Handling PDF files online is quite easy with this PDF editor. You can fill in 2020 form k 1 here in a matter of minutes. FormsPal expert team is continuously endeavoring to develop the tool and insure that it is even easier for users with its multiple functions. Unlock an constantly innovative experience now - take a look at and uncover new opportunities as you go! In case you are seeking to begin, this is what it requires:

Step 1: Just press the "Get Form Button" above on this site to see our pdf editing tool. This way, you'll find everything that is required to fill out your file.

Step 2: This editor gives you the ability to modify your PDF document in various ways. Enhance it by writing personalized text, correct what's originally in the document, and add a signature - all at your convenience!

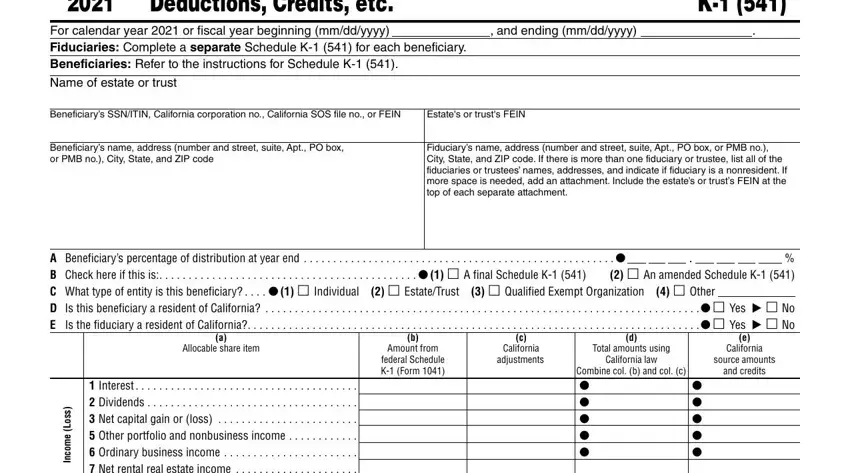

When it comes to blank fields of this particular form, here is what you should do:

1. While submitting the 2020 form k 1, be certain to include all of the necessary blank fields within the relevant section. This will help facilitate the process, which allows your information to be handled promptly and properly.

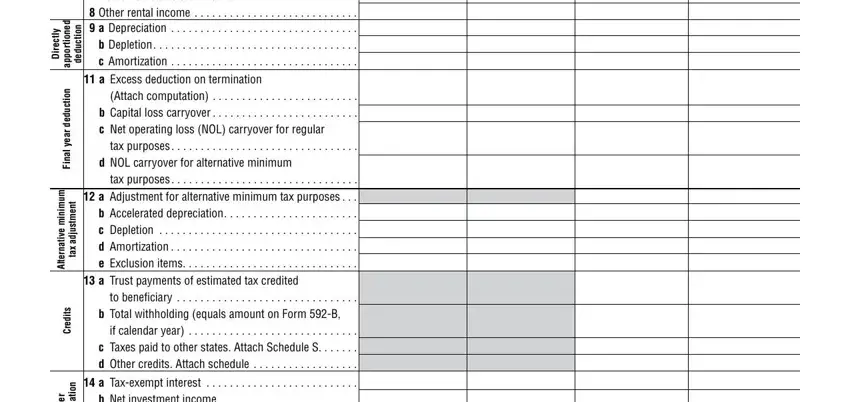

2. The subsequent stage is usually to fill out all of the following blanks: Interest, n o i t c u d e d, y l t c e r i D, d e n o i t r o p p a, n o i t c u d e d, r a e y l a n i F, m u m i n i m e v i t a n r e t l, t n e m t s u j d a, x a t, s t i d e r C, a Excess deduction on termination, Attach computation, tax purposes, to beneficiary, and r e h t O.

Always be really attentive when filling in Attach computation and m u m i n i m e v i t a n r e t l, as this is the section in which most users make mistakes.

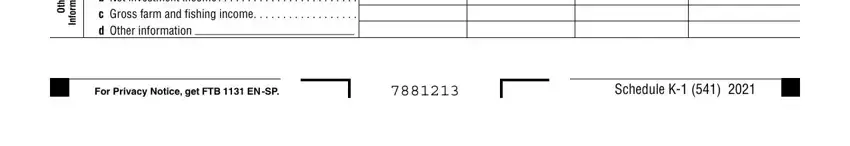

3. The next section should also be quite simple, r e h t O, n o i t a m r o f n I, a Taxexempt interest, For Privacy Notice get FTB EN SP, and Schedule K - all these form fields must be completed here.

Step 3: Reread the details you have inserted in the blank fields and then hit the "Done" button. Download the 2020 form k 1 the instant you register online for a 7-day free trial. Immediately access the pdf file inside your personal account page, together with any modifications and adjustments all saved! At FormsPal, we do everything we can to guarantee that all your details are maintained secure.