If you need to fill out Form 502Su, it's not necessary to install any applications - simply use our online PDF editor. Our development team is always working to develop the tool and insure that it is even faster for clients with its multiple features. Enjoy an ever-improving experience today! To get the ball rolling, take these basic steps:

Step 1: Click on the "Get Form" button above. It'll open up our pdf editor so that you could start filling in your form.

Step 2: As soon as you launch the tool, you will notice the document prepared to be filled out. In addition to filling in different blanks, you could also do many other actions with the Document, including adding custom textual content, modifying the initial textual content, adding images, signing the PDF, and much more.

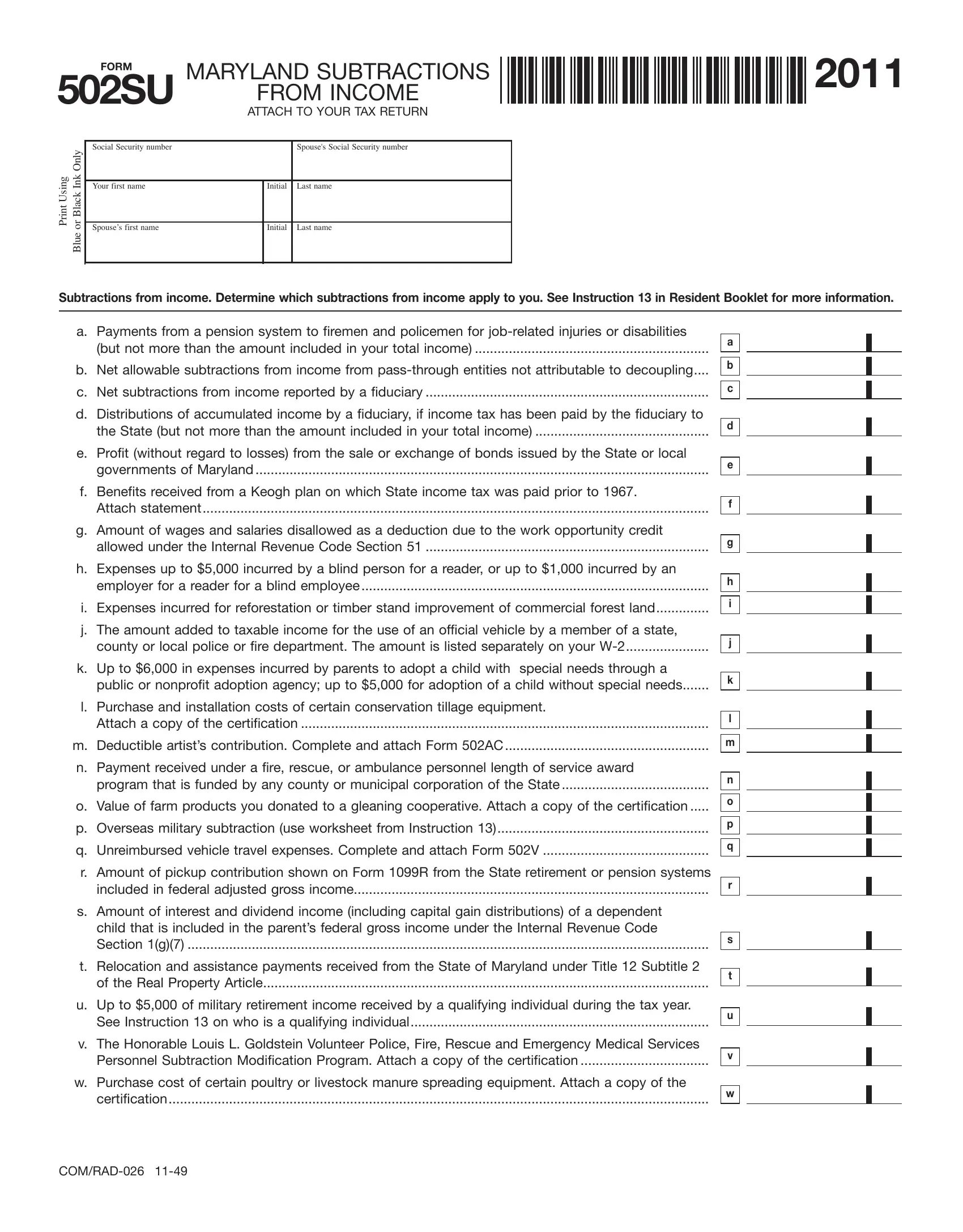

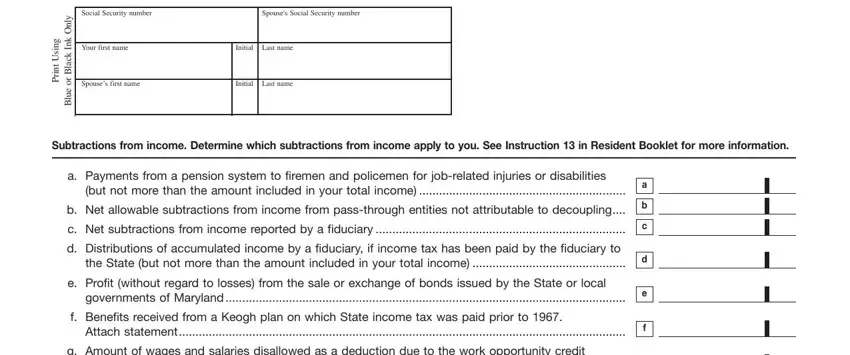

For you to finalize this PDF form, be sure to provide the required information in each and every field:

1. It is recommended to complete the Form 502Su properly, therefore be mindful while filling out the parts comprising these specific blank fields:

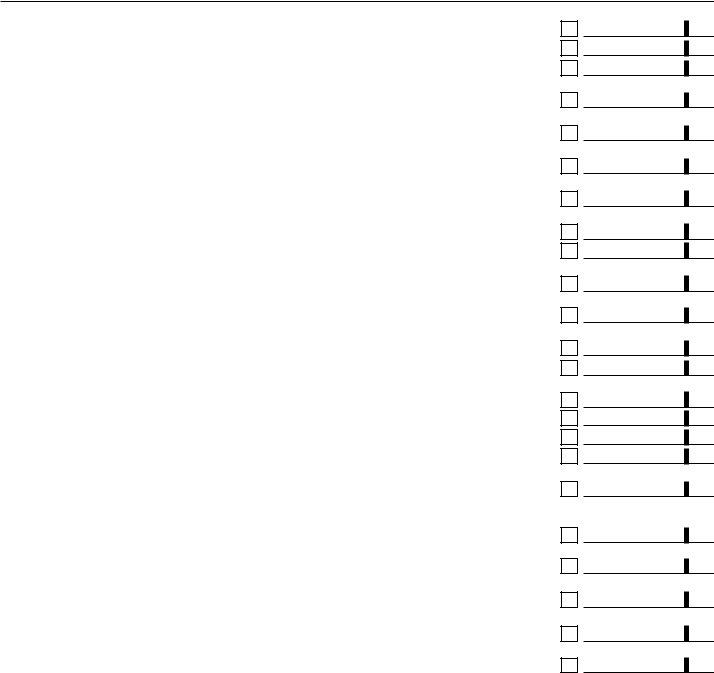

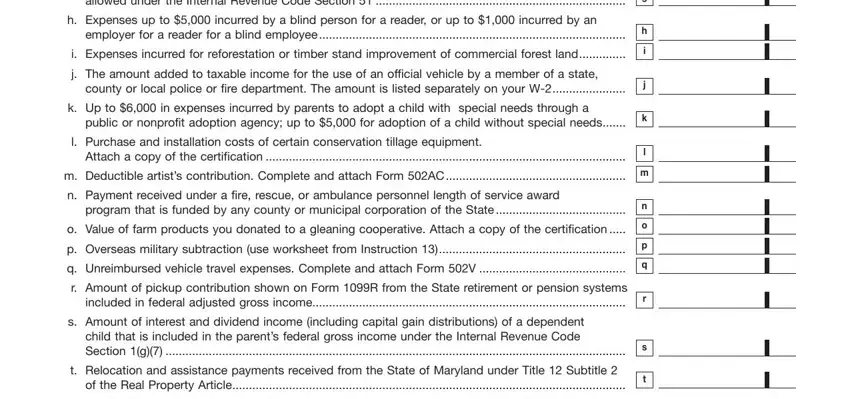

2. Once your current task is complete, take the next step – fill out all of these fields - allowed under the Internal Revenue, h Expenses up to incurred by a, employer for a reader for a blind, i Expenses incurred for, j The amount added to taxable, county or local police or fire, k Up to in expenses incurred by, public or nonprofit adoption, l Purchase and installation costs, Attach a copy of the certification, m Deductible artists contribution, n Payment received under a fire, program that is funded by any, o Value of farm products you, and p Overseas military subtraction with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

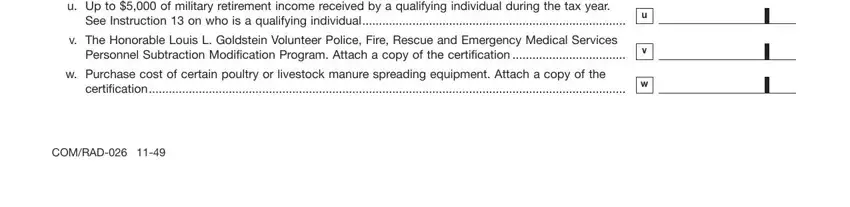

3. This third part is considered rather easy, u Up to of military retirement, See Instruction on who is a, v The Honorable Louis L Goldstein, w Purchase cost of certain poultry, certification, and COMRAD - all these form fields will have to be completed here.

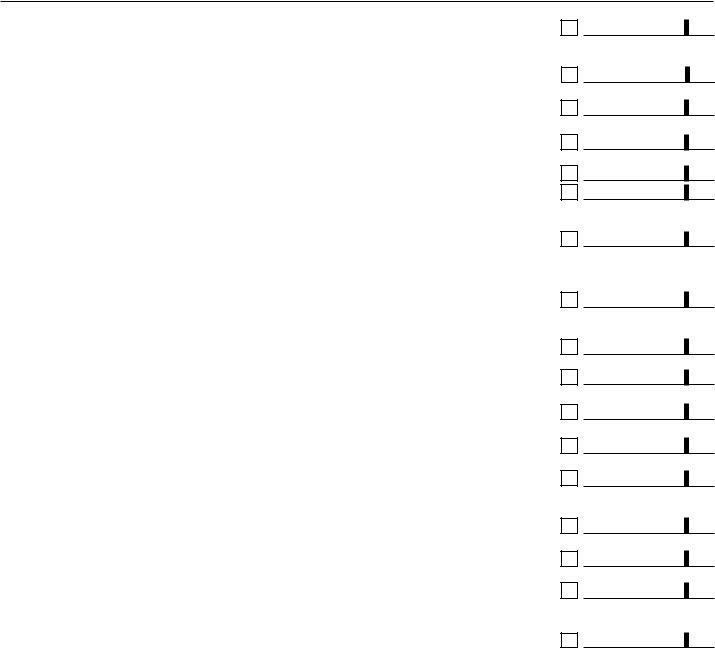

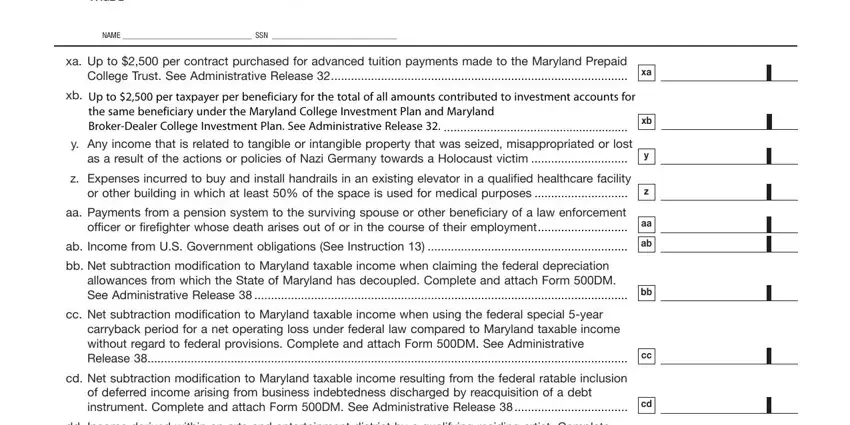

4. To move ahead, this next stage involves filling out several blank fields. These comprise of PAGE, ATTACH TO YOUR TAX RETURN, NAME SSN, xa Up to per contract purchased, Up to per taxpayer per, y Any income that is related to, as a result of the actions or, z Expenses incurred to buy and, or other building in which at, aa Payments from a pension system, ab Income from US Government, bb Net subtraction modification to, allowances from which the State of, cc Net subtraction modification to, and carryback period for a net, which you'll find integral to carrying on with this particular process.

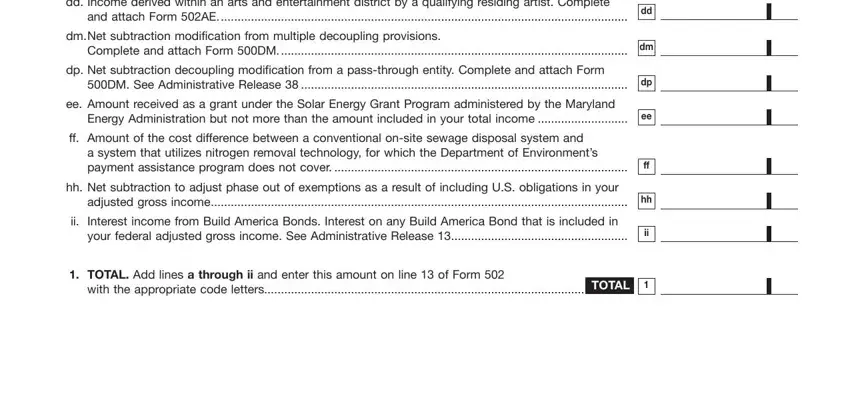

5. The form needs to be concluded with this section. Below there's a full listing of fields that require correct details to allow your form usage to be complete: dd Income derived within an arts, and attach Form AE, dm Net subtraction modification, Complete and attach Form DM, dp Net subtraction decoupling, DM See Administrative Release, ee Amount received as a grant, Energy Administration but not more, ff Amount of the cost difference, a system that utilizes nitrogen, hh Net subtraction to adjust phase, ii Interest income from Build, your federal adjusted gross income, TOTAL Add lines a through ii and, and with the appropriate code.

Be very attentive when completing dd Income derived within an arts and Complete and attach Form DM, since this is where most users make mistakes.

Step 3: Go through the details you've typed into the blanks and then press the "Done" button. Find the Form 502Su as soon as you register online for a free trial. Immediately view the pdf file within your personal cabinet, together with any modifications and changes automatically saved! FormsPal offers risk-free form editing with no personal information recording or distributing. Feel at ease knowing that your information is safe here!