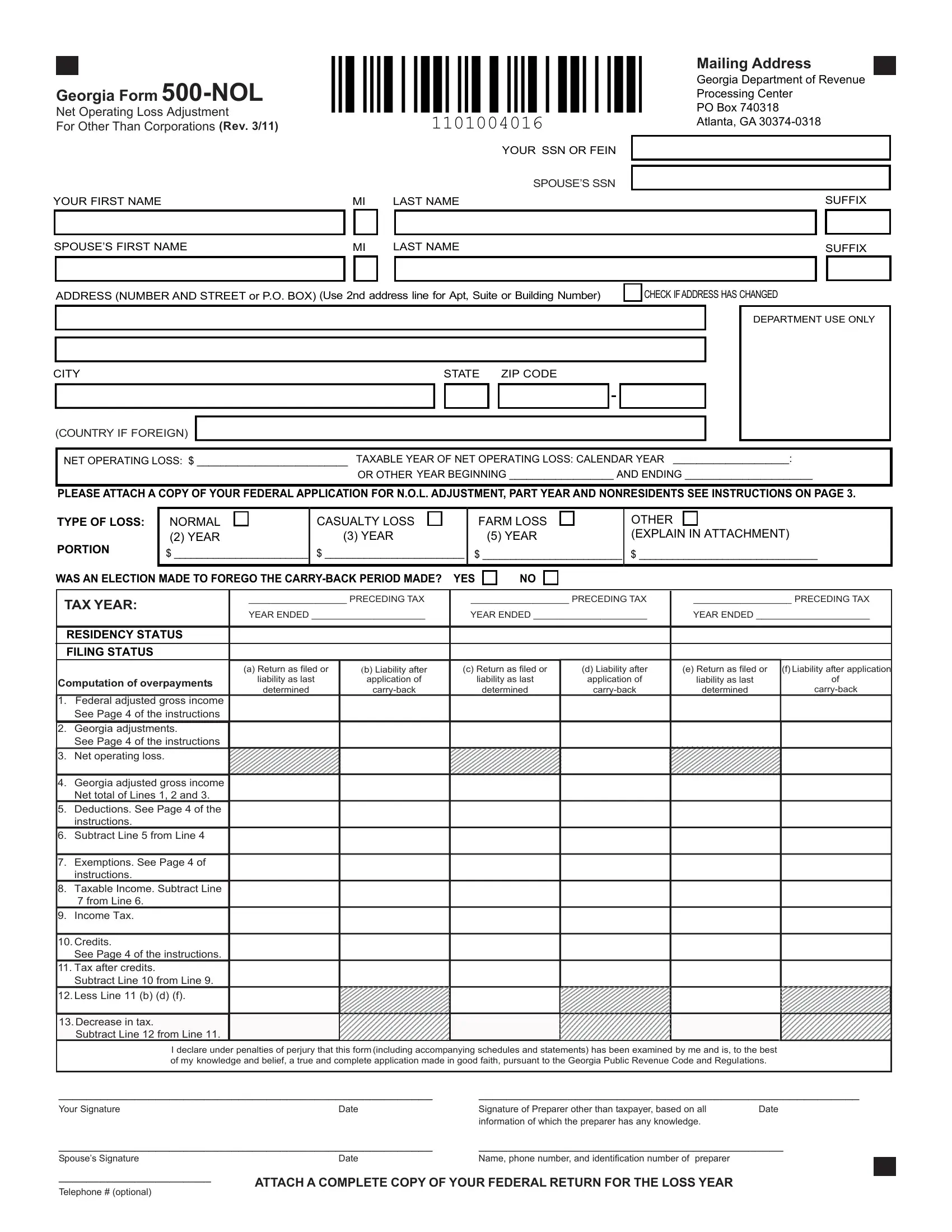

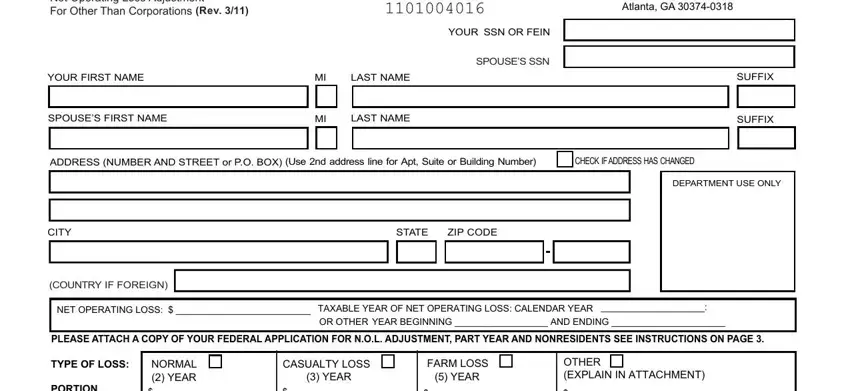

1. The Form 500 Nol needs specific information to be typed in. Make certain the following fields are complete:

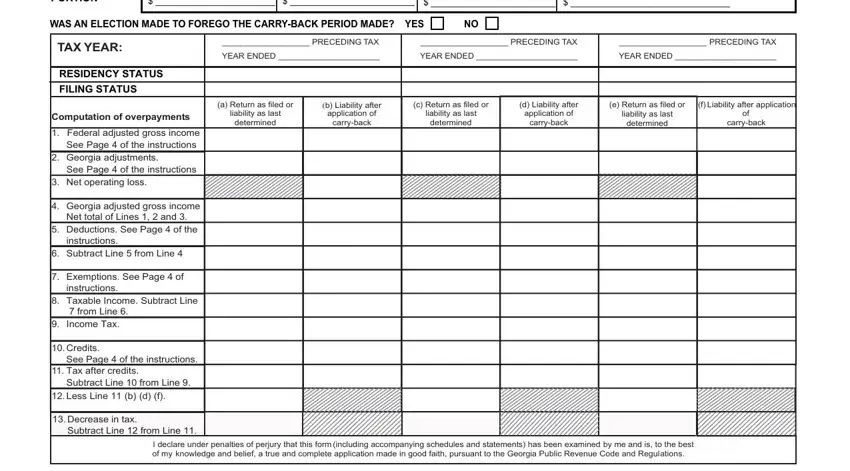

2. Once your current task is complete, take the next step – fill out all of these fields - PORTION, WAS AN ELECTION MADE TO FOREGO THE, PRECEDING TAX, PRECEDING TAX, PRECEDING TAX, YEAR ENDED, YEAR ENDED, YEAR ENDED, a Return as filed or, liability as last, determined, b Liability after, application of, carryback, and c Return as filed or with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

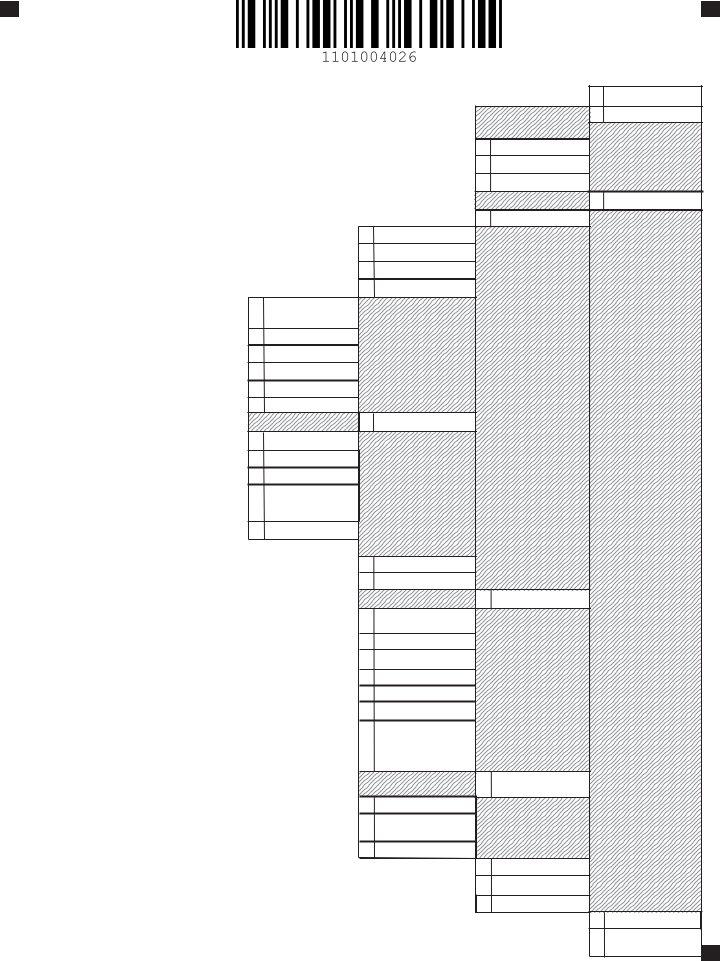

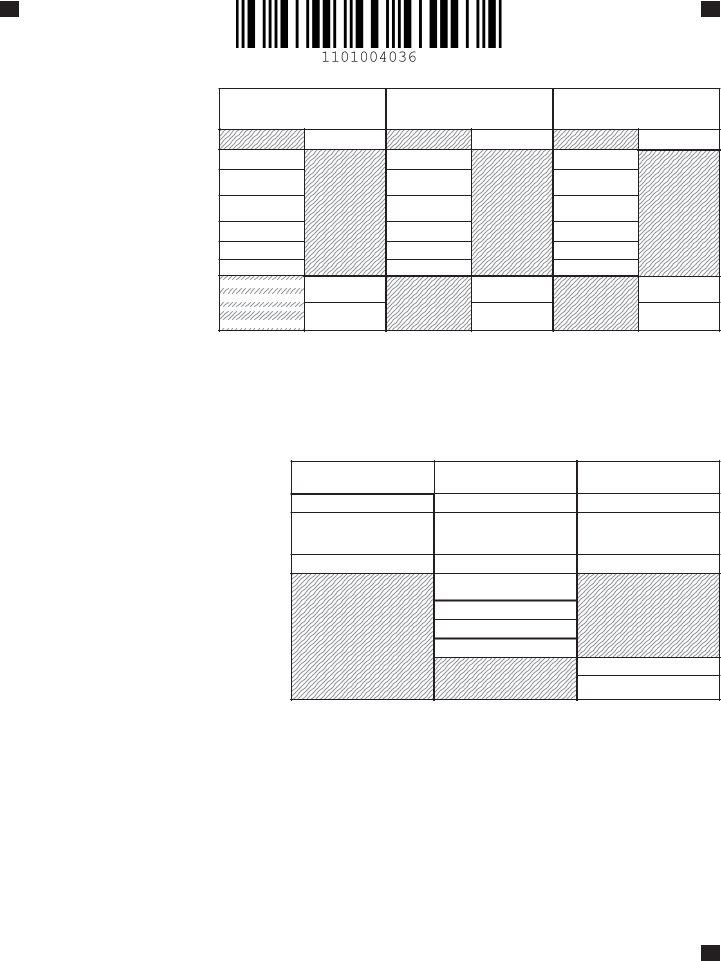

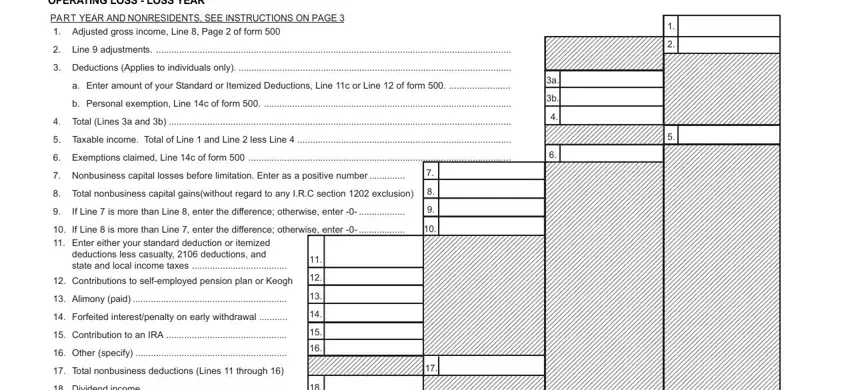

3. Completing COMPUTATION OF NET OPERATING LOSS, PART YEAR AND NONRESIDENTS SEE, Line adjustments, Deductions Applies to individuals, a Enter amount of your Standard or, b Personal exemption Line c of, Total Lines a and b, Taxable income Total of Line and, Exemptions claimed Line c of form, Nonbusiness capital losses before, Total nonbusiness capital, If Line is more than Line enter, If Line is more than Line enter, Enter either your standard, and Contributions to selfemployed is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

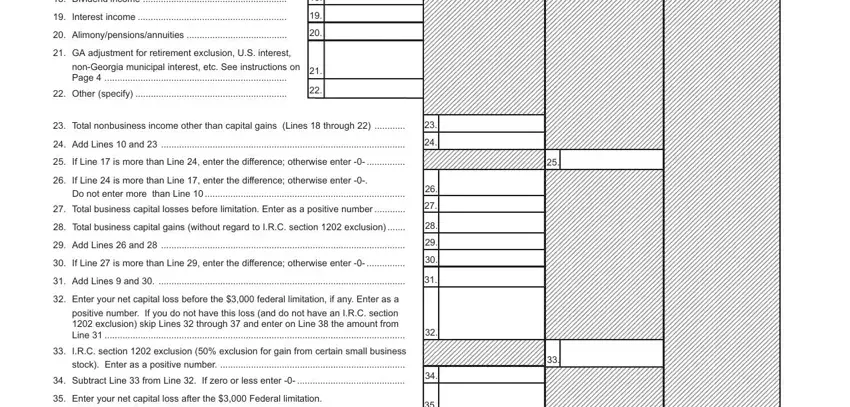

4. This next section requires some additional information. Ensure you complete all the necessary fields - Dividend income, Interest income, Alimonypensionsannuities, GA adjustment for retirement, nonGeorgia municipal interest etc, Other specify, Total nonbusiness income other, Add Lines and, If Line is more than Line enter, If Line is more than Line enter, Total business capital losses, Total business capital gains, Add Lines and, If Line is more than Line enter, and Add Lines and - to proceed further in your process!

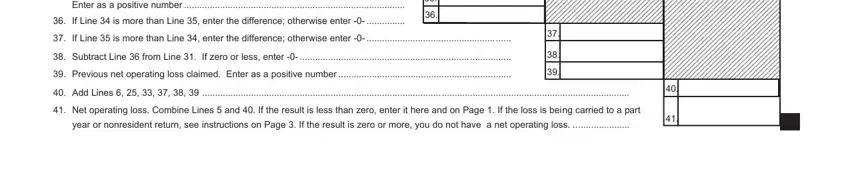

5. This document needs to be completed by filling in this area. Further you can see a detailed listing of form fields that need accurate information for your document usage to be accomplished: Enter as a positive number, If Line is more than Line enter, If Line is more than Line enter, Subtract Line from Line, If zero or less enter, Previous net operating loss, Add Lines, Net operating loss Combine Lines, and year or nonresident return see.

Always be really attentive when filling in Subtract Line from Line and If Line is more than Line enter, since this is the section where a lot of people make some mistakes.

Step 3: Make sure the details are accurate and just click "Done" to complete the project. Join FormsPal now and immediately obtain Form 500 Nol, set for download. All changes made by you are saved , allowing you to edit the pdf further when required. FormsPal offers risk-free form completion without personal information record-keeping or any sort of sharing. Feel at ease knowing that your information is secure with us!