If you wish to fill out oklahoma 538s, there's no need to install any sort of software - just try using our online tool. In order to make our tool better and easier to utilize, we continuously develop new features, with our users' suggestions in mind. Here is what you'd need to do to get going:

Step 1: Click the orange "Get Form" button above. It's going to open our pdf editor so that you can start completing your form.

Step 2: The tool will give you the capability to customize most PDF forms in many different ways. Modify it by adding personalized text, correct what's already in the PDF, and add a signature - all within a few mouse clicks!

Be attentive while filling in this pdf. Make sure that all necessary areas are filled out correctly.

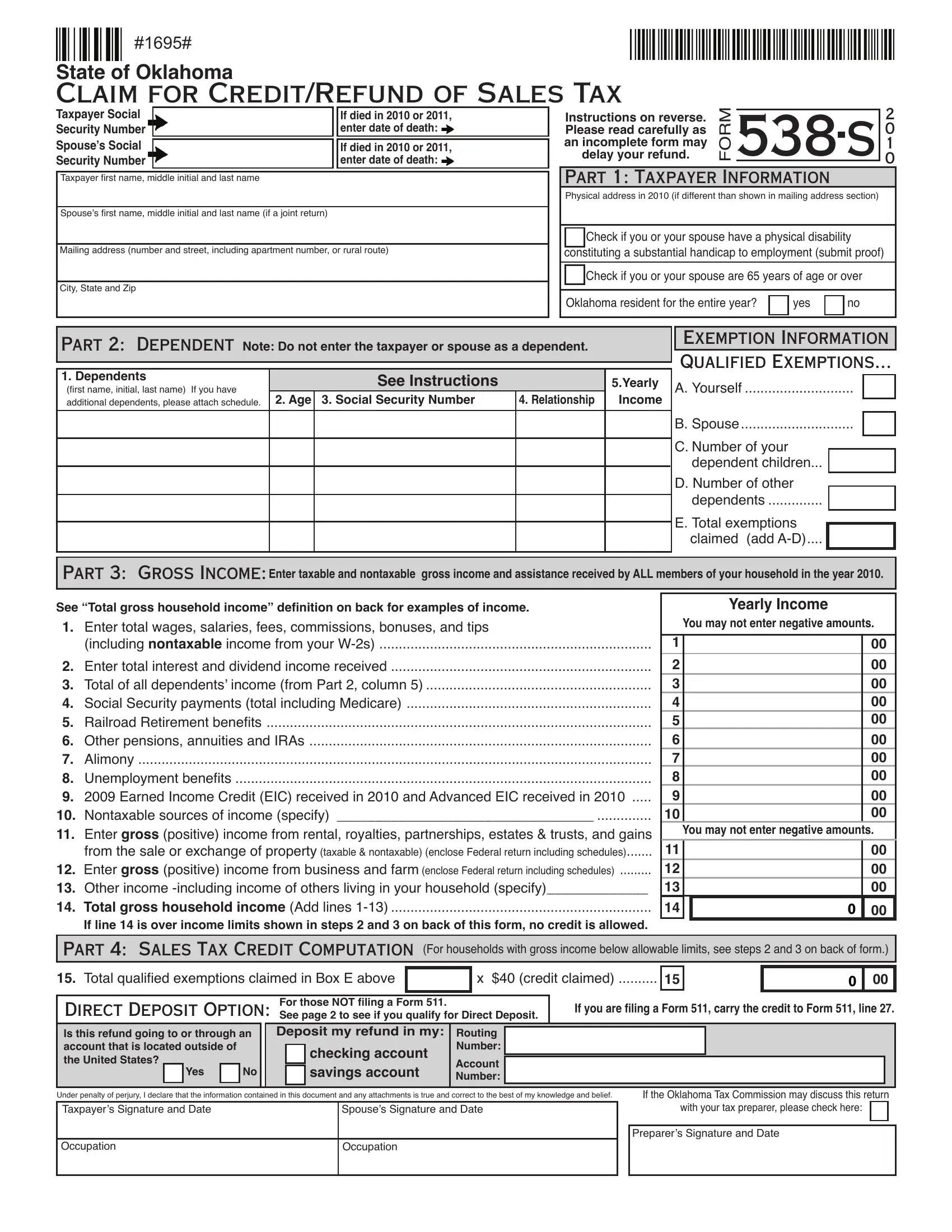

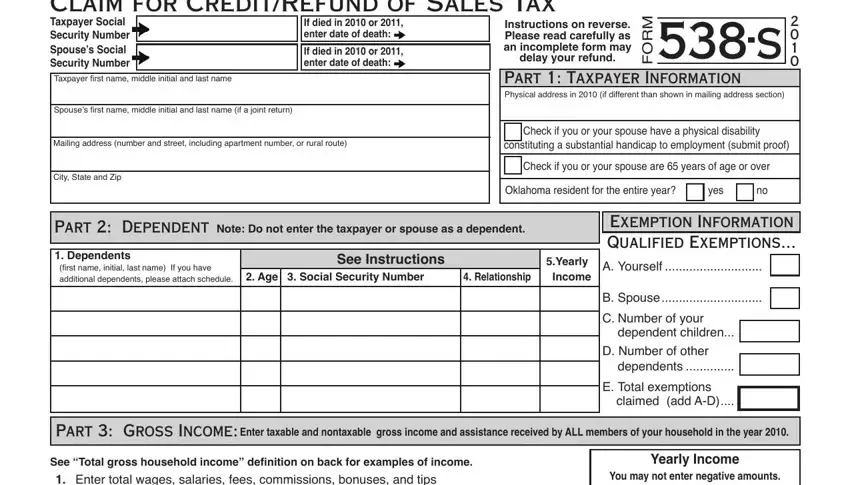

1. When filling out the oklahoma 538s, be certain to complete all of the needed blanks in the associated form section. It will help facilitate the process, making it possible for your information to be handled quickly and accurately.

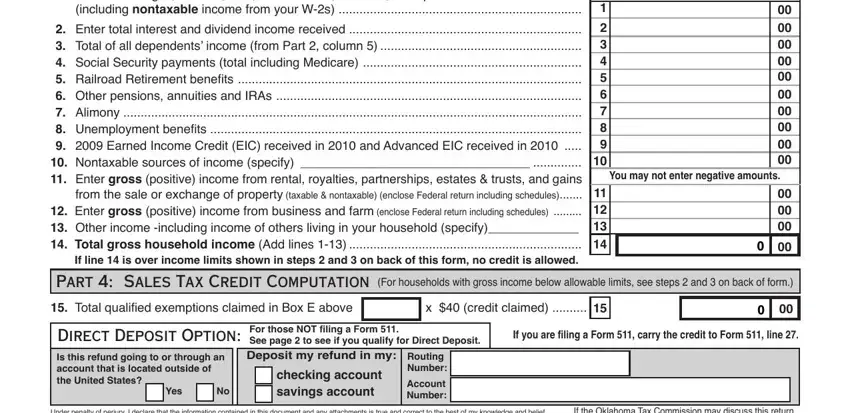

2. Just after performing the previous part, go to the subsequent stage and enter the essential details in all these blank fields - See Total gross household income, You may not enter negative amounts, Part Sales Tax Credit Computation, For households with gross income, Total qualiied exemptions claimed, Is this refund going to or through, Yes, checking account savings account, Routing Number, Account Number, If you are iling a Form carry the, Under penalty of perjury I declare, and If the Oklahoma Tax Commission may.

Concerning Yes and See Total gross household income, ensure you take a second look in this section. These two are the most significant fields in the form.

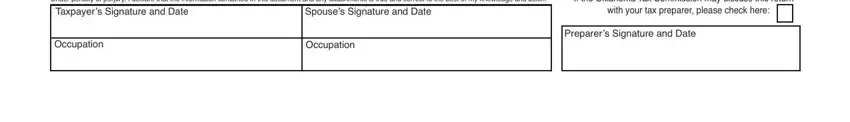

3. Completing Under penalty of perjury I declare, Spouses Signature and Date, If the Oklahoma Tax Commission may, with your tax preparer please, Occupation, Occupation, and Preparers Signature and Date is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Step 3: Be certain that the information is accurate and then simply click "Done" to progress further. Acquire your oklahoma 538s after you register at FormsPal for a free trial. Quickly gain access to the pdf document within your FormsPal account page, together with any edits and adjustments all kept! FormsPal guarantees safe form editor with no data record-keeping or distributing. Feel comfortable knowing that your information is secure with us!