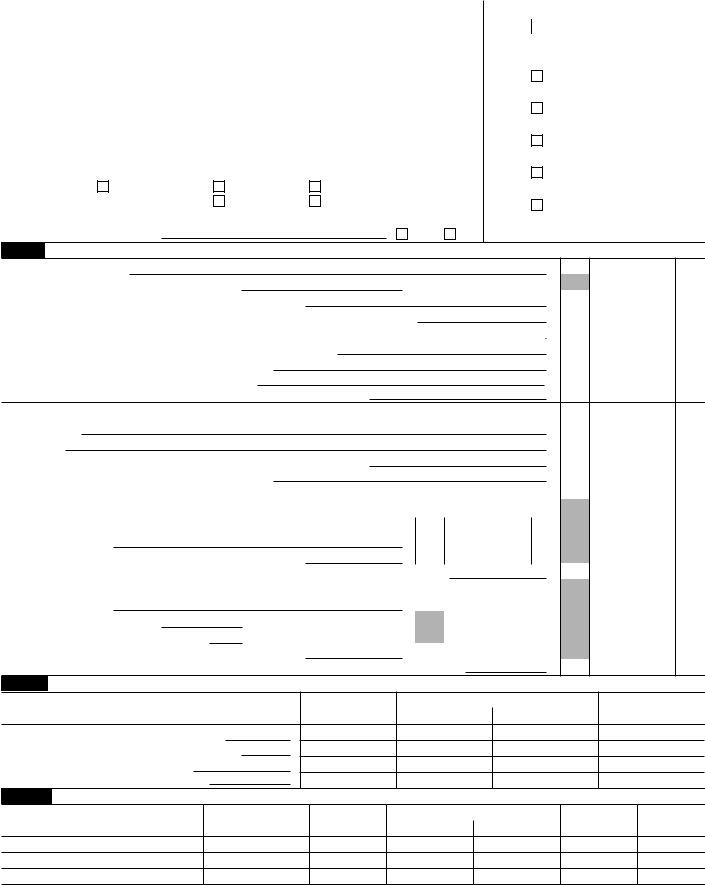

The Form 5227, titled Split-Interest Trust Information Return, serves as a critical document for managing the unique reporting requirements posed by split-interest trusts within the United States. Managed by the Department of the Treasury and overseen by the Internal Revenue Service (IRS), this form encompasses a detailed accounting of a trust's income, deductions, distributions, and balances for the tax year in question. It is meticulously designed to capture the specific data on charitable lead trusts, charitable remainder annuity trusts, charitable remainder unitrusts, pooled income funds, and other similar entities falling under section 664. The form outlines not just the ordinary income and deductions allocable to such income but extends to detail capital gains or losses alongside respective allocations. Moreover, it delves into intricacies such as the accumulation schedule for section 664 trusts, showcasing undistributed amounts from prior years alongside current tax year accumulations before any distributions. The document also probes into the distributions made over the course of the tax year, emphasizing the breakdown between beneficiaries on a granular scale. Form 5227's comprehensive approach to reporting is further exemplified in Part IV, which meticulously lays out the trust's balance sheet, capturing everything from cash and investments to liabilities and net assets. This level of detail ensures that both the IRS and the trusts involved have a clear, nuanced understanding of the financial movements and obligations affecting the charitable and financial landscape within a given tax period.

| Question | Answer |

|---|---|

| Form Name | Form 5227 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | f5227 form 5227 for 2012 |

Form 5227 |

|

|

|

|

|

|

OMB No. |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

2006 |

||||

Department of the Treasury |

|

▶ See separate instructions. |

|

|

|||||

Internal Revenue Service |

|

|

|

|

|

||||

Full name of trust |

|

|

|

|

A |

Employer identification number |

|||

|

|

|

|

|

|

|

|

|

|

Name of trustee |

|

|

|

|

B |

Type of Entity |

|||

|

|

|

|

|

|

||||

|

|

|

|

|

|

||||

Number, street, and room or suite no. (If a P.O. box, see page 3 of the instructions.) |

(1) |

Charitable lead trust |

|||||||

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

(2) |

Charitable remainder annuity trust |

|

City, state, and ZIP code |

|

|

|

|

|

described in section 664(d)(1) |

|||

|

|

|

|

|

|

|

(3) |

Charitable remainder unitrust |

|

C |

Fair market value (FMV) of assets at end of tax year |

D Date the trust was created |

|

described in section 664(d)(2) |

|||||

|

|

|

|

|

|

|

(4) |

Pooled income fund described in |

|

E |

Check applicable |

|

Initial return |

Final return |

Amended return |

|

section 642(c)(5) |

||

|

boxes (see |

|

|

|

|

||||

|

Change in trustee’s ▶ |

Name |

Address |

|

|

|

|

||

|

instructions) |

(5) |

Other |

||||||

FDid the

only)? If “Yes,” file Form 1041 |

Yes |

No |

Part I Ordinary Income (Section 664 trust only)

1 |

Interest income |

|

|

|

|

1 |

|

2a |

Qualified dividends (see instructions) |

|

2a |

|

|

|

|

|

|

|

|

|

|||

b |

Ordinary dividends (including qualified dividends) |

|

2b |

||||

3 |

Business income or (loss). Attach Schedule C or |

3 |

|||||

4 |

Rents, royalties, partnerships, other estates and trusts, etc. Attach Schedule E (Form 1040) |

4 |

|||||

5 |

Farm income or (loss). Attach Schedule F (Form 1040) |

5 |

|||||

6 |

Ordinary gain or (loss). Attach Form 4797 |

6 |

|||||

7 |

Other income. State nature of income |

▶ |

7 |

||||

8 |

Total ordinary income. Combine lines 1, 2b, and 3 through 7 |

8 |

|||||

|

Deductions Allocable to Ordinary Income |

|

9 |

Interest |

9 |

10 |

Taxes |

10 |

11 |

Other deductions. Attach a separate sheet listing deductions |

11 |

12 |

Total deductions. Add lines 9 through 11 |

12 |

13 |

Ordinary income less deductions. Subtract line 12 from line 8. Enter here and on line 21, column (a) |

13 |

|

Capital Gains (Losses) and Allocable Deductions |

|

14Total

|

(Form 1041) |

|

|

|

14 |

|

|

|

|

15 |

Deductions allocable to |

15 |

|

|

|

|

|||

16 |

Balance. Subtract line 15 from line 14. Enter here and on line 21, column (b) |

16 |

|||||||

17a |

Total |

|

|

|

|

|

|||

|

|

|

|

|

|||||

|

(Form 1041) |

|

|

|

17a |

|

|

|

|

b |

28% rate gain or (loss) |

17b |

|

|

|

|

|

|

|

c |

Unrecaptured section 1250 gain |

17c |

|

|

|

|

|

|

|

18 |

Deductions allocable to |

18 |

|

|

|

|

|||

19 |

Balance. Subtract line 18 from line 17a. Enter here and on line 21, column (c) |

19 |

|||||||

Part II Accumulation Schedule (Section 664 trust only)

Accumulations |

(a) Ordinary |

Capital gains and (losses) |

(d) Nontaxable |

||

|

|

||||

income |

(b) Net |

(c) Net |

income |

||

|

|||||

|

|

|

|||

20Undistributed from prior tax years

21Current tax year (before distributions)

22Total. Add lines 20 and 21

23Undistributed at end of tax year

Part III Current Distributions Schedule (Section 664 trust only)

Name of recipient |

Identifying |

(a) Ordinary |

Capital gains |

(d) Nontaxable |

(e) Corpus |

||

|

|

||||||

number |

income |

(b) |

(c) |

income |

|||

|

|

||||||

24a |

|

|

b |

|

|

c |

|

|

For Privacy Act and Paperwork Reduction Act Notice, see page 10 of the instructions. |

Cat. No. 13227T |

Form 5227 (2006) |

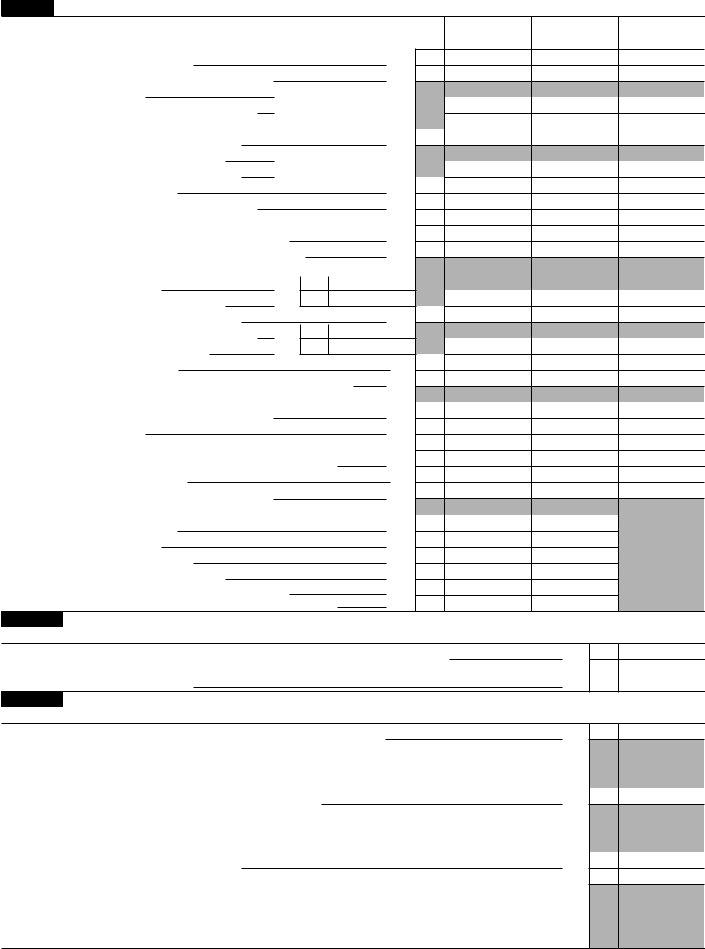

Form 5227 (2006) |

Page 2 |

|

|

Part IV |

Balance Sheet (see page 6 of the instructions) |

Assets

25

26Savings and temporary cash investments

27a |

Accounts receivable |

27a |

|

b |

Less: allowance for doubtful accounts |

27b |

|

28Receivables due from officers, directors, trustees, and other disqualified persons (attach schedule)

29a |

Other notes and loans receivable |

29a |

|

b |

Less: allowance for doubtful accounts |

29b |

|

30Inventories for sale or use

31Prepaid expenses and deferred charges

32a

b

33a

b Less: accumulated depreciation

34

35a Land, buildings, and equipment: basis b Less: accumulated depreciation

36Other assets. Describe ▶

37Total assets. Add lines 25 through 36 (must equal line 47)

Liabilities

38Accounts payable and accrued expenses

39Deferred revenue

40Loans from officers, directors, trustees, and other disqualified persons

41Mortgages and other notes payable. Attach schedule

42Other liabilities. Describe ▶

43Total liabilities. Add lines 38 through 42

Net Assets

44Trust principal or corpus

45a Undistributed income

b Undistributed capital gains

c Undistributed nontaxable income

46Total net assets. Add lines 44 through 45c

47Total liabilities and net assets. Add lines 43 and 46

(a) |

(b) |

(c) FMV (see |

Year Book Value |

Book Value |

instructions) |

25

26

28

30

31

32a

32b

32c

34

36

37

38

39

40

41

42

43

44

45a

45b

45c

46

47

Part

remainder annuity trust)

48a Enter the initial fair market value (FMV) of the property placed in the trust

bEnter the total annual annuity amounts for all recipients. Attach schedule showing the amount for each recipient if more than one

48a

48b

Part

remainder unitrust)

49a Enter the unitrust fixed percentage to be paid to the recipients

If there is more than one recipient, attach a schedule showing the percentage of the total unitrust dollar amount payable to each recipient.

bUnitrust amount. Subtract line 43, column (c), from line 37, column (c), and multiply the result by the percentage on line 49a. Do not enter less than

Note. Complete lines 50a through 51b only for those unitrusts whose governing instruments provide for determining required distributions with reference to the unitrust’s income. Otherwise, enter the amount from line 49b on line 52.

50a Trust’s accounting income for 2006

bEnter the smaller of line 49b or line 50a here, and on line 52 on page 3, unless the Caution below applies

Caution: Lines 51a and b need to be completed by those unitrusts whose governing instruments provide for current distributions to make up for any distribution deficiencies in previous years due to the trust income limit. See Regulations section

49a

49b

50a

50b

%

Form 5227 (2006)

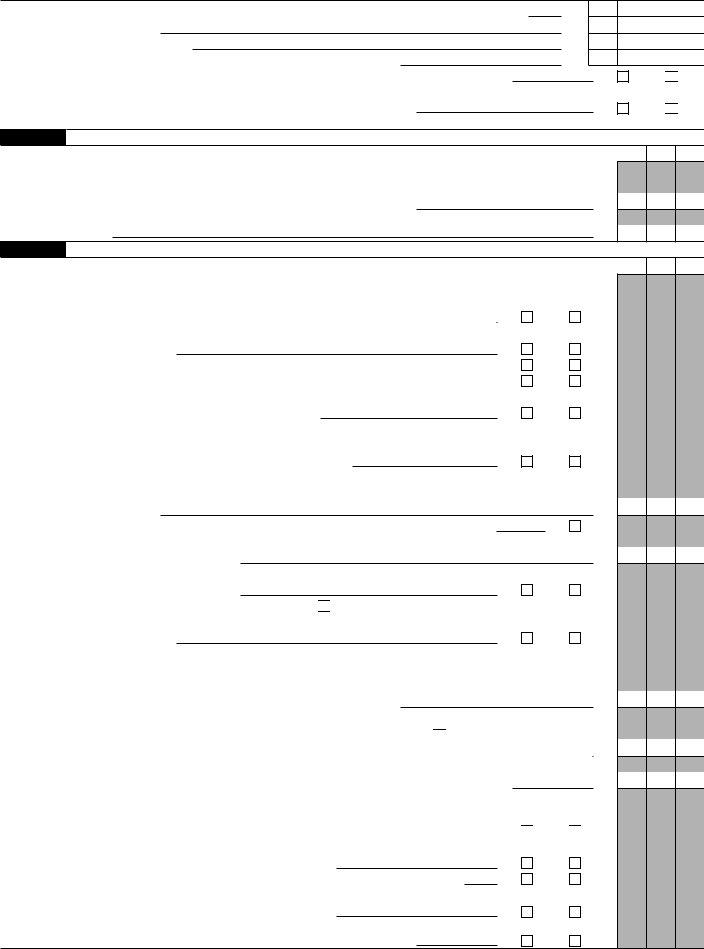

Form 5227 (2006) |

Page 3 |

51a Total accrued distribution deficiencies from previous years (see page 8 of the instructions)

bAdd lines 49b and 51a

52Unitrust distributions for 2006

53Carryover of distribution deficiency. Subtract line 52 from line 51b

54Did the trustee change the method of determining the fair market value of the assets? If “Yes,” attach an explanation.

55Were any additional contributions received by the trust during 2006?

If “Yes,” attach a schedule that lists the assets and the date(s) received.

51a

51b

52

53

Yes No

Yes No

Part

1Are the requirements of section 508(e) satisfied either:

●By the language in the governing instrument; or

●By state legislation that effectively amends the governing instrument so that no mandatory directions

that conflict with the state law remain in the governing instrument?

2Are you using this return only to report the income and assets of a segregated amount under section 4947(a)(2)(B)?

Yes No

1

2

Part

File Form 4720 if any item is checked in the “Yes” column (to the right), unless an exception applies.

1 |

|

|

a During 2006, did the trust (either directly or indirectly): |

|

|

(1) Engage in the sale or exchange, or leasing of property with a disqualified person? |

Yes |

No |

(2)Borrow money from, lend money to, or otherwise extend credit to (or accept it from)

|

a disqualified person? |

Yes |

No |

(3) |

Furnish goods, services, or facilities to (or accept them from) a disqualified person? |

Yes |

No |

(4) |

Pay compensation to, or pay or reimburse the expenses of, a disqualified person? |

Yes |

No |

(5)Transfer any income or assets to a disqualified person (or make any of either available

for the benefit or use of a disqualified person)? |

Yes |

No |

(6)Agree to pay money or property to a government official? (Exception. Check “No” if the trust agreed to make a grant to or to employ the official for a period after termination

of government service, if terminating within 90 days.) |

Yes |

No |

bIf any answer is “Yes” to 1a(1) through (6), did any of the acts fail to qualify under the exceptions described in Regulations sections

Organizations relying on a current Notice regarding disaster assistance, check here |

▶ |

cDid the trust engage in a prior year in any of the acts described in 1a, other than excepted acts, that were not corrected before January 1, 2006?

2Does section 4947(b)(3)(A) or (B) apply? (See page 9 of the instructions.) (If “Yes,” check

the “N/A” box in questions 3 and 4.) |

Yes |

No |

3Taxes on excess business holdings (section 4943): N/A

aDid the trust hold more than a 2% direct or indirect interest in any business enterprise

at any time during 2006? |

Yes |

No |

bIf “Yes,” did the trust have excess business holdings in 2006 as a result of (1) any purchase by the trust or disqualified persons after May 26, 1969; (2) the lapse of the

(3) the lapse of the

Use Schedule C, Form 4720, to determine if the trust had excess business holdings in 2006.

4Taxes on investments that jeopardize charitable purposes (section 4944): N/A

aDid the trust invest during 2006 any amount in a manner that would jeopardize its charitable purpose?

bDid the trust make any investment in a prior year (but after December 31, 1969) that could jeopardize its charitable purpose that had not been removed from jeopardy before January 1, 2006?

5Taxes on taxable expenditures (section 4945) and political expenditures (section 4955): a During 2006, did the trust pay or incur any amount to:

(1)Carry on propaganda, or otherwise attempt to influence legislation (section 4945(e))? Yes No

(2)Influence the outcome of any specific public election (see section 4955); or to carry

on, directly or indirectly, any voter registration drive? |

Yes |

No |

(3) Provide a grant to an individual for travel, study, or other similar purposes? |

Yes |

No |

(4)Provide a grant to an organization other than a charitable, etc., organization described

in section 509(a)(1), (2), or (3), or section 4940(d)(2)? |

Yes |

No |

(5)Provide for any purpose other than religious, charitable, scientific, literary, or

educational, or for the prevention of cruelty to children or animals? |

Yes |

No |

Yes No

1b

1c

3b

4a

4b

Form 5227 (2006)

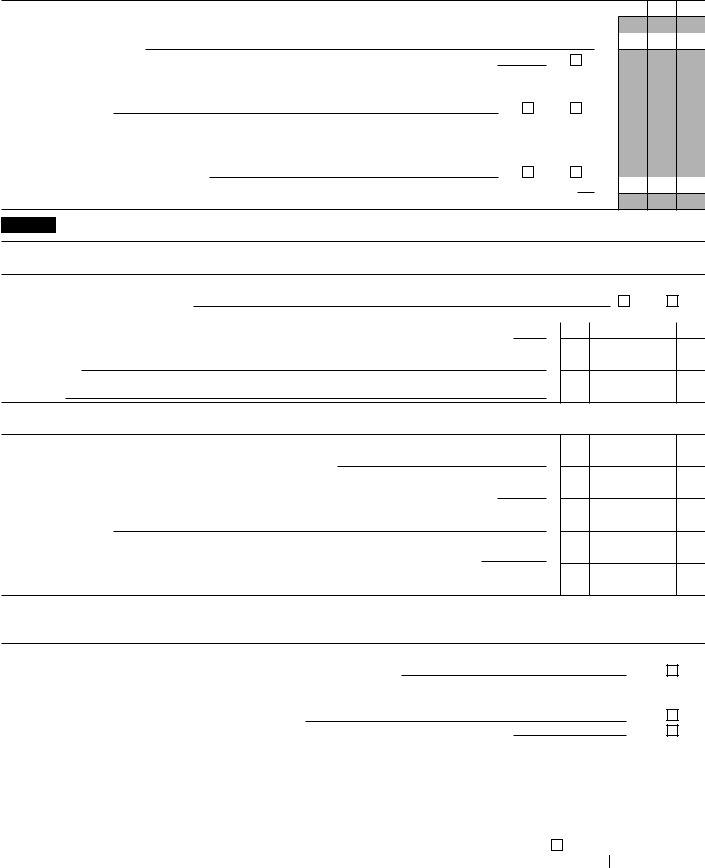

Form 5227 (2006) |

Page 4 |

5b If any answer is “Yes” to 5a(1) through (5), did any of the transactions fail to qualify under the exceptions described in Regulations section 53.4945, or in a current Notice regarding disaster assistance (see page 9

of the instructions)? |

|

Organizations relying on a current Notice regarding disaster assistance, check here |

▶ |

cIf the answer is “Yes” to question 5a(4), does the trust claim exemption from the tax because it maintained expenditure responsibility for the grant? (See page 9 of the

instructions.) |

Yes |

No |

If “Yes,” attach the statement required by Regulations section |

|

|

6Personal benefit contracts (section 170(f)(10)):

aDid the trust, during the year, receive any funds, directly or indirectly, to pay premiums

on a personal benefit contract? |

Yes |

No |

bDid the trust, during the year, pay premiums, directly or indirectly, on a personal benefit contract? If “Yes” to 6b, file Form 8870 (see instructions).

Yes No

5b

6b

Part VII Questionnaire for Charitable Lead Trusts, Pooled Income Funds, and Charitable Remainder Trusts

Section

1Does the governing instrument require income in excess of the required annuity or unitrust payments to be paid for charitable purposes?

Yes

No

2Enter the amount of any excess income required to be paid for charitable purposes for 2006

3Enter the amount of annuity or unitrust payments required to be paid to charitable beneficiaries for 2006

4Enter the amount of annuity or unitrust payments required to be paid to private beneficiaries for 2006

2

3

4

Section

1Enter the amount of contributions received during 2006

2Enter the amount required to be distributed for 2006 to satisfy the remainder interest

3Enter any amounts that were required to be distributed to the remainder beneficiary that remain undistributed

4Enter the amount of income required to be paid to private beneficiaries for 2006

5Enter the amount of income required to be paid to the charitable remainder beneficiary for 2006

1

2

3

4

5

Section

(All

1Check this box if you are filing for a charitable remainder annuity trust or a charitable remainder unitrust whose

charitable interests involve only cemeteries or war veterans’ posts |

▶ |

2Check this box if you are making an election under Regulations section

of the tax year. (See page 10 of the instructions.) |

|

|

|

|

▶ |

|||||||

3 Check this box if any of the |

|

|

|

|

▶ |

|||||||

|

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my |

|||||||||||

Sign |

knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than trustee) is based on all information of which preparer |

|||||||||||

has any knowledge. |

|

|

|

|

|

|

|

|

|

|

||

Here |

▶ |

|

|

|

|

|

|

|

|

▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Signature of trustee or officer representing trustee |

|

|

|

Date |

|||||||

|

|

|

|

|

|

|

|

|

|

|

||

Paid |

Preparer’s |

|

|

Date |

|

Check if self- |

Preparer’s SSN or PTIN |

|||||

|

|

|

|

|

|

|

|

|||||

signature ▶ |

|

|

|

|

employed |

|

|

|

|

|||

Preparer’s |

|

|

|

|

|

|

|

|

||||

Firm’s name (or yours |

▶ |

|

EIN |

|

|

|

|

|||||

Use Only |

|

|

|

) |

|

|||||||

address, and ZIP code |

|

Phone no. ( |

|

|||||||||

|

if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 5227 (2006) |

|