Any time you would like to fill out irs form 5471 instructions, you don't have to download and install any applications - simply try using our online tool. To make our editor better and simpler to use, we continuously work on new features, bearing in mind feedback coming from our users. All it requires is a few simple steps:

Step 1: First of all, open the pdf editor by pressing the "Get Form Button" above on this site.

Step 2: With the help of our handy PDF editing tool, it is possible to do more than merely complete blank form fields. Express yourself and make your docs appear sublime with custom textual content incorporated, or optimize the file's original input to excellence - all that accompanied by an ability to incorporate stunning pictures and sign it off.

In an effort to fill out this PDF document, be sure to provide the right details in every field:

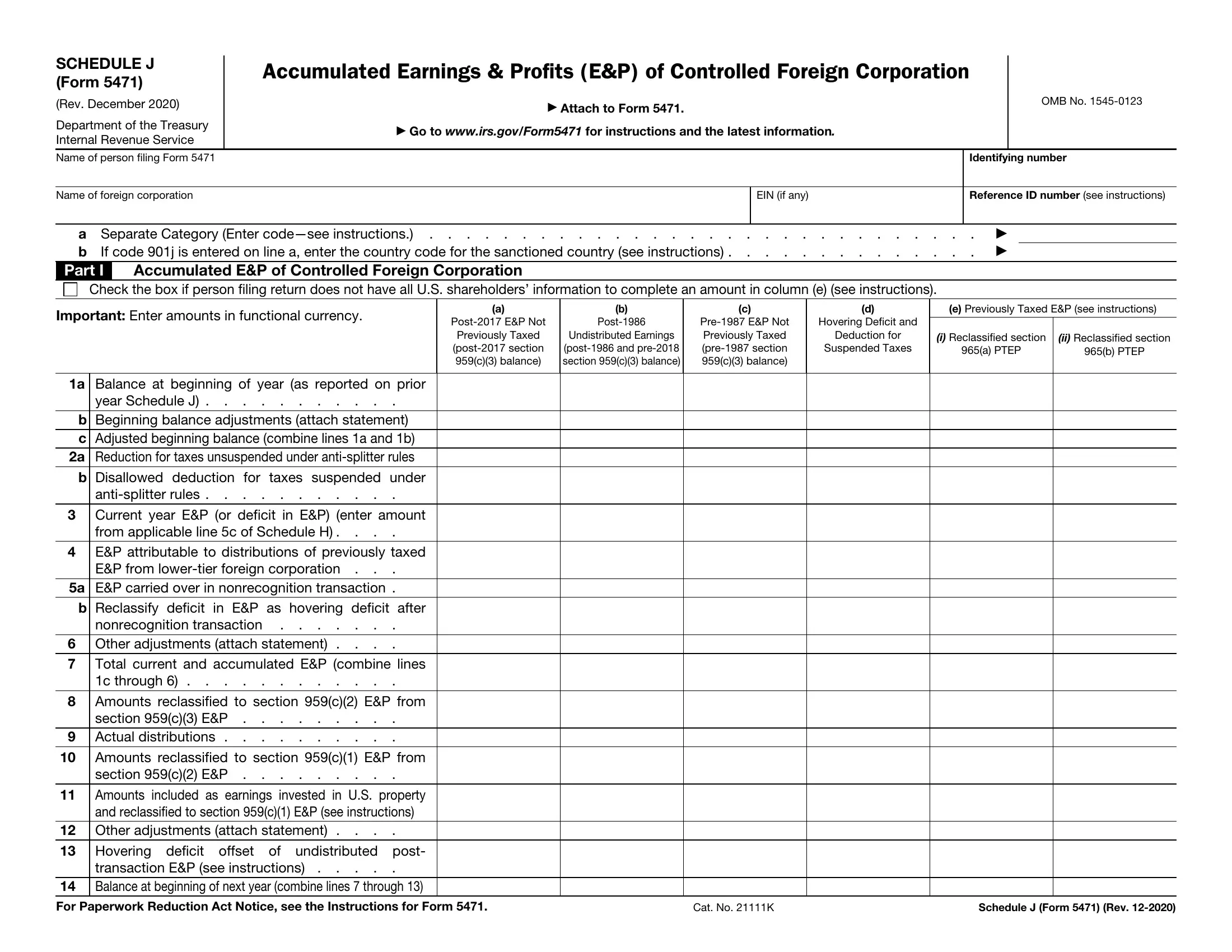

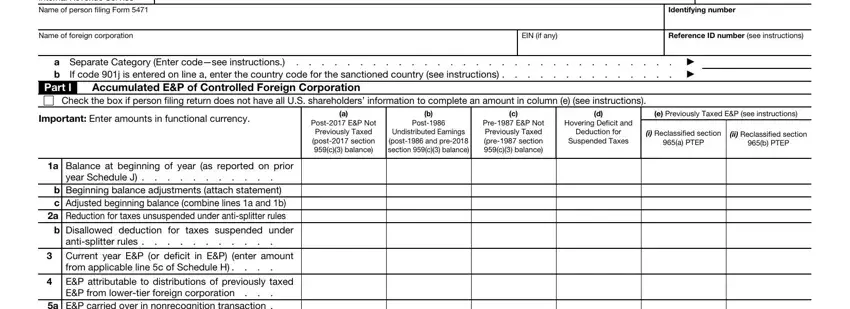

1. Fill out the irs form 5471 instructions with a number of essential fields. Get all the required information and be sure nothing is missed!

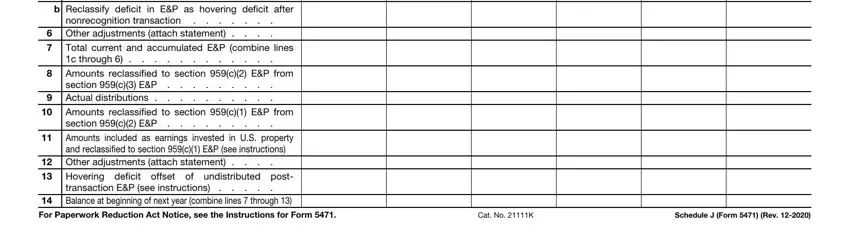

2. Just after performing the last section, go on to the subsequent part and enter all required details in these blanks - a EP carried over in, Reclassify deficit in EP as, Other adjustments attach, Total current and accumulated EP, Amounts reclassified to section c, Amounts reclassified to section c, Amounts included as earnings, Other adjustments attach, Hovering deficit offset of, Balance at beginning of next year, For Paperwork Reduction Act Notice, Cat No K, and Schedule J Form Rev.

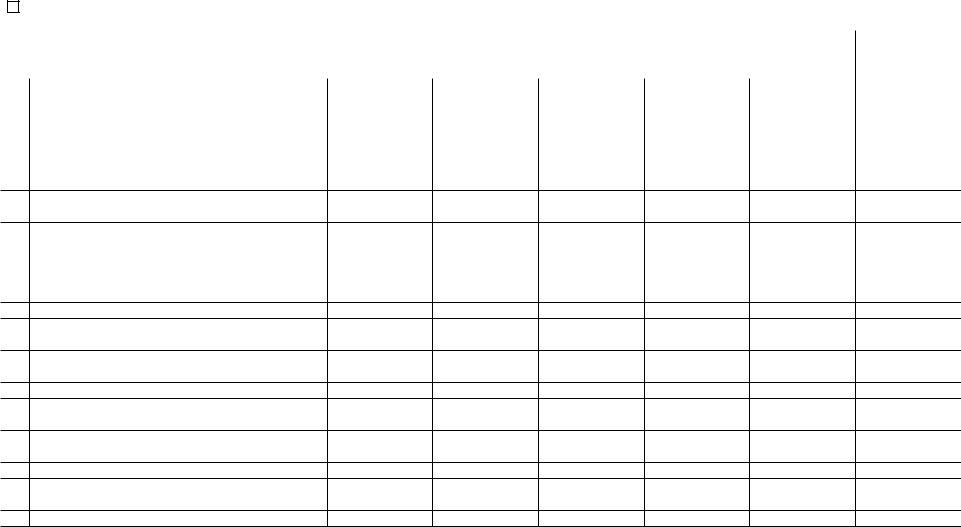

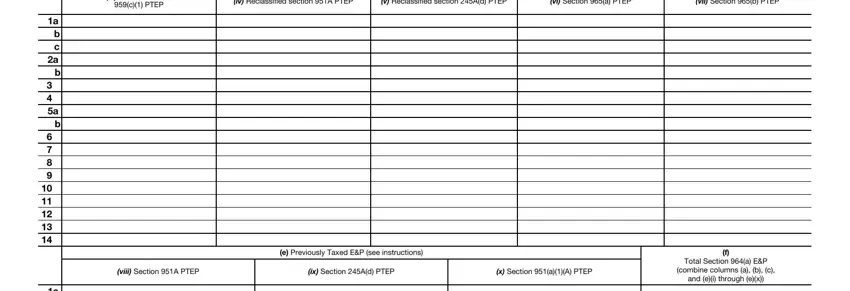

3. Completing iii General section, c PTEP, iv Reclassified section A PTEP, v Reclassified section Ad PTEP, vi Section a PTEP, vii Section b PTEP, a b c a b, a b, a b c a b, viii Section A PTEP, ix Section Ad PTEP, x Section aA PTEP, e Previously Taxed EP see, Total Section a EP, and combine columns a b c is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

It's easy to make a mistake when filling in the viii Section A PTEP, hence make sure you reread it before you decide to submit it.

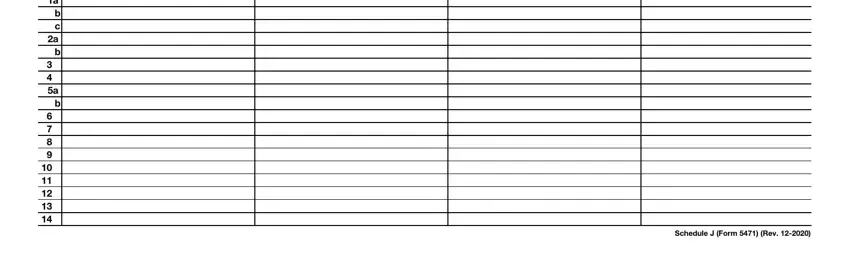

4. To move ahead, this section will require filling out a couple of fields. Examples include a b c a b, a b, and Schedule J Form Rev, which you'll find key to going forward with this particular document.

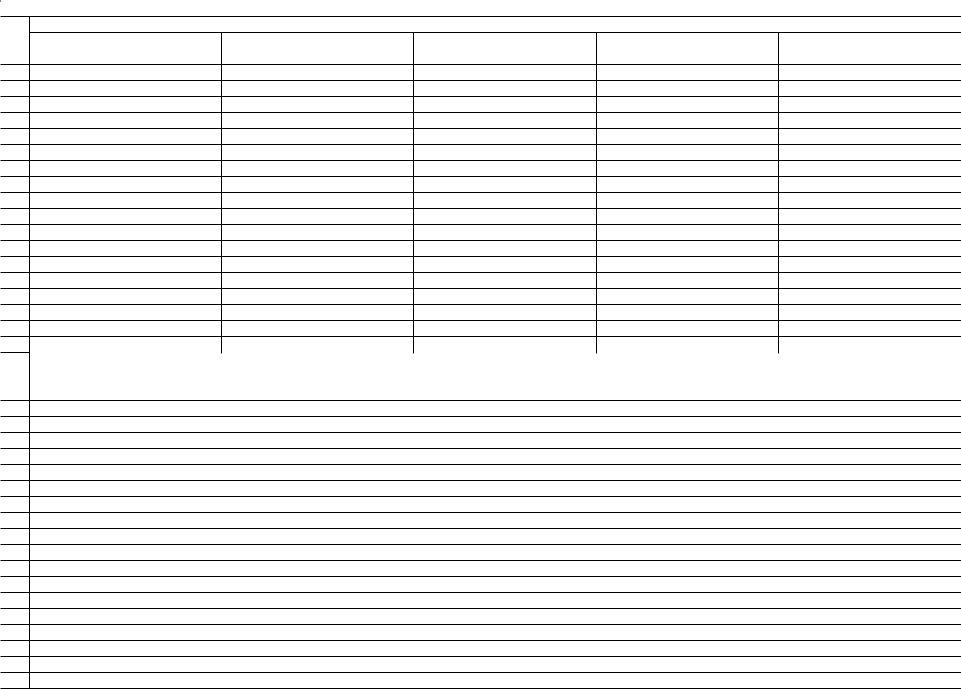

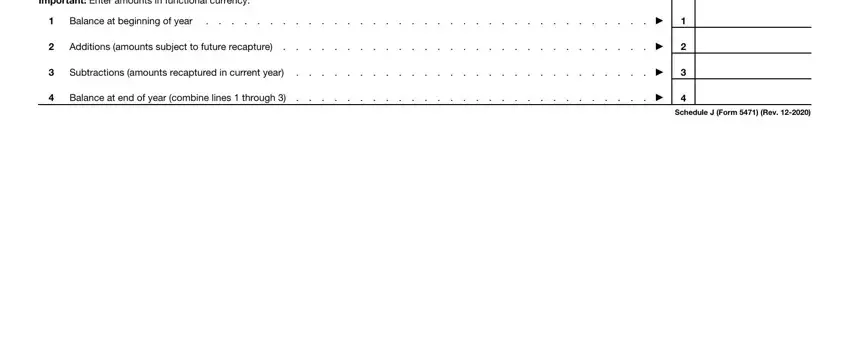

5. The very last point to complete this PDF form is crucial. Be certain to fill in the mandatory blanks, and this includes Important Enter amounts in, Balance at beginning of year, Additions amounts subject to, Subtractions amounts recaptured in, Balance at end of year combine, and Schedule J Form Rev, prior to submitting. In any other case, it could lead to an incomplete and possibly unacceptable form!

Step 3: Prior to moving on, it's a good idea to ensure that all form fields are filled out correctly. As soon as you confirm that it is good, press “Done." Go for a free trial plan at FormsPal and get instant access to irs form 5471 instructions - with all changes saved and accessible from your personal cabinet. FormsPal is focused on the privacy of our users; we make sure all personal data coming through our system remains confidential.