Understanding the intricacies of Form 5452, a Corporate Report of Nondividend Distributions, is pivotal for corporations navigating their annual tax obligations. Since its revision in January 1992, this form has been a crucial document for corporations recording distributions that are not considered dividends from the perspective of tax reporting. It is designed for use within the United States, with the Internal Revenue Service (IRS) mandating its submission alongside the corporation’s tax return for the relevant calendar year. Among its key aspects, Form 5452 encompasses questions regarding previous filings, detailed inquiries into whether distributions are part of a partial or complete liquidation, and requires a comprehensive breakdown of earnings and profits dating back to February 28, 1913. The form further categorizes shareholders at the date of the last dividend payment and details the total amount paid in distributions across various categories, thereby elucidating the tax implications of such distributions. These sections aim to clarify the taxable status of distributions reported to shareholders, distinguishing between those derived from current and accumulated earnings and profits and those that are not. With specific segments dedicated to supporting information, including calculations and adjustments related to earnings and profits for the tax year, Form 5452 encapsulates a systematic approach to reporting nondividend distributions. Instructions accompanying the form highlight both the necessity of adhering to the reporting requirements established under the Internal Revenue Code and the potential consequences of failing to do so. Detailed guidance is also provided for both the preparation of the form and the submission process, underscoring its significance in maintaining compliance with U.S. tax laws.

| Question | Answer |

|---|---|

| Form Name | Form 5452 |

| Form Length | 4 pages |

| Fillable? | Yes |

| Fillable fields | 1 |

| Avg. time to fill out | 1 min 12 sec |

| Other names | Nondeductible, 5452 form, Nontaxable, Distributions |

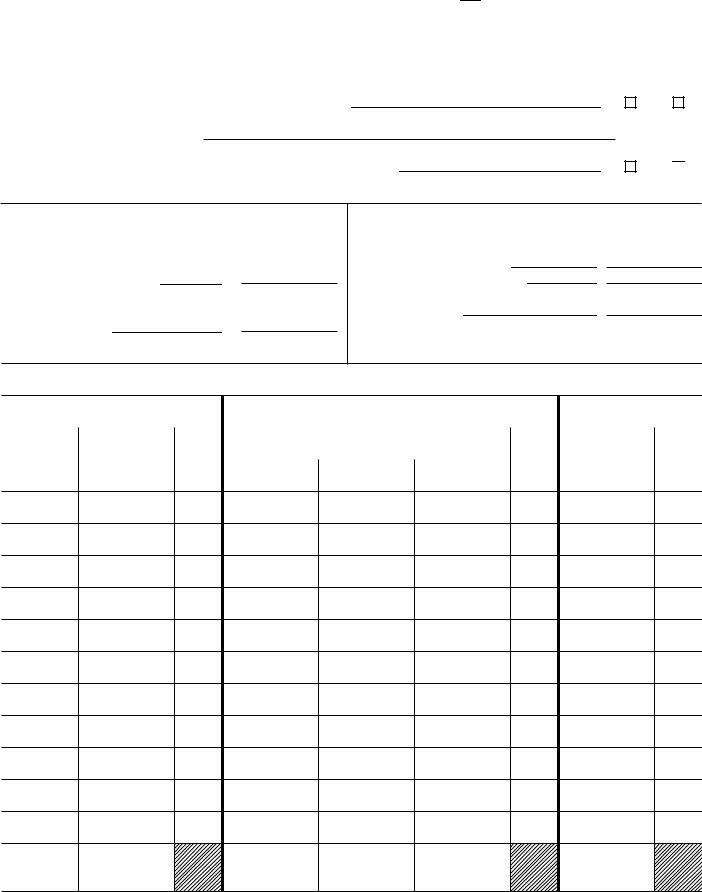

Form 5 4 5 2 |

Corporate Report of Nondividend Distributions |

|

|

(Rev. January 1992) |

▶ For calendar year ending December 31, 19 |

|

OMB No. |

|

Expires |

||

|

|

|

|

Department of the Treasury |

▶ Attach to the corporation’s tax return. |

|

|

Internal Revenue Service |

|

|

|

Name |

|

Employer identification number |

|

|

|

|

|

A (1) Has a Form 5452 been filed for a prior calendar year? |

▶ |

Yes

No

(2) If “ Yes,” state which year(s)

B Are any of the distributions part of a partial or complete liquidation? |

▶ |

If “ Yes,” describe in detail in a separate statement.

Yes No

C Earnings and Profits

●Accumulated earnings and profits (since February 28, 1913) at the

beginning of the tax year |

$ |

●Actual earnings and profits for the

current tax year |

$ |

DClassification of Shareholders at Date of Last Dividend Payment

●Number of individuals

●Number of partnerships

●Number of corporations and other shareholders

Note: If there are 12 or fewer shareholders, attach copies of the Forms

E Corporate Distributions

|

Column 1 |

|

|

Column 2 |

|

|

Column 3 |

|

|

|

|

|

|

|

|

||

|

Total Amount Paid |

|

Amount Paid During Calendar Year From Earnings & Profits |

|

Amount Paid During |

|

||

|

Amount |

|

Since February 28, 1913 |

|

Percent |

Calendar Year From |

Percent |

|

|

(Common (C), |

|

|

|||||

Date Paid |

Per |

|

|

|

Other Than Earnings |

|||

|

|

|

||||||

Preferred (P), |

|

|

|

Taxable |

Nontaxable |

|||

|

Share |

From the |

Accumulated |

Total |

& Profits Since |

|||

|

Other (O)) |

|

|

|||||

|

|

Current Year |

|

February 28, 1913 |

|

|||

|

|

|

|

|

|

|

||

$

$

$

$

$

$

Totals |

$ |

$ |

$ |

$ |

|

$ |

For Paperwork Reduction Act Notice, see the instructions on page 2. |

|

Cat. No. 11881T |

Form 5452 (Rev. |

|||

Form 5452 (Rev. |

Page 2 |

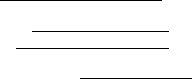

Instructions

(Section references are to the Inter nal Revenue Code. )

Paperwork Reduction Act Notice

We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping |

19 |

hr., 51 |

min. |

Learning about |

|

|

|

the law or the form |

1 |

hr., 20 |

min. |

Preparing the form |

3 |

hr., 35 |

min. |

Copying, assembling, and |

|

|

|

sending the form to the IRS |

|

32 min. |

|

If you have comments concerning the accuracy of these time estimates or suggestions for making this form more simple, we would be happy to hear from you. You can write to both the IRS and the Office of Management and Budget at the addresses listed in the instructions for the tax return with which this form is filed.

A Change To Note

The due date and the method of filing Form 5452 for distributions made in calendar years beginning after 1990 have been changed. See When To File, below, for the new rules.

Purpose of Form

Complete Form 5452 if nondividend distributions are made to shareholders under section 301 or 1368(c)(3).

Who Must File

All corporations that have made nondividend distributions to their shareholders must file Form 5452 for the calendar year in which the distributions were made. If the corporation is a member of a consolidated group, the parent corporation must file Form 5452. An S corporation should file this form only with respect to distributions made under section 1368(c)(3).

When To File

A calendar tax year corporation must file Form 5452 and supporting information with the income tax return due for the tax year in which the nondividend distributions were made.

A fiscal tax year corporation must file Form 5452 and supporting information with the income tax return due for the first fiscal year ending after the calendar year in which the nondividend distributions were made.

Nondividend Distributions

Nondividend distributions are distributions made to shareholders in the normal course of business. They are considered fully or partially nontaxable as dividends only because the paying corporation’s current and accumulated earnings and profits are less than the distributions. Nondividend distributions do not include

Taxable Status Reported to Shareholders

Complete columns 1, 2, and 3 in Item E, Corporate Distributions, showing the taxable and nontaxable status of distributions reported to shareholders. If noncash distributions were made, attach a statement showing their tax bases and fair market values.

Supporting Information

(a)Attach the following information to Form 5452. See Revenue Procedure

1.A computation of earnings and profits for the tax year (see the example on page 3 and the worksheet on page 4). Also attach a schedule of the differences between the earnings and profits computation and the Schedule

2.A

3.An ending book, Schedule L (Form 1120), vs.

(b)In addition, a consolidated filer must also attach the following information.

1.A schedule showing the allocation of the consolidated tax liability that identifies the method used. (If an intercompany agreement is in effect, provide that information).

2.A schedule showing the taxable income or loss for each member of the consolidated group.

3.For each member of a consolidated group that made nondividend distributions, provide the information requested in 1 through 3 of (a) above.

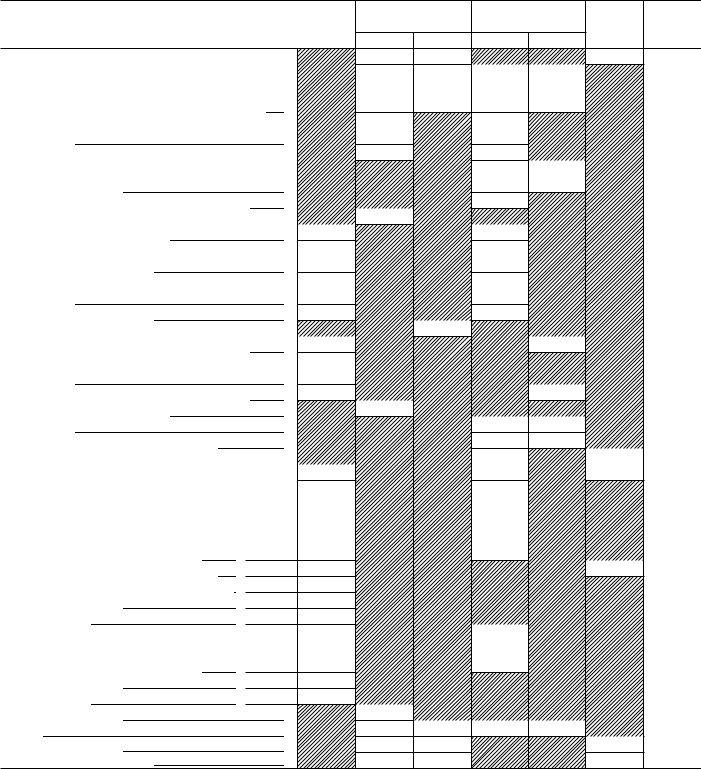

Form 5452 (Rev. |

Page 3 |

|

Example of a Current- Year Earnings and Profits Computation |

|

|

|||||

|

|

XYZ Corporation, EIN 00- 0000000 |

|

|

|

|

||

|

|

|

123 Main Street |

|

|

|

|

|

|

|

Anycity, Yourstate 20200 |

|

|

|

|

||

|

|

|

Retained Earnings |

Earnings and Profits |

Accumulated |

|

||

Incorporated 1/1/78 |

|

Earnings and |

|

|||||

|

Shown in Books |

Current Year |

Key |

|||||

|

|

|

Profits |

|||||

Accrual Method of Accounting |

|

Debit |

Credit |

Debit |

Credit |

Credit |

|

|

|

Balance |

|

||||||

|

|

|

|

|||||

Balance forward 12/ 31/ 91 |

|

|

$225,000 |

|

|

$20,900 |

|

|

|

1992 |

|

|

|

|

|

|

|

1 |

Taxable income from Form 1120, line 28 (or |

|

|

|

|

|

|

|

|

comparable line of other income tax return) |

|

|

214,700 |

|

$214,700 |

|

a |

2 |

Federal income taxes shown on books and on tax |

|

|

|

|

|

|

|

|

return |

|

$60,000 |

|

$60,000 |

|

|

a |

3 |

Excess of capital losses over capital gains (tax basis) |

3,600 |

|

3,600 |

|

|

a |

|

4 |

Depreciation adjustment on earnings and profits |

|

|

|

|

|

|

|

|

(section 312(k)) |

|

|

|

|

24,000 |

|

|

5 |

Depreciation adjustment on sale of property |

|

|

|

4,000 |

|

|

|

6 |

Total itemized expenses from line 5, Schedule |

11,050 |

|

|

|

|

|

|

a |

Travel and entertainment |

|

$200 |

|

200 |

|

|

a |

b |

Life insurance premium greater than cash |

|

|

|

|

|

|

|

|

surrender value (CSV) |

|

9,500 |

|

9,500 |

|

|

a |

c |

Nondeductible interest paid to carry |

|

|

|

|

|

|

|

|

bonds |

|

850 |

|

850 |

|

|

a |

d |

Contributions carryover |

|

500 |

|

500 |

|

|

a |

7 |

Total itemized income from line 7, Schedule |

|

14,500 |

|

|

|

|

|

a |

Life insurance proceeds greater than CSV |

|

6,000 |

|

|

6,000 |

|

a |

b |

Bad debt recovery (not charged against taxable |

|

|

|

|

|

|

|

|

income) |

|

3,500 |

|

|

|

|

b |

c |

|

5,000 |

|

|

5,000 |

|

a |

|

8 |

Reserve for contingencies |

|

10,000 |

|

|

|

|

c |

9 |

Totals |

|

|

|

78,650 |

249,700 |

|

|

10 |

Current- Year Earnings and Profits |

|

|

|

|

171,050 |

|

|

Cash Distributions: |

|

|

|

|

|

|

|

|

Preferred stock: 3/16/92, 6/15/92, 9/15/92, 12/15/92 |

40,000 |

|

40,000 |

|

|

a |

||

10,000 Shares at $1.00/Share = $40,000 |

|

|

|

|

|

|

|

|

Common stock: |

|

|

|

|

|

|

|

|

1. 3/31/92 - 90,000 Shares at $1.00 = $90,000 |

|

|

|

|

|

|

|

|

From |

72.81% |

65,525 |

|

65,525 |

|

|

a |

|

From accumulated earnings and profits |

23.22% |

20,900 |

|

|

|

(20,900) |

a |

|

Total distribution from earnings and profits |

96.03% |

86,425 |

|

|

|

|

|

|

From other distribution |

3.97% |

3,575 |

|

|

|

|

|

|

Total distribution |

100% |

90,000 |

|

|

|

|

|

|

2. 9/30/92 - 90,000 Shares at $1.00 = $90,000 |

|

|

|

|

|

|

|

|

From |

72.81% |

65,525 |

|

65,525 |

|

|

a |

|

From other distribution |

27.19% |

24,475 |

|

|

|

|

|

|

Total distribution |

100% |

90,000 |

|

|

|

|

|

|

Total cash distributions |

|

220,000 |

|

|

|

|

|

|

Totals |

|

304,650 |

229,200 |

171,050 |

171,050 |

|

|

|

|

75,450 |

|

|

|

(20,900) |

|

||

Balance forward 12/ 31/ 92 |

|

|

$149,550 |

|

|

|

||

Explanation of Key

a - Identical items on the same line.

b - Item completely offset in 1990. Bad debt reserve method used for purposes of book accounting. c - Item not completely offset.

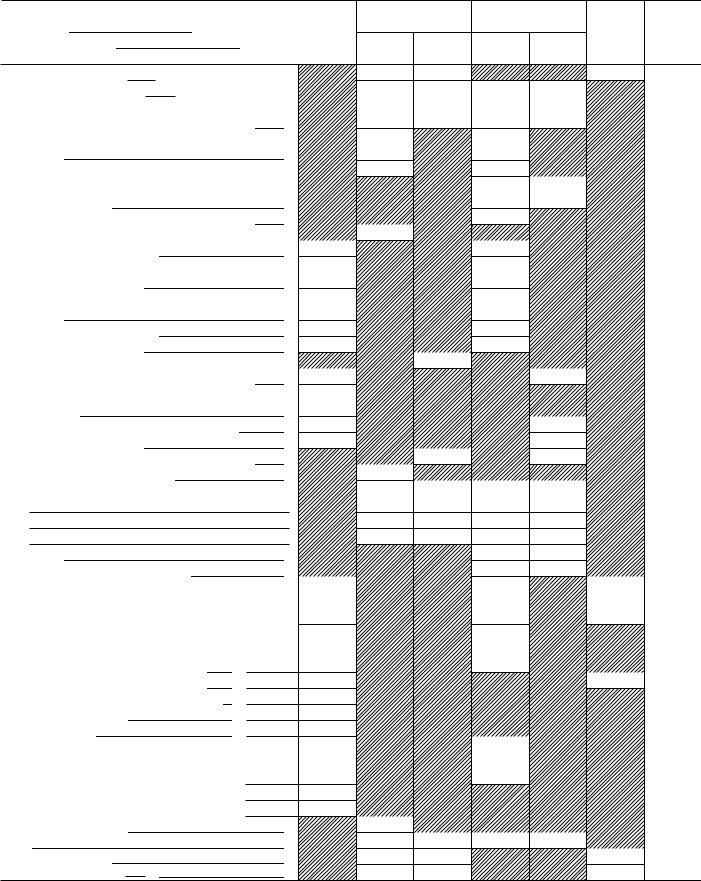

Form 5452 (Rev. |

Page 4 |

Worksheet for Computing Current- Year Earnings and Profits

|

|

Retained Earnings |

Earnings and Profits |

Accumulated |

|

||

Incorporated |

Shown in Books |

Current Year |

Earnings and |

|

|||

|

|

|

|

Profits |

Key |

||

|

|

|

|

|

|

||

Method of Accounting |

Debit |

Credit |

Debit |

Credit |

Credit |

|

|

|

|

Balance |

|

||||

|

|

|

|

|

|

|

|

Balance forward 12/ 31/ |

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

1 |

Taxable income from Form 1120, line 28 (or |

|

|

|

|

|

|

|

comparable line of other income tax return) |

|

|

|

|

|

|

2 |

Federal income taxes shown on books and on tax |

|

|

|

|

|

|

|

return |

|

|

|

|

|

|

3 |

Excess of capital losses over capital gains (tax basis) |

|

|

|

|

|

|

4 |

Depreciation adjustment on earnings and profits |

|

|

|

|

|

|

|

(section 312(k)) |

|

|

|

|

|

|

5 |

Depreciation adjustment on sale of property |

|

|

|

|

|

|

6 |

Total itemized expenses from line 5, Schedule |

|

|

|

|

|

|

a |

Travel and entertainment |

|

|

|

|

|

|

b |

Life insurance premium greater than cash |

|

|

|

|

|

|

|

surrender value (CSV) |

|

|

|

|

|

|

c |

Nondeductible interest paid to carry |

|

|

|

|

|

|

|

bonds |

|

|

|

|

|

|

d |

Contributions carryover |

|

|

|

|

|

|

e |

Other (list separately) |

|

|

|

|

|

|

7 |

Total itemized income from line 7, Schedule |

|

|

|

|

|

|

a |

Life insurance proceeds greater than CSV |

|

|

|

|

|

|

b |

Bad debt recovery (not charged against taxable |

|

|

|

|

|

|

|

income) |

|

|

|

|

|

|

c |

|

|

|

|

|

|

|

d |

Other (list separately) |

|

|

|

|

|

|

8 |

Refund of prior year Federal income taxes |

|

|

|

|

|

|

9 |

Reserve for contingencies |

|

|

|

|

|

|

10 |

Additional adjustments: |

|

|

|

|

|

|

11 |

Totals |

|

|

|

|

|

|

Current- Year Earnings and Profits |

|

|

|

|

|

|

|

Cash Distributions: |

|

|

|

|

|

|

|

From |

% |

|

|

|

|

|

|

From accumulated earnings and profits |

% |

|

|

|

|

|

|

Total distribution from earnings and profits |

% |

|

|

|

|

|

|

From other distribution |

% |

|

|

|

|

|

|

Total distribution |

100% |

|

|

|

|

|

|

Total cash distributions |

|

|

|

|

|

|

|

Totals |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Balance forward 12/ 31/ |

|

|

|

|

|

|

|