Whenever you desire to fill out form 533a, you won't need to download and install any sort of programs - simply try using our PDF editor. Our team is dedicated to providing you the best possible experience with our tool by continuously adding new functions and enhancements. With these improvements, using our editor gets easier than ever before! Getting underway is easy! All you need to do is follow these easy steps directly below:

Step 1: Click on the orange "Get Form" button above. It will open up our tool so that you could begin filling in your form.

Step 2: This tool will allow you to customize your PDF file in many different ways. Enhance it with your own text, correct what is already in the document, and place in a signature - all at your disposal!

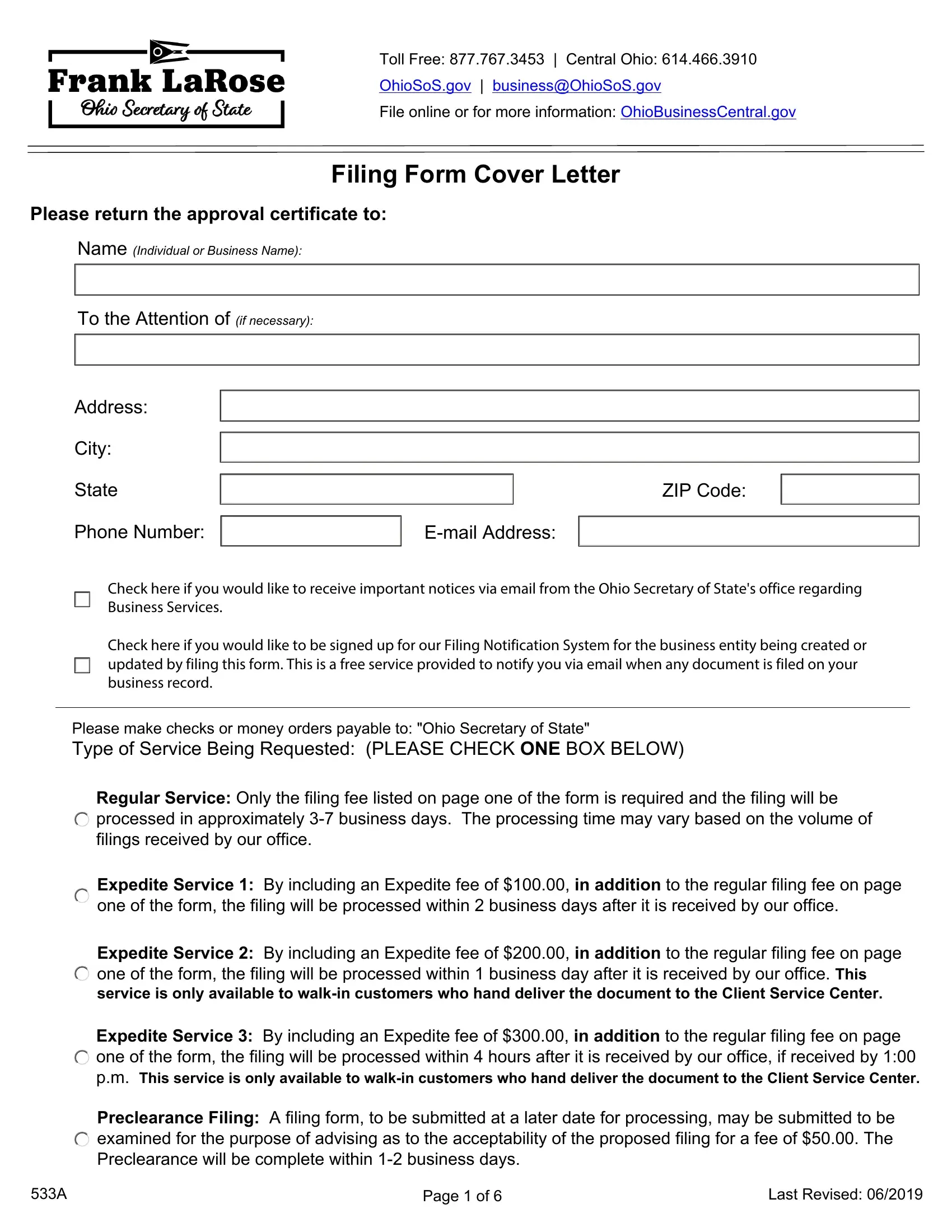

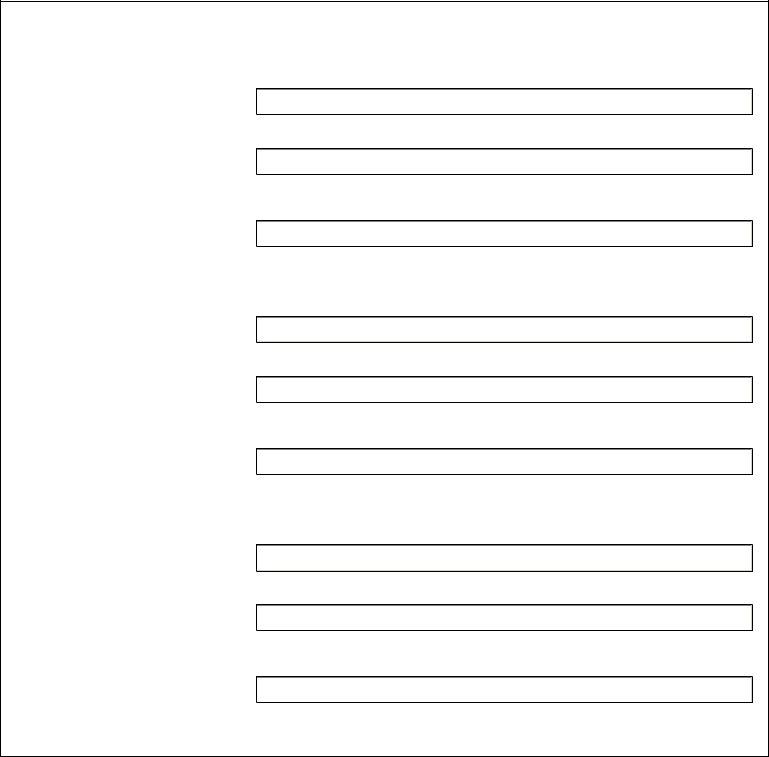

If you want to finalize this document, be sure you provide the necessary information in every blank:

1. It is advisable to complete the form 533a correctly, so be mindful while filling out the sections containing these fields:

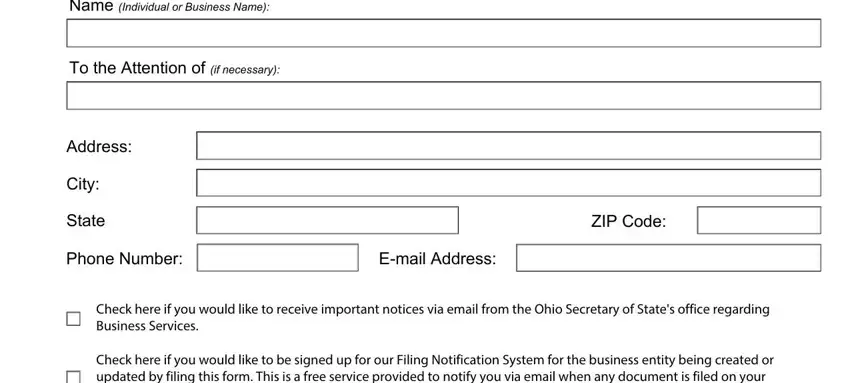

2. Right after the first section is filled out, go on to type in the relevant information in all these: Regular Service Only the filing, Expedite Service By including an, Expedite Service By including an, Expedite Service By including an, Preclearance Filing A filing form, Page of, and Last Revised.

It is easy to make a mistake while filling out your Preclearance Filing A filing form, hence make sure to go through it again before you'll submit it.

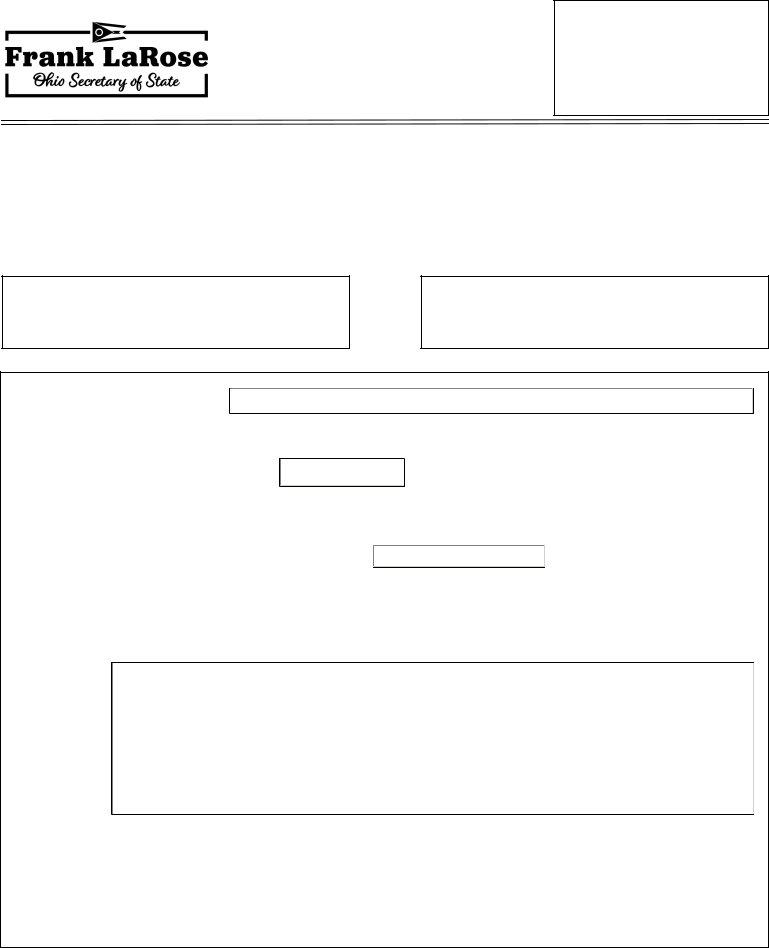

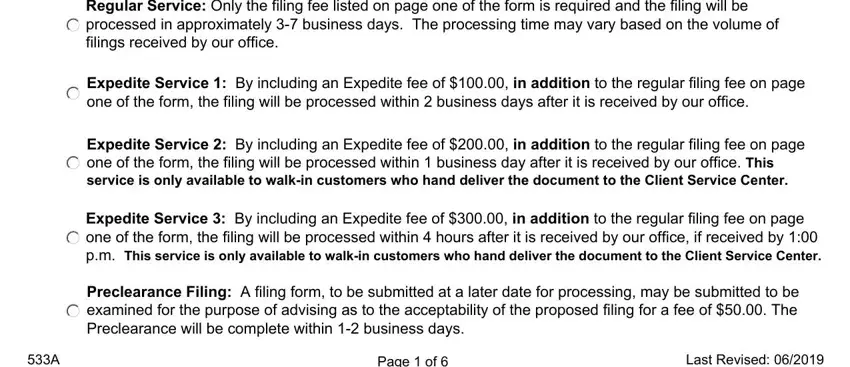

3. This third section is considered fairly uncomplicated, Articles of Organization for, ForProfit Limited Liability, Articles of Organization for, Nonprofit Limited Liability, Name of Limited Liability Company, Optional, Effective Date MMDDYYYY, Name must include one of the, The legal existence of the, Optional, This limited liability company, Period of Existence, Optional, and Purpose - these fields is required to be filled in here.

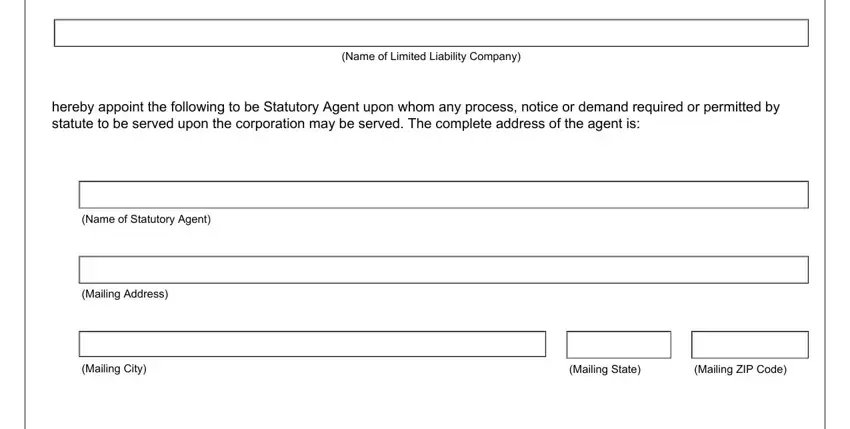

4. Completing Name of Limited Liability Company, hereby appoint the following to be, Name of Statutory Agent, Mailing Address, Mailing City, Mailing State, and Mailing ZIP Code is key in the fourth stage - make certain that you be patient and fill out every field!

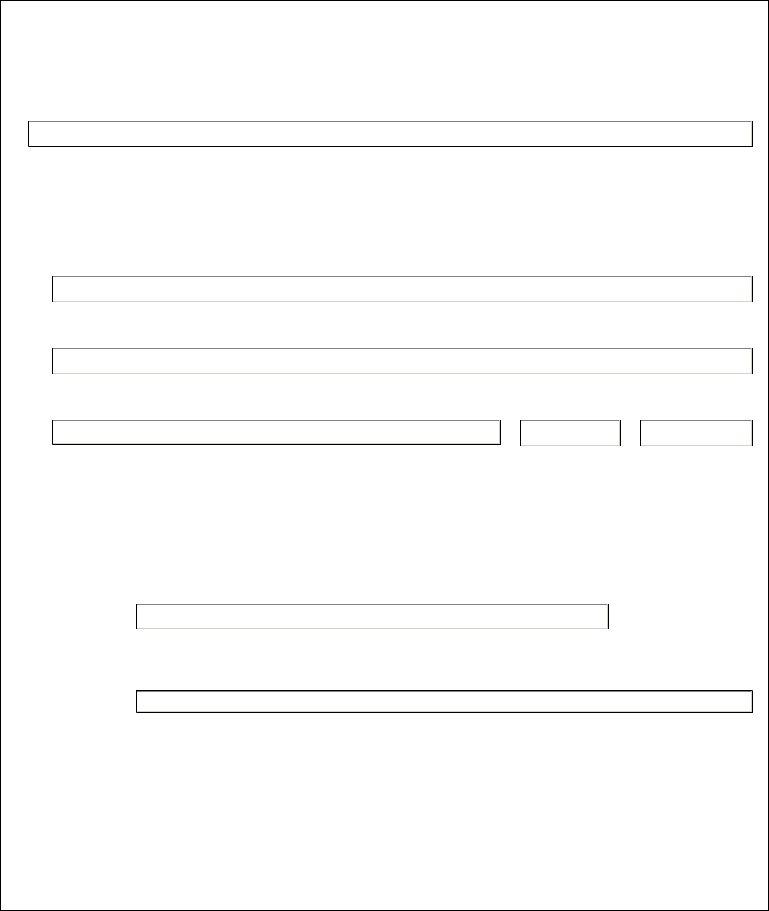

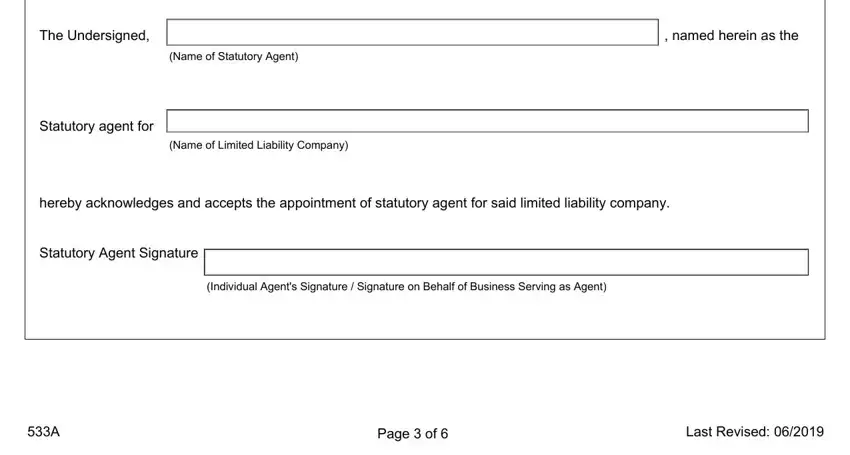

5. This document should be finalized by going through this segment. Further you can find an extensive list of form fields that require specific details for your document usage to be accomplished: The Undersigned, Name of Statutory Agent, named herein as the, Statutory agent for, Name of Limited Liability Company, hereby acknowledges and accepts, Statutory Agent Signature, Individual Agents Signature, Page of, and Last Revised.

Step 3: Right after you've reread the information in the blanks, simply click "Done" to conclude your form. Join us now and easily get form 533a, all set for downloading. All modifications you make are kept , meaning you can modify the document at a later stage if necessary. FormsPal guarantees your data privacy by using a secure method that never records or distributes any personal data involved. Be confident knowing your paperwork are kept protected any time you use our tools!