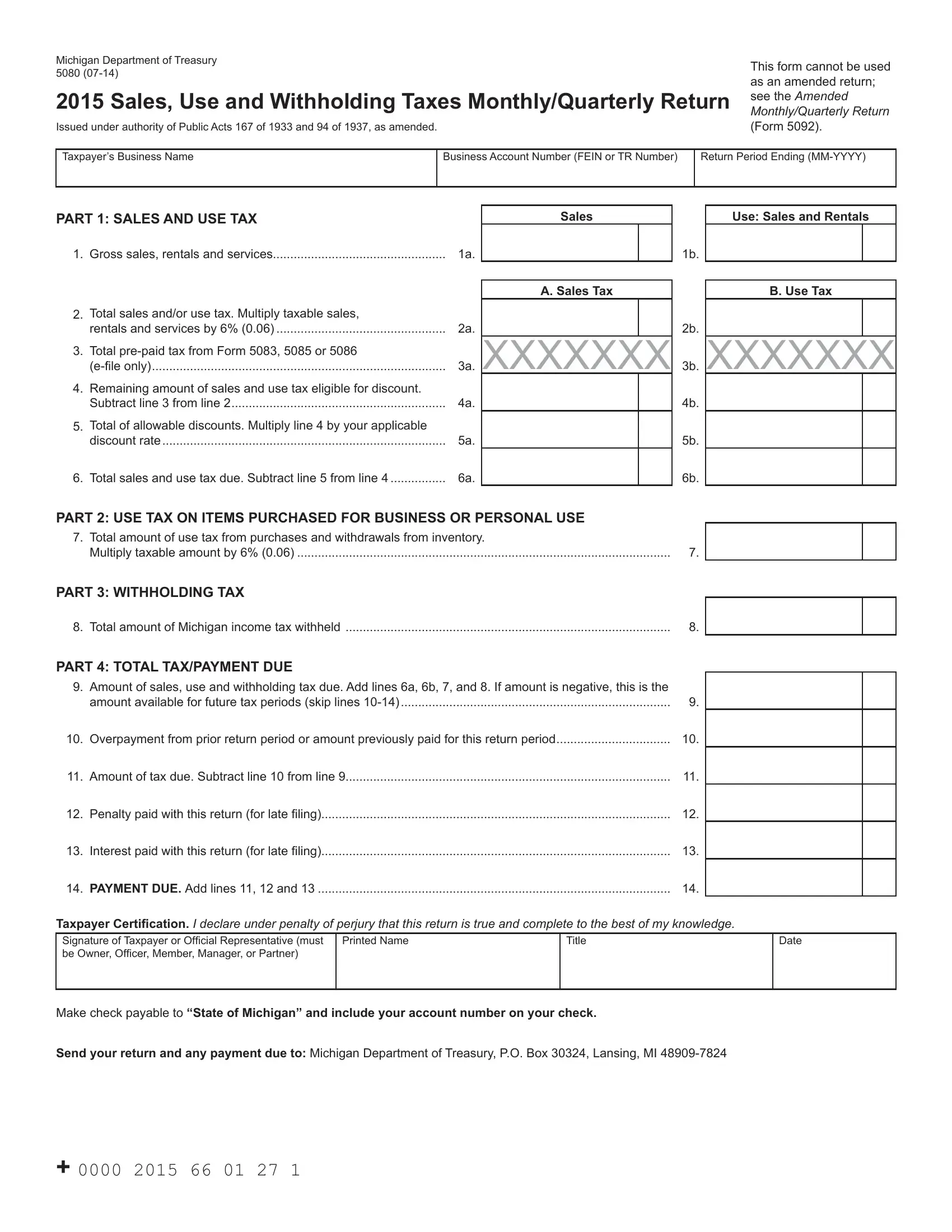

IMPORTANT: This is a return for Sales Tax, Use Tax, and/ or Withholding Tax. If the taxpayer inserts a zero on (or leaves blank) any line for reporting Sales Tax, Use Tax, or Withholding Tax, the taxpayer is certifying that no tax is owed for that tax type. If it is determined that tax is owed, the taxpayer will be liable for the deficiency as well as penalty and interest.

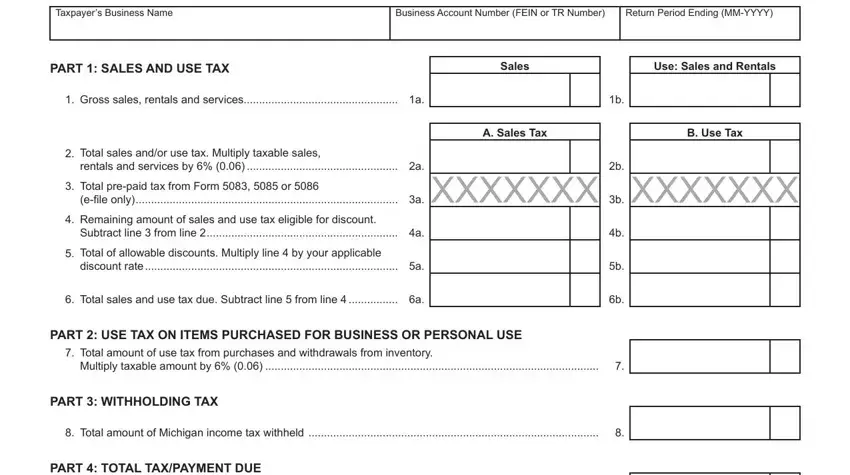

PaRT 1: SaleS and USe Tax

Line 1a: Total gross sales for tax period being reported. Enter the total of your Michigan sales of tangible personal property including cash, credit and installment transactions and any costs incurred before ownership of the property is transferred to the buyer (including shipping, handling, and delivery charges).

Line 1b: This line is used to report the following:

•Out-of-state retailers who do not have retail stores in Michigan: Enter total sales of tangible personal property including cash, credit, and installment transactions.

•Lessors of tangible personal property: Enter amount of total rental receipts.

•Persons providing accommodations: This would include but not limited to hotel, motel, and vacation home rentals. This also includes assessments imposed under the Convention and Tourism Act, the Convention Facility Development Act, the Regional Tourism Marketing Act, the Community Convention or Tourism Marketing Act.

•Telecommunications Services: Enter gross income from telecommunications services.

Line 2a: Total sales tax. Negative figures are not allowed or valid.

Line 2b: Total use tax. Negative figures not allowed or valid.

Line 5: Enter total allowable discounts. Discounts apply only to 2/3 (0.6667) of the sales and/or use tax collected at the 6 percent tax rate. See below to calculate your discount based on filing frequency:

Monthly Filer

•If the tax is less than $9, calculate the discount by multiplying the tax by 2/3 (.6667).

•Enter $6 if tax is $9 to $1,200 and paid by the 12th, or $9 to $1,800 and paid by the 20th .

•If the tax is more than $1,200 and paid by the 12th,

calculate discount using this formula: (Tax x .6667 x .0075). The maximum discount is $20,000 for the tax period.

•If the tax is more than $1,800 and paid by the 20th,

calculate discount using this formula: (Tax x .6667 x .005). The maximum discount is $15,000 for the tax period.

Quarterly Filer

•If the tax is less than $27, calculate the discount by multiplying the tax by 2/3 (.6667)

•Enter $18 if tax is $27 to $3,600 and paid by the 12th, or $27 to $5,400 and paid by the 20th.

•If the tax is more than $3,600 and paid by the 12th,

calculate discount using this formula: (Tax x .6667 x .0075). The maximum discount is $20,000 for the tax period.

•If the tax is more than $5,400 and paid by the 20th,

calculate discount using this formula: (Tax x .6667 x .005). The maximum discount is $15,000 for the tax period.

Accelerated Filer

•If the tax is paid by the 20th, calculate discount using this formula: (Tax x .6667 x .005). No maximum discount applies.

PaRT 2: USe Tax on ITeMS PURchaSed foR BUSIneSS oR PeRSonal USe

Line 7: To determine your use tax due from purchases and withdrawals, multiply the total amount of your inventory value by 6% (0.06) and enter here.

PaRT 3: WIThholdIng Tax

Line 8: Enter the total Michigan income tax withheld for the tax period.

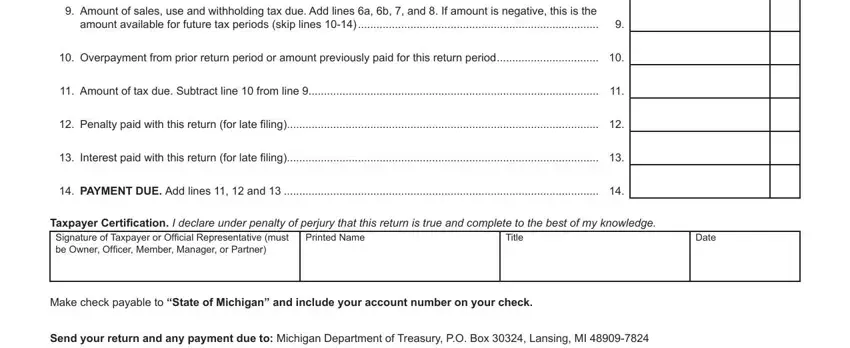

PaRT 4: ToTal Tax/PayMenT dUe

Line 9: If amount is negative, this is the amount available for

future tax periods (skip lines 10-14).

Line 10: Enter any payments you submitted for this period, prior to filing the return. If you are using an overpayment from a previous period only enter the amount needed to pay the total liability for this return. In the event an overpayment still exists declare it on the next return you file with a liability. (Liability minus overpayments/prior payment for this period must be greater than or equal to zero).

How to Compute Penalty and Interest

If your return is filed with additional tax due, include penalty and interest with your payment. Penalty is 5% of the tax due and increases by an additional 5% per month or fraction thereof, after the second month, to a maximum of 25%. Interest is charged daily using the average prime rate, plus 1 percent.

Refer to www.michigan.gov/taxes for current interest rate information or help in calculating late payment fees.