Working with PDF forms online is definitely simple with this PDF editor. Anyone can fill in oh form 525b here painlessly. FormsPal team is always endeavoring to expand the tool and enable it to be much faster for clients with its extensive functions. Enjoy an ever-improving experience today! This is what you'd have to do to get started:

Step 1: Just click the "Get Form Button" in the top section of this page to see our pdf file editing tool. This way, you'll find everything that is needed to work with your document.

Step 2: After you open the editor, you will notice the document all set to be filled in. Apart from filling in various blanks, it's also possible to perform some other things with the file, specifically putting on your own textual content, changing the initial text, inserting images, placing your signature to the form, and a lot more.

This PDF form will need specific data to be entered, so you should definitely take your time to fill in precisely what is asked:

1. Whenever filling out the oh form 525b, ensure to incorporate all needed blanks within its relevant part. It will help to speed up the process, allowing for your information to be processed quickly and accurately.

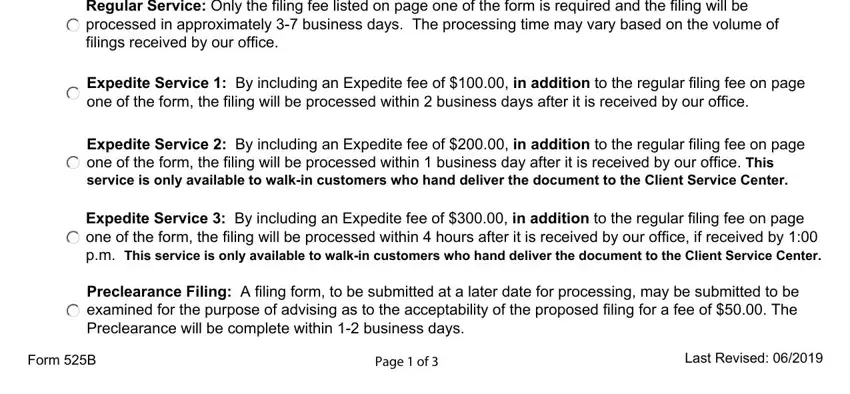

2. The next step would be to fill out these particular blanks: Regular Service Only the filing, Expedite Service By including an, Expedite Service By including an, Expedite Service By including an, Preclearance Filing A filing form, Form B, Page of, and Last Revised.

It's simple to get it wrong when completing your Expedite Service By including an, hence make sure that you look again before you send it in.

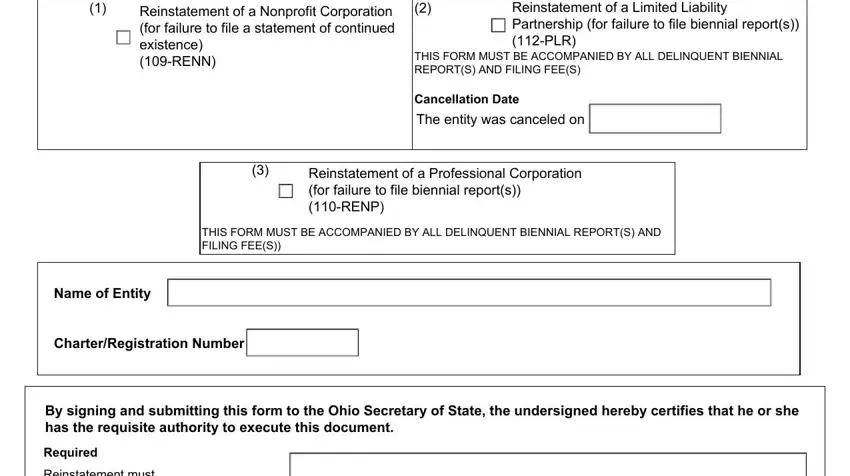

3. Completing Reinstatement of a Nonprofit, Reinstatement of a Limited, THIS FORM MUST BE ACCOMPANIED BY, The entity was canceled on, THIS FORM MUST BE ACCOMPANIED BY, Reinstatement of a Professional, Name of Entity, CharterRegistration Number, By signing and submitting this, Required, and Reinstatement must be signed by an is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

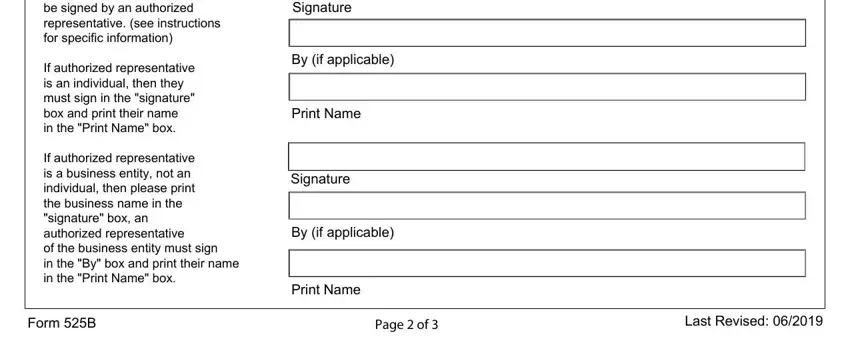

4. To move ahead, this form section requires completing a handful of blanks. Examples include Reinstatement must be signed by an, Signature, By if applicable, Print Name, Signature, By if applicable, Print Name, Form B, Page of, and Last Revised, which you'll find vital to carrying on with this particular PDF.

Step 3: After going through your entries, hit "Done" and you're all set! Find your oh form 525b the instant you register online for a free trial. Readily get access to the form inside your personal account, with any edits and changes being conveniently saved! FormsPal guarantees your data confidentiality by having a protected system that never saves or shares any sort of sensitive information used in the PDF. Be assured knowing your documents are kept safe whenever you use our services!