Handling PDF forms online can be super easy with our PDF editor. Anyone can fill out 540 es here without trouble. FormsPal expert team is continuously working to expand the editor and help it become much faster for clients with its multiple functions. Unlock an endlessly innovative experience today - check out and uncover new opportunities as you go! By taking several basic steps, you'll be able to start your PDF editing:

Step 1: Firstly, open the pdf tool by clicking the "Get Form Button" above on this site.

Step 2: When you launch the PDF editor, you will notice the form prepared to be filled out. In addition to filling in various blank fields, you might also perform several other actions with the PDF, including putting on custom textual content, editing the original text, inserting graphics, affixing your signature to the PDF, and much more.

This document will need particular information to be filled in, so you need to take your time to fill in exactly what is asked:

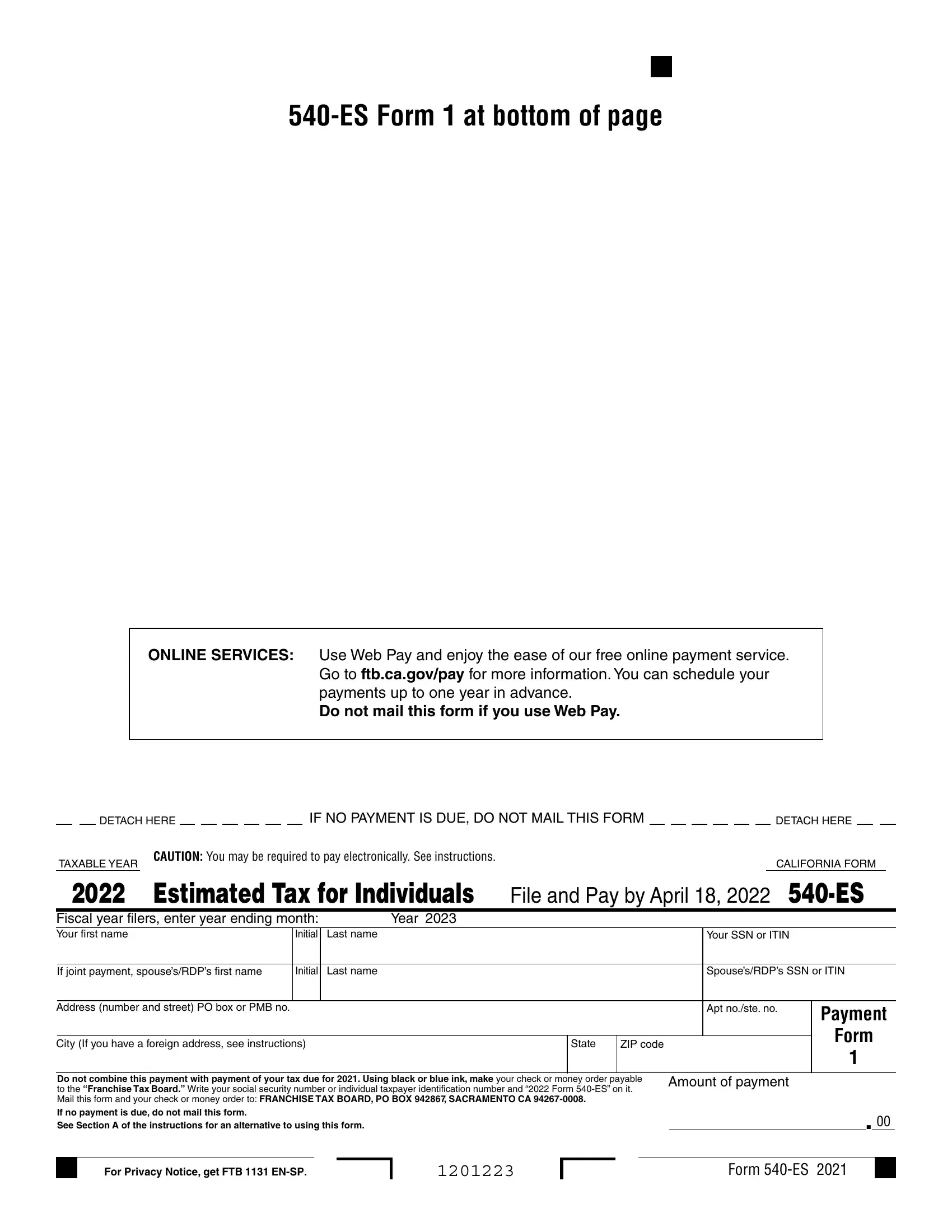

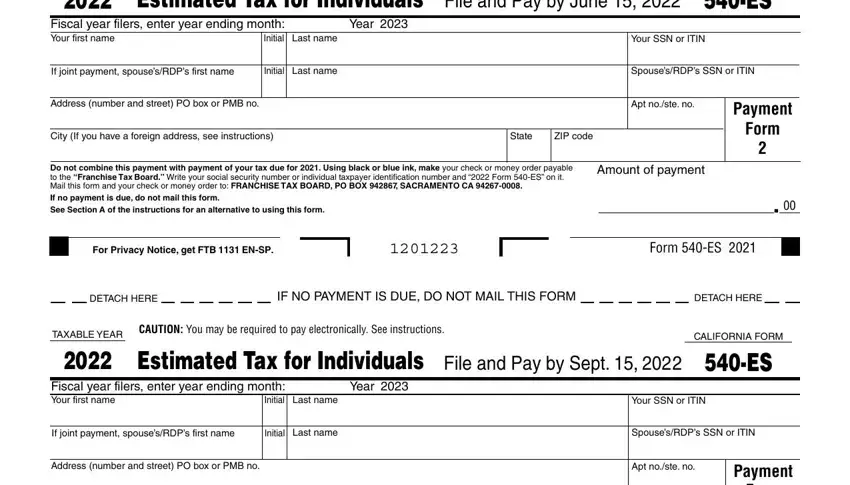

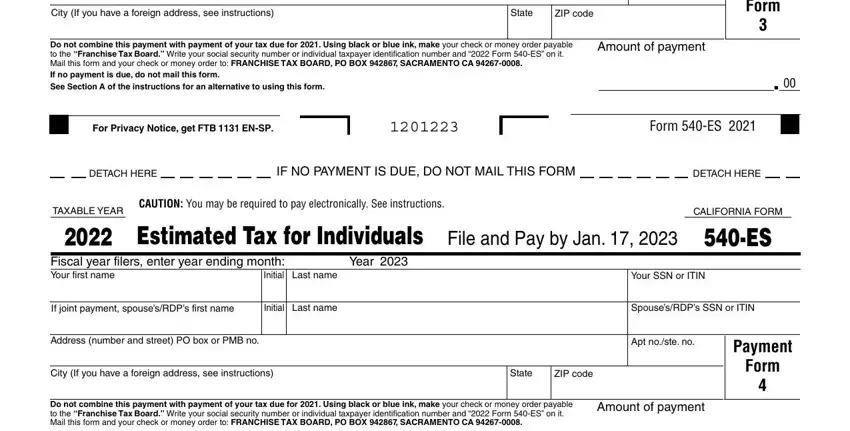

1. It is very important fill out the 540 es properly, thus be attentive when working with the areas including these blanks:

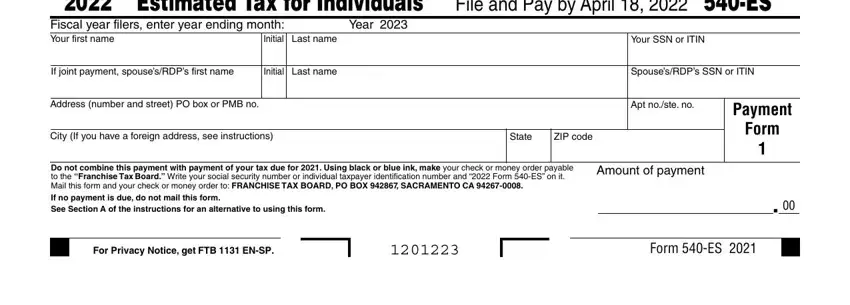

2. Once your current task is complete, take the next step – fill out all of these fields - Estimated Tax for Individuals, File and Pay by June, Fiscal year filers enter year, Last name, Year, Your SSN or ITIN, If joint payment spousesRDPs first, Initial, Last name, SpousesRDPs SSN or ITIN, Address number and street PO box, Apt noste no, City If you have a foreign address, State, and ZIP code with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

3. This next part should also be fairly easy, City If you have a foreign address, State, ZIP code, Do not combine this payment with, Amount of payment, Form, For Privacy Notice get FTB ENSP, Form ES, DETACH HERE, IF NO PAYMENT IS DUE DO NOT MAIL, DETACH HERE, TAXABLE YEAR, CAUTION You may be required to pay, CALIFORNIA FORM, and Estimated Tax for Individuals - every one of these form fields has to be filled out here.

Be very careful when completing State and Form, because this is where many people make errors.

Step 3: Prior to submitting your file, double-check that blanks have been filled out right. When you are satisfied with it, click “Done." Try a free trial plan with us and get instant access to 540 es - downloadable, emailable, and editable from your FormsPal account page. When using FormsPal, you can certainly complete forms without needing to worry about database leaks or entries getting shared. Our protected system ensures that your private details are stored safe.